Business Profile of Urban Company Limited

Urban Company was incorporated in December 2014, and working as a technology driven marketplace providing a wide range of home and beauty services through a trained professional persons across 59 cities in India, Singapore, UAE and Saudi Arabia. The company offer services to customers such as repair, cleaning, plumbing, electrical work, beauty treatments and massage therapy, performed by trained professional persons. Urban company solves the problems of fragmented market by providing rapidly growing home services with ensuring quality and easy accessibility. In 2029, home service sector projected to reach $97.4 billion and Urban Company recognised as leading platform with easy service accessibility in 48 cities of India by Redseer Report. The company earns revenue from platform services for customers, sales of Native products to customers and sales of products to service professionals. As of December 31, 2024, average 48,169 monthly active service professional worked for company.

Objective of Urban Company IPO

As per the draft red hearing prospects, the IPO issue consists fresh issue and offer for sale. The fresh issue consists of XXXX shares at the face value of ₨ 1.00 each aggregating up to ₹ 4,290.00 millions and OFS consists XXXX shares at face value of ₨ 1.00 each aggregating up to ₨ 14,710.00 millions. There are fresh shares issues and OFS by company and main objective of company is expenditure for new technology & cloud infrastructure, lease payments, marketing activities and general corporate expenses.

Details of Urban Company IPO

| IPO Open Date | Wed, Sep 10, 2025 |

| IPO Close Date | Fri, Sep 12, 2025 |

| Basis of Allotment | NA |

| Listing Date | Sep 17, 2025 |

| Face Value | ₹1 per share |

| Price | ₹98 to ₹103 per share |

| Lot Size | 145 Shares |

| Total Issue Size | 18,44,66,018 shares |

| (aggregating up to ₹1,900.00 Cr) | |

| Fresh Issue | 4,58,25,242 shares |

| (aggregating up to ₹472.00 Cr) | |

| Offer For Sale | 13,86,40,776 shares of ₹1 |

| (aggregating up to ₹1,428.00 Cr) | |

| Issue Type | Book Built Issue IPO |

| Listing At | BSE & NSE |

| QIB Shares Offered | Not less than 75% of the Net Offer |

| Retail Shares Offered | Not more than 10% of the Net Offer |

| NII (HNI) Shares Offered | Not more than 15% of the Net Offer |

Urban Company IPO: Issue Price & Size

The issue size of the IPO has been declared and the overall issue size of the IPO is Rs 1,900.00 Cr, out of which 4,58,25,242 Equity Shares, aggregating up to Rs 472.00 cr, comprise of fresh issuance, and the remaining Rs 1,428.00 Cr will be offered for sale by shareholders.

Launch Date of Urban Company IPO

Urban Company Limited IPO will be open on Sep 10, 2025 and close on the Sep 12, 2025. All types of investors can bid between these dates through their eligible categories.

Financial Statements of Urban Company Limited

| Ended December | For Yearly Ended | ||||

| Particulars (in millions) | 2024 | 2023 | 2024 | 2023 | 2022 |

| Revenue from operations | 8,460.16 | 6,009.00 | 8,280.18 | 6,365.97 | 4,375.75 |

| Other income | 842.49 | 740.27 | 999.731 | 896.41 | 713.92 |

| Total income | 9,302.65 | 6,749.27 | 9,279.91 | 7,262.38 | 5,089.67 |

| Expenses | |||||

| Purchases of stock – in – trade | 1,574.11 | 899.37 | 1,427.87 | 998.57 | 831.39 |

| Changes in inventories of stock – in – trade | -94.97 | -75.53 | -135.34 | 79.41 | -106.23 |

| Employee benefits expense | 2,578.46 | 2,525.82 | 3,448.18 | 3,770.861 | 4,438.64 |

| Finance costs | 77.88 | 68.82 | 92.00 | 71.92 | 79.32 |

| Depreciation and amortization expense | 277.14 | 279.31 | 367.99 | 306.51 | 280.16 |

| Other expenses | 4,618.66 | 3,629.13 | 5,006.48 | 5,159.53 | 4,707.84 |

| Total expenses | 9,031.28 | 7,326.92 | 10,207.18 | 10,386.80 | 10,231.12 |

| Share of net profit of JVs | – | – | – | – | – |

| Restated profit/(loss) before tax | 271.37 | -577.65 | -927.27 | -3,124.42 | -5,141.45 |

| Tax expense/(credit) | |||||

| Current tax | – | 0.21 | 0.45 | 0.31 | – |

| Income tax for earlier periods/years | – | – | – | 0.11 | – |

| Deferred tax | -2,154.60 | – | – | – | |

| Total tax expense/(credit) | -2,154.60 | 0.21 | 0.45 | 0.42 | – |

| Restated profit/(loss) | 2,425.97 | -577.86 | -927.72 | -3,124.84 | -5,141.45 |

Key financial ratios of Urban Company Limited

| Particulars | 2022 | 2023 | 2024 |

| Gross Profit Margin (%) | 64.44 | 62.67 | 62.5 |

| Operating Margin (%) | 17.78 | 16 | 18.75 |

| Net Profit Margin (%) | 13.33 | 12 | 13.75 |

| Return on Assets (ROA) (%) | 7.04 | 4.78 | 5.11 |

| Return on Equity (ROE) (%) | 8.39 | 5.83 | 6.18 |

| Asset Turnover | 0.53 | 0.40 | 0.37 |

| Inventory Turnover | 13.86 | 12.06 | 7.71 |

| Debt-to-Equity | 0.16 | 0.23 | 0.21 |

| Current Ratio | 9.82 | 7.09 | 6.13 |

| Debt Ratio (%) | 13.52 | 18.86 | 17.19 |

| Annual transacting consumers (in millions) | 5.75 | 4.93 | 4 |

| Average monthly active service professionals (in numbers) | 46,012 | 42,523 | 31,726 |

| EBITDA | 4,056.81 | –1,668.01 | –4,056.81 |

| EBITDA Margin | −92.71% | –26.22% | –92.71% |

| ROCE (%) | -4.01% | -19.64% | -29.98% |

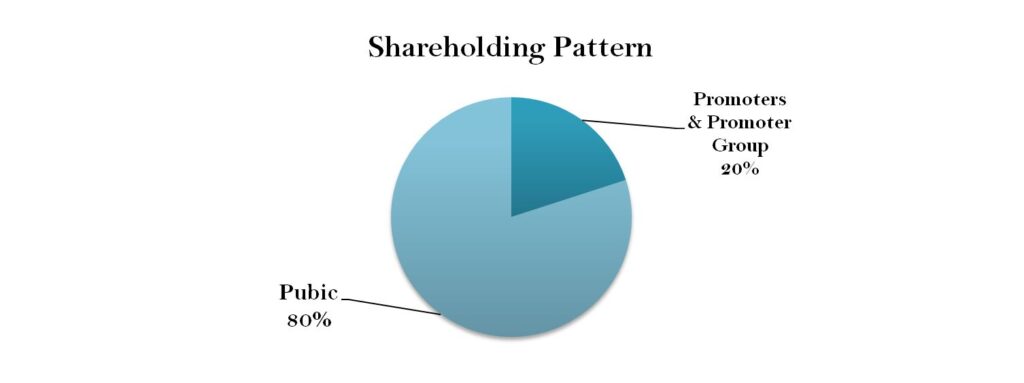

Promoters & Shareholding Urban Company IPO

As of date, according to the DRHP filed with SEBI promoters and promoter group have 20.01% shareholding in company.

| Pre – Offer | Post – Offer | |||

| Name | Number of Equity Shares | % Equity Shares | Number of Equity Shares | % Equity Shares |

| Promoters | ||||

| Abhiraj Singh Bhal | 9,77,62,500 | 6.67 | – | – |

| Raghav Chandra | 9,77,62,500 | 6.67 | – | – |

| Varun Khaitan | 9,77,62,500 | 6.67 | – | – |

| Members of Promoter Group | ||||

| Abhiraj Singh Bhal Family Trust | 25,000 | Negligible | – | – |

| Raghav Chandra Musaddi Trust | 25,000 | Negligible | – | – |

| Varun Khaitan Family Trust | 25,000 | Negligible | – | – |

| Total | 29,33,62,500 | 20.01 | – | – |

Should You Subscribe To Urban Company IPO

While investing or subscribing to any IPO, consider the investment rationales related to the company. Hence, here you can find out the strength of the company that will be its growth factors. And also check the risk factors that can affect the growth and operational efficiency of the company.

Competitive Strengths of Urban Company IPO

Market place benefits from effective network

To minimize travel distance for service professionals, company operates on a hyperlocal level platform. In hyperlocal platform, company separates each city into multiple micro-markets in a radius of 3-5 km but it depends on category of service. As of December 31, 2024, micro-markets services across various cities according to company are more than 12000. The company focuses on quality and reliability, especially introducing new service categories in micro-market by increasing market penetration. And service professional who work for company earn 30-40% extra than their peer, company claims.

In-house training professionals

The company provides in-house training programs for their service professionals which help them in delivering better service, know-how about service standard, tools, consumables and technology of platform. Over 220 dedicated training classrooms in 15 cities across country is claim by company as of December 31, 2024. Along with it, supply service professionals with high-quality tools and consumables which is under company name or with other brands through arrangements. These products are received by service professionals directly to their door step.

Robust technology platform

The entire business operations of company are embedded with technology-driven model which help company to scale its services effectively. New insights in specific service categories and geographies which gain by company it will apply such learning to creating a unified technology stack or across its operations. According to company this strategy facilitate to deliver new services quickly, reduce time to market for pilot projects and maintaining quality control in different regions.

Sustained User Growth

Urban Company recorded a consistent rise in annual transacting customers. The numbers is growing over the period from 0.38 crores in FY22 to 0.63 crores in nine months ended at December 31, 2024. The company witnessed increased in consumer spending on platform. The company claims to facilitate transactions for 13.26 million consumers all over the place where company operates. In nine months ended December 31, 2024, service spends per consumer increased from ₨ 3,349 in FY22 to ₨ 3,224.

Risk Factors of Urban Company IPO

Negative cashflows

The company offer incentives, discounts and promotions to customers from time to time which help in attract and retain customers. These incentives applied against the transaction costs and are recorded as reductions in platform services revenue. It includes incentives such as availability fees and other incentives such as training related and referral incentives. It create negative operating cashflows in past and if company is unable to generate required revenue growth then it may adversely affect operating business of company.

Aggressive competitive landscape

The company operates in highly competitive environment, where market is characterized by evolving consumer preferences and introduction of new services & offerings. Intense competition is faced by company from both traditional offline service providers and online service providers. It is necessary for company to attract both side customers and service professional to compete in two sided market. This intense competition may result in reduced demand for services on company platform, resulting negative impact on revenue and costs.

Human capital risk

The company success is majorly depends on ability to maintain and increase network capability of service professionals on company platform. The ability to retain service professionals depends on multiple factors which include variety and quality of offering, average earning of service professionals, ability to deliver quality training to service professionals and their satisfaction level. Any inability to maintain or increase the number of service professionals on company platform could adversely affect revenue of company.

Platform Disintermediation

The consumers and service professionals may circumvent company platform and engage through other means. Despite initially engaging through company platform, they both engage directly bypassing company platform to avoid service fees which company charge against for providing services. Although it reduced assurance in quality of services, accountability and post service support which is provided by company. It negatively affects financial condition and business operations of company.

Urban Company IPO Grey Market Premium

Grey market premium is the premium quoted over the IPO issue price. GMP shows that investors are ready to pay above the upper band of the IPO issue price. GMP is determined in the grey market as per the demand and supply of the shares in the primary market. A grey market is that unofficial ecosystem of unlisted companies’ stocks that start trading even before the launch of the IPO to the date of its listing.

Also Read: What is Grey Market Premium in IPO: How is GMP Calculated & Reliable

However, GMP is not a reliable factor, as it keeps fluctuating as per the demand and supply of shares in the primary market. There are numerous factors that affect the stock market in India and individual stock prices of different companies that are already listed and trading in the secondary market. However, for an IPO-bounded company, you can consider the GMP as the speculative listing price of the share

As per the sources, the GMP of Urban Company Limited IPO is trading at around Rs 19 in the grey market shows the share of Urban Company Limited is expected to list at around Rs 112 if you consider the upper price band of Rs 103 announced in the IPO for the bidding.