What is Algo Trading?

Algorithmic trading, also known as Algo-trading, uses pre-programmed specific set of instructions aimed to execute trades when a given set of parameters are met to generate profits at a speed and frequency that is impossible for a human trader. Algo executes a predefined set of instructions based on volume, quantity, time, pricing, or other metrics. Algo trading assists an investor/trader in overcoming his emotional quotient, removing trading biases and emotional backlogs, and putting trades on the terminal at lightning speed, reducing manual invention.

There are times when a human trader is unable to handle massive amounts of trade, and this is when an intelligent algorithm comes into play. These algorithms scrutinise every market quote and trade, identifying liquidity opportunities and converting the data into sound trading decisions. Algorithmic trading lowers transaction costs while giving investment managers greater control over their trading processes. Moneysukh provides best ALGO trading platform

Pros of Algorithmic Trading

- Faster execution Speed that is faster than what individuals can attain

- Use immediate execution to capitalise on rare or special events.

- Additional opportunities with simultaneous market checks

- lowering the risk posed by human emotion

- Lower transaction costs

- Reduce market impact

- Ensures decision-making based on rules

- Manpower with less supervision is required.

- Managing multiple open positions at the same time

- Persistence and discipline

- Enhanced opportunity with immediate execution

Cons of Algo trading

- Knowledge of programming language

- Regulatory challenges

- The strategy has a short lifespan

- Even if losses are incurred, the strategy will continue to operate.

- Monitoring is required to prevent technical failures.

- Trade's reliance on technology

Myths with Algo Trading

Set your strategy on best Algo trading platform and forget about it

The global economy, along with domestic factors, has many moving parts that in turn is influenced by various economic and financial cycles. Anything that was once built must be customised in accordance with current trends and environmental conditions, or it will become irrelevant. Similarly, Algo trading strategies must be monitored and adjusted in response to economic and financial conditions until the next cycle arrives.

New age Mom-and-Pop Investors Suffer Losses Due to High-frequency Traders

High Frequency Trading (HFT) is a subset of algorithmic trading that entails placing numerous orders at breakneck speeds. The objective is to earn a profit on each trade, often by taking advantage of price differences for the underlying in different markets/exchanges.

HFT is fundamentally opposed to traditional buy-and-hold investing, and because HFT's existence typically occurs for a small time frame window before price anomalies are identified by other traders. HFTs are perceived by retail investors to compete with retail traders and eat into their profits, but in reality, HFTs only compete with other HFTs.

Algo Trading is the same as High-Frequency Trading (HFT), Quantitative Trading and Automated Trading

Algorithmic trading is frequently confused with concepts and terminologies such as quant trading, high-frequency trading, and automated trading. Though they are closely related but they are not the same.

Algorithmic Trading - Algorithmic Trading is the process of developing a trading strategy into an algorithm and implementing it to follow a defined set of parameters. In other words, trading signals (buy/sell decisions) are generated based on a set of instructions. Parameters for instance can be price, quantity, timing, and other characteristics of the orders. The algorithms can be programmed to execute trades in more than one underlying, such as stocks, commodities, currencies, and so on.

Quantitative Trading – Quantitative trading entails developing trading strategies using advanced mathematical and statistical simulations, as well as quantitative analysis. Based on the strategy, this can then be implemented manually or automatically.

High-Frequency Trading (HFT) Trading – HFT is a subset of Algorithmic Trading. HFT is mostly a Tick-To-Trade game that requires sophisticated technology, programming, and specialised hardware in order to execute orders in an extremely short period of time and minimise response time with a direct network connection to exchange while performing a large number of trades.

Best Algo Trading Platform and Trading Strategies

Automated Trading – Automated Trading refers to completely automated trading in which machines are linked to market data, which is fed into Algo and the computer makes buy/sell decisions. A common ex. is the use of a Charting Strategy to generate buy/sell signals and using the broker computer to computer linked software to automatically push orders to the exchange. Instructions cannot be detailed. Unlike trading with algorithms, you can automate the trade execution only once. Every time a new condition must be set, constant human intervention is required.

Individual traders can’t do Algorithmic Trading

Individual traders can now trade in Algorithmic Trading. With the rise of various Algo trading platforms such as Tradetron and Algo bulls, traders/investors no longer need to invest large sums of money in infrastructure and technology, which is why it is an open domain for all to explore. Through these platforms, you can trade pre-built Algo trading strategies or you can create and back-test your own strategy to make a profit.

Widespread misbelieve that Algo Trading produces assured returns

In financial markets, there is no such thing as guaranteed returns. There is a chance that an investor or trader will get his or her hands on the finest strategy or investment avenue that offers lucrative returns, but as time passes and the market becomes volatile, this may result in profit or loss. Furthermore, large gains are dramatically reduced once overhead charges and taxes are deducted.

Algo trading works only in Trending Market

Algorithms can be implemented for all market scenarios; however, the coder must define the strategy and stick to it.

Algorithmic trading strategies are classified into

All the algorithmic trading strategies that are being used today can be classified broadly into the following categories:

Momentum-based strategies or trend-following Algo trading strategies

Momentum Strategy seeks to profit from the continuation of an existing trend by exploiting market swings. Investing based on momentum sounds less like an investment strategy and more like a breathtaking reaction to market information. The strategy is more volatile than most other strategies and attempts to capitalise on market volatility.

The goal is to capitalise on volatility by identifying opportunities to buy rising securities and sell them when they start to lose momentum. Simply put, buy higher and sell higher, and vice versa. The Algo typically repeats the same process in search of the next short-term uptrend or purchasing opportunity.

Arbitrage Algorithmic trading strategy

Arbitrageurs are investors who seek to profit from inefficiencies across the market. Inefficiencies can occur in any aspect of the market, including pricing, dividends, and regulation. Arbitrage is the ability to buy low and sell high in different markets/exchanges at the same time. By performing such trades correctly, a trader can lock in a free profit. When correlations deviate from the norm, arbitrage opportunities arise. But this is easier said than done: arbitrage opportunities may only exist for a limited time, buying and selling can be difficult, and transaction costs can eat into profits.

This is where the role of algorithmic trading comes in; it can account for many of the timing, risk, and transaction costs issues more easily than a human trader, allowing the trader to capture a larger pie of the risk-free spread. When an Algo strategy is run, it continuously compares prices across various stock exchanges and executes the trade when certain conditions are met. Because the trades are done by machines/bots, the chances of error are reduced and the speed is unrivaled by a human.

The security, for example, is listed on both the National and Bombay stock exchanges. Based on the parameters set, the algorithm calculates the price difference and automatically buys at a lower price and sells at a higher price. After the execution, the trader receives arbitrage profits.

Market-making Algo trading strategies

Every stock or security that trades on the exchanges requires a market of buyers and sellers. On exchange, some high-volume traders create a market for securities by willing to buy and sell at any time. Similarly, when a buyer places an order, the Market Making Algo strategy sells the securities from its own inventory and completes the order. Market Makers are compensated for their risk-taking capacity by providing buy/sell quotes in the market. These strategies profit from the difference between the ask (sell) and bid (buy) prices. This procedure improves market liquidity and price discovery.

Statistical Arbitrage Algorithmic Trading Strategy

To begin with, for an example, if the stock price of Tata Steel falls, the price of JSW will fall as well, but will soon recover. The algorithm exploits this market inefficiency by quickly purchasing shares at a low price and selling them when the price is corrected.

The strategy seeks to profit from one or more underlying assets' statistical mispricing based on their expected value. This is a short-term strategy that exhibits price distortions and comparable share misquoting. Such opportunities exist for a very limited time as market makers correct price inefficiencies and adjust prices. Based on a complex mathematical model, the algorithm monitors the changes and closes the transaction before the correction occurs.

Machine learning in trading

Machine Learning (ML) Algo, a subset of Artificial Intelligence, learns hidden patterns from massive, noisy, or complex datasets, draws interesting outcomes/trends/patterns, and improves its performance based on its own analysis.

The algorithms predict the range of very short-term price movements at a given confidence level. The benefit of using Artificial Intelligence (AI) is that humans create the initial program, and the AI develops and improves the model over time.

Types of Machine Learning Algorithms

Machine Learning Algorithm can be broadly classified into three types:

Supervised Learning Algorithms

Unsupervised Learning Algorithms

Reinforcement learning algorithm

Things to consider before beginning with Algo, including selecting an Algo trading platform and Algo trading strategy.

You can begin Algo trading in the following manner:

- Understanding of the Financial Markets

Before starting any work, one must have a proper understanding of it. In the same way, the first step to any kind of trading is to understand the market. Before you begin Algo trading, gain a thorough understanding of the instrument or market in which you intend to trade so that you can develop a hypothesis on which to base your trades.

- Master any Programming language for Coding your Algo

After you've developed an interest in financial markets and want to pursue Algo trading. To create an algorithm that works on instructions given by you, you must be well-versed in a programming language. Aside from learning a coding language, you should also be familiar with concepts such as quantitative analysis, linear algebra, probability theory, and econometrics. These concepts will help you lay a solid foundation for designing and writing algorithms.

- Back-test Your Strategy

You must test your algorithm via paper money before releasing it to make actual money. Back-test your strategy using historical data across various time frames. You can also use third-party back-testing software to ensure that your algorithms are working properly. You can modify your code based on whether or not they work as per your understanding.

-

Choose best broker for algo trading

At this moment, your strategy is ready for implementation and waiting for live action. All you have to do is select the best broker for algo trading and best platform for algorithmic trading for your trades to reach the exchange. Choosing a broker is also an important step because it is up to your broker to support your algorithm and provide various backend support to help you optimise your trading strategy.

- Go Live

Once you're satisfied with your algorithm trading, it's time to put it into action! Keep an eye on how things are going and make changes as needed.

The preceding steps are more interesting to read than to implement. Commitment, a long period of learning, comprehension, and implementation of an idea are required, and success is not guaranteed. You don't have to be the best trader or coder to work in Algo trading. To benefit from low brokerage and interest on your ledger balance while also having access to Algo trading without prior knowledge of coding, Sign-up with Moneysukh to get all the benefits under one roof.

We'd like to introduce you to platforms offered by Moneysukh; Tradetron and AlgoBulls. Before we proceed, let's go over some of the features of Tradetron and AlgoBulls.

Best Algo Trading Platform and Trading Strategies

Tradetron

Tradetron is a platform that was created to empower strategy creators by allowing them to automate their quant strategies and sell them to investors and traders all over the world while not having to write a single line of code. Tradetron is a multi-asset, multi-currency, multi-exchange Algo Strategy marketplace that allows people to create Algo strategies using their state-of-the-art, patent-pending, web-based strategy builder, which allows you to point and click to create conditions and positions that form the building blocks of an Algo strategy. Once created, it can be listed on a marketplace where people can subscribe and take the trades in their own brokerage accounts.

Features of Tradetron

- Earn by listing your strategy

- Make your Algo strategy with no knowledge of coding

- Multiple asset classes to multiple exchanges

- Multiple Execution Types from paper to live trading.

- Earn by listed your strategy on the marketplace.

- Backtest through historical data.

Let’s get started with Tradetron

- Complete your account opening process with Moneysukh. (Link)

- Go to https://tradetron.tech/ and signup on their platform.

- Verify you Email-id and complete E-KYC process on Tradetron platform.

- Now To connect Moneysukh with Tradetron, Go to Broker and Exchanges in Tradetron from the top-right Menu.

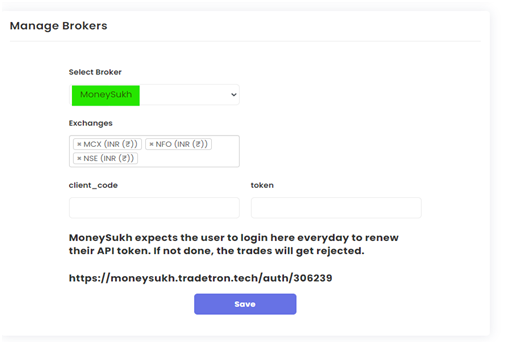

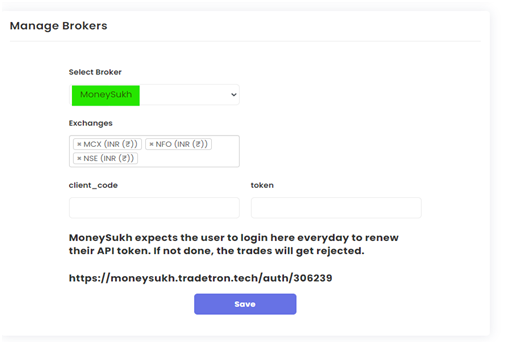

Best Algo Trading Platform

5. Click on Add broker

6. Select Moneysukh from the drop-down menu

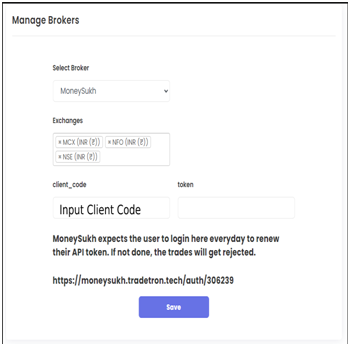

- Fill in your Client Code and leave the token field blank

- Now the broker is added successfully. However, to trade, you need to generate the token manually every day before the market opens. Go to the broker and exchange section and click on the token generation link for the same.

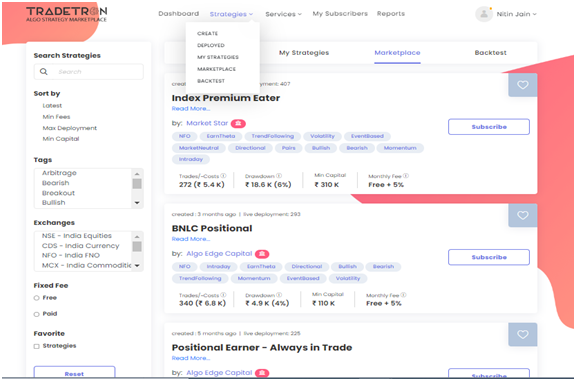

- After successfully configuring Moneysukh as your broker, you are all set to check all their strategies. Go to “marketplace” and you can find all the strategies there.

- Click on the strategy to read more about it, if it suits your investment criteria click on subscribe.

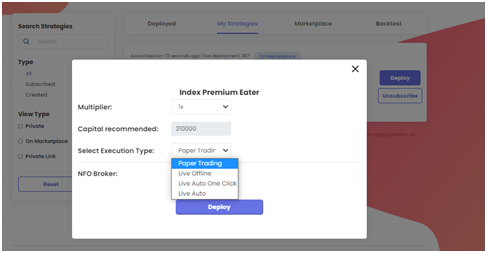

Go to “My strategies” to deploy that strategy. You can change multiplier and execution type.

Congratulations you just deployed your first strategy.

AlgoBulls

AlgoBulls unique AI-driven trading algorithmic platform unlocks the potential of capital market investment. Market players can pick from a diverse set of smart, AI-driven strategies developed at the junction of cutting-edge technology and extensive trading knowledge with AlgoBulls

They provide a distinct range of trading Algos for both novices and experts that perform all transactions, allowing anybody from any part of the world to profit from the capital market. AlgoBulls offers a powerful, tech-driven, and AI-led trading platform where both traders and developers may design their own trading strategies and even monetize their skills all under one roof

Features of AlgoBulls

- Realistic trading simulations with virtual money.

- Backtesting strategy on authentic historic data

- Offer multi-exchange and multi-country trading modules

- With AlgoBulls, you can tweak and fine-tune without writing a single line of code

- Algo trading for retail investor to HNI.

- Build, List and earn from your strategy

Let’s get started with your first AlgoBulls trade.

- Get Started with AlgoBulls.

Sign up and then add Moneysukh as your broker or log in with your Moneysukh account.

- Add money in AlgoBulls Plans and Wallet.

- Add the right strategy

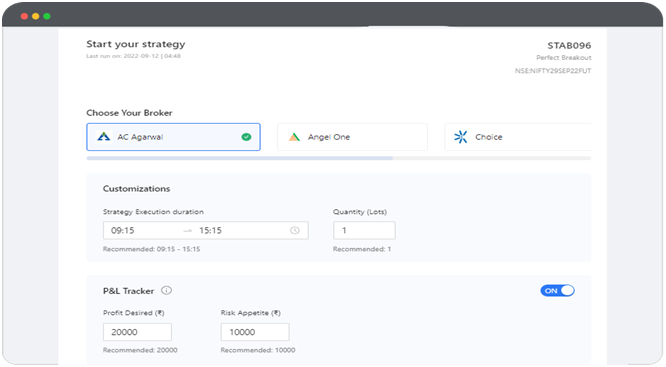

Complete the verification, subscribe to a plan and choose from our rich pool of expert trading algorithms developed by professionals or build your own unique strategy as per your needs and specifications.

- Factor in the risk

Stay shielded from market volatility and turbulences by adding in your specific risk appetite into the trading algorithm equation and our systems will take care of the rest

- Trading is just a click away

Best Algo Trading Platform

With every other factor set to the right levels, as per your comfort and liking, you can now kick start your trading journey through our platform and enjoy the benefits of a highly automated and smart trading ecosystem from anywhere in the world

5 Comments

[…] are several Algo based Trading Strategies available to traders and investors, and the ideal approach for a certain trader will depend on […]

[…] implementation and efficiency in executing the trades. Therefore algo traders use multiple forms of algorithmic trading strategies to generate small profits even at taking advantage of small pricing discrepancies of stock traded at […]

[…] implementation and efficiency in executing the trades. Therefore algo traders use multiple forms of algorithmic trading strategies to generate small profits even at taking advantage of small pricing discrepancies of stock traded at […]

[…] Also Read: Best Algo Trading Platform and Trading Strategies […]

The best trading platforms along with the super amazing algo trading strategies is listed above in the blog post, read to understand in detail.