Business Profile of the Paras Healthcare Limited

Paras Healthcare is the fifth largest healthcare provider in North India, Bihar, and Jharkhand, with an aggregate of 2,135 beds as of FY24. The company operates eight hospitals under the “Paras Health” brand, spread across five states and one union territory. The company focuses on providing specialized tertiary medical care in Tier 2 and 3 cities, offering clinical specialties such as cardiac sciences, oncology, neuro sciences, gastro sciences, orthopedics, and joint replacement.

As of March 31, 2024, the company had a medical team of 1,091 doctors and 1,509 nurses. They have team of skilled clinicians, who are experienced and well recognized in their fields having won several awards and accolades. In July 2017, Commelina Ltd (an affiliate of Creador, global private equity firm) acquired a stake in Paras healthcare.

Paras Healthcare Limited IPO Objective

As per the draft red hearing prospects, the IPO issue consists only of offer for sale.

- The OFS consists of up to 14, 974, 010 Equity Shares aggregating up to Rs. XXXX million. Nothing from those proceeds of OFS will be allotted to company.

- Paras Healthcare IPO offer only has fresh issue of Rs. 4, 000 million. As per DRHP document, the company aims to utilize IPO proceedings towards payment of certain borrowing at company levels, investment in subsidiaries for payment of borrowings and corporate general purposes.

| Particulars | Estimated Amount |

| Payment of certain outstanding borrowings availed by company | 2179.58 |

| Investment in Subsidiaries, in the form of debt or equity for payment of borrowings | 820.42 |

| General corporate purposes | XXXX |

(₹ Million)

IPO Details of Paras Healthcare Limited:

| IPO Open Date | N.A. |

| IPO Close Date | N.A. |

| Basis of Allotment | N.A. |

| Listing Date | N.A. |

| Face Value | ₹1 per share |

| Price | N.A. |

| Lot Size | N.A. |

| Total Issue Size | XXXX Equity shares |

| Aggregating up to ₹XXXX Cr | |

| Fresh Issue | XXXX Equity shares |

| aggregating up to ₹400 Cr | |

| Offer For Sale | Up to 14,974,010 Equity Shares |

| Aggregating up to ₹XXXX crores | |

| Issue Type | Book Built Issue IPO |

| Listing At | BSE & NSE |

| QIB Shares Offered | Not less than 75% of the Net Issue |

| Retail Shares Offered | Not more than 10% of the Net Issue |

| NII (HNI) Shares Offered | Not more than 15% of the Net Issue |

Issue Price & Size: Paras Healthcare Limited IPO

The issue price of Paras Healthcare Limited hasn’t been released yet. Upon releasing the dates, the investors can bid between those price ranges. The company has both fresh issue of Rs. 400 crores as well as offer for sale of up to 14,974,010 equity shares.

Launch Date of Paras Healthcare Limited IPO

The IPO opening date of Paras Healthcare hasn’t been officially announced yet, upon the declaration of dates investor can bid for IPO.

Paras Healthcare Limited Financial Statements

| Particulars | FY24 | FY23 | FY22 |

| Income | |||

| Revenue from operations | 11290.39 | 9179.2 | 7799.24 |

| Other income | 219.84 | 181.33 | 132.48 |

| Total income | 11510.23 | 9360.53 | 7932.72 |

| Expenses | |||

| Purchases of stock-in-trade | 3048.95 | 2415.36 | 2077.92 |

| Changes in inventories of stock-in-trade | -81.83 | -51.24 | -23.7 |

| Employee benefits expense | 1672.58 | 1336.94 | 1000.74 |

| Finance costs | 670.64 | 491.89 | 315.22 |

| Depreciation and amortization expense | 807.17 | 654.78 | 514.13 |

| Retainers and consultants fee | 2939.84 | 2348.23 | 1900.81 |

| Fair value changes on financial instruments | -133.84 | 531.48 | 458.64 |

| Other expenses | 2520.42 | 1903.62 | 1690.79 |

| Total expenses | 11443.93 | 9631.06 | 7934.55 |

| Profit / (loss) before exceptional item and tax | 66.3 | -270.53 | -2.83 |

| Profit / (loss) before tax | 66.3 | -270.53 | 30.51 |

| Loss for the year (A) | -153.31 | -427.92 | -148.08 |

| Particulars | Paras Healthcare | Apollo Hospitals | Fortis Healthcare | Global Health | Jupiter Lifeline Hospitals | Krishna Institute of Medical Sciences | Max Healthcare | Narayana Health | Yatharth Hospital and Trauma Care Services |

| Total bed capacity (count) | 2135 | 10134 | 4500+ | 2823 | 961 | 3975 | ~4000 | 6074 | 1605 |

| Number of operational beds (count) | 1332 | 9369 | 4500+ | 2823 | 961 | 3503 | ~4000 | 5332 | 1605 |

| Number of ICU beds (count) | 425 | N.A. | N.A. | 664 | N.A. | N.A. | N.A. | N.A. | 455 |

| Bed Occupancy Rate (%) | 52.34% | 65% | 65% | 62% | 64% | 54% | 75% | 53% | 54% |

| Average revenue per occupied bed | 44345.37 | 57500 | 60900 | 61900 | 54900 | 31900 | 75800 | 38400 | 28600 |

| Average length of stay (days) | 3.1 | 3.3 | 4.3 | 3.2 | 3.9 | 4.1 | 4.2 | 4.4 | 4.8 |

| In-patient volume – discharged patients (count) | 81047 | 569988 | N.A. | 155915 | 49100 | 191167 | 231625 | 236000 | 49000 |

| In-patient revenue | 9225.33 | 87045 | 50590 | 28138 | 8604 | N.A. | N.A. | 29099 | 5886 |

| Out-patient volume – consultations (count) | 569139 | 1922696 | N.A. | 2683293 | 831200 | 1587997 | 2505000 | 2541000 | 327000 |

| Out-patient revenue (₹ million) | 1641.97 | 21304 | 8262 | 5360 | 1994 | N.A. | N.A. | 10672 | 819 |

| Revenue from Operations (₹ million) | 11290.39 | 190592 | 68929.2 | 32751.11 | 10954.82 | 24981.44 | 68490 | 50182.49 | 6705.47 |

| Total Income (₹ million) | 11510.23 | 191835 | 69406.8 | 33497.75 | 10954.82 | 25109.29 | N.A. | 50934.38 | 6861.57 |

| Profit / (loss) before tax (₹ million) | 66.3 | 13805 | 8579.7 | 6258.64 | 1952.63 | 4562.14 | 15940 | 8885.28 | 1563.44 |

| Loss for the year (₹ million | -153.1 | 9350 | 6452.2 | 4780.6 | 1766.12 | 3360.07 | 12780 | 7896.24 | 1144.75 |

| EBITDA (₹ million) | 1544.11 | 21150 | 13154 | 9030.53 | 2641.38 | 6532.11 | 19070 | 12275.48 | 1955.49 |

| EBITDA Margin | 13.68% | 13.20% | 19.08% | 27.57% | 24.11% | 26.15% | 27.80% | 24.46% | 29.16% |

| RoE (%) | -8.32% | 16.11% | 17.27% | 17.96% | 23.09% | 20.53% | 41.69% | 35.22% | 24.06% |

| RoCE (%) | 5.86% | 19.95% | 21.47% | 21.40% | 21.74% | 20.64% | 36.82% | 28.93% | 25.90% |

| Capital expenditure per total bed capacity | 5.84 | 12.8 | 15.83 | 11.41 | 8.39 | 6.57 | 10.57 | 6.31 | 3.64 |

| Debt to Equity (times) | 1.65 | 0.51 | 0.22 | 0.14 | – | 0.61 | 0.41 | 0.55 | 0.1 |

| Number of Hospitals (count) | 8 | 73 | 28 | 5 | 3 | 12 | 19 | 18 | 5 |

| Revenue Growth Rate (% ) | 23% | 14.63% | 10.75% | 20.75% | 21.32% | 13.46% | 16.01% | 10.47% | 28.34% |

| Increase in EBITDA (%) | 76.24% | 20.87% | 15.38% | 33.67% | 24.42% | 5.01% | 16.56% | 18.38% | 41.47% |

| Capital Employed (₹ million) | 12458.24 | 119439 | 52154.2 | 36647.53 | 11703.56 | 30902.72 | 46393.2 | 43027.02 | 8890.26 |

| Tier 2 city mix (%) | 62.53% | N.A. | N.A. | N.A. | N.A. | N.A. | N.A. | N.A. | N.A. |

| Net profit ratio (%) | -1.33% | 4.87% | 9.30% | 14.27% | 16.12% | 13.38% | 18.70% | 15.50% | 16.68% |

| Number of surgeries (count) | 30219 | N.A. | N.A. | N.A. | N.A. | N.A. | N.A. | N.A. | N.A. |

Paras Healthcare Limited Promoters & Shareholding

As of date, there are only one promoters of the company.

The promoter in aggregate collectively holds 75.32% of the paid-up share capital of company.

| Name of Shareholder | Number of Equity Shares | % of total pre-Offer Equity Share | Selling Shareholder |

| Promoter | |||

| Dr. Dharminder Kumar Nagar | 7,35,19,238 | 75.32 | Up to 2,928,320 Equity Shares |

| Total | 7,35,19,238 | 75.32 | |

| Promoter Group | |||

| Gurdeep Kaur Nagar | 1 | Negligible | |

| Ranya Nagar | 1 | Negligible | |

| Total | 2 | Negligible | |

| Investor Selling Shareholder | |||

| Commelina Ltd | 2,40,91,380 | 24.68 | Up to 12,045,690 Equity Shares |

| Total | 2,40,91,380 | 24.68 | |

| Grand Total | 9,76,10,620 | 100 | |

Should You Subscribe to Paras Healthcare Limited IPO or Not

While investing or subscribing to any IPO, consider the investment rationales related to the company. Hence, here you can find out the strength of the company that will be its growth factors. And also check the risk factors that can affect the growth and operational efficiency of the company.

Competitive Strengths of Paras Healthcare Limited:

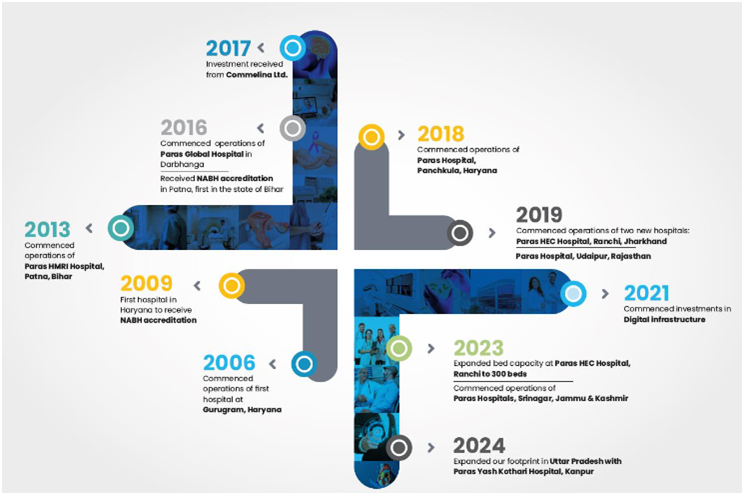

One of the largest healthcare providers in the underserved markets of North India

Established back in 2006, Paras Hospitals is the fifth largest healthcare provider in North India, Bihar, and Jharkhand, with an aggregate of 2,135 beds as of FY24. The company has expanded its presence in underserved markets, such as Gurugram and Panchkula in Haryana, Patna and Darbhanga in Bihar, Udaipur, Ranchi, Jharkhand, and Srinagar in J&K. The company has consistently identified attractive opportunities and has a first mover advantage in its hospitals.

The company has received various accreditations, including the first hospital in Haryana to receive NABH accreditations in 2009, the first hospital in Bihar to receive NABH accreditation in 2016, and the third hospital in Udaipur to receive NABH accreditation in 2021.

Asset light business model

The company’s Patna and Udaipur hospitals have been converted from a revenue share model to a partial fixed rent model, and the company has leased the property from its subsidiary, Plus Medicare Hospitals Private Limited. To lower capital and operating expenditure, the company has implemented initiatives such as more shared rooms, reduced administrative space, optimal flooring specifications, efficient external features, lean hospital design, and outsourcing non-core services.

Delivering quality clinical care

The company has introduced modern equipments and prioritizes attracting and retaining renowned clinicians to deliver quality healthcare services. As of FY24, the company has 1,091 doctors and 1,509 nurses, with 44.12% of doctors having been associated with the company for over seven years. The company offers a variety of specialties across its hospitals, providing comprehensive medical treatments and a one-stop solution for patients. Key departments include cardiac sciences, oncology, neuro sciences, gastro sciences, orthopedics, and renal sciences. They have focused on reducing variability, improving process times, reducing wait time and maximizing resource utilization to achieve clinical excellence.

Robust operating infrastructure

The company has developed a robust information technology infrastructure to improve the quality and affordability of its services. The company has invested in new technologies and customized its technology platforms to cater to its requirements. The technology initiatives focus on enhancing patient experience, clinical experience, and financial and operational efficiencies through process automation.

Patient experience has been digitized, with a patient mobile application, and messaging-based digital delivery platform for patients to receive e-prescriptions, lab reports, invoices, and discharge summary. The patient application allows for continuous tracking and monitoring of a patient’s health, and a centralized call center team with a customer relationship management application. The company has also implemented cost efficiency through centralized and cloud-based applications, ensuring agility and cost control for on-premise infrastructure management.

Future plans

- Company plans to expand its presence in underserved markets and operate 2,935 beds by FY29

- Scale operations at newer hospitals by attracting leading clinicians and introducing new multi-speciality services and supported by the latest technology

- Explore potential medical technologies and advanced medical equipment to improve the quality of care and success rate of procedures for patients

- Upgrade its digital infrastructure to improve operational efficiencies and patient experience

- Improve operating efficiencies and drive profitability.

Risk Factors of Paras Healthcare Limited:

History of losses

The company has been experiencing losses from previous three fiscals, despite an increase in revenue. This was primarily due to increased stock-in-trade purchases past fiscal. The company’s chain hospital and subsidiary like Srinagar hospital, Paras Healthcare (Ranchi) Private Limited and Plus Medicare Hospitals Private Limited has been making losses. The company’s strategy to expand beds and establish new hospitals in new geographies may lead to additional capital expenditure and may incur potential losses initially.

| Name of the Subsidiary | FY24 | FY23 | FY22 |

| Paras Healthcare (Ranchi) Private | -326.51 | -404.23 | -204.2 |

| Plus Medicare Hospitals Private | -546.18 | -29.49 | – |

Dependency on skilled staff

The company’s growth strategy relies heavily on attracting and retaining experienced healthcare professionals. The demand for skilled doctors is always high, but the availability of specialist doctors in India is limited due to training periods. So in order to attract good healthcare professionals, the hospital competes with other healthcare providers to attract and retain doctors from a limited pool of candidates. The company also needs to identify and retain other healthcare professionals like nurses and paramedical staff to support services. A limited supply of healthcare professionals may increase compensation, recruitment costs and training cost of young recruits. Failure to retain and regular recruitment could negatively impact the company’s business, reputation, and financial condition.

| Category | FY24 | FY23 | FY22 |

| Doctors | 820 | 679 | 578 |

| Attrition rate (%) | 48.6 | 48.79 | 50.5 |

| Nurses | 1509 | 1442 | 1145 |

| Attrition rate (%) | 91.02 | 87.84 | 102.84 |

| Other Healthcare Professionals | 670 | 549 | 467 |

| Attrition rate (%) | 50.27 | 40.91 | 42.82 |

| Housekeeping and Support Staff | 1114 | 935 | 741 |

| Attrition rate (%) | 57.98 | 53.04 | 61.58 |

Geographic concentration

All their hospitals are located in North India, which exposes us to adverse economic or political circumstances affecting healthcare demand. Four of our hospitals, two in Gurugram and Patna, Haryana, and two in Patna and Darbhanga, Bihar, have been operational for over five years. Any unfortunate incident or loss of business in areas could negatively affect business fundamental and financial condition.

Srinagar which became operational last year and and Kanpur hospitals, which began operations April 2024, contributed a small portion (3.06%) to overall revenue for FY24. The Srinagar hospital posted an operating loss of Rs. 240.00 million during the 10 months of operations. If these hospitals do not meet anticipated patient footfall levels for a prolonged basis, the profitability could be adversely affected.

| Hospitals operational for | FY24 | FY23 | FY22 | Growth between FY23 and FY24 | Growth between FY22 and FY23 |

| Over 5 years | 9276.12 | 8115.88 | 7215.78 | 14.30% | 12.47% |

| Between 3 and 5 years | 1644.27 | 1063.32 | 583.46 | 56.52% | 82.24% |

| Total of 6 hospitals | 10940.39 | 9179.2 | 7799.24 | 19.19% | 17.69% |

| Less than 3 years | 350 | – | – | – | – |

| Revenue from operations | 11290.39 | 9179.2 | 7799.24 | 23.00% | 17.69% |

Segment concentration

The company generates a significant portion of its revenues from the provision of certain specialties at its hospitals. Key specialties contributed more than 10% of the company’s revenue during Fiscals 2024, 2023, and 2022. The table shows the revenue generated by these specialties, with cardiac sciences, oncology, neuro sciences, and gastro sciences contributing the most.

Services provided using new technologies may not be accepted by patients due to uncertainty around their effectiveness. Any reduction in demand or temporary or permanent discontinuation of such services could negatively impact the company’s business, results, and financial condition.

| Specialty | FY24 | FY23 | FY22 |

| % of Revenue from Operations | |||

| Cardiac sciences | 13.24% | 12.97% | 13.20% |

| Oncology | 18.90% | 16.89% | 14.15% |

| Neuro sciences | 1514% | 14.53% | 13.96% |

| Gastro sciences | 12.30% | 14.02% | 12.69% |

| Total | 59.58% | 58.41% | 54.00% |

Hindrances in expansion

The company plans to expand its network of hospitals in North India, with plans to launch two new hospitals in Gurugram and Ludhiana. These expansions aim to increase the hospital’s bed capacity from 2,135 to 2,935 by FY29.

The company also plans to establish another hospital in Panchkula, providing synergies with its existing hospital.

However, the company faces challenges in expanding its network, such as delays in receiving approvals for construction in Srinagar and Kanpur, and the failure to open a 50-bed hospital.

The company has also received notices of liquidated damages from Heavy Engineering Corporation Limited for the delay in opening a 50-bed hospital.

The company may also face risks in integrating new hospitals with its existing network and establishing standard operating procedures. The company’s growth and operations may be adversely affected if it fails to manage these risks.

Revenue from in-patient department

The company generates a significant portion of its revenues from in-patient services. The company has introduced various new services, modernized equipments, increased their bed capacity, which has lead to increase in patients footfall.

| Particular | FY24 | FY23 | FY22 |

| % of Revenue from sale of services – Healthcare | |||

| Operating Income – in patient department | 84.89% | 84.78% | 85.16% |

Improving occupancy rates depends on factors like brand recognition, community acceptance, attracting and retaining quality healthcare professionals, developing super-specialty practices, and competitiveness.

Data in table mentioned below, shows that the bed occupancy has remained flat on lower side but the average revenue generated from each bed has increased after being flat in previous years.

| Particular | FY24 | FY23 | FY22 |

| Bed occupancy rate | 52.34 | 56.35 | 54.41 |

| Average revenue per occupied bed | 44345.37 | 40464.33 | 40100.03 |

| Average length of stay (days) | 3.14 | 3.22 | 3.55 |

Delay in receiving payments

As insurance company success in spreading their links, more number of people will rely on insurance companies to pay the medical bills. Usually patients pay for their medical expenses either by themselves or through third-party insurance agent, including private and public insurers or government schemes. The primary collection risk for trade receivables is the failure of corporate customers, government agencies, and third-party administrators to pay in a timely manner for the services we provide. Although no insurance company has defaulted on its commitment but the amount to get cleared can get longer than usual if it is stuck in any compliance matter.

| Revenue from | FY24 | FY23 | FY22 |

| % of Revenue from Operations (%) | |||

| Self Pay | 40.63% | 40.89% | 45.98% |

| Insurance | 29.61% | 29.32% | 30.68% |

| Government Schemes and PSUs | 29.76% | 29.79% | 23.34% |

Malfunction of medical devices

Use of modern machinery comes with sophisticated problems, which can only be tacked with authorised person. Failures, accidents, defects, faulty maintenance, or incorrect use due to improper training can cause injuries to employees or patients. Significant malfunctions in equipments can lead to significant repair, maintenance costs and unnecessary loss of revenue for the company. Also any injury to patients could cause huge liability for the hospital.

| Particular | FY24 | FY23 | FY22 |

| Percentage of Total Expenses (%) | |||

| Repairs and Maintenance | 2.36% | 2.30% | 2.59% |

Paras Healthcare Limited Grey Market premium

Grey market premium is the premium quoted over the IPO issue price. GMP shows that investors are ready to pay above the upper band of the IPO issue price. GMP is determined in the grey market as per the demand and supply of the shares in the primary market. A grey market is that unofficial ecosystem of unlisted companies’ stocks that start trading even before the launch of the IPO to the date of its listing.

Also Read: What is Grey Market Premium in IPO: How is GMP Calculated & Reliable

However, GMP is not a reliable factor, as it keeps fluctuating as per the demand and supply of shares in the primary market. There are numerous factors that affect the stock market in India and individual stock prices of different companies that are already listed and trading in the secondary market. However, for an IPO-bounded company, you can consider the GMP as the speculative listing price of the share

According to various online sources, the Grey Market Premium or GMP of the Paras Healthcare Limited is trading around Rs XX in the grey market. It means shares are trading at the upper band issue price of Rs XX with a premium in the grey market and may list around the same price.