Covered Call Option Strategy-Bullish Options Trading Strategies

Covered call option trading strategy consists of two parts in which the trader anticipates the security’s price to increase slightly in the near future. Investors/traders use this option strategy to go long on an underlying security and sell call options on a share-for-share basis. The ensuing situation is known as a covered call position, regardless of whether the shares are bought before or after the calls are sold. Covered Call Strategy involves selling of OTM Call Option of the same underlying.

Risk with Covered Call Option trading Strategy

When the underlying asset rises above the shorted strike price, the call option holder will begin to suffer losses. The premium offers some profit possibility above the strike price, but it is restricted. In the event of a significant stock price increase, covered call writers often feel as if they lost a fantastic opportunity to profit from upside gains.

Reward

When the security price rises, the strategy will benefit by pocketing the premium obtained from shorting the Call Option.

Construction

Buy 1 Bank nifty

Sell 1 Call Option

| Option Type | Expiry Date | Strike Price | LTP | Action | No. Of Lots |

| FUTURES | 29/03/2023 | -NA- | 39500.0 | Buy | 1 |

| CALL | 29/03/2023 | 40500.0 | 179.35 | Sell | 1 |

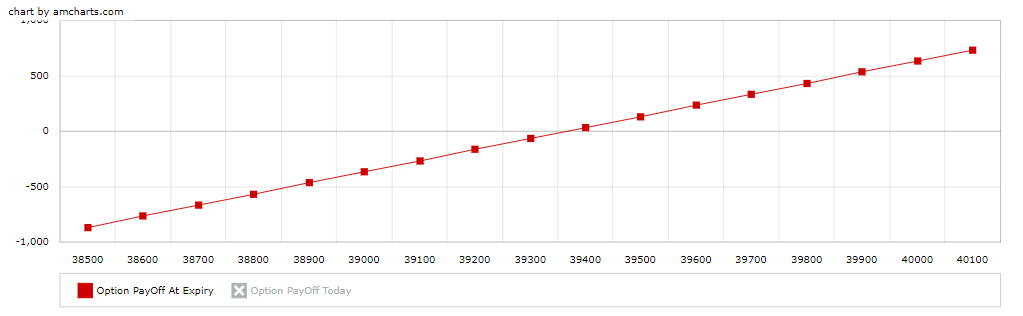

Payoff Chart

| Market Expiry | Payoff 1 | Payoff 2 | Net Premium | Option Payoff At Expiry |

| 38500.0 | -1050.0 | 0.0 | 179.35 | -870.65 |

| 38600.0 | -950.0 | 0.0 | 179.35 | -770.65 |

| 38700.0 | -850.0 | 0.0 | 179.35 | -670.65 |

| 38800.0 | -750.0 | 0.0 | 179.35 | -570.65 |

| 38900.0 | -650.0 | 0.0 | 179.35 | -470.65 |

| 39000.0 | -550.0 | 0.0 | 179.35 | -370.65 |

| 39100.0 | -450.0 | 0.0 | 179.35 | -270.65 |

| 39200.0 | -350.0 | 0.0 | 179.35 | -170.65 |

| 39300.0 | -250.0 | 0.0 | 179.35 | -70.65 |

| 39400.0 | -150.0 | 0.0 | 179.35 | 29.35 |

| 39500.0 | -50.0 | 0.0 | 179.35 | 129.35 |

| 39600.0 | 50.0 | 0.0 | 179.35 | 229.35 |

| 39700.0 | 150.0 | 0.0 | 179.35 | 329.35 |

| 39800.0 | 250.0 | 0.0 | 179.35 | 429.35 |

| 39900.0 | 350.0 | 0.0 | 179.35 | 529.35 |

| 40000.0 | 450.0 | 0.0 | 179.35 | 629.35 |

| 40100.0 | 550.0 | 0.0 | 179.35 | 729.35 |

Covered Call Option Trading Example

Suppose Bank Nifty is currently trading around 39350. The investor/trader is relatively optimistic on the index and trades futures contract of 1 lot of Bank Nifty @ Rs 39500. He also shorts one 40500 Call Option at a premium of approximately Rs. 179.

Scenario 1

If the Bank Nifty at expiry ends at 40000, the trader’s long position will appreciate by Rs. 20000 [(40000-39500)*40] + the premium he got for penning it, i.e. Rs.7160 (179*40). His overall profit will be Rs 27160.

Scenario 2

If Bank Nifty at expiry ends at 41000, the trader will benefit on his long futures position but make losses on his short call option contract. His total payoff from the strategy would be Rs. 47160. {(41000-39500) – (41000 – 40500) + (179)} *40.

Moneysukh has been a trader oriented broker and have always tried to help clients in saving more and earn more. Moneysukh has introduced platform and concept of interest on ledger balance for clients who wish to make their option trading strategies.

Also read: Long Combo Option Strategy

No comment yet, add your voice below!