Support and resistance are levels of a security's price at which the price is expected to stop and reverse, depending on the direction of the move. Support and resistance levels are critical points in time where supply and demand forces meet. Technical analysts regard these support and resistance levels as critical in determining market psychology and supply and demand. Prices in financial markets are driven by supply and demand extremes; as demand grows, so do prices. Price movement is sideways when supply and demand are equal. When these levels of support or resistance are broken, the supply and demand forces that created them are assumed to have shifted, and new levels of support and resistance are likely to emerge. There is no default indicator for identifying dynamic supply and demand changes. However, the functionality of certain indicators can be extrapolated to a support and resistance indicator.

Support

Support is defined as a price level or zone where we anticipate increased buyer demand, thereby providing support to the price level and preventing it from falling further. This means that the price is more likely to "bounce" off from that level than break through it. The strength of support is determined by whether it causes a temporary pause or a permanent reversal. When the price has significantly surpassed the predicted level, it is likely to continue declining until it finds another support level.

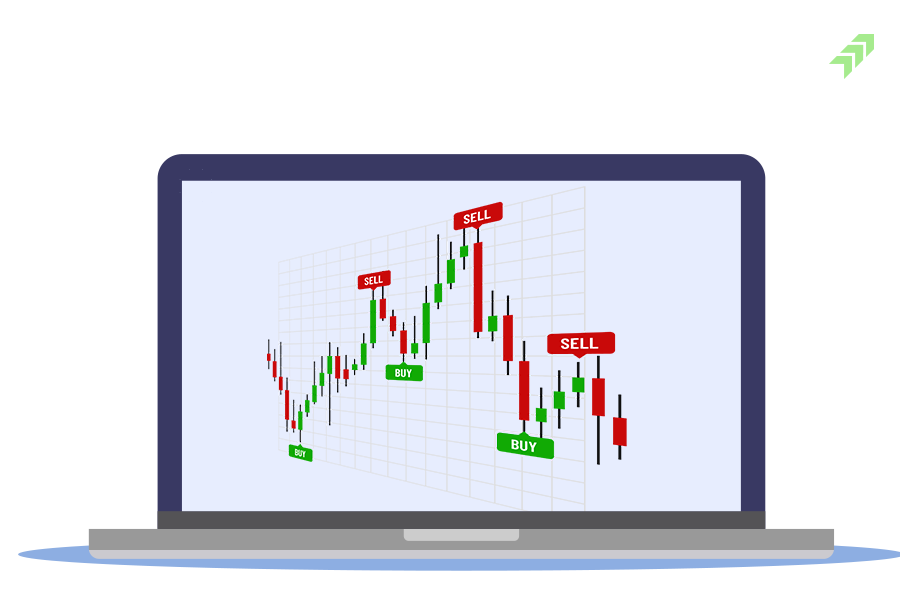

Once a support level has been identified, those levels can serve as a potential entry because when a price reaches a support level, it will either bounce back, away from the level of support or will continue in its direction until it reaches the next support level. If the price moves against the trade, you can square off your position at a small loss. However, if the price moves in a positive direction, the move could be sizable.

Resistance

Resistance is the point at which a trend comes to a halt or pauses. On a chart, resistance is an area where the price has risen but now struggling to break through. It is the price level where we anticipate increased supply from sellers, resulting in price level resistance. The price is more inclined to bounce off of this level rather than break through it. A resistance zone exists when the price range of a security is not confined to a single point and reverses from a series of points in the vicinity. As the price approaches resistance, logic would suggest that sellers become more inclined to sell and buyers become less inclined to buy. It is expected that by the time the price reaches the resistance level, supply will have surpassed demand, preventing the price from rising above resistance.

The resistance level does not always hold; a break above it indicates that the bulls have triumphed over the bears. A break above resistance indicates a new interest in buying and/or a lack of motivation to sell. Resistance breaks and new highs indicate that buyers' expectations have risen and they are willing to pay even higher prices. Furthermore, sellers could not be forced to sell until prices rose above resistance or the previous high. Once resistance is broken, another resistance level at a higher level must be established.

Find Support and Resistance

Some of the methods for identifying support and resistance are mentioned below

• Tops and bottoms that are horizontally aligned.

• Trendlines can be formed by connecting multiple tops or bottoms.

• Fibonacci support and resistance

• Indicator support and resistance

• Tops and bottoms that are horizontally aligned.

Stocks develop tops and bottoms. A bottom, for example, is a price formation in which prices bound back from the lowest reversal point in a range. When multiple tops or bottoms (or both) are horizontally aligned on the chart, we can draw a horizontal line at this level to identify an area of support or resistance. Horizontal lines can also change their function. It is not unusual for a strong resistance line to act as support after it has been broken.

• Trendlines can be formed by connecting multiple tops or bottoms.

Tops and bottoms do not always have to be horizontally aligned; they can also be formed at trendlines and channels. When the stock consistently forms higher bottoms, we can draw a line connecting the various bottoms. This is referred to as a trendline, and it will serve as support for the next bottom formation. Lower tops are formed when the stock is in a downtrend. We can draw a line connecting the various tops here. This is known as a resistance line, and it will act as resistance as you descend.

• Fibonacci Support and Resistance

During market corrections, the Fibonacci tool is frequently used to identify price reversals. Fibonacci retracement levels indicate critical areas in which a stock could stall. Among the most common ratios are 23.6 percent, 38.2 percent, and 50 percent. These are typically found between securities’ high and low points and are intended to forecast the future direction of their price movement.

• Indicator Support and Resistance

Technical indicators, such as the 200-day moving average, serves as an important Support and resistance line. Pivot points which serve as pivot support and resistance levels, can also be used to identify market support and resistance levels.

When support become resistance and Vis-à-vis

A key concept in technical analysis is that when a resistance or support level is broken, its role is reversed. Support and resistance are levels where price returns again and again. At the resistance level, there are enough sellers to prevent the price from rising any further and to reverse the price to the downside. When a specific level is tested repeatedly, the likelihood of breaking that level increases. The resistance level will usually break with healthy volume. Investors / traders must be cautious to avoid false breakouts. The price may appear to break through resistance, but if good volumes are not traded, it will reverse in the opposite direction. The same logic applies to support, which, once broken, becomes resistance.

2 Comments

[…] technical indicators such as candlestick chart patterns, support and resistance, RSI, Moving averages, Bollinger band, Fibonacci Retracements and Swing Trading are used while […]

[…] timing of profit booking, apart from fundamental factors also use the technical indicators like Support & Resistance, Chart Patterns, Moving Averages, Volume, RSI, Bollinger Band, Fibonacci Retracement, Swing Trading […]