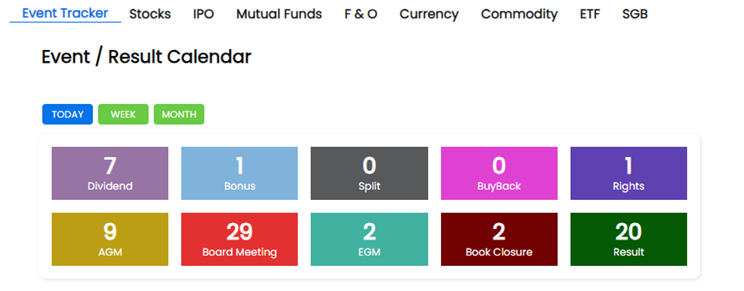

Volatility knocks on the door quarter after quarter as the earnings season approaches. Even if we take out earnings season, there are many other corporate actions like dividends, bonuses, right-issue AGMs, etc. that play an important role for shareholders and stakeholders. Long-term investors who have their systematic investment plan (SIP) strategy in place need not worry much about the corporate result, but investors who take advantage of cycle uptrends and downtrends might be very interested in corporate actions. Investors often seem to get irritated visiting exchange websites, seeing those old pale colors, sorting again and again, and visiting different links for different corporate actions. But not to worry, because on the new Money website, you can find all the corporate action and company details under one header.

You can check all the corporate action that will take place on that particular day, events in the next week, or all the events within the next month.

Read also – Five Corporate Actions and Its Impact on Stock Prices

Having all the company-related information under one roof always comes in handy. Suppose you saw a company that you had heard of before at an upcoming event on the event calendar. You wish to know about the company’s business lines, MCAP, important ratios, etc. Now either you can search on the internet or you can just type in the name of the company in the Moneysukh website search bar and get the company details instantly.

The website not only presents you with data limited to financial numbers, but the website presents you with data related to their IPO, Mutual funds, F&O data, and many more.

The website provides you with real-time performance of all the IPOs that got listed on exchanges, be it NSE or BSE. The Moneysukh website holds IPO data of all types, be it SME, Midcap, etc. The website provides updates on upcoming issues and companies that have filed prospectuses with SEBI.

Also Read – What to Check Before Buying IPO: Things to Know & Is it Safe

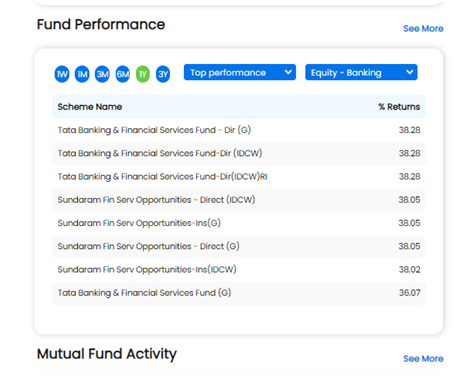

For investors who opt for a systematic investment plan (SIP), the mutual funds section will be very helpful in finding out the scheme. The section provides details, from the top holdings of stocks to Fund performance, on what stocks have been added or removed. You can check performance of funds for 1 week to the stretch of 3 years.

No comment yet, add your voice below!