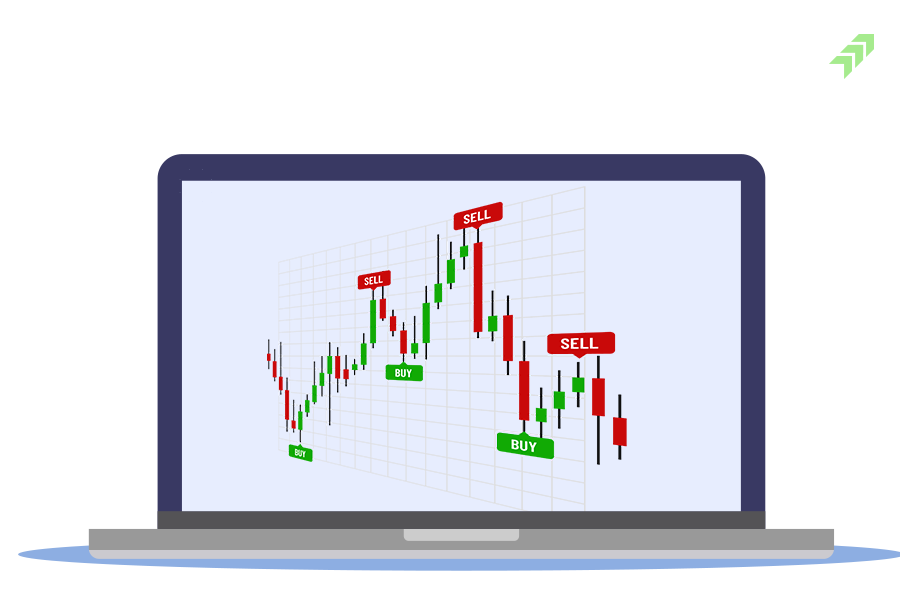

Candlestick chartsare one of the most reliable tools in technical analysis that you use to predict the stock price movement. The combination of certain charts patterns or even a few single candles is enough or you can say are reliable to know the trend in the market. Candlestick chart patterns are not only useful in identifying the current trend it helps to know when the trend is likely to change.

The trend reversal in the candlestick chart can be confirmed when a pattern of various candles is formed together. However, there are few candles enough to tell the trend reversal. However, it is quite difficult to know at which point there could be a trend reversal, and you can take your trade position accordingly. There are certain specific candlesticks that are formed at specific times that can be used to know the trend reversal if you expect the formation of the candle at that point in time.

The candlestick charts are formed as per the sentiments of traders towards that particular stock. And series of multiple candles can give an idea about the next move in the stock, and if you use other technical indicators you can get a clearer picture of the stock market. So, in this article, we are going to talk about trend reversal patterns candlesticks and which one is more reliable.

Also Read: How to Read, Analyse& Use Candlestick Chart Patterns for Trading

What is Trend Reversal in the Stock Market?

Trend reversal in the stock market is the change in the direction of the current trend. Suppose the current trend in the market or individual stock is bullish or upward, and now the trend has changed to a bearish or downtrend, it is the phase of trend reversal. Identifying the trend reversal in the stock market is one of the difficult jobs, but you use candlestick charts and other indicators to find it.

5 Most Common Candlestick Reversal Patterns

#1 Hammer Candlestick for Trend Reversal

Hammers are one of the common trend reversal patterns in the candlestick chart. When the hammer candlestick pattern is formed usually end of the bearish trend at the bottom or support level, it indicates the reversal of trend. As the name indicates, a hammer candlestick has the shape of a long lower shadow or tail of at least twice the length of the body. The hammer could be an inverted hammer also opposite of the hammer, and if appears in an uptrend, there could be a trend reversal.

The colour of the candle doesn't matter and the hammer indicates bears tried to pull the stock price to new lows but was not able to hold their dominance and buyers came at this point and pulled the price up. You can confirm the trend reversal when the hammer is formed with other candlesticks formed behind this. When the next candle after this hammer is formed with a price closed above the opening price of the candlestick formed before the hammer giving a strong trend reversal.

#2 Engulfing Candlestick for Trend Reversal

When two candles are formed in which the latest one is big enough to engulf the previous one, it can give the trend reversal indication. The engulfing candlestick chart patterns can be created during the bullish as well as bearish trend.

You have to recognize the pattern at the right time, if a bearish trend is running and the engulfing candle is formed, it is the end of the bearish trend and the reversal of a trend. Similarly, when a bullish trend in the market and an engulfing candle comes, a reversal is likely.

An engulfing candlestick is the full body of a candle formed with little tails or shadows on both sides. When this candle engulfs its previous entire candle, the engulfing candle could be dark or white it doesn't matter but it should completely engulf the body of the first black candlestick charts. And with the next candle after engulfing you can get the confirmation of trend reversal.

#3 Harami Candlestick for Trend Reversal

Harami candlestick is one of the most common candlestick reversal patterns that can be created at the end ofa bearish as well as a bearish trend. In the Japanese language, harami means pregnant as when two candles are formed in which the second candle is a smaller body candle with no tails and open and close price is within the body of its previous candle that seems like it is formed in a pregnant shape.

You can use the Harami for trend reversal and it can be formed in both types of trend reversal bullish and bearish. And as per the situation, it is called either a bullish harami or bearish harami candlestick chart pattern. However, you cannot rely on this individual harami candle to confirm the trend reversal you can use other technical indicators like MACD or RSI for more accurate results.

Also Read: Top 5 Best Technical Indicators for Intraday or Day Trading

#4 Piercing Line Candlestick for Trend Reversal

Piercing line candles can be also one of the most reliable trend-reversal candlestick chart patterns. A piercing line candlestick is formed with two candles the first candle is formed with a full long-body bearish candle and the second candle is also a full long-body bullish candle but formed with the open price of the stock at the gap and the close price at the middle of the bearish candle or 50% of the bearish candle.

Piercing line candlesticks show their market initiated with the bearish trend but later buyers dominant and reversed the situation and pulled the market upwards. The piercing line is the bullish trend reversal candlestick pattern that you can use in combination with other indicators.

Also Read: What are the Best and most Accurate Trend Reversal Indicators

#5 White Soldiers& Black Crows Candlesticks

Three white soldiers and three black crows are also the two most common and most reliable candlestick patterns that can be used for trend reversal. You can use them with strong trend reversal signals as both types of candlestick patterns have the combination of three patterns in a row. And when these types of candles are formed back-to-back it confirms the reversal of the current trend.

In three white solders, a series of three candles with long bodies are formed and each candle must have an open price higher than the previous candle it would be better if the open price is above the middle of the previous candles creating the new high and ended nearly high of the day.3-white soldiers candles give the strong single trend reversal from bearish to bullish.

While on the other hand, the three black crows' candlestick chart patterns are the reverse of the white shoulders. When a series of 3 candles with long bodies is formed and each candle has an open price below the half body of the previous candles shows the formation of three black crows' candles. The closing price of each candle should be the new low or you can say at its lowest levels.

Three black crow candlestick chart patterns are a clear signal of a bearish trend on the cards, or you can end up with a bullish trend and confirmation of a bearish trend. As there is the formation of three candles in the black crows and the formation of these three candles is clearly visible to you, then you can consider it for trend reversal. The reliability of this candlestick pattern is very high.

Which Candlestick Pattern is Most Reliable?

Apart from this trend reversal candlestick chart patterns, there are many others like Abandoned Baby, Doji, Evening Star Morning Star etc. But all of them are not reliable or you can say can’t be used individually for trend reversal; you need to get the confirmation of reverse in the current trend with other popular technical indicators. Though, they can give signals but not enough to rely on.

Also Read: What are the Top Best & Most Used Indicators in TradingView?

On the other hand, what we have listed above are the top five best trend reversal patterns candlesticks you can use in technical analysis. However, the accuracy of prediction using these candlestick patterns is totally dependent on your knowledge, experience and interpretational skills to understand the accurate formation of such candles and use them for trend reversal.

Also Read: Is Technical Analysis Useful or Useless or Enough for Trading

Final Words

Trend reversal candlestick patterns can be visible anytime, anywhere during the market trading hours. You need to recognize them at the right time with accurate predictions. Every candlestick is not meant to tell you the reversal of a specific trend, they can be used for both ether bullish or bearish. Their timing and place are the factors that you can use in the context of the current trend.

However, a few candlesticks can be used for only bullish trend reversal and a few are meant for bearish trend reversal, which you can check if you already know which trend is running and looking for the reversal. In such a situation relying only on the candlestick chart patterns would be not a wise decision, even if you can wrong indications. Here you can also combine the technical indicators to confirm.

Also Read: How to Add or Remove, Hide & Save Indicators in TradingView

Merely recognizing the right candlestick chart pattern for trend reversal would be not enough, you also need to implement the trade strategy at the right time at the right point. Yes, when you get the confirmation of trend reversal you also need the right entry point to buy or sell the stock. Here you can get help from the market experts, who can easily tell the entry point in the stock.

Technical analysts have better knowledge and understanding of the candlestick chart patterns. Hence, you can become a customer of Moneysukh, here you will get trading recommendations from the market experts who have access to the most advance charting system like TradingView. These professionals can easily recognize all types of candlestick chart patterns and interpret them in trade.

Also Read: How to Use Supertrend Indicator in TradingView: Settings & Strategy

Moneysukh is a full-fledged broker also providing discount broking services in India to trade and invest in the equity market, currency market and commodity market. You can open here a trading account and demat account at the lowest brokerage charges and enjoy the best online trading platforms accessible through various devices with the facility to trade non-stop from anywhere.

Also Read: Short Term trading v/s Intraday trading: which one is more profitable