Bull Call Spread Option Strategy-Bullish Options Trading Strategies

The Bull Call Spread option trading strategy is employed by traders who are relatively optimistic on the market in the short term and anticipate that the underlying asset will provide reasonable returns. This approach entails purchasing an in-the-money (ITM) call option and selling a deep out-of-the-money (OTM) call option with the same expiry date and underlying. The out-of-the-money call is short in order to fulfill the trader’s fundamental premise. Writing a call helps to compensate for the long in the money put while lowering the total premium spent. However, gains are also restricted if the underlying moves unexpectedly to the upside. This strategy is also called as ‘Bull Call Debit Spread’ as your account gets debited while deploying these bullish option strategies.

Risk:

Risk is limited to the net premium paid

Reward:

Reward is too limited to the level of short out of the money put.

Construction

Buy 1 ITM Call Option

Sell 1 Deep OTM Call Option

| Option Type | Expiry Date | Strike Price | LTP | Action | No. Of Lots |

| CALL | 29/03/2023 | 39400.0 | 575.3 | Buy | 1 |

| CALL | 29/03/2023 | 39900.0 | 341.25 | Sell | 1 |

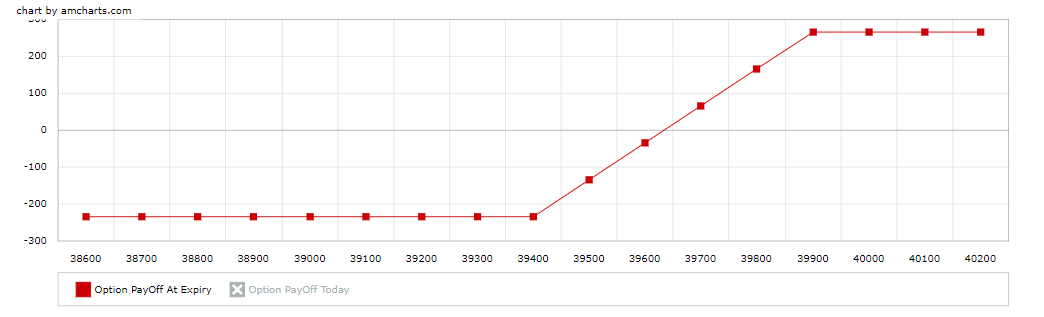

Payoff Chart

| Max Risk | Max Reward | Lower Break Even | Upper Break Even |

| 234.04999 | 265.95 | 39634.05 | 39634.05 |

| Market Expiry | Payoff 1 | Payoff 2 | Net Premium | Option PayOffAt Expiry |

| 38600.0 | 0.0 | 0.0 | -234.05 | -234.05 |

| 38700.0 | 0.0 | 0.0 | -234.05 | -234.05 |

| 38800.0 | 0.0 | 0.0 | -234.05 | -234.05 |

| 38900.0 | 0.0 | 0.0 | -234.05 | -234.05 |

| 39000.0 | 0.0 | 0.0 | -234.05 | -234.05 |

| 39100.0 | 0.0 | 0.0 | -234.05 | -234.05 |

| 39200.0 | 0.0 | 0.0 | -234.05 | -234.05 |

| 39300.0 | 0.0 | 0.0 | -234.05 | -234.05 |

| 39400.0 | 0.0 | 0.0 | -234.05 | -234.05 |

| 39500.0 | 100.0 | 0.0 | -234.05 | -134.05 |

| 39600.0 | 200.0 | 0.0 | -234.05 | -34.05 |

| 39700.0 | 300.0 | 0.0 | -234.05 | 65.95 |

| 39800.0 | 400.0 | 0.0 | -234.05 | 165.95 |

| 39900.0 | 500.0 | 0.0 | -234.05 | 265.95 |

| 40000.0 | 600.0 | -100.0 | -234.05 | 265.95 |

| 40100.0 | 700.0 | -200.0 | -234.05 | 265.95 |

| 40200.0 | 800.0 | -300.0 | -234.05 | 265.95 |

Bull Call Spread Option Trading Example

Assume the Bank Nifty is trading around 39450 levels and a trader employs a Bull-Call-Spread strategy. He paid premium of Rs. 575 for going long on one 39400 in-the-money call option and received Rs. 340 for shorting one 39900 out-of-the-money Call Option. The net premium paid for applying for the strategy is Rs. 9400 [(575-340)*40].

Scenario 1

If the Bank Nifty indices fall to 39100 at expiration, the highest loss is equivalent to the net premium paid for the strategy, which is Rs. 9400.

Scenario 2

if at expiry, the Bank Nifty index closes at 39650 level, net profit will be

Net profit

Rs. 600 = {(39650 – 39400) + (-575+340)}*40]

Scenario 3

If the spot Bank Nifty closes at 40500 at expiration, the intrinsic value of the 39900 in-the-money (ITM) call will be Rs. 1100 and that of the 39900 out-of the-money (OTM) call will be Rs. 600. The contract’s net profit settlement at expiration will be equivalent to

Net profit = (intrinsic value of ITM call) – (intrinsic value of OTM call) – (Net premium paid)

Rs. 10600 = {(40500-39400) – (40500-39900) – (575-340)}*40]

Traders who do option trading and make their custom option strategies, guess what, Moneysukh has come up with a platform which is absolutely free for its clients that will assist them in formulating their option trading strategies.

Also read Bull Put Spread Option Strategy

No comment yet, add your voice below!