Diagonal Bull Call Spread Explanation

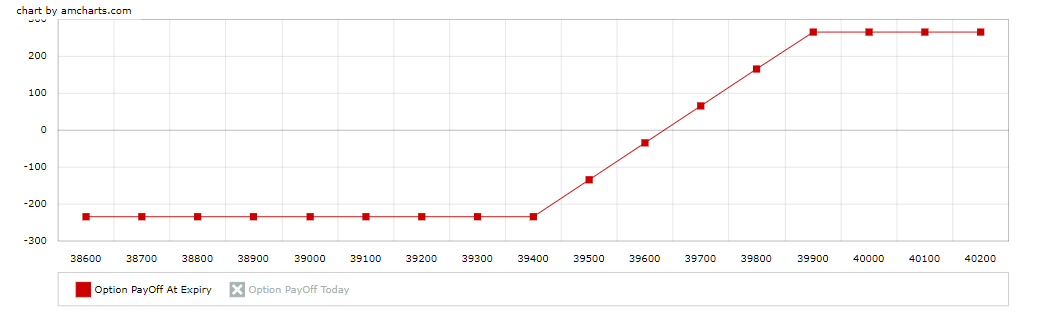

This strategy is typically employed when the trader is bullish in the longer term and moderately neutral to bullish on the underlying stock over the near term. The diagonal bull call spread strategy involves shorting Near-Month out of the money (OTM) Call Option and buying of long term in the money Call Option of same underlying.

Risk:

Maximum possible loss for the diagonal bull call spread is limited to the initial debit taken to put on the spread. This happens when the stock price goes down and stays down until expiration of the longer term call.

Reward:

Limited

Construction

Sell Near-Month OTM Call

Buy Mid-Month ITM Call

Diagonal Bull Call Option Trading Example

Suppose NIFTY is trading at 5300 odd points, Mr. X is neutral for the near-month contract and bullish for the mid-month contract. He applies Diagonal Bull Call Spread Strategy where he will sell 1 5400 Near-Month OTM Call Option for a premium of Rs. 25 and buy 1 5200 Mid-Month ITM Call Option at a premium of Rs.

- His net investment will be Rs. 10500. [(235-25)*50]

Scenario 1

At the Near-Month expiry if NIFTY closes at 5000, then Mr. X will get to keep the premium amount of 5400 Near-Month OTM Call Option of Rs. 1250. (25*50)

At the Mid-Month expiry if NIFTY closes at 4900, then Mr. X will make a loss on his premium amount paid for 5200 Mid-Month ITM Call Option i.e. Rs. 11750. (235*50)

His net payoff will result in a loss of his entire investment value i.e. Rs. 10500. [(235-25)*50]

Scenario 2

At the Near-Month expiry if NIFTY closes at 5200, then Mr. X gets to keep the premium amount of 5400 Near-Month OTM Call Option of Rs. 1250. (25*50)

At the Mid-Month expiry if NIFTY closes at 5300, then Mr. X will make a loss on the 5200 Mid-Month ITM Call Option of Rs. 6750. [(100-235)*50]

His net payoff will result in a loss of Rs. 5500. (6750-1250)

Scenario 3

At the Near-Month expiry if NIFTY closes at 5400, then Mr. X will get to keep the premium amount of 5400 Near-Month OTM Call Option of Rs. 1250. (25*50)

At the Mid-Month expiry if NIFTY closes at 5500, then Mr. X will make a profit on 5200 Mid-Month ITM Call Option of Rs. 3250. [(300-235)*50]

His net payoff will result in a profit of Rs. 4500. (1250+3250

Also read: Covered Combination Option Strategy

No comment yet, add your voice below!