One of the main motives for developing the advanced Algo trading software is to make the entire trading system automated with the least human intervention during the trades. However, there are still various functions that need to be performed manually by the traders, especially while trading with advanced options strategies in the derivatives market.

AlgoTest, one of the most advanced trading solutions for options trading provides unlimited features making the most of crucial tasks not only automated but also more efficient and manageable even in various market conditions.

We already discussed the top features of this software, and today in this article we are going to discuss the hidden features of the AlgoTest that can give you an edge while trading in the option market. These functions are also integrated into the Trade Radar, one of the most advanced algo trading software offered by Moneysukh.

Hidden Features on AlgoTest in Trade Radar:

Auto Square Off On Margin Error

To trade in the options market you have to deposit a certain margin of money and if there is any shortfall and you are unable to maintain to minimum margin, either you can incur the huge losses or can be imposed by the margin penalty by the exchange.

Also Read: What is F&O Margin Penalty: SEBI Rules & How to Avoid it

To avoid such penalties or unexpected losses due to short-fall of margins AlgoTest has developed the auto square off on margin error feature that helps traders manage unexpected margin shortfalls. When you enable this feature, it will exit all the trade positions when a margin error occurs in your account to prevent your trade position from major losses.

Payoff Analyser

This is another hidden and very useful feature in AlgoTest that allows traders to visualize their trade positions with key matrices. The payoff analyser will show you the various key information like option Greeks, and equity curve with maximum profit or loss all in one place. This feature will help you to visualize and better understand the various outcomes of your strategies.

Adding the Leg or Square off Leg

This hidden feature in AlgoTest helps the traders adjust their trade positions in their strategy or make other key changes as per the unexpected market conditions. Using this feature you can add legs on the fly for the additional margin benefits or hedging making your trade position align with the changed market conditions to minimize the impact of risks.

The Broker Level SL & Target

This Broker Level Stop Loss (SL) / Target Profit (TP) feature will provide you with the privilege of setting the parameters based on your broker’s account used. This means you can set the Stop Loss, Target and Trailing Stop Loss on all the strategies that you deployed on a specific broker on the platform.

However, this setting will be applicable only when you trade or execute your strategies through AlgoTest. On the other hand, if you try to apply this setting manually on trades directly on the broker’s terminal it will be not applicable.

No Entry after Time

This unique feature will help you to manage the re-entries by preventing trades after a specified time. This means you can enable this feature that will stop your strategy into any new trade position after a specific time that will provide you control over strategy executions during market hours.

One of the best advantages of this hidden feature is you can ensure that re-entries can occur only within a predefined timeframe to stop unexpected trades in the last few periods of the market hours. At the end of the trading session, there could be unexpected moves in the market.

Trailing Stop Loss Based on Percentage

Using this feature, you can adjust your stop loss based on the movement of the market or underlying security. The trailing SL feature will help you to ensure your profitability by moving the stop loss as the trades become in positions that are more favourable.

Compare Backtest Feature

This comparison feature will allow you to compare the different versions of their strategy while backtesting side-by-side. This helps to refine your strategy by testing various parameters like stop loss levels or trailing stops for better decisions with clear historical performance data.

Based on the comparison of your past backtest you can optimize your algo-trading strategies to get the best results. The comparison feature with backtesting enables you to make changes to multiple parameters on your Algo-trading strategy’s leg and then compare them to each other.

Also Read: What are the Most Popular & Profitable Algo Trading Strategies

Algo Test Docs

Providing all the information with useful functions and features is one of the biggest strengths of any technical product. Here to keep the traders and users updated with the technical know-how of the AlgoTest trading application, it has separately created an Algo Test docs.

This doc page provides the official product documentation for Algo Test to explain the detailed information about every feature on the platform. On this page, you can find useful information including step-by-step guides, video tutorials, and in-depth explanations to make the end-users easily understand all the functions and fully utilize its tools and functions.

Export-Import Strategy in AlgoTest

It is also one of the most interesting features in AlgoTest allowing you to import or export your strategy from one account to another account at one click. This unique feature allows you to avoid inputting your strategy manually into different accounts. To know this feature better let’s find out how you can export or import your strategy in AlgoTest.

Also Read: How to Create Strategy in AlgoTest using TradeRadar

How to Export Strategy in AlgoTest?

To copy or export and import your strategy from one account to another account you have to follow the simple steps given below.

Steps to Export Strategy in AlgoTest:

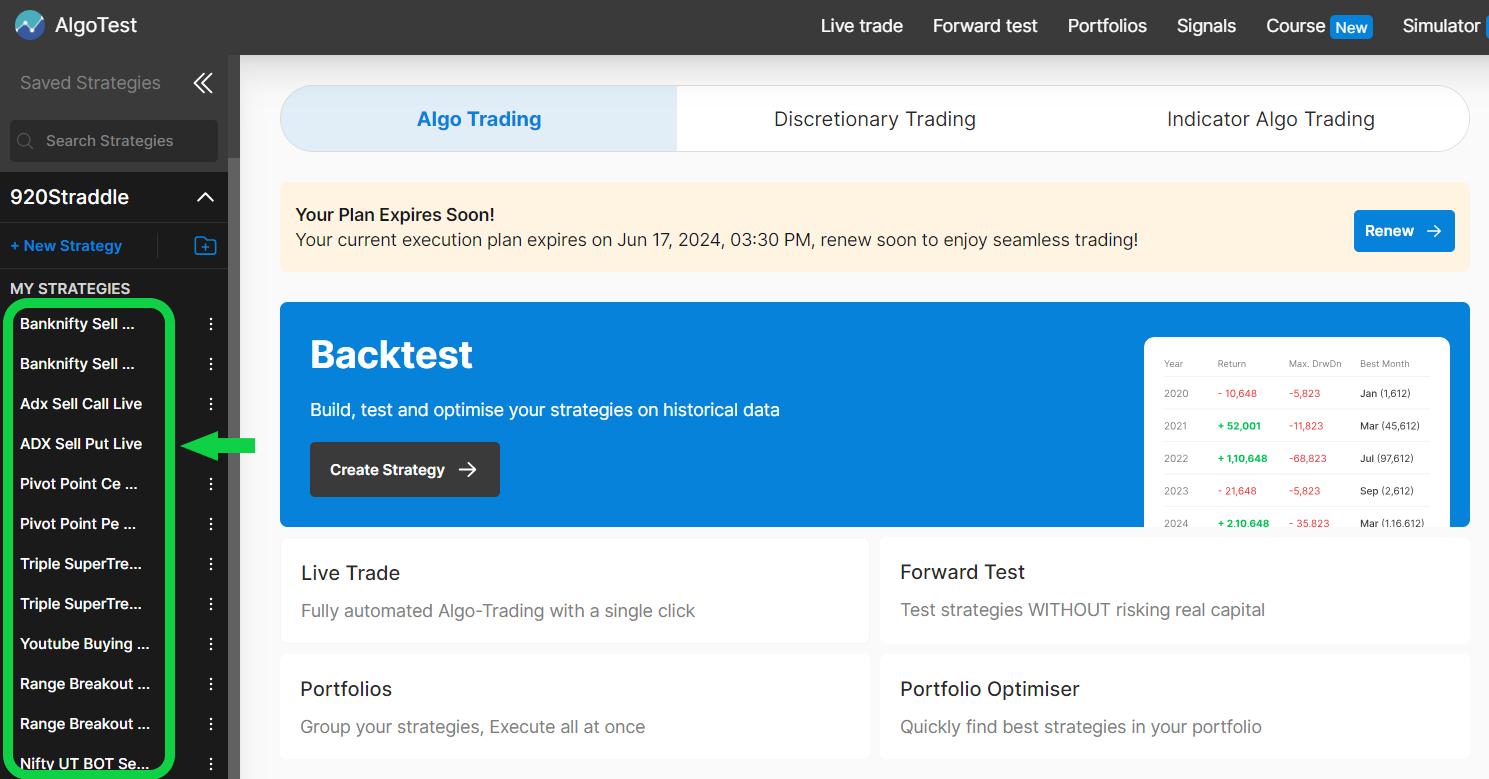

Step 1: First visit AlgoTest and log in to your account.

Step 2: Now you have to select the strategy you want to copy.

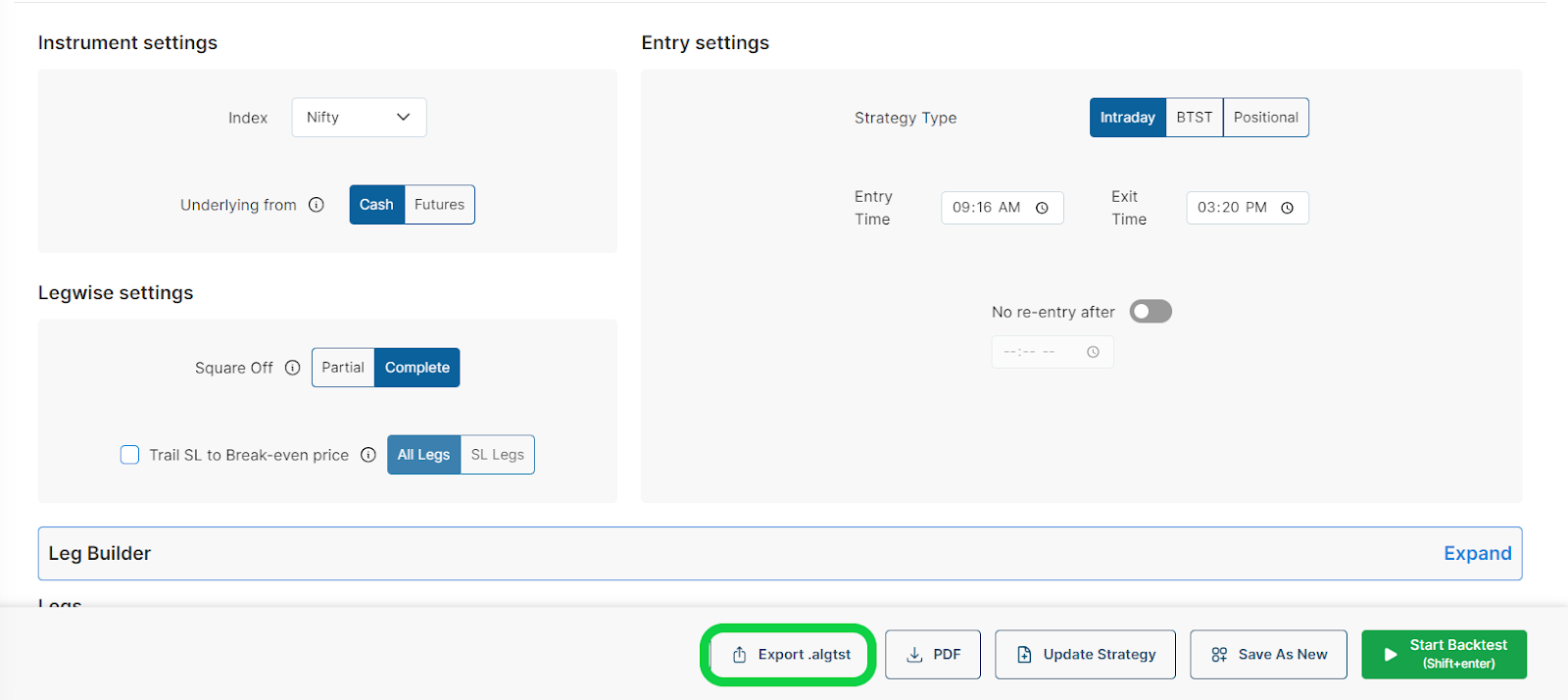

Step 3: Here to download the strategy file, you have to click on the “Export .algtst” button.

Step 4:After downloading the file to your device, you can use it or share it with the user you want to share this strategy.

Also Read: How to Deploy Strategy in AlgoTest with Moneysukh TradeRadar

Steps to Import Strategy in AlgoTest:

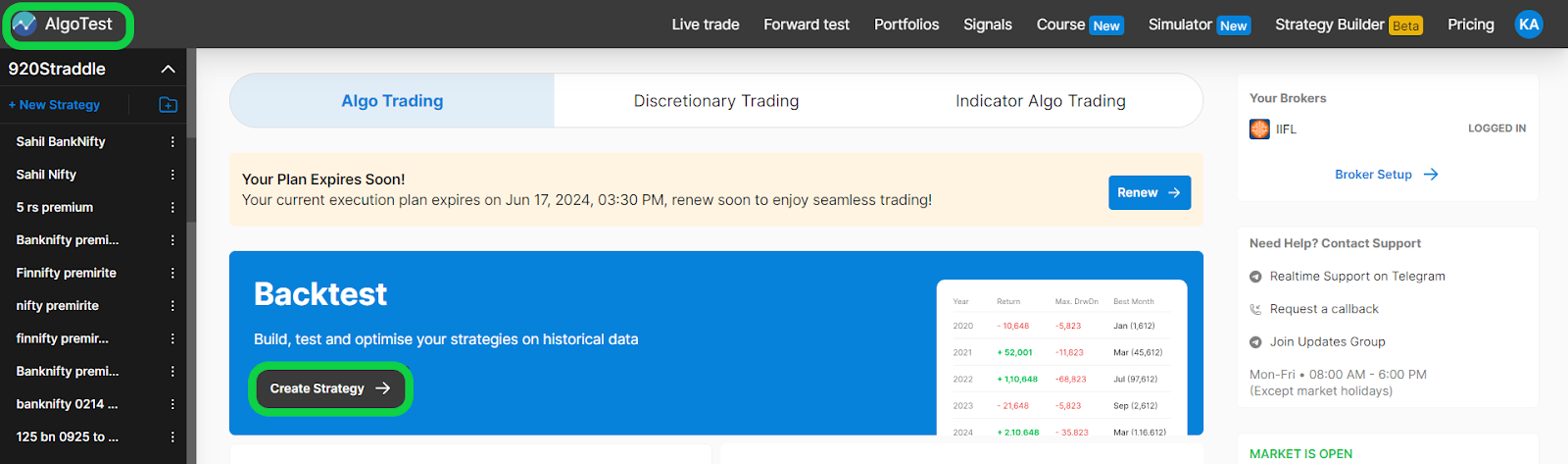

Step 1: Login into your account where you want to import this strategy.

Step 2: Now click on the ‘Create Strategy’ button as shown in the image below.

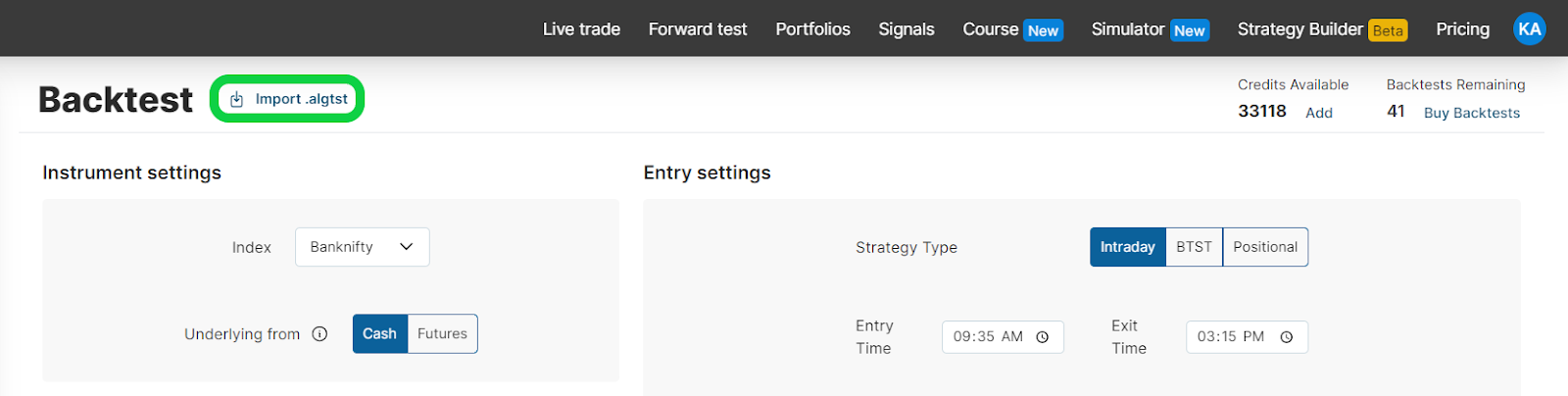

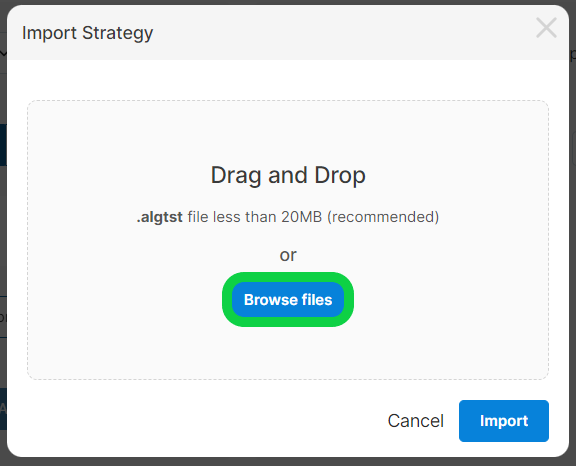

Step 3: Here you need to click on the Import .algtst button.

Step 4: Now click on the browse button and select the file you downloaded.

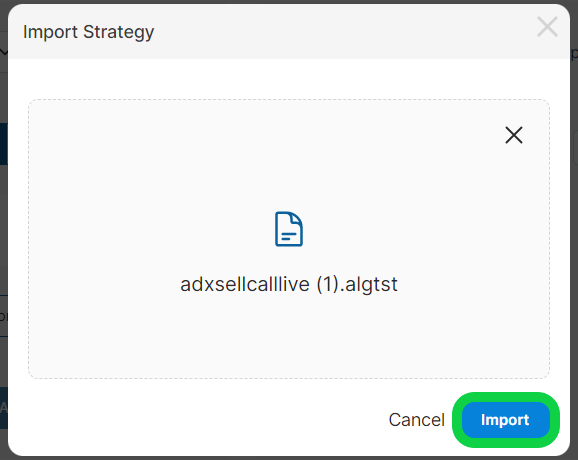

Step 5: Here you need to click on the “Import” button to import the strategy.

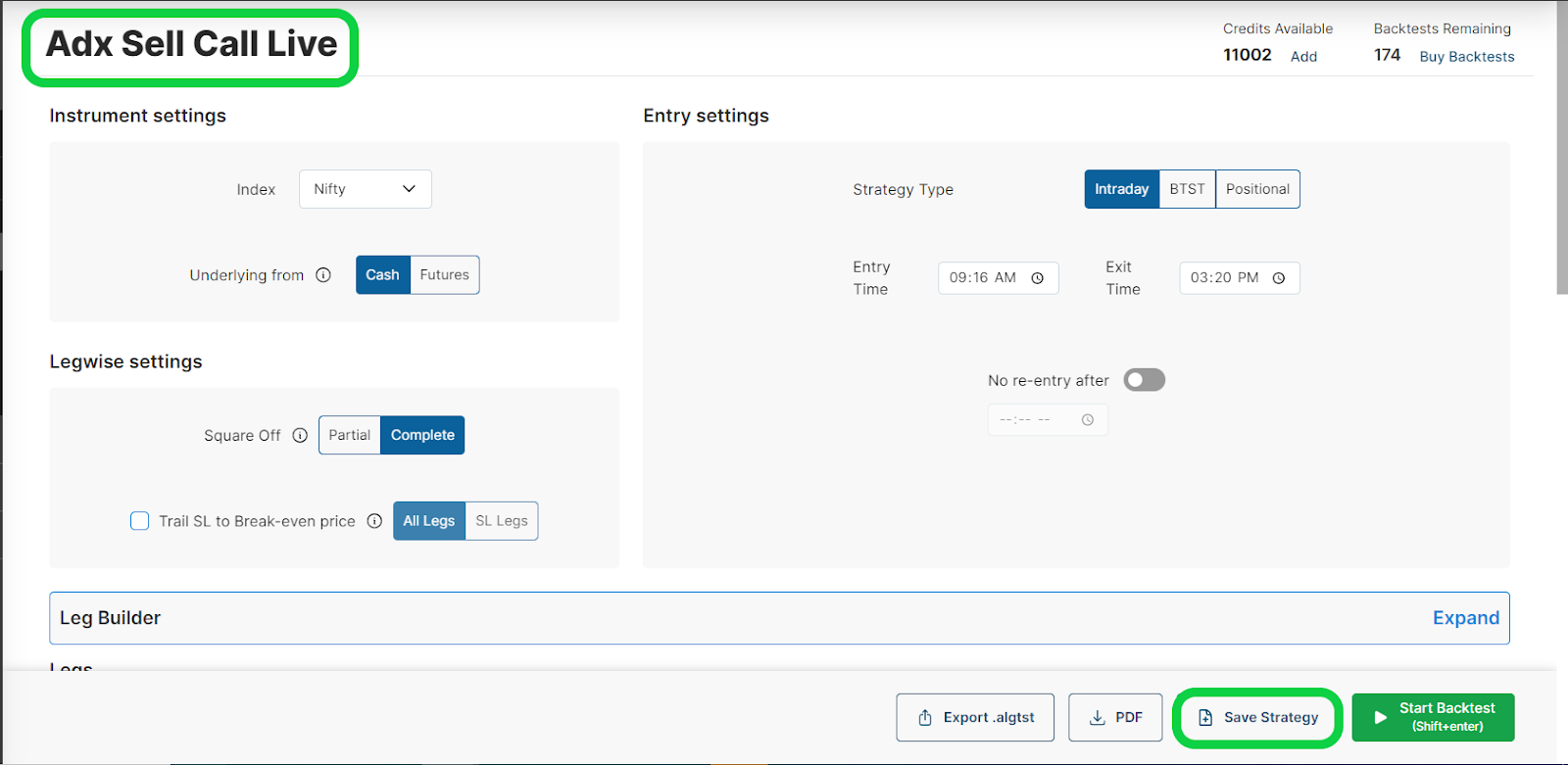

Step 6: Now your strategy will be imported into your new account.

Step 7: Here you can save the strategy with your desired name.

Summing-up

The AlgoTest has these hidden features like auto square off on margin error, payoff analyser, adding or squaring off the legs, no entry time, target-based SL and comparing the backtesting strategy. The AlgoTest doc provides all the useful information about the functions and features available and integrated into this Algo Trading software.

Also Read: Six Advantages of Algorithmic Trading with Algo Trading Tips

The best thing all these functions and features are also available in Trade Radar, one of the best Algo Trading platform offered by the best discount brokers in India. If you have a trading and demat account with Moneysukh, you can log into your trading account and freely access and enjoy these features through Trade Radar at the lowest brokerage charges.