What is Traderadar?

Traderadar is a platform offered by Moneysukh to all its clients to help them navigate the stock market while removing the noise and helping investors identify stocks that fit their needs and goals. Moneysukh Traderadar generates buy or sell signals based on complex mathematical algorithms and also gives results from manual input choices by the operator using the platform.

Moneysukh Traderadar generates comprehensive insights by analyzing tremendous quantities of data across multiple exchanges under one dashboard. Trade Radar is a new iteration of algorithmic cloud-based tools that provide a unique decision-making edge in markets and are accessible from anywhere to all Moneysukh clients free of charge. The platform offers complete insights into the market, from equities going up or down, new long positions being added, and machine-generated option strategies for all market conditions. It has a straightforward and user-friendly user interface that allows users to perform sophisticated analytics without having the burden of obtaining the data, writing code, or seeking programming assistance. Trade Radar facilitates investors, traders, hedgers, and arbitragers by providing the finest software tools available. Radar Signal Trading Systems make it simple for investors to monitor technical indicators, such as openings, resistance or support levels, and changing volumes on volatile days.

How to build bullish strategy in Traderadar?

It’s easy to build an option strategy with Traderadar. Follow these simple steps and you will surely be able to trade your first strategy.

- Go to traderadar.com

- Scroll down to ‘Scanners for options’ segment.

- Choose the first option “OPTION CHAIN & ANALYSIS”.

- If you are registered with Moneysukh and have trading account, use your login id credentials to sign in. Otherwise in order to use the platform, you first have to open a trading account with Moneysukh.

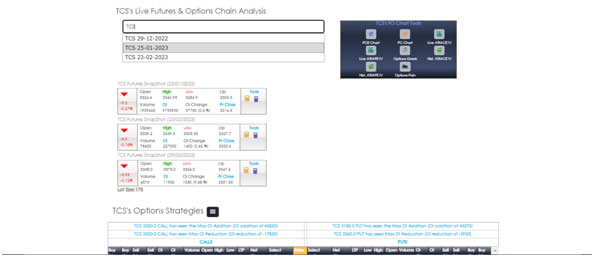

- After the login process, a window will appear with Nifty 50 selected as default script. You can choose any other derivative stock of your preference.

- Scroll down the page and an option chain table will appear. You can implement your strategy by choosing among the strikes you want. You can even trade future.

- After choosing strikes click on “calculate option payoff”.

- What will option payoff page show?

- One-click execution of strategy

- Strike-wise payoff to the trader

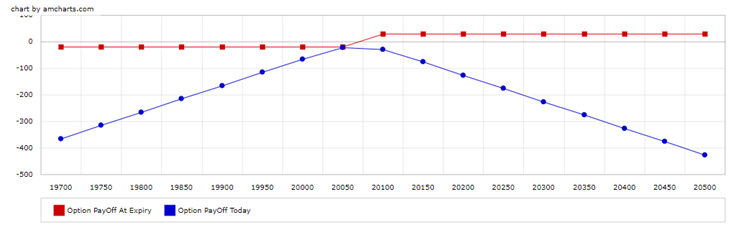

- Interactive payoff chart visually shows the strike of profit and loss

- Breakeven point, maximum reward, and maximum loss

- Implied volatility of options with option Greeks

Or

You can trade on a machine-generated trading strategy after inputting your outlook for the market.

Suppose you thought of implementing a Bull Call strategy.

Following are the steps for implementing Bull Call option strategy. (After login steps)

- Scroll down to NIFTY’s Options Strategies

- Click on the ham burger adjacent to “NIFTY’s Options Strategies”.

- List of market scenarios will appear, choose the bullish option, since you want to implement bullish strategy.

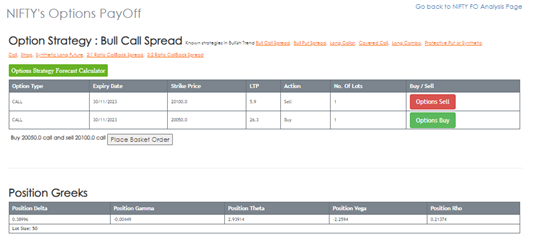

- Click on the strategy and you will be directed to the Option payoff page.

What is Bull Call strategy option strategy?

Setup of the strategy

- Buy 1 call at a lower strike.

- Sell 1 call at a higher strike.

Also known by the name long call spread, it is a vertical spread made up of options trading strategies aimed at profiting from a stock’s finite price gain. A bull call spread consists of buying the lower strike call and selling the higher strike call, both of which expire at the same time. The bullish call spread aims to reduce stock losses while also capping gains.

The bull call spread lowers the cost of the call option, but there is a cost associated with it. Because of the lower and upper strike prices, the bull call spread’s losses and gains are restricted. If the security price falls below the lower strike price—the initial, acquired call option—at expiration, the investor does not execute the option. The option strategy expires entirely useless, and the investor loses the initial net premium paid. Traders will utilise the bull call spread if they feel an asset’s value will appreciate. If the security price has gone up and is trading above the upper strike price at expiry, the investor executes their first option with the lower strike price. However, the second, sold-call option remains outstanding. The option buyer at a higher strike will automatically execute this call option. The positive payment from the first call option will be used to compensate for the two sold calls. As a result, earnings from the first call option purchased are restricted to the strike price of the sold option. The difference between the lower and upper strike prices, minus the net cost of entering into the contract, is the net cash flow.

The option premium collected from selling the call option partially compensates the premium paid by the investor or trader for purchasing the call option. Because the investor may only lose the net cost of creating the spread with a bull call spread, the risk is reduced. The strategy’s disadvantage is that the gains are also restricted.

Let’s now take up a scenario to elaborate Bull Call option strategy.

| Option Type | Expiry Date | Strike Price | LTP | Action | No. Of Lots |

| CALL | 30/11/2023 | 20100.0 | 5.9 | Sell | 1 |

| CALL | 30/11/2023 | 20050.0 | 26.3 | Buy | 1 |

Bull Call Option Strategy Greeks

| Position Delta | Position Gamma | Position Theta | Position Vega | Position Rho |

| 0.38996 | -0.00449 | 2.93914 | -2.2594 | 0.21374 |

Bull Call Option Strategy Pay-Off Details

| Max Risk | Max Reward | Lower Break Even | Upper Break Even |

| 20.4 | 29.6 | 20070.4 | 20070.4 |

| Market Expiry | Payoff 1 | Payoff 2 | Net Premium | Option PayOff At Expiry | Option PayOff At 1 Days To Expire |

| 19700.0 | 0.0 | 0.0 | -20.4 | -20.4 | -364.908 |

| 19750.0 | 0.0 | 0.0 | -20.4 | -20.4 | -314.908 |

| 19800.0 | 0.0 | 0.0 | -20.4 | -20.4 | -264.908 |

| 19850.0 | 0.0 | 0.0 | -20.4 | -20.4 | -214.908 |

| 19900.0 | 0.0 | 0.0 | -20.4 | -20.4 | -164.908 |

| 19950.0 | 0.0 | 0.0 | -20.4 | -20.4 | -114.908 |

| 20000.0 | 0.0 | 0.0 | -20.4 | -20.4 | -64.908 |

| 20050.0 | 0.0 | 0.0 | -20.4 | -20.4 | -21.216 |

| 20100.0 | 0.0 | 50.0 | -20.4 | 29.6 | -29.317 |

| 20150.0 | -50.0 | 100.0 | -20.4 | 29.6 | -75.906 |

| 20200.0 | -100.0 | 150.0 | -20.4 | 29.6 | -125.906 |

| 20250.0 | -150.0 | 200.0 | -20.4 | 29.6 | -175.906 |

| 20300.0 | -200.0 | 250.0 | -20.4 | 29.6 | -225.906 |

| 20350.0 | -250.0 | 300.0 | -20.4 | 29.6 | -275.906 |

| 20400.0 | -300.0 | 350.0 | -20.4 | 29.6 | -325.906 |

| 20450.0 | -350.0 | 400.0 | -20.4 | 29.6 | -375.906 |

| 20500.0 | -400.0 | 450.0 | -20.4 | 29.6 | -425.906 |

Why Choose Traderadar?

If you are looking for a platform that is easy to use and offers a range of features, like stock scanner; on base of candlesticks, MA, volume, Open Interest (OI), etc, option strategy builder, pay-off chart, stocks for swing buy. Then Moneysukh Traderadar is the platform for you.

Traderadar is a web-based platform that offers a range of features, including:

- Simple and easy-to-use interface

- Variety of screening tools

- Range of market data

- Interactive charts and graphs

- Available at No Cost

- Dedicated customer support team

Traderadar is the perfect platform for both new and experienced traders. It’s simple and easy-to-use interface makes it easy to get started, and the range of features and tools available means that you can trade with confidence.

No comment yet, add your voice below!