What is Swing Trading; Strategies, Indicators & Best Stocks

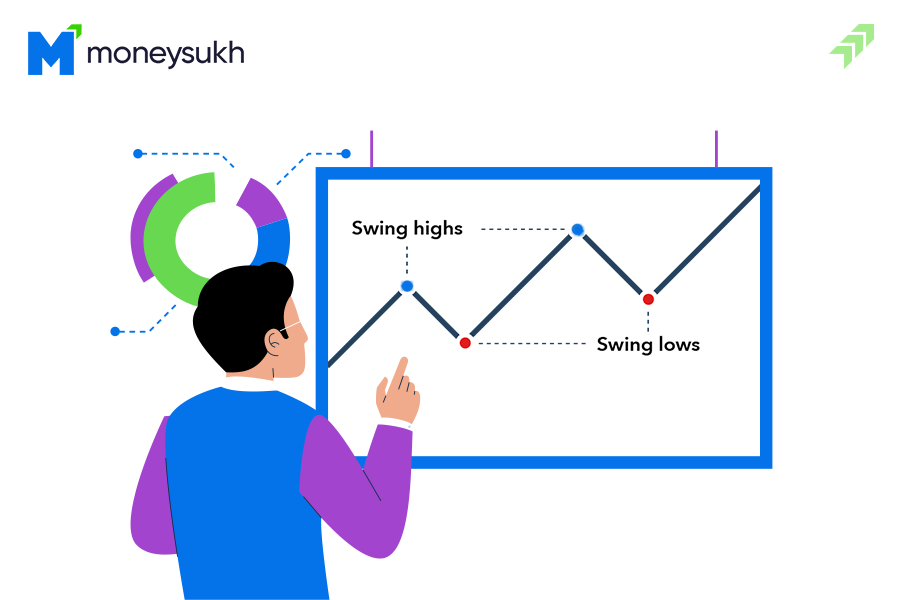

Swing Trading is a kind of trading technique used while trading in investable instruments like stocks, commodities, and currencies. Swing traders use certain indicators and parameters to buy, sell or hold a position in stocks ranging from one day to several days depending on the profit they can generate.

While moving further, making the discussion about swing trading more comprehensive, we will take the example of the stock market, where it is most widely used. Moreover, we try to cover all the aspects to make this topic comprehensible with the best swing strategies, indicators, and best stocks & swing trading tips.

What is Swing Trading in Stock Market ?

Using swing trading in the stock market means traders are considering the various factors and using the technical indicators to pick the stocks and hold their position to make short-term profits.

The main motive of swing trading is to grab any stock having the potential for price movement or likely to swing in the market. Traders use technical indicators to buy, sell or hold the stock as per the trend and book profits or minimize their losses depending on their risk-bearing capability.

Best Indicators for Swing Trading

To make swing trading functional several indicators are also well-known as technical analysis tools in the stock market. Traders use these tools and decide at which point they should buy, or sell to make profits or reduce their losses. Though there are many indicators available for swing trading in the stock market below we have listed the most widely and effective indicators.

Best Swing Trading Indicators:

- Moving Averages

- Volume

- Ease of movement

- Relative strength index (RSI)

- Stochastic Oscillator

Along with these indicators traders use certain swing trading strategies or tactics to make their predictions more accurate and generate some amount of profit from the stock market. And the chances of higher profitability and lower losses depend on the best suitable swing trading strategies applied.

Best Swing Trading Strategies

Though there are many strategies we will let you know the best five swing trade strategies that are not only highly effective but also most widely used by traders across the world.

Top Five Swing Trading Strategies:

Fibonacci Retracement: This pattern helps traders to find out the support and resistance levels to enter or exit into a particular stock or in any underlying index or instrument.

Trend Trading: As the name indicates, traders use this technique to find out the current trend of the market and make their positions accordingly.

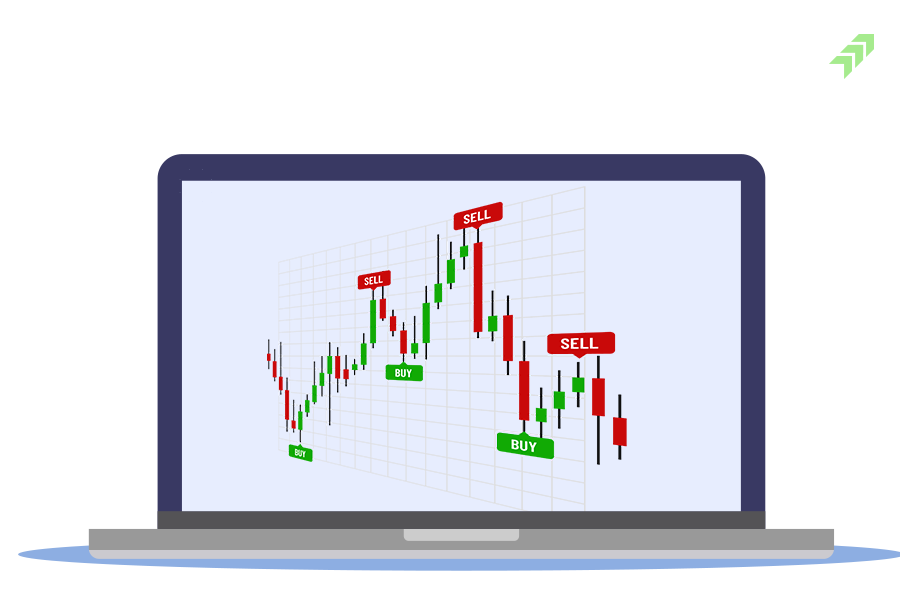

Japanese Candlesticks: One of the most reliable, widely applied, and easy-to-use trading patterns in which Japanese candlestick charts are formed with the price movement of stock giving a right indication.

Support and Resistance: One of the most important indicators helps to identify the bottom and top levels where stocks can resist or stops while going downside.

MACD Crossover: The crossover of Moving Average Convergence/Divergence is one of the strong indicators or popular swing trading tactics that help to find the trend direction and reversals. This indicator consists of two signal lines and crossing these lines indicates a trend to choose to buy or sell a stock.

These are the high-probability swing trading strategies you can follow in swing trading to maximize your profit and minimize your losses while trading into stocks or any other financial instrument. But you need to be very careful while choosing the stocks for swing trading, as all these indicators do not work in all types of stocks. There are certain criteria to select the stocks for swing trading.

How to Select Stocks for Swing Trading?

Choosing the right stock for swing trading is one the most important factor to make the trading strategies effective. Do you know how to find stocks for swing trading? Don’t worry we will tell you how to find the right stocks for making your swing trading strategies successful and profitable.

Volume & Liquidity Stocks: For swing trading, you need to choose the stocks consistently or have a significant volume of trade on regular basis. A high-volume trading stock means its liquidity in the market is good enough to easily find the buyers and sellers making your swing trading strategy effective.

Volatility & Correlation: VIX or volatility index of a particular stock indicates how it reacts in certain market conditions. A stock that moves beyond the market trend can be risky for swing trading. Apart from that, the correlation between the price movements of the stock is important to make the trade positions into that stock. Checking the historical price movement and beta will help you to decide.

Repetitive Trading Patterns: Stocks trade with their repetitive patterns are reliable for swing trading. Stocks reflecting the true price according to the company fundamentals, economic news, and industry trend always repeat their historical patterns and are suitable for swing trading.

Price of the Stock: Penny stocks or shares with very small prices are not usually reliable for swing trading. Yes, most of the stocks in the main index or having the high volume trade are priced neither too high nor too small. You should pick the stock perfectly priced and affordable for traders & investors in the market.

Transparent Company Info: Though swing trading works on technical analysis, having the fundamental information of the company at the time of trade is also equally important. Yes, companies making their fundamental information like financial reporting, corporate actions, and other operating information publicly available through PR and media are the right stocks for swing trading.

Best Swing Trade Stocks

If you are trading in the Indian stock market you can choose the best swing trade stocks from the main index like Sensex and Nifty of the top stock exchange. Stocks in Future & Options are also good for swing trading, as their liquidity in the market is very high and also moves with the repetitive historical patterns.

However, blue-chip listed companies' stocks move according to the market trend and are also very transparent while disclosing their fundamental information to the public. The stocks entered newly in the market or listed just after IPO is not meant for swing trading, as you can't compare or apply the indicators due to the lack of historical price that creates certain patterns. So, always choose the stock quite old after listing in the market, it would be suitable for swing trading and can give you the best returns in the market.

Summing-up

Compare to day trading, swing trading can give you better returns but you need to apply the right strategy and be capable to understand and take the right actions at the right time as per the price fluctuations. At the same time, you also need to understand that swing trading is riskier than day trading as you need to hold your position for a long time which also increases the cost of your fund invested.

But by using the true indicators with the right swing trading strategy you can generate a significant amount of profits and increase your wealth while trading or investing in the stock market. Make sure all the indicators and swing strategies discussed above are used in the market but you have to apply the right one as per the market condition and your risk-bearing capability.

Make sure take help from the experts like technical analysts and fundamental analysts before making any position into any stock. These experts can charge you little amount but will help you maximize the profits and minimize the losses while trading in stock markets or any other financial instrument.

2 Comments

[…] Also Read:Swing Trading Strategies Indicators & Best Stocks […]

[…] Also Read:Swing Trading Strategies Indicators & Best Stocks […]