Options Buying vs Selling: Which Strategy to Use?

For the last 2-3 years, we have seen a drift of retail clients moving from trading stocks and futures to buying options. This may be fuelled by the confinements on intraday leverages on stocks and futures beneath the new peak margin rules. This slant is additionally reinforced by a deluge of more youthful, more forceful clients and traders. What draws individuals to options is leverage – the capacity to urge exposure to huge trading positions with little amounts of money. This actuates ravenousness and the idea that you just can make cash rapidly. For illustration, expect Bank Nifty is trading at 42000, and 42000 calls are at Rs 100 (lot measure = 25). With Rs 2500 (25 x 100) of premium, you’ll be able to get a presentation to a contract that’s esteemed at Rs 10.5L (42000 x 25) or use of 42 times. In case you compare this with trading intraday stocks or futures which at best gives up to 8 times use (Bank Nifty prospects edge of around 12%), you’d get the fascination towards option buying.

Leverage, in our view, is like a suicidal weapon of mass devastation unless utilized carefully. The most important risk management rule when trading successfully with us is to make sure you don’t take a position that could result in a loss of more than 10% of your trading capital. When buying options, the complete esteem of the option can be wiped out rapidly. This implies you shouldn’t be buying choices for more than a little rate (<10%) of your capital at any given time. This run of the show gets broken regularly by amateur traders in an endeavor to urge the wealthy rapidly. This can be tempting destiny.

Let me tell you about one of the many amazing times when things went up and down really quickly. Back in 2022, one of our clients went all in some time recently Budget in Feb 2022 by buying deep out-of-the-money call options with all the cash he had. He got super fortunate as Bank Nifty went up over 10% in 2 days and this Rs 10L turned into more than Rs 1 crores. But the story didn’t end there, he continued trading super forcefully, and finished up losing not fair the complete 1 crore but more than his introductory capital till the final month. To be cognizant of the hazard, an imperative portion of the checklist for anybody buying choices ought to be to see at the introduction in terms of contract esteem and not the premium. So, in the event that you had Rs 1L in your trading account and say you bought 4 lots of the Bank nifty 42000 calls at Rs 100, don’t think of it as a Rs 10,000 premium, but an introduction of Rs 42 lakhs (the overall contract esteem = Rs 10.50lks x 4).

Option Buying

The foremost common way in which traders lose cash is by buying Calls when they think the market is bullish and buying Puts when they think the market is bearish. More frequently than not, they purchase OTM Options. Here is the issue with that: Suppose Nifty is at 18000, and you purchase Clever Week after week Call choice of Strike 18500, the alternative will have a premium of around 100 Rs. This implies that your option begins making cash at 18500. But you begin breaking indeed (in the event that you proposed to hold till expiry) as it were at 18500 + 100 = 18600, as you have got to recover the 100 Rs premium you paid for the option. In simple words only after 18600, you are getting some serious cash otherwise it’s all in vain.

Crux: You have to be precise and accurate in direction. Not only accurate but you have to be accurate by 600 points and moreover time is running out. So in my view, the probability of success is very low but not impossible. All these 3 put together are troublesome to happen. Indeed in case the market doesn’t move against you and remains level, as the contract approaches expiry, the premium drops alongside the time esteem. In this scenario, intrinsic value eroded sharply. And one thing is sure time value is consistently going down. The most common reason why option buyers lose money is that they are constantly battling against time. This is often not at all like train cash or futures trading where you’ll be able possibly to hold the stock until the end of time or proceed to roll the prospects contracts, yet at a little rollover fetched.

Another big mistake- average your positions

Averaging down or buying more of a stock in the event that the cost goes against you is likely the greatest destroyer of your hard-earned money however averaging down can work sometimes after you purchase stocks and the markets are in a long-term bull showcase since you’ve got time in your support or the capacity to hold on to the position until the end of time. It is over the top to think of doing the same with long/buy alternatives when time is always ticking against you. Whereas averaging down might work in some cases, catastrophe may fair be one stock absent. For case, within the case of Reliance capital, as the stock kept dropping from Rs 2000 to Rs 9 a few long times back, numerous retail financial specialists who had bought Reliance Capital at higher costs kept buying more attempting to normalize down, indeed offering/selling other stocks to buy more of Reliance Capital. The riches annihilation was immense. But the proper way to exchange the markets is to never get overexposed to any exchange that can cause more than 10% of your exchanging/ trading capital. Always remember one thing if your losses are controlled only then you can survive in turbulent times.

Option selling

- Selling a call option generally termed as call writing as it were once you accept that upon expiry, the fundamental resource or the underlying assets will not increment past the strike cost

- It is also known as ‘Short Call’

- When you short a call option you accept the premium sum. The profit of an option seller is constrained to the premium he receives, however his loss is absolutely unlimited. The breakdown point is the point at which the call option seller gives up all the premium he has made, which means he is neither making money nor losing money. The breakeven point ( BEP) is the point at which the call option seller gives up all the premium he has made, which suggests he is not one or the other making cash nor is losing cash.

- An option selling position comprises unlimited risk, so a margin requirement is necessary. Margins in the case of selling options are similar to futures margins. P&L = Premium – Max [0, (Spot Price – Strike Price)]. Breakdown point = Strike Price + Premium Received

Conclusively the seller of the call option trusts that the cost of the resource will decay, or at slightest never rise as tall as the alternative strike/exercise cost some time recently it terminates, in which case the cash gotten for offering the alternative will be an immaculate benefit. Let’s take an example – For occurrence, SUN PHARMA is trading at 1,000 per share. You may offer a call on that stock with a 1,000 strike cost for 200 with a close in one month. One contract would deliver you 20,000 if the lot size is 100 ( 200*100). For each cost underneath the strike cost of 1,000, the option will lapse totally useless, and the call seller would get to keep the money premium of 20,000. Between 1,000 and 1,200 – the call seller still gains a few of the premium but not all of it. Over 1,200 for a share, the call seller would start to lose cash past the 20,000 premium that has been gotten.

Think approximately the risk profile of both the call option and the writer. The call alter buyer bears no chance. He fair needs to pay the desired premium amount to the call option seller, against which he would purchase the proper to purchase fundamental at an afterward point. We know his hazard (greatest misfortune) is confined to the premium he has as of now paid. In any case, after you think around the risk profile of an option writer we know that he bears a boundless chance. His potential misfortune can increment as and when the spot cost moves over the strike price. Having said this, think around the stock trade – how can they oversee the hazardous introduction of a choice seller within the scenery of an ‘unlimited loss’ potential? What in the event that the loss gets to be so tremendous if the call writer chooses to default? Clearly, the exchanges cannot manage to allow a subordinate member to carry such a tremendous default hazard, thus it is obligatory for the seller to pay the same margin as if he would create a position in the future.

How to trade Options with Moneysukh?

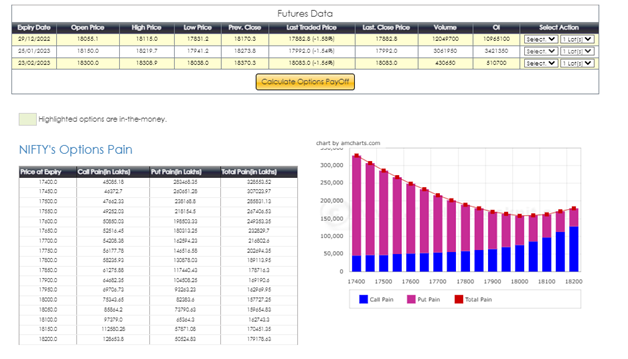

Moneysukh introduces “Trade Radar”, especially for traders where options traders found everything in one place. Options traders may access to-

- Market outlook

- Option chain analysis

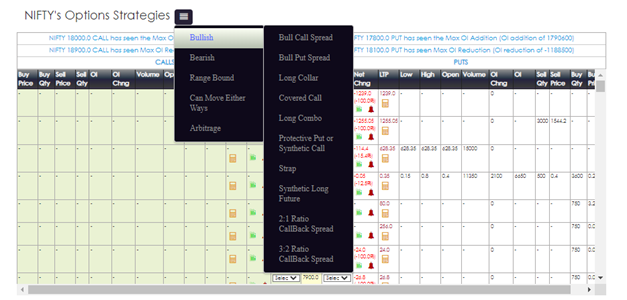

- Pre-built strategies

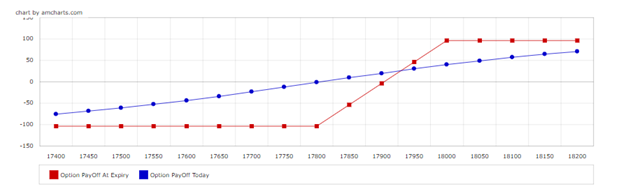

- Pay off graphs

- Popular screeners

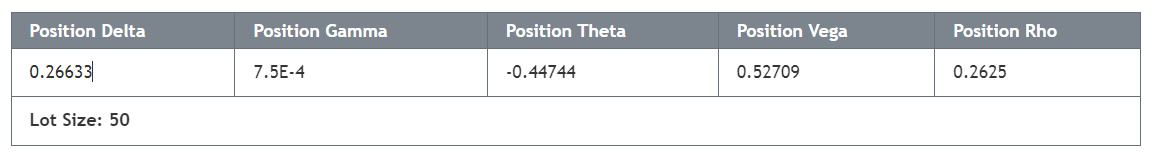

- Options Greeks

Through Trade Radar, option or derivative traders get the above features absolutely free. Apart from this our clients/traders get Interest on their funds' transfer for trading. In simple words suppose any client deposits Rs 100000 for trading and utilizes all his funds in futures and option positions even though he is entitled to get interest on the entire funds (on Rs 1,00,000).

| Script | Lot Size | Strike | Quantity | Premium | Total Value | Margin Required | |

| Nifty | Buy | 50 | 18,000.00 | 10.00 | 100.00 | 50,000 | 50,000 |

| Sell | 50 | 18,000.00 | 10.00 | 110.00 | 55,000 | ||

| Profit | 5,000 | ||||||

| Brokerage & Regulatory Charges | 115 | ||||||

| Net Profit | 4,885 | ||||||

| Interest Earned on Ledger Balance | 50,000*2.7%

= 1350/12 = 112.5 |

||||||

Traders can place multiple orders at the same time and traded directly from options chain. Moreover for the answers of your questions we have round the clock support team.

2 Comments

[…] Future and Option traders typically use the VIX India to decide whether buy or sell an option contract. And when VIX India is high trading into options becomes more attractive as buyers are likely to book more profits. And Option traders also earn high when VIX India is falling. […]

Very Informative