In the latest Lok Sabha question report stating that over 7.40 crore were ITRs filed for FY 2022–23, 9.2% more than the 6.94 crore ITRs filed for FY 2021–22. Out of 7.40 crore return filers, nearly 5.16 crore declared zero tax liability. The number of people who filed income tax returns (ITRs) during the last four years has risen. The data showed that the number of people filing ITRs increased from 6.48 crores to 7.4 crores during these four years, while the number of people filing returns amounting to zero tax liability increased from 2.9 crores in 2019–20 to 5.16 crores in 2022–23.

The share of persons claiming zero-tax liability out of the total number of people who filed ITR was 45% in 2019–20, which touched 70% in 2022–23, and fell a bit to 69% in FY 2022-23.

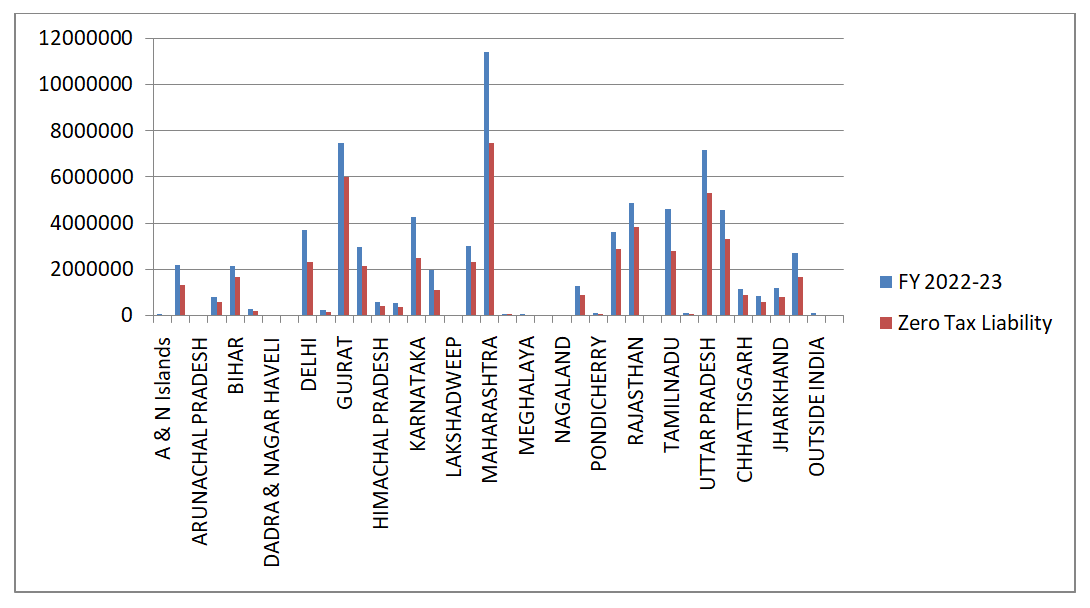

The Ministry of Finance submitted state-wise data on the number of persons who filed income tax returns (IT returns) during the last four years, from FY 2019–20 to FY 2022–23. Among states, As of FY 2022-23, Maharashtra has the highest number of persons filing ITR, with more than one crore filing each year. Following Maharashtra are Gujarat and Uttar Pradesh, with over 60 lakh people filing ITR in each of the four years considered. Between 40 to 50 lakh, people file ITR in Rajasthan, Tamil Nadu, and West Bengal, Karnataka each year. These seven states account for approximately 60% of the total number of people in India who filed ITR in FY 2022-23.

In FY 2022-23, 3 states, Nagaland, Gujarat, and Punjab, claimed zero tax liability accounting for over 80%, which has shown improvement from 5 states in the previous year. Those five states included Bihar, Nagaland, Rajasthan, Gujarat, and Punjab. Share of Zero tax filing has been highest in percentage term over the past years.

For FY 2022-23, five States with a Percentage of Population that filed ITR exceeding 10% are Chandigarh at 22.6%, Delhi at 17.4%, Goa at 14.6%, Punjab at 11.8%, and Gujarat at 10.4%. The position of these five states has been consistent over the years.

India's direct tax collection for FY23 saw a 17.63% YoY growth from the previous year, reaching Rs. 16.61 lakh crore, who filed returns paying taxes out of the total 7.4 crore taxpayers. The collections exceeded budgeted estimates by Rs. 2.41 lakh crore, resulting in a 16.97% increase from the revised budget of Rs. 14.20 lakh crore. Gross collections of direct taxes increased by 20.33% YoY to Rs. 19.68 lakh crore, compared to Rs. 16.36 lakh crore in FY 2021–22.

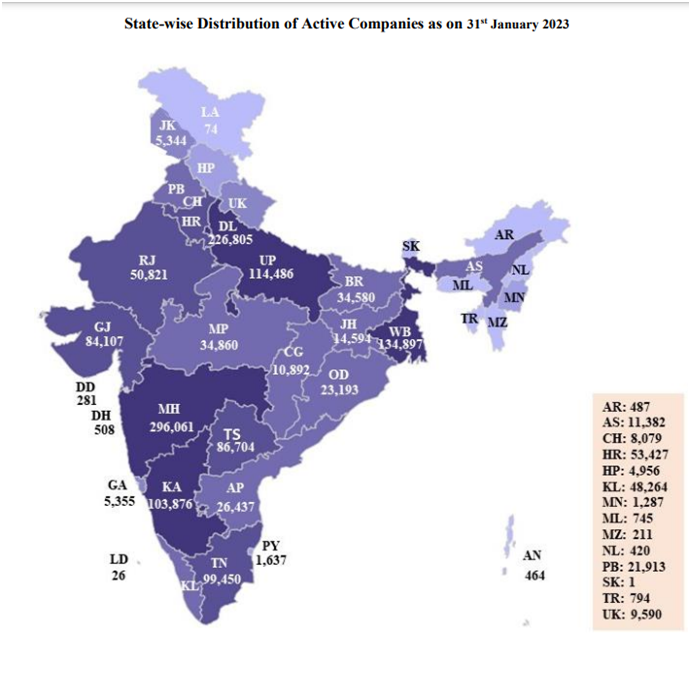

Corporate tax collections rose by 16.91% YoY to Rs. 10,04,118 crore, while personal tax collections reached Rs. 9,60,764 crore, a 24.23% YoY increase. As of January 2023, 15,17,008 active companies were listed with the Ministry of Corporate Affairs. There is an increase of 1% in the total number of active companies compared to December 2022.

No comment yet, add your voice below!