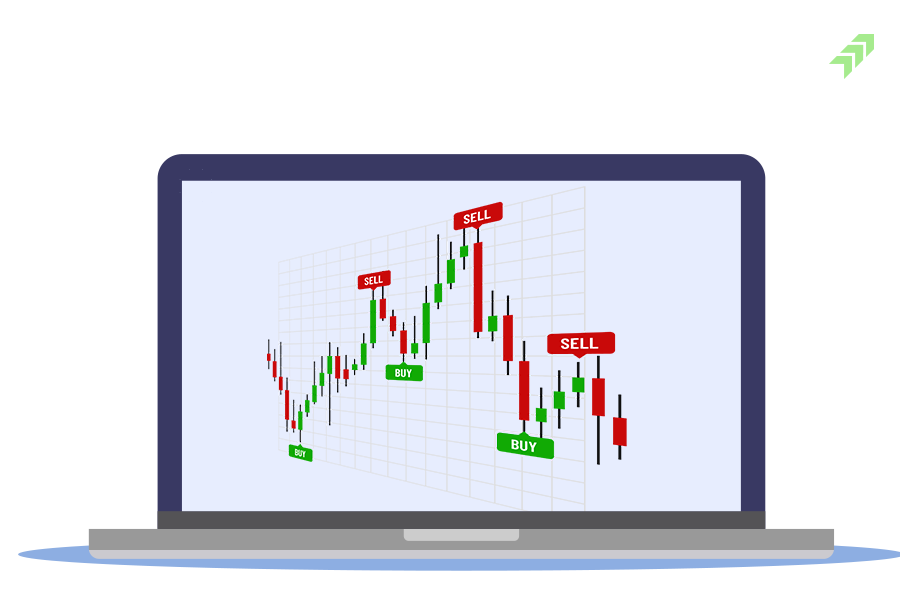

Candlestick charts

Candlestick charts are a popular component of technical analysis because they allow traders to interpret price information quickly and from only a few price bars. Candlestick price action entails determining where the security price opened and closed for a given period, as well as the price high and lows for the specified period. The trader determines the time range that each candle represents. The daily time-frame is a popular time-frame. Many components of a candle help a trader predict the direction the price of a security will go. Individual candlesticks form patterns over time that traders can use to identify major support and resistance levels.

Candlesticks have three basic features

Body

The body is the colored part of a candle that represents the spread between the opening and closing prices over a given time period. The time period can range from minute, hour, day, week, etc... They are the most fundamental component of candlestick charts.

Shadow

A shadow is a vertical line drawn on a candle in a candlestick chart to show the highs and lows of a security over a given time period in relation to the opening and closing prices.

Color

There are numerous color combinations that investors become accustomed to seeing on trading terminals, but the combination of green & red is preferred by most.

When,

Closing Price > Opening Price = Candlestick color is Green

But When,

Closing Price < Opening Price = Candlestick color is Red

Candlestick patterns

Every candlestick tells a story about the battle between bulls and bears and buyers and sellers. It's important to remember that most candle patterns require confirmation based on the context of the preceding and following candles. Many novices make the common mistake of spotting a single candle formation without considering the context. To achieve the best results, it is prudent to combine them with other indicators. Some of the common candlestick patterns are as follows.

-

Bullish Reversal Candlestick Patterns

Hammer

Hammer pattern is a single candlestick pattern that appears at the end of a downtrend and indicates a bullish reversal. It is one of the most reliable and widely used candlestick patterns. The pattern is used to identify capitulation bottoms followed by a price bounce, which traders use to enter long positions. Hammer candlestick patterns appear after a security's price has fallen over three trading days. The candle formed has a lower shadow that creates a new low in the downtrend sequence before closing near or above the open. Candle's real body is small and located at the top, with a lower shadow that should be more than twice as large as the real body. This represents the longs that finally gave up and stopped trading as shorts began to cover their positions and bargain hunters entered from the sidelines. The next candle must close above the hammer candle's low, preferably above the body, to confirm the hammer candle. It is advisable to time the entry using a momentum indicator such as a MACD, stochastic, or RSI.

Piercing Pattern

A piercing pattern forms near support levels and indicates a potential bullish reversal. This pattern is made up of two candlesticks, the first of which is bearish and the second of which is bullish. It's a lot like the dark cloud cover pattern. The only distinction is that dark cloud cover indicates a bearish reversal, whereas a piercing pattern indicates a bullish reversal. The first candlestick in the formation is red, indicating a down day, and the second candlestick is green, indicating a day that closes higher than it opened. When looking for a bullish reversal, any red candlestick followed by a green candlestick could be an indicator, but the piercing pattern is unique because the reversal is likely to be unexpected by most market participants.

- The pattern is preceded by a price decline. (This could be a brief downtrend, but if the candles appear after a price increase, it is not a significant reversal indicator.)

- The price gap falls to start the second day. (This pattern is more common in stocks due to their ability to have overnight gaps, as opposed to currencies or other 24-hour trading assets.) On a weekly chart, this pattern can appear in any asset class).

- The second candle must close above the first candle's midpoint. (This indicates that buyers outnumbered sellers on this particular day.)

Bullish Engulfing

There must be an ongoing trend for an engulfing pattern to form. The trend in this case should be downward. The engulfing pattern is the opposite of the harami pattern, except that the candlesticks in the pattern cannot be the same color. It resembles an outside reversal pattern. The engulfing pattern, like the harami pattern, is made up of two candlesticks, the first of which is of which is a relatively short candlestick with a short real body and the second of which is a large candlestick with a large real body that engulfs the real body of the first candlestick. The engulfing pattern is a trend reversal pattern and must therefore appear in an existing trend. If the pattern appears at or near a support or resistance line, or a trendline, it is more reliable. The colors of the candlesticks are also important. The first candlestick in an uptrend must be red, indicating that it opened higher than its close price. A larger candlestick must then be green, indicating that it opened lower than it closed. The first candlestick's small real body indicates indecision and uncertainty about the uptrend. The large body of the second candlestick indicates that demand has surpassed supply and that uptrend is very likely. Volumes should be higher on the second candlestick than on the first. So, prior to the formation of a bullish engulfing pattern, traders anticipate that the price of a share will fall and sell the shares. Multiple bearish candles form as a result of low buying pressure. When a stock is close to a support level, traders believe it is undervalued and that now is the time to buy. With strong buying pressure, the share price recovers and engulfs the previous candle. As a result, the bullish engulfing pattern indicates that market participants are no longer in favour of the bearish trend and that the bulls have reclaimed full control.

The Morning Star

The Morning star is opposite of the evening star and is a bullish bottom reversal pattern. It signals weakness in a downtrend, which could lead to a trend reversal. The morning star, like the evening star, is made up of three candlesticks, with the middle candlestick forming a star. In the morning star pattern, the first candlestick must be red and have a large real body. The second candlestick in the formation is the star, which has a short real body that is separated from the first candlestick's real body. The distance between the two candlesticks' real bodies distinguishes a star from a doji or a spinning top. The star does not have to appear below the first candlestick's low and can appear within its tail. The star is the first sign of trend weakness because it indicates that the sellers were unable to lower the price much lower than the previous close. The third candlestick must be green and close well into the body of the first candlestick to confirm the weakness. If the third candle opens above the real body of the star, leaving a gap between the real bodies of the second candlestick (star) and the third candlestick, the accuracy of the morning star is significantly improved, though this does not happen very often. Reliability is also improved if the volume on the first candle is below average and the volume on the third candle is above average.

To identify a Morning Star, look for the following criteria:

- The price must be in a downward trend before the signal is generated.

- The first candle must confirm the downtrend by having a real long red body. This demonstrates that the bears have control over the stock.

- The second candle, either a Star candlestick or a Doji pattern, must represent indecision.

- This demonstrates that supply and demand are equal, and the bears and bulls are fighting for dominance.

- The third candle must be a green candle that covers at least half of the first day's red candle.

- The probability of a reversal is increased if there is a gap on both sides of the Star candle.

- This final candle confirms the impending reversal.

Three White Soldiers

The Three Advancing White Soldiers, also known as the Three White Soldiers. This is a trend reversal patterns. The Three White Soldiers generally signals a weakness in an established downtrend and the possibility of an uptrend forming. This pattern is the opposite of the Three black crow pattern. The Three White Soldiers pattern is named after three relatively long bullish candlesticks of green color. Each of the three candles in formation should close near or on the period's high price, with each candlestick making steady price advances. The candle in the pattern should not have long shadow on the upside and should preferably open within the real body of the prior candle in the pattern. When this pattern appears in a downward trend, it indicates the onset of strength and the possibility of a trend reversal. If the candlesticks in the pattern are overextended and make significant advances, you should be cautious of overbought scenarios.

White Marubozu

Marubozu is a technical indicator that indicates a stock traded strongly in one direction throughout the session and closed at a high or low price for the day. Marubozu pattern translates to "Close-Cropped" or "Shaven-Head" in Japanese. A candle is said to have a shaved bottom if it has no lower shadow. A candle is said to have a shaved top if it has no upper shadow. A Marubozu candle's qualification and interpretation can only be determined by comparing it to the candles that came before it and the color of the candlestick formed.

The white Marubozu candle is a very bullish one-day bullish indicator that moves upward, indicating that buyers controlled the stock price from the opening bell to the closing bell. White Marubozu is a bullish continuation/reversal pattern. A continuation is likely if a White Marubozu occurs at the end of an uptrend. A reversal is likely if a White Marubozu occurs at the end of a downtrend. This candle is frequently seen in high volume. As a result, determining whether it is a continuation or reversal becomes critical.

Three Inside Up

The three inside up candlestick pattern indicates a bullish reversal. The pattern is supposed to indicate the weakness of the current downtrend and a possible trend reversal. The pattern's first bearish candle shows that the bears are still in charge. The second candlestick of the pattern, on the other hand, is engulfed within the prior candle's real body, indicating indecision and consolidation. The third and final candlestick completes this bullish reversal pattern by closing higher than the first. A reversal pattern signal is more powerful if it occurs after a steep trend, because markets rarely sustain rapid price movement.

- The market should be in a downtrend.

- The first candle will be a red large body candle.

- The next candle ends upward, indicating that the downward trend has been broken. The body of this up candle will be small enough to open and close without touching the body of the first red candle.

- Finally, the third candle will be green and will overlap the second.

If the second candle does not reach the middle point of the first candlestick, but the third closes beyond the open or low of the first candle, the pattern is considered valid.

Bullish Harami

A bullish harami signals the end of a bearish trend. The bullish harami candlestick pattern is a two-bar Japanese candlestick pattern. It forms when a large bearish red candle appears on the first day, followed by a smaller bearish candle the next day. The key feature of the bullish Harami is that prices should gap up on the second day.

The bullish harami indicator is represented on the chart as a long candlestick followed by a smaller body, known as a doji that is completely contained within the vertical range of the previous body. A line drawn around this pattern may resemble a pregnant woman to some. Harami is derived from an old Japanese term that means "pregnant."

Tweezer Bottom

The Tweezers pattern is a trend reversal pattern that consists of two candlesticks that have the same high or low or some variation of the same high or low. It is the only candlestick pattern in which the highs and lows are more important than the body or shape of the candles. The colors of the two candlesticks should alternate, with the first confirming the current trend and the second indicating weakness. The Tweezers Bottom pattern appears during a downtrend, with the first candlestick being red and having a large real body, followed by a bullish candlestick with a short real body. The two candlesticks must have the same low or their real bodies' bottoms must be at the same level. When it appears at market lows, near support lines, or at lower trend lines, the pattern is more reliable.

Inverted Hammer

An inverted hammer candlestick is a type of chart pattern that frequently occurs at the end of a downtrend when buyer pressure raises the price of an asset. It denotes a bullish reversal or a short-term downtrend reversal. An inverted hammer forms after a long-lasting sell-off, when prices are near their all-time lows. The body of the candle can be red or green, but it is most often green, indicating buying pressure at that low price. The wick of an inverted hammer can be long or short; if it is longer than the body, there was more buying pressure at that low price than selling pressure.

Important pattern indicators of the inverted hammer are low that is at a similar level to the open or close, a wick that is double the length of the real body with little or no tail, and a gap down in security price from the previous day's close. This pattern does not occur as frequently as other hammer candlesticks, so it must be identified carefully to avoid confusion. It can give traders an indication of upcoming movement in the direction of the current trend.

Three Outside Up

It is a three-candlestick pattern that is typically formed in a downtrend or an extended downward price swing in an uptrend, and it may indicate a potential price reversal to the upside. One red candlestick immediately followed by two candlesticks of the opposite color distinguishes the three outside up candlestick patterns. The three outside up pattern is one of the most reliable candlestick patterns for predicting a price reversal.

How to recognize a formation of the Three Outside Up pattern

- With the closure lower than the open, the first candle maintains the bearish trend, showing significant selling interest and building bear confidence.

- The second candle begins lower but quickly reverses, crossing through the first tick in a bullish showing. This price action raises a red flag for bears, signaling that a reversal is possible.

- The stock continues to rise, with the price now above the first candle’s range, completing a bullish outside day candlestick. This increases bullish sentiment and triggers buy signals, which are confirmed when the security makes a new high on the third candle.

The size of the engulfing second candlestick also contributes to the pattern's strength. The larger the engulfing second candlestick is in comparison to the first bearish candlestick, the stronger the pattern.

On-Neck Pattern

The on neck candlestick is a bearish continuation pattern. The first candle in a on-neck pattern is bearish, and the second is bullish. The body of the first candle is longer than that of the second. The second candle closes near or close to the first, but its upper and lower shadows cannot be longer than twice the body length. The closing price of the second candle is equal to the low price of the first candle.. The small bullish candle could be any bull candle, Doji pattern, or rickshaw man with a smaller real body. The pattern name is attributed to the fact that it forms a horizontal line that resembles a neckline at the point where the two closing prices are nearly identical. In theory, the price should continue to fall following the pattern.

Traders should use on neck pattern in addition to other types of technical analysis to forecast concrete assessment of the trend.

Look for the following criteria to identify the On Neck pattern:

- A downtrend must be in effect.

- A tall bearish (red) candle must be visible.

- A smaller bullish (green) candle must appear after the red candle.

- The close of the green candle should be close to the low of the previous candle. It should not rise above the low price of the previous candle.

- Look for a red candle on the third day to confirm the On Neck pattern and continue the downward trend.

2. Bearish Candlestick Pattern

Hanging man

It is a single candlestick pattern that appears at the top of an uptrend. This pattern is widely known among traders because it is regarded as a reliable tool for forecasting changes in trend direction. It is a bearish candlestick pattern that indicates that the market is about to reverse as the bulls appear to be losing steam. The reversal may not begin immediately after the hanging man is formed. Instead, it sends a signal that the current momentum is nearing its end as the price action prepares for a possible change in trend direction.

The hanging man pattern arises when two major criteria are met:

- The underlying has been in an uptrend.

- The real body is small, and the candle's tail is long. Upper shadow is minimal to non-existent.

The formation occurs when the open, high, and close prices are all the same and there is a long tail. The tail should ideally be at least twice the length of the body. In an uptrend, the formation of a hanging man indicates that longs have lost their strength. While demand has been driving up the stock price, there was a lot of selling on the day. The pattern is still a technical indicator, and the message it conveys should not be taken as a direct signal.

Dark cloud cover

The Dark Cloud Cover pattern requires a large black / red candle to form a "dark cloud" over the preceding rising candle. This is a three candlestick reversal formation in which the dark cloud cover candle makes a new high of the uptrend sequence as it rises above the prior candle close but ends up closing red as sellers step in early. Like the bearish engulfing pattern, buyers push the price higher at the start of the session, but sellers take control later in the session and tank the price sharply lower.

This shift from buying to selling suggests that a price reversal to the downside is probable. The bodies of dark cloud cover candles should close below the midpoint of the previous candlestick body. The three-candle pattern is made up of the preceding candle, the dark cloud candle, and the following confirmation candle.

Bearish Engulfing

A bearish engulfing pattern can occur anywhere, but it is more meaningful after a price advance. A green candlestick is followed by a large red candlestick, which engulfs the smaller green candle. The preceding green candle maintains unassuming buyers' optimism, as it should be near the top of an uptrend. The bearish engulfing candle will actually open higher, giving longs hope for another rise because it indicates more bullish sentiment at first. However, the sellers arrive in a very strong and extreme fashion, driving the price through the opening level, raising some concerns among the buyers. As the price falls through the previous close's low, the selling becomes even more intense. When a bearish engulfing candle forms on an uptrend, it indicates that there will be more sellers the next day, and so on as the trend begins to reverse into a breakdown. On a reversion bounce in an existing downtrend, a bearish engulfing may form, resuming the downtrend at a faster pace due to new buyers trapped on the bounce. It is critical to pay attention to the volume, especially on engulfing candles, as with all candlestick patterns.

The Evening Star

The Evening Star pattern is a candlestick pattern that appears at the end of an uptrend and signals the beginning of a downtrend. It is made up of three candlesticks: one large bullish candlestick, one small-bodied candlestick, and one bearish candlestick. When the evening star pattern is supported by volume and other technical indicators such as resistance level, the signal is confirmed. The Morning Star pattern is the inverse of the Evening Star pattern, which indicates a bullish reversal.

Identification of evening star

Day 1 -: An Evening Star reversal pattern begins with a large bullish green candle. The first day is usually dominated by bulls, who set new highs.

Day 2 -: The second trading day starts with a bullish gap up. The bulls are clearly in command at the start of Day 2. Bulls, on the other hand, do not drive prices much higher. Day 2's candlestick is quite small and can be bullish, bearish, or neutral (i.e. Doji). In general, a bearish candle on Day 2 is a stronger indicator of an impending reversal.

Day 3 -: On Day 3, the most significant candlestick appears. It starts with a gap down, and bears are able to press prices even lower, often wiping out the gains made on Day 1.

Three Black Crows

Stock market analysts use the term "three crows" to describe a market downturn. The three black crows pattern occurs when bears outnumber bulls for three consecutive trading sessions, resembling a staircase. Each candle should open lower than the previous day's open, ideally in the middle of the previous day's price range. Each candlestick should also close progressively lower in order to set a new near-term low. As a result of this trading action, the shadow or wick will be very short or nonexistent. The three crows help to confirm the end of a bull market and a shift in market sentiment. If the pattern involves a significant move lower, traders should be watchful for oversold conditions, which could lead to consolidation before a further move lower.

Three white soldiers are the opposite pattern of three black crows and their characteristics aid in identifying a bullish reversal.

Black Marubozu

Marubozu is a technical indicator that indicates a stock traded strongly in one direction throughout the session and closed at a high or low price for the day. Marubozu pattern translates to "Close-Cropped" or "Shaven-Head" in Japanese. A candle is said to have a shaved bottom if it has no lower shadow. A candle is said to have a shaved top if it has no upper shadow. A Marubozu candle's qualification and interpretation can only be determined by comparing it to the candles that came before it and the color of the candlestick formed.

A bearish Marubozu opens near the day's high and falls to close near the candle's low. It forms a long red/black candle, indicating that sellers held the price from the opening bell to the closing bell. The absence of shadows indicates an opening at the highest level and a steady decline in prices throughout the session. Its significance is determined by the chart's overall context, as it may be part of another pattern, both bullish and bearish.

Three Inside Down

Gregory Morris introduces the Three Inside Down three-line pattern as an extension of the Bearish Harami pattern. It is more likely to happen during a bullish trend. The pattern consists of a single long bullish candle followed by two significantly smaller bearish candles. The asset's price is strongly trending upward, indicating the market's strong bullish grip. Following the trend, the first candle in the three inside-down candlestick patterns closes positively. The second candle in the pattern begins with a 'gap down.' This abrupt and unexpected down move in the middle of a strong uptrend completely destabilises the bulls. Meanwhile, buoyed by the gap-down opening, the bears make a strong entry and seize control of the session by driving prices lower. The session concludes with the second candle's closing price remaining higher than the first candle's opening price. By this point, buying interest has completely faded, leaving the bears in command. The selling pressure increases in the third session, with the bears continuing their sell-off. As a result, the third and final candle in the pattern is also red. For the three inside down pattern formation to be successful, the third candle must close below the second bearish candle and the first long bullish candle. This strong downward move in the third session confirms the bearish trend reversal.

Bearish Harami

A bearish harami gets its name from its resemblance to the appearance of a pregnant woman. The Japanese word for pregnant is harami. it is a two-bar Japanese candlestick pattern that indicates that prices are about to fall. The pattern appears at the top of uptrends when the preceding green candlestick makes a new high with a large body, followed by the small harami candlestick as buying pressure gradually fades. Longs believe the pullback is just a pause before the uptrend resumes due to the gradual nature of the buying slowdown. The second candle's body must be contained within the body of the first candle. As the bearish harami candlestick closes, the next candle closes lower, which causes a panic sell-off as existing buyers rush for the exits to restrict further losses. The size of the second candle determines the pattern's effectiveness; the smaller it is, the more likely a reversal will occur.

Shooting Star

It is a bearish reversal candlestick formation that indicates a single candle top. It has a small lower body and a long upper shadow. When the price is pushed higher and then immediately rejected lower, it forms a long wick / shadow to the upside. The wick should, in general, be twice the size of the body. In addition, the closing price should be close to the low of the candle.

This pattern formation is a bearish reversal candlestick that indicates a single candle top. The pattern should appear after at least three consecutive green candles indicating rising price and demand. It has a long upper shadow and a small lower body. It forms when the price is pushed higher and then immediately rejected lower, leaving a long wick / shadow to the upside. In general, the wick should be twice the size of the body. Furthermore, the closing price should be close to the candle's low. The Inverted Hammer pattern has a similar structure, but it corresponds to a bullish reversal signal rather than a bearish reversal signal. This candlestick pattern is often seen at the end of a downtrend, support level, or pullback.

This means that the last of the frantic buyers has entered the stock, just as profit takers unload their positions, and short-sellers push the price down to close the candle near the open. This effectively traps late buyers who bid the price high. Fear is at its peak here because the next candle should close at or below the shooting star candle, triggering a panic selling spree as late buyers rush to exit and limit losses. Generally, a short-sell signal is formed when the low of the following candlestick price is broken with trail stops at the high of the candlestick's body or tail.

Tweezer Top

The Tweezer top is a bearish reversal candlestick pattern formed at the end of an upswing. It consists of two candlesticks, the first bullish and the second bearish. The highs of both Tweezer candlesticks are nearly identical. The previous trend is an uptrend when the Tweezer top candlesticks pattern appears.

Points to consider when identifying the Tweezer Top pattern

- The preceding trend should be upward.

- On the first day of this pattern's formation, a bullish candlestick should be formed.

- The following day, a bearish candlestick with a high similar to the previous day's candlestick should form.

Three Outside Down

The pattern necessitates the formation of three candles in a specific order, indicating that the current trend has lost steam and may indicate a trend reversal. The first green candlestick is accompanied by two red-body candlesticks to form the pattern.

Characteristics of three outside down candlesticks pattern

- A small bullish candlestick is formed on the day 1, which represents an extension of the bullish trend.

- Following that, a large red candle will form. It will last long enough for the first green candle to be entirely contained within its true body.

- The third and final candle, must be red as well. This candle, on the other hand, should close higher than the second. This indicates that the uptrend is shifting.

3.Continuation Candlestick Patterns

Doji

A Doji pattern is a name for a session in which the open and close of a security's candlestick are nearly equal and are frequent components in patterns. Doji candlesticks have the shape of a cross, an inverted cross. Doji are neutral patterns that appear in a variety of important patterns. A Doji candlestick forms when the open and close prices of a security are nearly equal for the given time period, and it generally indicates a reversal pattern for technical analysts. The term "Doji" means "blunder or mistake" in Japanese, and refers to the rarity of having the open and close prices be exactly the same.

Spinning Top

A spinning top is a short real body and long upper and lower shadows that are vertically centered. The candlestick pattern represents uncertainty about the asset's future direction. It means that neither buyers nor sellers will have an advantage. If the candle that follows confirms a strong price advance or decline, spinning tops can indicate a potential price reversal. The close of a spinning top can be above or below the open, but the two prices are always close together.

Rising Three Methods & Falling Three Methods

The rising three methods is a bullish, five candle continuation pattern that indicates an interruption, but not a reversal, of the current uptrend. The pattern begins with a bullish candlestick with a large real body within a well-defined uptrend. Subsequent candlesticks, typically three consecutive bearish small-bodied candlesticks trading above and below the low and high of the first candlestick. The final bar is a bullish candlestick with a large real body that breaches the high and closes above the high and close established by the first candlestick, indicating that the bulls have regained control of the security's direction.

Falling three methods

occurs when a downtrend slows down due to bears' lack of conviction in continuing to drive the security's price lower. This causes a counter-movement, which is frequently the result of profit-taking and, possibly, an attempt by eager bulls anticipating a reversal. The subsequent failure to make new highs or close above the opening price of the long down candle emboldens bears to re-engage, resulting in the downtrend resuming. When the long bearish candlestick within the defined downtrend is the first in the pattern, the falling three methods pattern forms. It is followed by three ascending small-bodied candlesticks that trade below the first candlestick's open, or high, price and above the close, or low, price. The fifth and final candlestick should be long and bearish, piercing the lows established since the first, indicating that the bears have returned.

Upside Tasuki Gap & Downside Tasuki Gap

The Upside Tasuki Gap is a bullish continuation pattern that develops in an uptrend that is still in progress. The pattern shows the strength of an uptrend by the gap open of the pattern's second candle, as well as its escalating price. The third candle of the pattern indicates a pause in the trend as the bear attempt to lower the price but are unable to close the gap between the first and second candles. The inability of the bear to close the gap indicates that the uptrend will most likely continue. The first candle in the formation of the pattern must be bullish and, ideally, tall. The second candle must gap up and close bullish. Finally, the third candle must be negative and close to the gap zone formed by the previous two candles.

Downside The Tasuki Gap is a bearish continuation pattern that appears in the midst of a downtrend. The first and second candles are bearish and quite tall. The second candle makes a negative gap opening, leaving a distance between the first and second candle. The third candle is bullish and closes right between the first candle's close and the second's open. That is, in the gap zone. The final bar that closes the gap between the first two bar, should be noted that it does not have to close the gap completely. The inability of the bull to close that gap suggests that the downtrend may continue.

Mat-Hold

A bullish or bearish mat hold pattern can emerge. A bullish pattern appears in an uptrend, while a bearish pattern appears in a downtrend. A mat hold pattern indicates that a previous trend is continuing.

A bullish mat-hold pattern begins with a large upward candle, then a gap higher and three smaller candles moving lower. In order to validate the pattern, 2nd, 3rd, 4th must remain above the first candle's low. The 5th candle is a large candle that continues to rise. When the bullish mat hold pattern appears within an uptrend, it indicates that the uptrend is likely to resume to the upside.

The bearish version is the same as the bullish version, except that candles one and five are large down candles and candles two through four are smaller and move to the upside. These candles must remain below the first candle's high point. Candle five is a long candle to the downside that completes the pattern. It must occur during a downward trend.

Rising Window & Falling Window

When the price continues to rise, the Rising Window, also known as a "gap up," appears, and it is always considered a bullish signal. Window candlestick patterns have very rigid support and resistance zones. A stiff support region is formed in the case of a Rising Window pattern, which also increases the likelihood of trade opportunities on subsequent re-tests of the support area. To form a Window, there must be space between the real bodies of two candles; in fact, their shadows should not overlap. The space between the candles refers to the distance between the previous candle's high and the current candle's low. This pattern suggests that the bulls are in charge, and a further rise in price is expected.

A Falling Window candlestick pattern is defined as a price gap in a downward trend. A stiff resistance region is formed in the case of a Falling Window candlestick pattern, which increases the likelihood of trade opportunities on subsequent re-tests of the resistance area. The first and second candle must not be bullish. After following a significant downturn (as evidenced by the gap down), the buyers attempt to force the price back up. They were, however, ineffective, and the fall is expected to continue. It must occur when the price trend is downward, and it is always a bearish signal. This continuation pattern is very common on charts with shorter time scales, but it is less common on charts with longer time scales.

High Wave

The high wave candlestick is a type of spinning top basic candlestick with one or two long shadows. The high wave candlestick pattern indicates that the market is neither bullish nor bearish. The Long-Legged Doji is similar to the High Wave. Long lower shadows and long higher wicks are used to demonstrate the design of candlesticks. They have small bodies as well. Any accumulation of candles indicating extreme market volatility following a strong trend indicates the possibility of a reversal. The idea behind this pattern is that bears and bulls compete to push the price in a particular direction.

2 Comments

[…] Hammer candlestick pattern is a single candlestick pattern that appears at the end of a downward trend and indicates a bullish reversal. It is one of the most reliable and widely used candlestick patterns. The pattern is used to identify capitulation bottoms….. Read More […]

[…] Triple Bottom chart Pattern usually forms after a prolonged downtrend in which bears take hold of the market. Three lows are […]