The market has taken sharp corrections in the previous session. Factors can be many, starting with star loser HDFC Bank, whose result failed to impress the investors, rising inflation in the UK and USA, which feared the market that the Federal Reserve would delay its interest rate cut from March, profit booking in the market from high levels, or any unknown international reason that’s under the hood. For today’s weekly expiry, we suggest implementing the short iron condor option strategy.

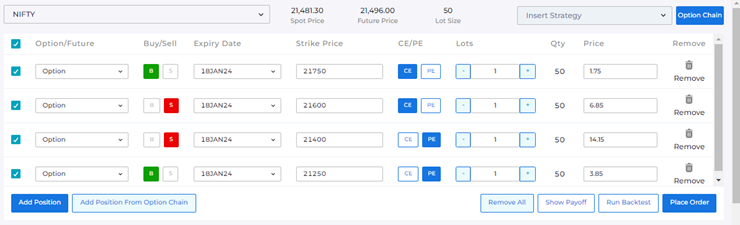

Short iron condor strategy strikes

| Option Type | Expiry Date | Strike Price | LTP | Action |

| CALL | 18-01-2024 | 21750 | 1.75 | Buy |

| PUT | 18-01-2024 | 21250 | 3.85 | Buy |

| CALL | 18-01-2024 | 21600 | 6.85 | Sell |

| PUT | 18-01-2024 | 21400 | 14.15 | Sell |

| Max Profit | Max Loss | Reward/ risk | Breakeven | margin required |

| 770 | -6,730.00 | 0.11 | 21388-21620 | 50188 |

Payoff chart of Short iron condor option strategy

Short iron condor options strategy is a neutral option strategy that involves selling out of the money (OTM) Call and out of the money (OTM) Put option, and buying far out of the money Call and Put options of the same expiry and the same underlying. This is a net credit payoff strategy, meaning the trader executing this strategy will earn a premium rather than paying a net premium. At the time of initiating this strategy, the underlying price is usually somewhere between the two middle strikes. Usually, all four options are equidistant from each other. That said, this is not a hard-and-fast rule. This strategy works best when the underlying has witnessed volatility (meaning the security has experienced a fall or rise) and is now consolidating.

Also read: Short Iron Condor-Neutral Strategy

Both profits and losses under this strategy are limited. The trader initiating the short iron condor strategy would experience profitability as long as the underlying price was within the two breakeven points, and the trade would turn unprofitable when the underlying price was outside either of the two breakeven points. A short iron condor has two breakeven points: lower and upper.

Benefits of short iron condor option strategy

- Net credit strategy

- Benefit of time decay

- Loss is limited

Drawbacks of short iron condor option strategy

- Limited Profit

- Volatility on either side can lead to a loss in position.

You can build your own option strategy and even automate it through Moneysukh on Keev, with backtesting, paper trading, forward test on multiple segments absolutely free. All you have to do is signup with Moneysukh.

No comment yet, add your voice below!