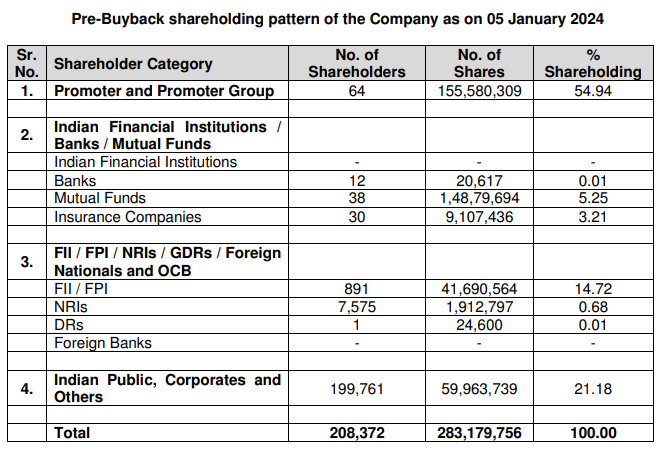

Bajaj Auto, India's leading bike manufacturer and the manufacturer of the #1 entry sport bike Pulsar 125 cc, announced a share buyback through a tender offer at its most recent board meeting. Bajaj Auto's board meeting on January 8th, 2024, approved the proposal for the buyback of up to 4,000,000 fully paid-up equity shares of face value of Rs 10 each by the company (representing 1.41 percent of the total number of equity shares of the company) at a price of Rs 10,000 per equity share payable in cash for a total consideration not exceeding Rs 4,000 crore. Company promoters who, as of December 2023, hold 54.94 percent of the shares will also participate in the buyback.

This is the second time the company will do a share buyback, following a buyback in July 2022 worth Rs 2,500 crore at Rs 4,600 per unit. Since then, the automaker's share value has more than doubled. The last buyback was through the open market, but this time it is through a tender offer route.

As stated in the circular, the Rs 4,000-crore share buyback represents 16.33 percent and 14.49 percent of the total paid-up equity share capital and free reserves (including the securities premium account), according to the audited standalone financial statements and audited consolidated financial statements for the financial year ended March 31, 2023.

Earlier on January 3rd, in intimation to the exchange, the company said that it would be considering a stock buyback on January 8th. The managing director of Bajaj Auto, Rajiv Bajaj, said that the buyback would be far bigger this time. Following the backpack news on January 3rd, the stock rose 5%, touching a lifetime high of Rs 7059. The stock has outperformed Nifty by approximately 80% on a yearly basis and is trailing the best auto performer, Tata Motors, by 10%.

The company generated over Rs 3,600 crore of free cash flow in the first half of the financial year 2023–24 (H1FY24), which is 1.6 times higher than H1FY23. As of September 30, 2023, Bajaj Auto held Rs 17,326 crore of surplus funds on its balance sheet after a dividend distribution of Rs 4,000 crore during the quarter.

On the first day of the new year, the company reported its sales figures. Bajaj Auto reported a 16 percent rise in total sales to 3,26,806 units in December 2023, compared to 2,81,514 units in December 2022. Total two-wheeler sales were at 2,83,001 units last month as against 2,47,052 units in the year-ago period, a growth of 15 percent, it added. Domestic two-wheeler sales were up 26% YoY at 1,58,370 units. Whereas, exports of two-wheelers increased by 2.5% on a year-over-year basis to 1,24,631 units. Total commercial vehicle sales witnessed a nice push of 27 percent at 43,805 units as against 34,462 units in the same month a year ago, the company said.

BAJAJ AUTO has also informed the exchange that the board of the company is scheduled for January 24 to consider and approve the unaudited financial results of the company for the quarter and nine months ending on December 31, 2023.

The stock, by the end of November 2023, broke out of its long-term channel and has since been trading higher with a minor pullback. The stock is trading in an overbought zone as per the RSI indicator at 90. The stock in the current session has again made a lifetime high and is currently trading 1.74% positive at Rs 7104.

No comment yet, add your voice below!