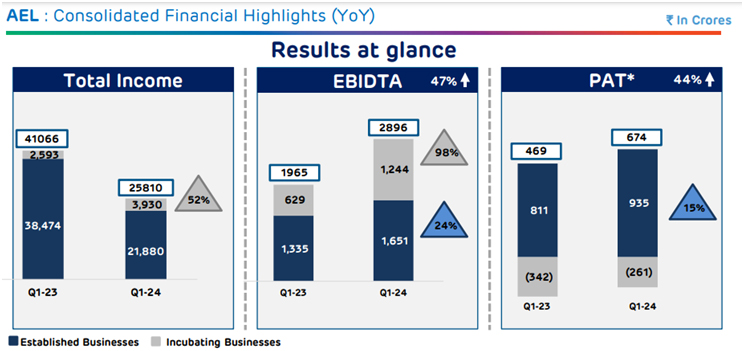

Adani Group’s flagship company, Adani Enterprises, reported a 44 percent year-on-year (YoY) jump in net profit to Rs 674 crore for the first quarter of the financial year 2024, as against Rs 469.46 crore in the corresponding period last year. The strong results come at a time when Adani Group companies are gradually recovering from the impact of a report by US short-seller Hindenburg Research in January.

Companies’ total consolidated revenue fell by 38% year-on-year (y-o-Y) to Rs. 25,810 crore on account of a reduction in IRM volume and a correction in coal prices. On a Q-o-Q basis, consolidated revenue has seen a decline of 18.72%.

Consolidated EBIT (earnings before interest, taxes, and depreciation) on a year-over-year basis increased by 41% to Rs. 2181 crore on account of strong operational growth, but on a Q-o-Q basis, the EBIT fell by 18.98%.

Total income from incubated businesses increased by 52% year over year from Rs. 2593 crore to Rs. 3930 crore, whereas net losses from incubated businesses at the consolidated level fell from Rs. 342 crore to Rs. 261 crore.

Going through the segment wise financials of Adani Enterprise, under established businesses, ANIL Ecosystem saw a 209% Y-o-Y jump in revenue on account of an increase in volume, mining services saw a year-over-year fall due to lower volume, and Primary Industries IRM fell by almost half due to a correction in coal prices and lower volume. Incubated businesses such as Transport & Logistics Airports saw a revenue jump of 35% y-o-y due to an increase in passenger movements.

The company also announced that its data center business hold an orderbook of 110 MW from Hyperscale & Enterprise customers. During the quarter, Adani Airports passangers handling increased by 27% to 21.3 Mn passengers from seven operational airports, the company Construction of 79.8 Lane-KM during the quarter.

A message from Gautam Adani, Chairman of the Adani Group: "These results are a validation of the Adani Group's robust operational and financial achievements... Our expertise in executing large-scale projects, like Kutch Copper, Navi Mumbai Airport, and the certification of India’s first 5 MW onshore wind turbine, coupled with our world-class O&M capabilities, are fundamental drivers that continue to accelerate our infrastructure journey, which is poised to play a significant role in meeting the aspirations of the largest emerging middle-class cohort in the world. As we explore strategic expansion and growth, we remain committed to upholding the highest standards of governance, compliance, and performance."

The shares of Adani Enterprise closed 2 percent in green yesterday ahead of the release of the result, and today the stock at the time of reporting is trading at Rs. 2526.

No comment yet, add your voice below!