The year 2022 was full of surprises and shocks. At a time when the US Federal Reserve is slamming the economic paddle hard to contain wild inflations and Russia-Ukraine war, Covid and companies are transitioning from just in time to just in case inventory. The Indian market has outperformed its global peers and demonstrated resilience in times of volatility.

There may be rare occasions when major indices across the world fall while Indian indices close in positive territory, in percentage equal to Interest on Ledger Balance by Moneysukh, i.e. around 2.7%. The data below shows the YTD closing statistics for the major indexes.

| Index | YTD | Index | YTD |

| Nasdaq | -33.70% | KOSPI | -21.95% |

| S&P 500 | -19.84% | Hang Seng Index | -15.82% |

| EURO STOXX 50 | -11.21% | SSE Composite Index | -14.78% |

| Dow Jones | -9.24% | ||

| Nikkei 225 | -9.74% | BSE SENSEX | +2.95% |

| FTSE 100 | -0.43% | NIFTY 50 | +2.87% |

(Data as of Dec 28, 2022)

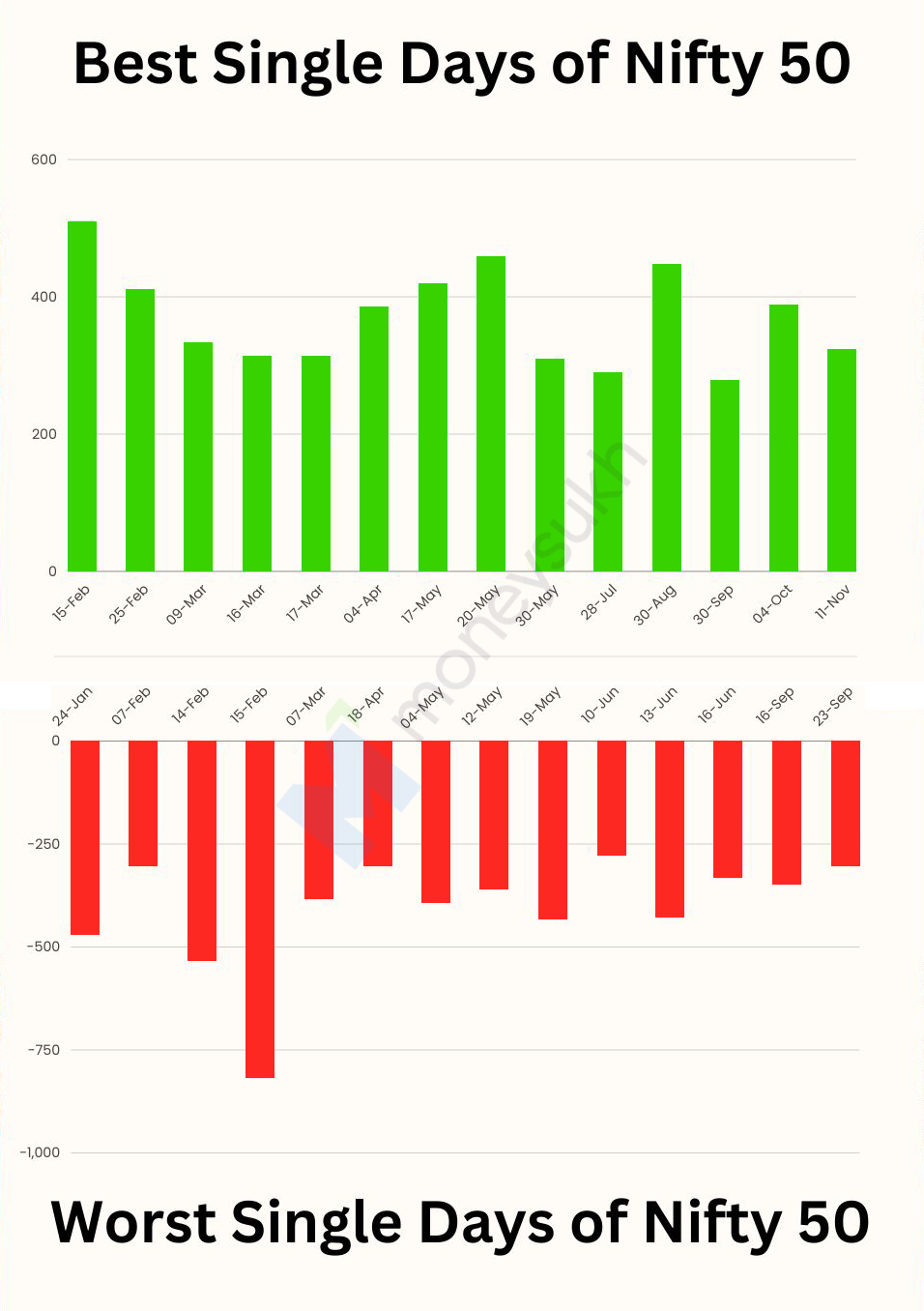

In 2022, the stock market did not move in a single path, there were 14 instances in 2022 when the Nifty soared more than 300 points in a day and more than 8 instances when the Nifty plummeted by more than 300 points. The Nifty 50 2022 market had its worst day since Russia attacked Ukraine.

According to market analysts various reforms, increased profitability due to inflation, pent up demand, strong Covid-19 management, and China +1 policy, have helped India's performance. Given the outperformance and premium valuations above peers, Indian indices closed the year on a volatile note. Next year path of the stock market will be determined by various variables some of them could be the devaluation of the Indian rupee, the openness of the Chinese economy, rising crude and escalation in Russia Ukraine war..

Among the top gainers this year were Software & IT Services, Retailing, and Manufacturing, to mention a few. The coordinated coordination and action of the central bank and government has kept the economy from overheating while simultaneously undertaking large capital expenditures.

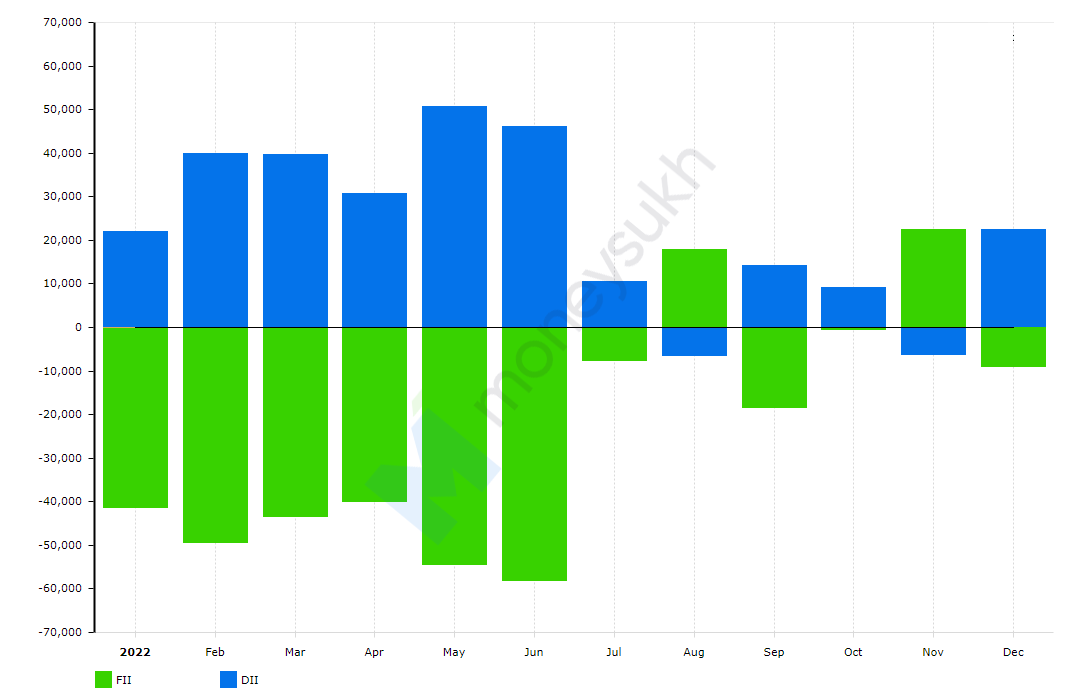

Hot money has been rushing to safe havens as the US Federal Reserve began to raise interest rates. Other central banks like ECB, BoJ, Bank of England has started to tighten financial conditions too. In 2022, India had a record outflow of FII. Over Rs 2.8 lakh cr of hot money has flown out of India as of December 27, 2022.

Best performing IPOs in 2022

| IPO Name | Listing date | Offer size (cr) | Offer price | Listing Price | Listing day closing price | Listing day gain/loss |

| Uma Exports Ltd | 07-Apr-22 | 60 | 68 | Rs 80 | 84 | 23.53% |

| Global Health Ltd | 16-Nov-22 | 2205.57 | 336 | Rs 401 | 415.65 | 23.71% |

| Campus Activewear Ltd | 09-May-22 | 1400.14 | 292 | Rs 360 | 378.6 | 29.66% |

| Dreamfolks Services Ltd | 06-Sep-22 | 562.1 | 326 | Rs 505 | 462.65 | 41.92% |

| Ruchi Soya Industries Ltd | 08-Apr-22 | 4300 | 650 | Rs 850 | 924.85 | 42.28% |

| Syrma SGS Technology Ltd | 26-Aug-22 | 840 | 220 | Rs 262 | 313.5 | 42.3% |

| Electronics Mart India Ltd | 17-Oct-22 | 500 | 59 | Rs 90 | 84.45 | 43.14% |

| Hariom Pipe Industries Ltd | 13-Apr-22 | 130 | 153 | Rs 214 | 224 | 46.86% |

| Harsha Engineers International Ltd | 26-Sep-22 | 755 | 330 | Rs 450 | 485 | 47.24% |

| DCX System Ltd | 11-Nov-22 | 500 | 207 | Rs 286 | 308.8 | 49.18% |

Uma Exports Ltd.

Back in 1988, when Uma Exports was incorporated, the Company was initially engaged in the business of export of building materials i.e. marble, granite, marble chips, etc to the neighboring country, Bangladesh. Keeping in view the demand in Bangladesh market the Company diversified from export of building materials to export of agricultural produce and commodities in the year 1997. Since then, the Company has been engaged in exporting agricultural produce and commodities including rice, wheat, sugar and spices. They have explored the business opportunities in Malaysia and Sri Lanka in addition to Bangladesh during these years. The India food industry is poised for huge growth in its importance in the global economy as a critical player in the food processing segment. India’s food and grocery market are the sixth largest in the world.

Revenue from Operation: 1,276.99

Profit/loss for the period – 24.16 cr

Basis EPS – Rs. 9.64

Net Profit Margin (%) – 1.91

Current ratio in FY21: 1.47

Total Debt/Equity – 0.39

DCX System Ltd.

They are a leading manufacturer of electronic subsystems and cable harnesses. They are the preferred Indian offset partners for foreign original part manufacturers (OEMs) executing defence manufacturing projects. With the make India Policy and resulted ban of importing of many defence items has opened a window of opportunity for the company. The company primarily engages in the defence sector, where global spending is increasing. Global defence spending is expected to grow at 4.06% CAGR between 2021-2026. The company is a rapidly growing in the Indian defence space and its revenue from operations has grown at a CAGR of 56.64% between Fiscal 2020 and Fiscal 2022.

Revenue from operations – Rs. 1102 cr

Total Expenses – Rs. 1035 cr

Profit for the year – Rs. 66 cr

EPS – Rs. 8.48

Harsha Engineers International Ltd.

Since its inception in 1986, Harsha Engineers International Limited* (Harsha) is the largest manufacturer of precision bearing cages in organized sector in India in terms of capacity and operations and amongst the leading manufacturers of precision bearing cages in the world with a market share of 5% to 6% in the organized segment of the global brass, steel, polyamide bearing cages in terms of revenue.

They are a technology driven company with a strong focus on research and development, which has allowed them to develop products suited to their customers’ requirements. They have the expertise to design and develop advance tooling in-house which enables us to manufacture complex products. Harsha’s principal production facilities are at Changodar and Moraiya, near Ahmedabad in Gujarat in India. They also have production facility through subsidiary in Changshu, China and step down subsidiary in Ghimbav Brasov in Romania.

Total Income - Rs. 1339. cr

Total expenses - 1,21,2. 37 cr

Profit after tax – Rs. 91.95 cr

Pat margin – 6.9%

Basic EPS – Rs. 16.06

Hariom Pipe Industries Ltd.

Hariom Pipe Industries Limited (Hariom Pipe) is a premium manufacturer of iron and steel products. Today, the company has stronghold in the South Indian market. They hold a diverse product portfolio consisting of Mild Steel (MS) Billets, Pipes and Tubes, Hot Rolled (HR) Coils, Sponge Iron and Scaffolding Systems. They cater to a variety of industrial applications across multiple sectors. With the existing furnance capacity of 1,04, 232 Mtpa, rolling mill capacity of 84, 000 Mtpa and pipe mill capacity of 84, 000, the company is ready to capitalise on the solid growth of the global steel industry.

Total Income – Rs. 433.28 cr

Total expenses – Rs. 374.45 cr

Profit as % of Total income – 7.3%

Adjusted EPS – 18.82

Debt to Equity – 87

Electronics Mart India Ltd.

From 1980 till Today, with 11.79 Lakhs square feet of retail space, a strong workforce of 2200 employees, 121 stores, and over 4 decades of legacy. They are the 4th largest consumer durable and electronics retailer in India and as of Financial Year 2020, they are the largest player in the Southern region in revenue terms with dominance in the states of Telangana and Andhra Pradesh. The company recorded a 25.06% CAGR in revenue from 2015 to 2020. Bajaj Electronics – a brand owned by EMI, is a household name when it comes to purchasing electronics.

Total revenue Rs. 4353.07 cr

Total Expenses – Rs. 4212.32 cr

Profit for year – Rs. 103.89 cr

Basic EPS – Rs. 3.46

Net profit margin – 2.38

Syrma SGS Technology Ltd.

Syrma SGS one-stop-solution electronics manufacturing services (EMS) includes product design, quick prototyping, PCB assembly, Box build, repair & rework and automatic tester development services. They provide high-mix, flexible volume, precision OEM manufacturing. Syrma SGS also offers OEM solutions for RFID tags & inlays and high-frequency magnetic components. They are engaged in turnkey electronics manufacturing services (EMS), specialising in precision manufacturing for diverse end-user industries.

The EMS companies are expected to offer a bouquet of services in designing, prototyping, testing services, manufacturing capabilities, microelectronics, optoelectronics, and radio frequency or wireless services.

Total Income Rs. 654.50 cr

Expenses Rs. 606.61cr

Net Profit after Tax Rs. 30.60 cr

EPS - Rs. 2.72 cr.

Ruchi Soya Industries Ltd.

Established in 1986 and featuring among the top five FMCG players in India, Ruchi Soya is a leading manufacturer of healthier edible oils, soya food, premium table spread, vanaspati and bakery fats. It is also the highest exporter of soya meal, lecithin and other food ingredients from India.

The Company has focused on continuous expansion across business verticals to consolidate and sustain its industry leadership. Over the years the Ruchi group has metamorphosed from a trader to a manufacturer & marketer. With a turnover of over US$ 5 Billion Ruchi Soya is now a company with a strong portfolio of brands viz. Nutrela, Mahakosh, Sunrich, Ruchi Gold & Ruchi No.1., The oil palm plantation business has high barriers, which give these companies an edge over the competition. The name of Ruchi Soya Industries stands changed to Patanjali Foods with effect from June 24.

Total Revenue – Rs 24284.38 cr

Total Expenses – Rs 23210 cr

Profit for the year – Rs. 806.31 cr

Basic EPS – 27.26

Net profit margin – 3.33

Total Debt to EEQ – 0.72

Dreamfolks Services Ltd.

DreamFolks is India's largest airport service aggregator platform facilitating an enhanced airport experience to passengers leveraging our proprietary technology solutions

As at Sep 30, 2022, through partnerships with other service providers, they have a global footprint extending to 1,483 Touch-points in 121 countries, across the world out of which, 268 touch-points are present in India and 1,215 Touch-points overseas. By leveraging technology, they facilitate enhanced passenger airport experience by integrating global card networks operating in India.

Revenue from Operation: Rs. 2,824.98 million

Total Expenses – Rs. 2635.16

Profit after tax – Rs. 162.47

Basic EPS – 3.11

Campus Activewear Ltd.

Introduced in 2005, 'Campus' is the India’s largest sports and athleisure brand in India terms of value and volume in Fiscal 2021. It was introduced as a brand that offers a diverse product portfolio for the entire family. They offer multiple choices across styles, color palettes, price points and an attractive product value proposition. Campus had an approximately 15% market share in the branded sports and athleisure footwear industry in India by value for Fiscal 2020, which increased to approximately 17% in Fiscal 2021.

Total Revenue: Rs 1196.58

Total Expenses – Rs. 1025.30

Profit for year – 125.19

Net Profit margin – 10.48

Basic EPS – 4.12

Global Health Ltd.

Global Health Limited is one of the largest private multi-speciality tertiary care providers operating in the North and East regions of India. The company has key specialities in cardiology and cardiac science, neurosciences, oncology, digestive and hepatobiliary sciences, orthopaedics, liver transplant, and kidney and urology.

Global Health Limited have a network of four hospitals currently in operation (Gurugram, Indore, Ranchi and Lucknow) under the "Medanta" brand. As of June 30, 2022, the company provides healthcare services in over 30 medical specialities and engages over 1,300 doctors led by experienced department heads, spanning an area of 4.7 million sq. ft., the operational hospitals have 2,467 installed beds.

After COVID, there is a renewed emphasis on enhancing the healthcare system in the country. A significant growth potential and transformation awaits the players in the segment.

Revenue from Operation: 1764.25 cr

Total expenses – 1389.41 cr

Profit and loss – 218.78 cr

Profit % of Total revenue – 12.15 %

EPS – Rs. 8.64

No comment yet, add your voice below!