Easy Options and Strategy is a trading product that allows F&O traders to trade in various derivative scripts by just selecting a few options. You can trade on highly liquid options with limited risk, as the loss in buying options is limited to the net premium paid. Traders can directly trade calls or puts through Strategy Builder or make their own strategies and select strikes from ATM, near OTM, and far OTM strikes. One of the main concerns with options is the risk of losing your entire investment.

While standalone buying and selling options are normally associated with high risk, traders can turn to several ready-made option trading strategies that have limited risk and boost overall returns. By using ready-made option strategies on the Moneysukh easy-option platform, Traderadar, risk-averse traders can enhance their overall returns. However, it’s always important to keep in mind that risk does not vanish, so a participant must understand the possible loss and whether it’s worth the potential gain.

Options strategies can range from quite simple to very complex, with a variety of payoffs and sometimes odd names (Straddle, strangle, condor) regardless of their complexity, all options strategies are based on the two basic types of options: the call and the put

Let’s discuss the first odd name, i.e., Straddle through the payoff table and chart, option Greeks, and the implied volatility of options.

Long straddle

Setup of the strategy

- Buy an ATM call option

- Buy ATM put option

A long-straddle strategy combines the best of both worlds. When an investor or trader predicts a substantial move in stock price but the direction of the shift is unknown, this strategy can be applied. The method looks to benefit if the underlying security extends over the higher break-even point or falls below the lower break-even point. A long-straddle option strategy involves buying a call and buying a put with the same strike and expiration date. For example, the investor may be anticipating a court ruling against the company in the coming quarter, the outcome of which will be either extremely good or very bad for the company. The strategy is constructed for a net premium. There is no cap on potential profits that can be earned from strategy, whereas potential loss is limited to the total cost of employing the straddle.

Straddle and strangle are both similar strategies with comparable risk characteristics. The main difference between a straddle and a strangle is that a straddle is constructed with ATM strikes, while a strangle is constructed with OTM options. Both techniques employ a call and a put option from the same expiry cycle and are also constructed for a net cost.

The overall cost of applying the strategy plus taxes is the highest probable loss. Both options will be worthless if the security price at expiration is equal to or between the strike prices.

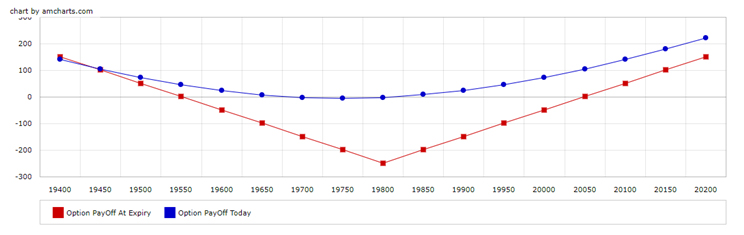

Let’s now take up a scenario to elaborate on the long-straddle option strategy. Suppose the Nifty is trading at 19808 levels. We will but 19800 put option and 19800 call option. Under the given scenario, the strategy will breakeven when Nifty trade above 20048 levels or fall below 19551 levels.

| Option Type | Expiry Date | Strike Price | LTP | Action | No. Of Lots |

| PUT | 30/11/2023 | 19800.0 | 85.05 | Buy | 1 |

| CALL | 30/11/2023 | 19800.0 | 163.25 | Buy | 1 |

Position Greeks

| Position Delta | Position Gamma | Position Theta | Position Vega | Position Rho |

| 0.15939 | 0.00262 | -14.29349 | 24.30469 | 0.71646 |

Pay-Off Details

| Max Risk | Max Reward | Lower Break Even | Upper Break Even |

| 248.3 | Unlimited | 19551.7 | 20048.3 |

| Market Expiry | Payoff 1 | Payoff 2 | Net Premium | Option PayOff At Expiry |

| 19400.0 | 400.0 | 0.0 | -248.3 | 151.7 |

| 19450.0 | 350.0 | 0.0 | -248.3 | 101.7 |

| 19500.0 | 300.0 | 0.0 | -248.3 | 51.7 |

| 19550.0 | 250.0 | 0.0 | -248.3 | 1.7 |

| 19600.0 | 200.0 | 0.0 | -248.3 | -48.3 |

| 19650.0 | 150.0 | 0.0 | -248.3 | -98.3 |

| 19700.0 | 100.0 | 0.0 | -248.3 | -148.3 |

| 19750.0 | 50.0 | 0.0 | -248.3 | -198.3 |

| 19800.0 | 0.0 | 0.0 | -248.3 | -248.3 |

| 19850.0 | 0.0 | 50.0 | -248.3 | -198.3 |

| 19900.0 | 0.0 | 100.0 | -248.3 | -148.3 |

| 19950.0 | 0.0 | 150.0 | -248.3 | -98.3 |

| 20000.0 | 0.0 | 200.0 | -248.3 | -48.3 |

| 20050.0 | 0.0 | 250.0 | -248.3 | 1.7 |

| 20100.0 | 0.0 | 300.0 | -248.3 | 51.7 |

| 20150.0 | 0.0 | 350.0 | -248.3 | 101.7 |

| 20200.0 | 0.0 | 400.0 | -248.3 | 151.7 |

Pay-Off Chart

Following are the steps through which traders can use the Traderadar Easy Option Strategy Builder.

- Go to www.traderadar.moneysukh.com.

- On scrolling through the page, come to the second section, ‘Scanners for options’.

- After scrolling to the section, you will encounter two tabs: one for ready-made strategies and the other for making strategies.

- Click on ‘EASY OPTIONS STRATEGIES’, if you wish to trade on machine-generated strikes. Or else you can click on ‘OPTION CHAIN & ANALYSIS’, if you wish to make your own option strategy by visualizing payoff chart tables and charts, Greeks, etc.

- After selecting the strategy, you can execute the trade using the basket order.

- You can explore various other Traderadar features, like finding stocks for swing trading on the basis of technical indicators, chart patterns, candlesticks, etc.

No comment yet, add your voice below!