Straddles and strangles are non-directional option strategies, meaning a trader can profit from either side moment in underlying, whether a significant spike or fall in the underlying security. Straddles and strangles are also considered volatility strategies. Non-directional strategies can be used by investors when they anticipate a major market movement and want to gain profit irrespective of whether the asset price rises or falls.

Short straddle option strategy and short strangle option strategy are opposite of straddles and strangles, these strategies profit when the market trades sideways. Short straddles and short strangles have a maximum profit equal to the premium received from selling the call-and-put options. The only reason to take a short position, with its unlimited risk and small profit potential, is when an analyst or market participant anticipates the market to move sideways. The trader must have proper stop losses put in place if the underlying picks volatility.

Short Straddle Option Strategy

Want to profit from a tight-range market scenario? By executing a short straddle option strategy you can profit from underlying trading in a range. To implement this strategy a trader shorts a call and put an option of the same underlying, at the same expiration and same strike price.

When a trader believes there is little predicted volatility in the underlying price, traders opt for a short straddle, with the expiration date set to occur after the projected price change. A short straddle is executed when a trader shorts both a call option and a put option on the same strike. A short straddle receives a higher premium and has a maximum profit potential higher than a strangle. The breakeven marks for a straddle are closer together than for a strangle. If a straddle is held until expiry, the chances of making the maximum profit potential are reduced. The goal is to have both options expire worthless while profiting from the premiums paid.

You can trade Short Straddle Algo Strategy through Moneysukh on the AlgoBulls platform, let’s discuss with an example

Bank Nifty Short Straddle strategy (STRAT052) – According to the description provided by AlgoBulls (Algo trading platform), a short straddle is a net-credit option strategy that profits when underlying security remains around the ATM Strike.

The implementation consists of selling 1 at-the-money (ATM) CALL and 1 at-the-money (ATM) PUT of the same underlying, same expiry at the start time. The strategy has a risk of 25% and the maximum profit is capped at the sum of short call strike and short put strike.

You can also build various range-bound option strategies through our Traderadar platform. Traderadar provides other useful data like screeners, scanners, EOD data, FO analysis, etc. Take an example,

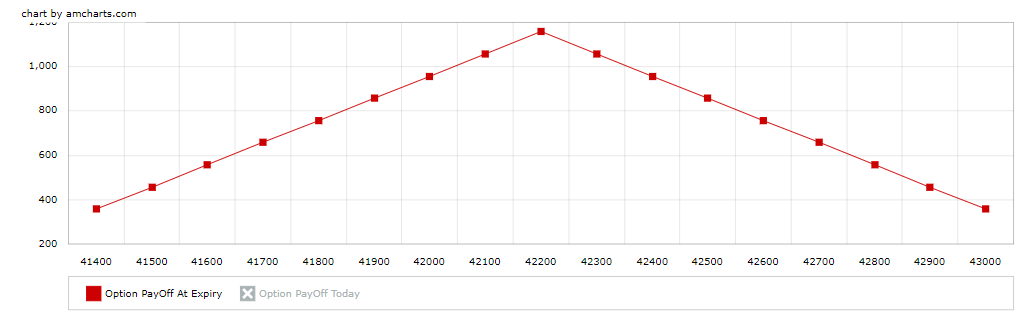

Supposing Bank Nifty is trading at 42228

Short Straddle

Sell 42200 CALL

Sell 42200 PUT

| Option Type | Expiry Date | Strike Price | LTP | Action | No. Of Lots |

| CALL | 25-01-2023 | 42200 | 672.05 | Sell | 1 |

| PUT | 25-01-2023 | 42200 | 486 | Sell | 1 |

The payoff chart, various pre-build strategies, option Greeks, etc for BANKNIFTY and all other stocks in the F&O segment can be found on our platform – Traderadar.moneysukh.com free of cost for all our clients.

Short Strangle Option Strategy

Short strangle option strategy can be implemented when the investor holds a neutral market view and expects very little volatility in the underlying asset price in the near term. The strategy entails limited profit and unlimited risk. The payoff is limited to the premiums received, while the risk of loss can be significant.

To earn maximum profit from this strategy, the price of the underlying asset shouldn’t have price movement greater than the shorted options. For implementing a short strangle, just like the short straddle strategy, a call and put option is shorted (sold) at the same underlying, same expiry but on a different strike price.

There is a greater chance of keeping the premium received, as the breakeven points are further apart than for a comparable straddle. If there is a distance between the breakeven, the premium received and maximum profit potential for selling one strangle is lower than for one straddle.

You can trade Short strangle Algo Strategy through Moneysukh on the AlgoBulls platform, let’s discuss this with a Bank nifty example

Bank Nifty Short Strangle strategy (STRAT053) – According to the description provided by the AlgoBulls platform, the strategy is a net-credit option strategy that profits when underlying security remains around the ATM Strike.

It consists of the following two legs:

Short OTM Put.

Short OTM Call.

The strategy has a risk of 22%, Maximum Profit is capped at the sum of the Short CE strike and Short PE strike.

You can also build various range-bound option strategies through our Traderadar platform. Traderadar provides other useful market data like screeners, scanners, EOD data, FO analysis, etc.

Now taking an example, Supposing Bank Nifty is trading at 42228

Short strangle

Sell 42300 CALL

Sell 42100 PUT

| Option Type | Expiry Date | Strike Price | LTP | Action | No. Of Lots |

| PUT | 25-01-2023 | 42100 | 446.95 | Sell | 1 |

| CALL | 25-01-2023 | 42300 | 613.8 | Sell | 1 |

The payoff chart, option Greeks, etc for BANKNIFTY and all other stocks in the F&O segment can be found on our platform – Traderadar.moneysukh.com free of cost for all our clients.

Illustration between two strategies through a bank nifty example

- If a trader forecast little volatility and wishes to earn a 100% premium, he can execute a short strangle strategy.

- Breakeven points.

- In a short straddle, a trader shorts both the call and put options of the same strike. But in the case of a Strangle, the trader sells the call at a higher strike and put it at a lower strike.

- Strangles are less expensive to implement than straddles.

- Choosing the strike price is critical in determining risk parameters and profit from the strategy. Selling an at-the-money option in a short straddle can make a trader earn a big premium upfront.

- Short strangles is preferred over short straddles because they provide a significantly bigger safety zone.

3 Comments

[…] expects relatively little volatility in the underlying asset price in the near future, the short strangle option strategy can be employed. The method involves a fixed profit and an infinite risk. The reward is restricted […]

[…] Strategy is another name for the Iron Butterfly strategy. It is a market-neutral options trading strategy that combines buying and selling of call-and-put options. This strategy is used by traders when […]

[…] Also Read: Short straddle and strangle option strategy […]