During the initial trading session of the week, the benchmark Nifty50 index surged and surpassed its previous all-time high that was made in early February of 21,126 to reach a new peak of 22186. The following day, the Nifty opened on a negative note, traded volatile initially, and after the first half attempted to surpass yesterday’s all-time high but was unable to do so. Trendline formation in spot index refers an ascending triangle formation is in progress, although confirmation of this pattern still on the cards. Reason behind making all time high and trading at higher level, including but not limited to domestic news, SIP inflows, sound fundamentals, sluggish development in China, and stable crude prices.

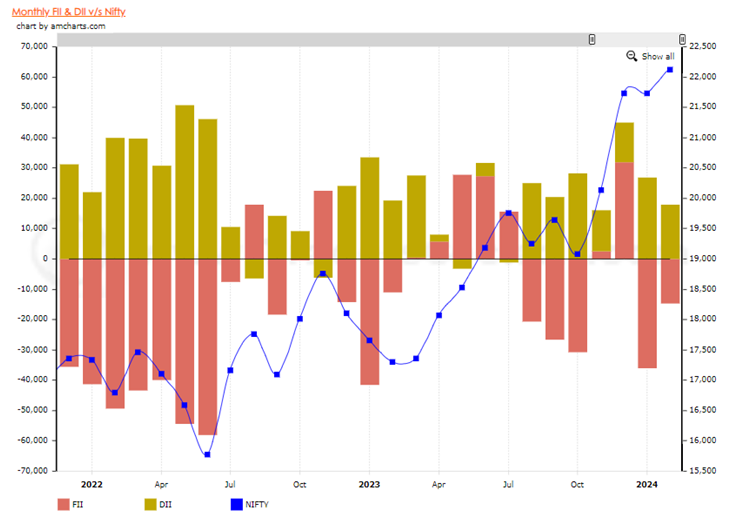

Domestic institutional investors (DIIs) which have been supporting the markets, which consist of banks, insurance companies, and mutual funds, are the net purchasers in the equity segment. Strong inflows from retail investors have bolstered the DIIs; small investors have increased their stock market participation via direct equity platforms and systematic investment plans (SIPs).

Countering the robust equity inflows from retail investors, the FPIs have turned out to be sellers in the secondary market. FPI continued to be a buyer in primary markets and debt market, front running the fund inflows predicted by JP Morgan’s EM index and Bloomberg index in future. Between February 1 and 19, 2024, FIIs sold equities in Indian markets amounting to near about Rs. 14,700 crore on a monthly basis. Rising US bond yields in the US, robust job numbers, and inflation data are among the reason, which give the Fed enough reason to keep the interest rate higher for longer. March rate cut expectations have diminished, and market participants now anticipate respite only after June. The US Federal Open Market Committee minutes of the recent meeting are due to be released the day after tomorrow.

The worldwide deceleration, and China’s deceleration in particular, has been advantageous for Indian equities. Even though valuations appear alluring to long-term investors, global investors are hesitant to invest in Chinese equities due to problems in the real estate sector and high local government debt. Also, foreign direct investment in China has plunged to its worst in 30 years, so the FIIs might be compelled to invest in Indian equities. The Chinese central banks have thus far stabilized the economy through key interest rate adjustments, and the government appears to be awaiting a broader economic downturn before implementing fiscal measures to prevent a decline in the currency and bond markets.

India is undergoing a ripple effect, and this mood is anticipated to persist. The focus is now on the forthcoming federal elections in mid-2024, with expectations that the markets will maintain their momentum, despite global economic uncertainties.