Business Profile of Shadowfax Technologies Limited

Shadowfax Technologies Ltd was incorporated in 2016 which offers e-commerce express parcel delivery and a suite of value-added offerings. It is a logistics solution provider company in India, service offering includes e-commerce and D2C delivery, hyperlocal & quick commerce and SMS & personal courier services through Shadowfax’s Flash app. The logistics network of company includes 4,299 touchpoints across first- and last-mile centres and sort centres as of September 30, 2025, serving 14,758 pin codes. Under clients list of company includes Shadowfax Technologies, Flipkart, Myntra, Swiggy, Bigbasket, Zepto, Nykaa, Blinkit, Kartrocket, Zomato, Uber, Pincode, Purplle, Licious, ONDC, Magicpin, among others.

Objective of Shadowfax Technologies Limited IPO

As per the draft red hearing prospects, the IPO issue consists fresh issue and offer for sale. The fresh issue consists of 9,41,17,647 shares at the face value of ₨10.00 each aggregating up to ₹ 1,000.00 cr and OFS consists 8,23,48,779 shares at face value of ₨ 10.00 each aggregating up to ₨ 907.00 cr. There are fresh shares issues and OFS by company and main objective of company is funding of capital expenditure, lease payments, marketing, inorganic acquisitions and general corporate purposes.

Details of Shadowfax Technologies Limited IPO

| IPO Open Date | Tue, Jan 20, 2026 |

| IPO Close Date | Thu, Jan 22, 2026 |

| Basis of Allotment | NA |

| Listing Date | Jan 28, 2026 |

| Face Value | ₹10 per share |

| Price | ₹118 to ₹124 |

| Lot Size | 120 Shares |

| Total Issue Size | 15,38,12,096 shares |

| (aggregating up to ₹1,907.00 Cr) | |

| Fresh Issue | 9,41,17,647 shares |

| (aggregating up to ₹1,000.00 Cr) | |

| Offer For Sale | 8,23,48,779 shares of ₹10 |

| (aggregating up to ₹907.00 Cr) | |

| Issue Type | Book Built Issue IPO |

| Listing At | BSE & NSE |

| QIB Shares Offered | Not less than 75% of the Net Offer |

| Retail Shares Offered | Not more than 10% of the Net Offer |

| NII (HNI) Shares Offered | Not more than 15% of the Net Offer |

Shadowfax Technologies Limited IPO: Issue Price & Size

The issue size of the IPO has been declared and the overall issue size of the IPO is Rs 1,907.00Cr, out of which 9,41,17,647 Equity Shares, aggregating up to Rs 1,000.00cr, comprise of fresh issuance, and the remaining Rs 907.00Cr will be offered for sale by shareholders.

Launch Date of Shadowfax Technologies Limited IPO

Shadowfax Technologies Limited IPO will be open on Jan 20, 2026 and close on the, Jan 22, 2026. All types of investors can bid between these dates through their eligible categories.

Financial Statements of Shadowfax Technologies Limited

| Particulars (₹ in million) |

Ended March 31 , 2025 |

Ended March 31 , 2024 |

Ended March 31 , 2023 |

| Income | |||

| Revenue from operations | 93,899.03 | 78,151.48 | 57,345.19 |

| Other income | 5,109.98 | 2,440.94 | 1,631.72 |

| Total income | 99,009.01 | 78,592.42 | 58,976.91 |

| Expenses | |||

| Employee benefits expense | 8,481.81 | 7,577.03 | 7,282.50 |

| Finance costs | 68.95 | 63.72 | 13.39 |

| Depreciation and amortisation expense | 340.27 | 581.10 | 300.36 |

| Other expenses | 91.202.27 | 73,515.90 | 68,099.68 |

| Total expenses | 100,093.30 | 81,737.75 | 75,695.93 |

| Restated loss before exceptional items and tax | ( 1,084.29 ) | ( 3.145.33 ) | ( 16,719.02 ) |

| Exceptional items | ( 13,464.34 ) | ( 131.08 ) | – |

| Restated loss before tax | ( 14,548.63 ) | ( 3,276.41 ) | ( 16,719.02 ) |

| Tax expense | |||

| Current tax | – | . | – |

| Current tax on account of business combination | 24,868.42 | . | – |

| Deferred tax | – | – | – |

| Total tax expense | 24,868.42 | – | – |

| Restated loss for the period / year | ( 39,417.05 ) | ( 3,276.41 ) | ( 16.719.02 ) |

Key financial ratios of Shadowfax Technologies Limited

| Particulars (₹ in million, unless otherwise specified) |

Ended March 31 , 2025 | Ended March 31 , 2024 | Ended March 31 , 2023 |

| Restated loss for the period / year | ( 39,417.05 ) | ( 3,276.41 ) | ( 16,719.02 ) |

| Basic ( loss ) earnings per share | ( 9.98 ) | ( 0.87 ) | ( 4.43 ) |

| Diluted ( loss ) / earnings per share | ( 9.98 ) | ( 0.87 ) | ( 4.43 ) |

| Total equity | 14,455.18 | 22,296.42 | 24,719.15 |

| EBITDA | ( 14,139.41 ) | ( 2,631.59 ) | ( 16,405.27 ) |

| Net Worth | 15,618.77 | 23,016.37 | 25,483.14 |

| Return on Net Worth | ( 252.37 ) % | ( 14.24 ) % | ( 65.61 ) % |

| Net Asset Value per share | 3.68 | 6.10 | 6.76 |

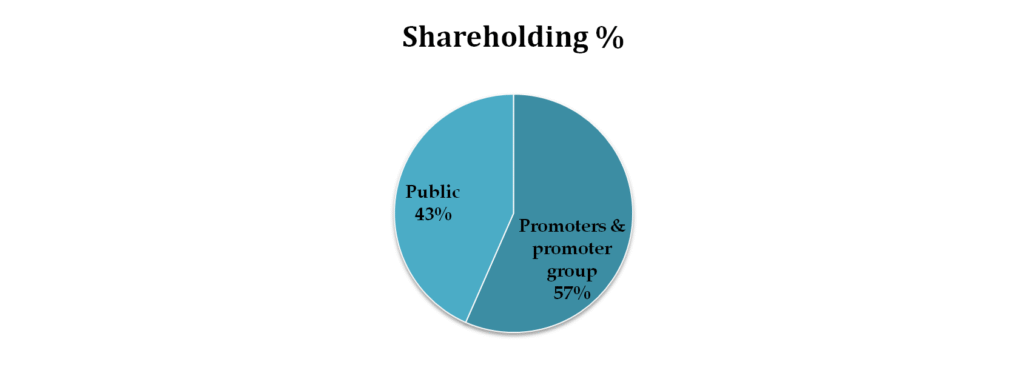

Promoters & Shareholding Shadowfax Technologies Limited IPO

As of date, according to the DRHP filed with SEBI promoters and promoter group have 56.68% shareholding in company.

| Name | Number of Equity Shares | % of Equity Share capital |

| Promoters & promoter group | 85,885,929 | 56.58 |

| Public | 65,903,043 | 43.42 |

| Total | 151,788,972 | 100 |

Should You Subscribe To Shadowfax Technologies Limited IPO

While investing or subscribing to any IPO, consider the investment rationales related to the company. Hence, here you can find out the strength of the company that will be its growth factors. And also check the risk factors that can affect the growth and operational efficiency of the company.

Competitive Strengths of Shadowfax Technologies Limited IPO

Largest last-mile gig-based delivery partner infrastructure

Among 3PL e-commerce players, company platform had access to India’s largest crowdsourced last-mile delivery fleet in terms of average monthly transacting delivery partners as of the Financial Year 2025. The last-mile operations are executed through a dynamic, gig-based fleet, ensuring seamless end-consumer experiences while delivering strong value through cost efficiency for digital commerce clients. This data-driven approach has helped cultivate a fleet of efficient delivery partners over the course of multiple years.

Extensive nationwide network

The network infrastructure of company serves as the backbone of efficient and scalable delivery system, encompassing firstmile, middle-mile, and last-mile facilities. It includes automated sort centers that have high sortation speed, accuracy, and overall throughput, with some centers being operated through automized cross belt sorters. As of September 30, 2025, we had the ability to service 14,758 pin codes through our network of more than 4,299 touch points across first and last mile centers, franchisee partners, and sort centers. It ensures speed, reliability, and throughput, particularly for time-sensitive and value-driven deliveries.

Business model with profitability

The company has a proven track record of achieving rapid growth at scale. The total revenue from operations grew from ₹14,151.24 million for the Financial Year 2023 to ₹18,848.22 million for the Financial Year 2024 and to ₹24,851.31 million for the Financial Year 2025. Whereas, Adjusted EBITDA was ₹486.69 million, reflecting an Adjusted EBITDA Margin of 1.96%%, and for ended September 30, 2025. The capital turnover ratio for Financial Year 2025 was 3.96x, which is the highest capital turnover ratio among the 3PL peers in India.

Agile and customisable logistics services

The company serves the diverse and complex needs of its clients and end-consumers through a comprehensive suite of express logistics solutions, including forward parcel delivery, reverse pickups and hand-in-hand exchange logistics, prime delivery, quick commerce, on-demand hyperlocal delivery, and critical item logistics. The company is only 3PL of scale in India offering both end-to-end delivery for e-commerce and last-mile delivery for quick commerce, food delivery, and other hyperlocal use case.

Risk Factors of Shadowfax Technologies Limited IPO

Persistent Loss

The company incurred losses aggregating to ₹(118.82) million and ₹(1,426.38) million in the Financial Years 2024 and 2023, respectively and negative cash flows from operating, investing and financing activities in certain periods. It incurred net losses in the past, and has had negative cash flows from operating, investing and financing activities in certain periods in the Financial Years 2025, 2024 and 2023. If company continues to experience losses and negative cash flows, it could adversely affect company.

Crowdsourced model adds operational risk

The company relies on crowdsourced network of delivery partners, comprising of 205,864 Average Quarterly Unique Transacting Delivery Partners as of September 30, 2025, with whom they do not have any exclusive arrangements, for certain aspects of business, and any change to the supply of delivery partners may disrupt business operations, lead to additional losses and expose company to additional risks.

Transit damage risk

The delivery partners of company sometimes mishandle goods, often stemming from pressures related to meeting tight delivery schedules or from insufficient training. Errors such as improper stacking, inadequate securing of goods, or exposure to harmful environmental conditions cause damage to product during transit and may lead to operational inefficiencies and client dissatisfaction.

Insurance not cover all losses

The company maintains various insurance policies to safeguard against risks and unexpected events. The insurance coverage includes protection against losses caused by fire and burglary, as well as directors’ and officers’ liability but it may be insufficient to cover all losses associated with business operations. If company cannot pass increased insurance costs onto clients and customers then financial condition, cash flow, and profitability could be adversely impacted.

Shadowfax Technologies Limited IPO Grey Market Premium

Grey market premium is the premium quoted over the IPO issue price. GMP shows that investors are ready to pay above the upper band of the IPO issue price. GMP is determined in the grey market as per the demand and supply of the shares in the primary market. A grey market is that unofficial ecosystem of unlisted companies’ stocks that start trading even before the launch of the IPO to the date of its listing.

Also Read: What is Grey Market Premium in IPO: How is GMP Calculated & Reliable

However, GMP is not a reliable factor, as it keeps fluctuating as per the demand and supply of shares in the primary market. There are numerous factors that affect the stock market in India and individual stock prices of different companies that are already listed and trading in the secondary market. However, for an IPO-bounded company, you can consider the GMP as the speculative listing price of the share

As per the sources, the GMP of Shadowfax Technologies Limited IPO is trading at around Rs 16in the grey market shows the share of Shadowfax Technologies Limited is expected to list at around Rs ₹140 if you consider the upper price band of Rs ₹124 announced in the IPO for the bidding.