Business Profile of the Aegis Vopak Terminals Limited

Aegis Vopak Terminals Limited is the largest Indian third-party owner and operator of tank storage terminals for liquified petroleum gas (LPG) and liquid products. Companies network of terminals has an aggregate storage capacity of approximately 1.50 million cubic meters for liquid products and 70,800 metric tons of static capacity for LPG. They offer secure storage facilities and associated infrastructure for liquids such as petroleum, vegetable oil, lubricants, and various categories of chemicals and gases.

As of June 30, 2024, they have a diversified network of terminals spread strategically across five key ports in India, handling approximately 23.00% of liquid and 61.00% of total LPG import volumes. The synergies of the operation of the company is supported by two of its promoters, Aegis Logistics Limited and Vopak India BV, who provide us with a deep understanding of the industry globally.

Aegis Vopak Terminals Limited IPO Objective

As per the draft red hearing prospects, the IPO issue consists only of offer for sale.

- Aegis Vopak Terminals IPO offer only has fresh issue of Rs. 35, 000 million. As per DRHP document, the company aims to utilize IPO proceedings towards payment of certain borrowings, funding of its capital expenditure plans and corporate general purposes.

| Particulars | Estimated amount |

| Payment of certain outstanding borrowings availed by company | 20271.83 |

| Funding of capex towards contracted acquisition of the cryogenic LPG terminal at Mangalore | 6713 |

| General corporate purposes | XXXX |

| Total | XXXX |

(₹ Million)

IPO Details of Aegis Vopak Terminals Limited:

| IPO Open Date | Mon, May 26, 2025 |

| IPO Close Date | Wed, May 28, 2025 |

| Basis of Allotment | NA |

| Listing Date | June 2, 2025 |

| Face Value | ₹10 per share |

| Price | ₹223 to ₹235 per share |

| Lot Size | 63 Shares |

| Total Issue Size | 11,91,48,936 shares |

| (aggregating up to ₹2,800.00 Cr) | |

| Fresh Issue | 11,91,48,936 shares |

| (aggregating up to ₹2,800.00 Cr) | |

| Offer For Sale | N.A. |

| N.A. | |

| Issue Type | Book Built Issue IPO |

| Listing At | BSE & NSE |

| QIB Shares Offered | Not less than 75% of the Net Offer |

| Retail Shares Offered | Not more than 10% of the Net Offer |

| NII (HNI) Shares Offered | Not more than 15% of the Net Offer |

Issue Price & Size: Aegis Vopak Terminals Limited IPO

The issue size of the IPO has been declared and the overall issue size of the IPO is Rs 2,800.00 Cr, out of which 11,91,48,936 Equity Shares, aggregating up to Rs 2,800.00 cr, comprise of fresh issuance only.

Launch Date of Aegis Vopak Terminals Limited IPO

Aegis Vopak Terminals IPO will be open on May 26, 2025 and close on the May 28, 2025. All types of investors can bid between these dates through their eligible categories.

Aegis Vopak Terminals Limited Financial Statements

| For quarter ended June 30, 2024 | For quarter ended June 30, 2023 | FY24 | FY23 | FY22 | |

| Revenue from operations | 1540.28 | 1143.71 | 5617.61 | 3533.32 | – |

| Other income | 23.42 | 16.73 | 83.6 | 26.59 | 0.03 |

| Total income | 1563.7 | 1160.44 | 5701.21 | 3559.91 | 0.03 |

| Expenses | |||||

| Employee benefits expense | 123.2 | 112.74 | 437.97 | 305.37 | – |

| Finance costs | 480 | 409.29 | 1708.88 | 1381.62 | 5.2 |

| Depreciation and amortisation expense | 313.02 | 276.67 | 1139.91 | 912.02 | – |

| Other expenses | 281.93 | 250.79 | 1204.27 | 934.93 | 5.75 |

| Total expenses | 1198.15 | 1049.49 | 4491.03 | 3533.94 | 10.95 |

| Profit before tax | 365.55 | 110.95 | 1210.18 | 25.97 | -10.92 |

| Profit for the year | 257.77 | 73.2 | 865.44 | -0.75 | -10.92 |

| Metric | As of 3 months ended | FY24 | FY23 | FY22 | |

| June 30, 2024 | June 30, 2023 | – | – | – | |

| Static Capacity for Liquid Terminal Division (CBM) | 1497483 | 1394062 | 1497483 | 1343012 | – |

| Capacity Utilization % for Liquid Terminal Division | 72.49% | 72.38% | 75.81% | 75.96% | – |

| Static Capacity for Gas Terminal Division (MT) | 70800 | 67100 | 70800 | 47100 | – |

| Throughput for Gas Terminal Division (MT) | 382579 | 323743 | 1588727 | 858412 | – |

| Revenue from operations (₹ million) | 150.28 | 1143.71 | 5617.61 | 3533.32 | – |

| Revenue Growth YoY (%) | 34.67% | N.A. | 58.99% | N.A. | N.A. |

| Total Income (₹ million) | 1565.7 | 1160.44 | 5701.21 | 3559.391 | 0.03 |

| EBIT (₹ million) | 845.55 | 520.24 | 2919.06 | 1407.59 | -5.72 |

| Operating EBITDA (₹ million) | 1135.15 | 780.18 | 3975.37 | 2293.02 | -5.75 |

| Operating EBITDA Margin (%) | 73.70% | 68.21% | 70.77% | 64.90% | N.A. |

| EBITDA (₹ million) | 1158.57 | 796.91 | 4058.997 | 2319.61 | -5.72 |

| EBITDA Margin (%) | 74.09% | 68.67% | 71.19% | 65.16% | N.A. |

| Profit after tax (₹ million) | 257.77 | 73.2 | 865.44 | -0.75 | -10.92 |

| PAT Margin (%) | 16.48% | 6.31% | 15.18% | -2.00% | N.A. |

| Capital Expenditure (₹ million) | 247.12 | 1783.34 | 4750.58 | 32350.05 | 280.2 |

| Net Worth (₹ million) | 11774 | 11055.93 | 11519.42 | 10982.03 | -5.34 |

| Total Debt (₹ million) | 25841.82 | 23522.82 | 25864.17 | 17451.68 | 981 |

| Total Equity(₹ million) | 10226.23 | 9601.12 | 9971.65 | 9530.91 | 18.89 |

| Net Debt (₹ million) | 24972.19 | 23340.55 | 24800.42 | 17214.44 | 912.18 |

| Net Debt to Operating EBITDA ratio(x) | 5.5 | 7.48 | 6.24 | 7.51 | N.A. |

| Capital Expenditure to Operating EBITDA ratio (%) | 21.77% | 228.58% | 119.50% | 1410.81% | N.A. |

| RoE (%) | 10.08% | 3.05% | 8.68% | N.A. | N.A. |

| RoCE (%) | 9.61% | 6.32% | 8.39% | 5.26% | N.A. |

| Operating Cash Flow (₹ million) | 1091.73 | 469.1 | 3372.08 | 1724.86 | 5.01 |

| Total Debt to Equity ratio (x) | 2.53 | 2.45 | 2.59 | 1.83 | 51.93 |

Aegis Vopak Terminals Limited Promoters & Shareholding

As of date, there are two promoters of the company.

The promoter along with promoter group in aggregate collectively holds 97.41% of the paid-up share capital of company.

| Name of Shareholder | Number of Equity Shares held | % of total pre- Issue paid up Equity capital |

| Aegis Logistics Limited | 49,53,73,957 | 50.1 |

| Vopak India B.V | 46,78,52,000 | 47.31 |

| Total | 96,32,25,957 | 97.41 |

Should You Subscribe to Aegis Vopak Terminals Limited IPO or Not

While investing or subscribing to any IPO, consider the investment rationales related to the company. Hence, here you can find out the strength of the company that will be its growth factors. And also check the risk factors that can affect the growth and operational efficiency of the company.

Competitive Strengths of Aegis Vopak Terminals Limited:

Owner and operator of Tank Storage Terminals

As per records, Aegis Vopak is the largest Indian third-party owner and operator of tank storage terminals for LPG and liquid products. Their comprehensive storage systems comprise tanks with a designed life of approximately 40 years and can store and handle over 40 different complex and critical products. The company currently own and operate two LPG storage terminals across two Indian ports and 16 liquid storage terminals across five Indian ports.

They have diversified network of terminals spread strategically across five key ports in operation on the West and East coast of India. The terminals are located at ports that create a unique ‘necklace of terminals’ that enables us to cater to storage requirements in different regions across India.

The terminals are equipped to support the import, export, storage, and handling of various liquid products received via ships and road tankers.

Capacity expansion

The company has a strong track record in capacity expansion and infrastructural upgrades, catering to liquid and gas storage needs. They leverage promoters experience which also gives them competitive advantage in capacity expansion, cost-effective materials procurement,, and construction capabilities to upgrade tank storage capacities and infrastructure. Aegis is responsible for construction, working on an arm’s length basis with the company, ensuring no construction-related risks. This separation of responsibilities allows the company to focus on efficient operation and management of terminals.

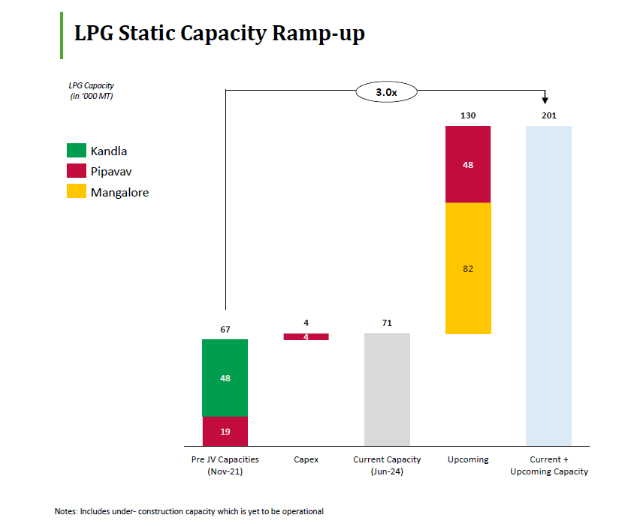

The company plans to increase LPG storage capacity to 200,800 MT by the end of Fiscal 2025 and liquid storage capacity to 1,673,773 cubic meters.

Backed by strong promoter

Aegis Vopak operates as a joint venture between Aegis, an Indian company and Vopak India BV, part of Royal Vopak. Aegis has three distinct business segments: sourcing LPG, storing liquids and LPG, and distributing LPG through a network of terminals for liquid products and gas, LPG filling plants, and pipelines. Vopak India BV, part of Royal Vopak, is one of the world’s leading tank storage companies with a network of 76 terminals in 23 countries. Vopak operates a liquid terminal with a storage capacity of 275,000 cubic meters and owns a 21,000 MT cryogenic LPG terminal capable of handling a throughput of 1.5 MMTPA. The promoters bring in their synergies to achieve efficiency.

Diversified Customer Base

The company has built relationships with a diverse range of customers, partly based on the long-standing relationships established by its promoter, Aegis. The company has a diversified customer base of over 400 customers, total scale and reach of 23 countries, 77 terminals, 250 products, 500 industrial connections, and 400 jetties and berths.

The revenue composition is fairly distributed among their top clients reducing concentration to any one client. As can be seen from table, their top five client contribute to around 30% of their revenue and their and top 10 customers contribute to about 45% of their total revenue from operations. Any deterioration of relationship with top client, or substantial reduction in their dealings with the company could have an adverse effect on the company’s operations.

| Particulars | 3-Mon ended June 30, | ||||

| – | FY22 | FY23 | FY24 | 2023 | 2024 |

| Revenue from top five customers | – | 1085.92 | 1981.19 | 400.53 | 589.66 |

| Revenue from top five customers, as a % of revenue from operations | – | 30.72% | 30.72% | 34.17% | 38.29% |

| Revenue from top 10 customers | – | 1487.45 | 2503.14 | 514.98 | 752.36 |

| Revenue from top 10 customers, as a % of revenue from operations | – | 42.07% | 44.56% | 43.94% | 48.85% |

| Revenue from repeat customers | – | – | 4891.42 | 1132.65 | 1367.61 |

| Revenue from repeat customers, as a % of revenue from operations | – | – | 87.07% | 99.03% | 88.79% |

Future plans

- Expand its LPG terminal network and add new locations to meet the growing demand.

- Build a greenfield terminal at New Mangalore port in Karnataka and a cryogenic facility at Pipavav Terminal in Pipavav, India.

- Expand its liquid storage terminal at Jawaharlal Nehru Port Authority in Navi Mumbai.

- Committed to sustainability and aims to contribute to the energy transition by focusing on low-carbon fuels

- Explore inorganic growth opportunities in the future.

Risk Factors of Aegis Vopak Terminals Limited:

Operational risks

Aegis Vopak business is divided into two segments: Gas Terminal Division, which primarily handles LPG, and Liquid Terminal Division, which handles petroleum, chemicals, and vegetable oils. The nature of business is very delicate and requires high degree of consistency during handling and transportation. Operations incidents may be affected by various factors, including equipment breakdowns, accidents, fatalities, labor disputes, and hazards associated with liquids and gases.

These risks can result from misconduct, improper operations, weather, natural disasters, equipment aging, mechanical failure, unscheduled downtime, transportation interruptions, and terrorist attacks.

| Business Segment | FY22 | FY23 | FY24 | Three months ended June 30, | |

| % of Revenue from Operations | 2023 | 2024 | |||

| Gas Terminal Division | – | 31.52% | 36.55% | 35.71% | 45.07% |

| Liquid Terminal Division | – | 68.48% | 63.45% | 64.29% | 54.93% |

Conflicts between promoters

Aegis and Royal Vopak are joint venture partners with 50.10% and 47.31% of the company’s equity share capital, respectively. They exercise significant control over the company and are reliant on them for operations. If any sort of conflict arises and promoter among them self couldn’t find resolution of the conflict, It could potentially disrupt the company’s business and operations.

Location of terminals

Their terminals are primarily located along the west coast of India, generating significant revenue. However, these terminals are susceptible to local and regional factors like weather, natural disasters, and government policies. Despite disruptions like the Kandla terminal in 2023 due to the Biparjoy Cyclone, they have not experienced significant disruptions in the past three fiscals.

| Particulars | FY22 | FY23 | FY24 | Three months ended June 30, | |

| – | – | – | 2023 | 2024 | |

| Revenue generated from terminals situated on the west coast of India | – | 3238.81 | 5183.76 | 1048.34 | 1445.69 |

| Revenue generated from terminals situated on the west coast of India, as a % of revenue from operations | – | 91.61% | 92.28% | 91.66% | 93.87% |

| Revenue generated from terminals situated on the east coast of India (₹ million) | – | 296.52 | 433.85 | 95.36 | 94.41 |

| Revenue generated from terminals situated on the east coast of India, as a percentage of revenue from operations (%) | – | 8.39% | 7.72% | 8.34% | 6.13% |

Dependency on oil and gas outlook

Company business is divided into two segments i.e. oil and gas division. So the company receives significantly revenue from oil and gas division. The division is influenced by many factors both from demand as well supply. From supply side the sector is influenced by factors such as the discovery and development of new reserves, prices, renewable energy, political and economic conditions, refining, and transportation costs, etc. On the contrary, demand from final customer and industry plays important role in company’s margin. Any prolonged reduction in oil and gas prices could depress capital expenditure, resulting in a decline in demand for storage services.

| Particulars | FY22 | FY23 | FY24 | Three months ended June 30, | |

| – | – | – | 2023 | 2024 | |

| Revenue from customers in the oil and gas sector (₹ million) | – | 1284.97 | 2124.23 | 430.27 | 654.12 |

| Revenue from customers in the oil and gas sector, as % of revenue from operations | – | 36.36% | 37.81% | 37.62% | 42.47% |

Aegis Vopak Terminals Limited Grey Market premium

Grey market premium is the premium quoted over the IPO issue price. GMP shows that investors are ready to pay above the upper band of the IPO issue price. GMP is determined in the grey market as per the demand and supply of the shares in the primary market. A grey market is that unofficial ecosystem of unlisted companies’ stocks that start trading even before the launch of the IPO to the date of its listing.

Also Read: What is Grey Market Premium in IPO: How is GMP Calculated & Reliable

However, GMP is not a reliable factor, as it keeps fluctuating as per the demand and supply of shares in the primary market. There are numerous factors that affect the stock market in India and individual stock prices of different companies that are already listed and trading in the secondary market. However, for an IPO-bounded company, you can consider the GMP as the speculative listing price of the share

As per the sources, the GMP of Aegis Vopak Terminals IPO is not available in the grey market. Stay tuned for the latest IPO GMP numbers of Aegis Vopak Terminals IPO.