Category: Trading Vs Investing

The two types of participants in equity markets; Investors – who work on the principle of buy and forget for a long time in the belief that their investment will yield capital returns and dividends over time, and second are traders – who engage in the buying and selling of financial assets for a short period of time for profit. Investing in vision capacity to see a diamond in a coal mine. An investor should have a firm grasp on the fundamentals and target for the security. When markets are volatile, an inventor will sell his portfolio and seek refuge in safe heaven assets, whereas a trader will see volatility as an opportunity to profit from price movements.

What is Order Flow in Trading?Analysis and Trading Strategy

Trading or investing in the stock market without analysis is like gambling,it’s not sure you will earn a profit, even there are equal chances of losses. You can use fundamental

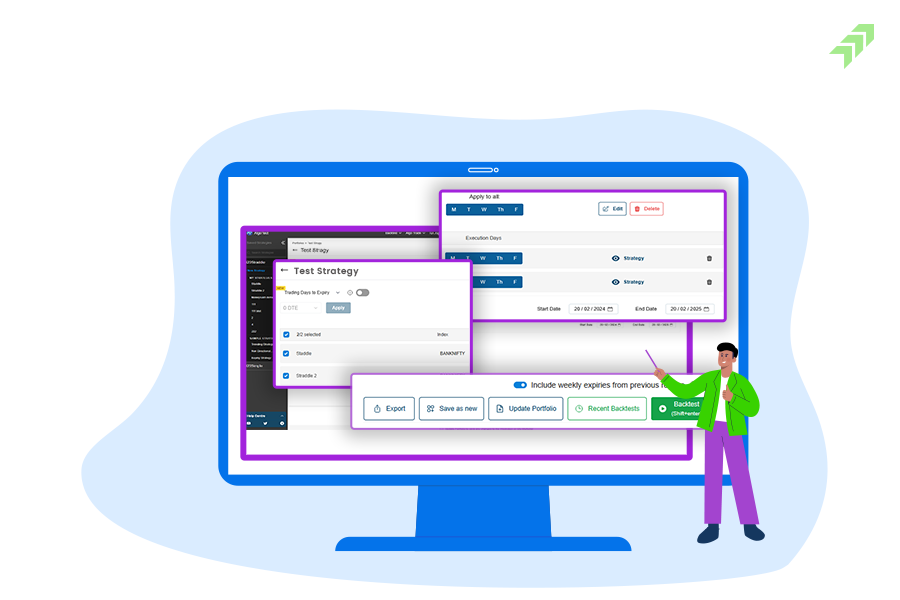

What are the Top Features of Algo Trading in TradeRadar?

Trading with Algo could be a totally different experience especially if you are trading in options. The TradeRadar at Moneysukh offers unlimited interesting features that can make your Algo trading

What are the Different Types of Orders in Stock Market Trading?

Placing orders in the stock market is one of the most crucial points, where you need to be a little cautious. As there are various types of orders in the

How to Recover Loss in Option Trading: Tips to Avoid Losses

The loss in trading is very common across the segments in the various financial markets. Trading in financial instruments can be risky if the market is highly volatile and you

Algo or Manual Trading Which one is better for the Option Market?

Algo trading is becoming more popular with the introduction of more improved versions of the software making the complicated trading strategies easier to implement as per the market conditions. Manual

How to Reduce Slippage in Algo Trading: Tips to Avoid Slippage

Placing the orders or executing as per your expected is not possible in the stock market, especially in highly volatile underlying securities like options. The fluctuation in the price of

What is a Simulator in Algo Trading? Benefits & Top Features

Option trading with Algo-based trading software could be not only challenging but also very interesting with advanced features providing you with a highly sophisticated trading platform to trade in the

Types of Orders in Option Trading in Algo with Order Placement Tips

In options trading placing the orders could be challenging especially if you are novice in the market. As there are different types of orders you can place in the option

Why Choose Algorithmic Software for Options Trading: 10 Reasons

Trading in options is more complicated and challenging than any other financial instrument. Though trading in this segment could be more rewarding but also very risky, especially if you are