Business Profile of the Fujiyama Power Systems Limited

Fujiyama Power Systems is a manufacturer of products and solutions in the roof-top solar industry, offering on-grid, off-grid, and hybrid solar systems. The company specializes in solar panel manufacturing, solar inverter manufacturing, and lead acid and lithium-ion battery production. They have a strong R&D capability and a wide variety of solar SKUs. The company has a strong brand recall and reputation, with brands like UTL Solar and Fujiyama Solar.

They have developed three manufacturing facilities and R&D capabilities domestically. They have an installed capacity of 540,800 solar panels, 287,925 solar inverters, 219,648 e-Rickshaw chargers, and 7488 lithium-ion batteries. The company have a track record of developing online UPS with single card, combo UPS, high frequency online UPS, and single card surface mount technology inverters. They have a wide variety of SKUs and a pan-India distribution network. They have been recognized as India’s “largest Company in off-grid inverter” and India’s “most preferred smart city brand.”

Fujiyama Power Systems Limited IPO Objective

As per the draft red hearing prospects, the IPO issue consists only of offer for sale.

- The OFS consists of up to 1,00,00,000 Equity Shares aggregating up to Rs 228.00 Cr. Nothing from those proceeds of OFS will be allotted to company.

- Fujiyama Power Systems IPO offer only has fresh issue of Rs. 6000.00 million. As per DRHP document, the company aims to utilize IPO proceedings towards cape of manufacturing facility, payment of certain borrowings an corporate general expenses.

| Particulars | Total estimated expenditure |

| Financing the cost of establishing the manufacturing facility in Ratlam, MP, India | 2666 |

| Payment of certain outstanding borrowings availed by company | 3000 |

| General corporate purposes | XXXX |

(₹ Million)

IPO Details of Fujiyama Power Systems Limited:

| IPO Open Date | Nov 13, 2025 |

| IPO Close Date | Nov 17, 2025 |

| Basis of Allotment | NA |

| Listing Date | Nov 20, 2025 |

| Face Value | ₹1 per share |

| Price | ₹216 to ₹228 per share |

| Lot Size | 65 Shares |

| Total Issue Size | 3,63,15,789 shares |

| (aggregating up to ₹828.00 Cr) | |

| Fresh Issue | 2,63,15,789 shares |

| (aggregating up to ₹600.00 Cr) | |

| Offer For Sale | 1,00,00,000 shares of ₹1 |

| (aggregating up to ₹228.00 Cr) | |

| Issue Type | Book Built Issue IPO |

| Listing At | BSE & NSE |

| QIB Shares Offered | Not less than 50% of the Net Offer |

| Retail Shares Offered | Not more than 35% of the Net Offer |

| NII (HNI) Shares Offered | Not more than 15% of the Net Offer |

Issue Price & Size: Fujiyama Power Systems Limited IPO

The issue size of the IPO has been declared and the overall issue size of the IPO is Rs828.00 Cr, out of which 2,63,15,789 Equity Shares, aggregating up to Rs 600.00 cr, comprise of fresh issuance, and the remaining Rs228.00 Cr will be offered for sale by shareholders.

Launch Date of Fujiyama Power Systems Limited IPO

Fujiyama Power Systems Limited IPO will be open on Nov 13, 2025 and close on the, Nov 17, 2025. All types of investors can bid between these dates through their eligible categories.

Fujiyama Power Systems Limited Financial Statements

| Particulars | For 6-Mon ended Sep 30, 2024 | FY24 | FY23 | FY22 |

| Revenue from operations | 7217.35 | 9246.88 | 6640.83 | 5068.38 |

| Other income | 23.53 | 25.1 | 12.44 | 12.88 |

| Total income | 7240.88 | 9271.98 | 6653.27 | 5081.26 |

| Expenses: | ||||

| Cost of material consumed | 5371.78 | 6975.1 | 4998.21 | 4257.58 |

| Changes in inventories | -252.74 | -117.43 | 20.71 | -519.84 |

| Other operating expenses | 231.77 | 317.36 | 159.39 | 88.41 |

| Employee benefits expense | 326.2 | 506.16 | 435.66 | 328.18 |

| Finance costs | 100.63 | 257.37 | 154.26 | 46.49 |

| Depreciation and amortisation expense | 79.37 | 128.08 | 59.41 | 13.65 |

| Other expenses | 373.85 | 579.32 | 510.87 | 471.27 |

| Total Expenses | 6230.86 | 8645..96 | 6338.51 | 4685.74 |

| Profit before tax | 1010.02 | 626.02 | 314.76 | 395.52 |

| Profit for the period | 750.9 | 453.03 | 243.66 | 285.43 |

| Parameters | FY22 | FY23 | FY24 | For 6-Mon ended Sep 30, 2024 |

| Revenue from Operations | 5068.38 | 6640.83 | 9246.88 | 7217.35 |

| Export Revenue as % of Revenue from Operations | 2.78% | 4.96% | 4.19% | 2.28% |

| EBITDA | 442.78 | 515.99 | 986.37 | 1166.49 |

| EBITDA Margin (%) | 8.74% | 7.77% | 10.67% | 16.16% |

| PAT | 285.43 | 243.66 | 453.03 | 750.9 |

| PAT Margin % | 5.63% | 3.67% | 4.90% | 10.40% |

| ROE % | 15.76% | 12.62% | 18.91% | 23.84% |

| ROCE % | 21.54% | 16.81$ | 26.60% | 26.47% |

| Debt/Equity Ratio (in Times) | 0.78 | 1.09 | 0.84 | 0.48 |

| Advt. and Marketing Exp. as a % of Revenue from operations | 2.57% | 2.58% | 1.06% | 1.59% |

| Revenue from Operations by Product category | ||||

| Solar Panel | 1413.15 | 1928.01 | 3319.66 | 2634.91 |

| Solar Battery | 1663.12 | 1677.75 | 2166.42 | 1776.41 |

| Solar UPS/ Inverter/Converter | 1128.56 | 1191.59 | 1680.46 | 1743.45 |

| E-Rickshaw Charger | 206.38 | 389.32 | 593.23 | 314.93 |

| Online UPS | 322.48 | 443.99 | 339.32 | 184.13 |

| Other Products, including services and other operating income | 334.48 | 1010.16 | 1147.79 | 563.52 |

| Revenue from Operations by Sales Channel (B2B vs B2C) | ||||

| B2C | 4741.48 | 5800.81 | 7228.1 | 6518.42 |

| B2B | 326.9 | 940.02 | 2018.78 | 698.93 |

| No. of SKUs in portfolio (Nos) | 423 | 452 | 487 | 509 |

| No. of Channel Partner (Nos) | 2922 | 3771 | 4587 | 5104 |

Fujiyama Power Systems Limited Promoters & Shareholding

As of date, there are three promoters of the company.

The promoter along with promoter group in aggregate collectively holds 99.84% of the paid-up share capital of company.

| Name of Shareholder | No. of Shares held | % of pre-Offer shareholding | Selling shareholder |

| Promoter | |||

| Pawan Kumar Garg | 10,83,51,570 | 38.68 | Up to 10,000,000 Eq. Shares |

| Yogesh Dua | 10,83,51,575 | 38.68 | Up to 10,000,000 Eq. Shares |

| Sunil Kumar | 1,37,50,000 | 4.91 | |

| Total holding of Promoters | 23,04,53,145 | 82.27 | |

| Promoter Group | |||

| Rita Garg | 20,37,125 | 0.73 | |

| Satnarayan Garg | 21,25,000 | 0.76 | |

| Shiv Kumar Garg | 1,37,50,000 | 4.91 | |

| Harsh Bala Dua | 12,50,000 | 0.45 | |

| Sandeep Dua | 1,37,50,000 | 4.91 | |

| Madhvi Bhatia | 1,37,50,000 | 4.91 | |

| Anju Bala | 12,50,000 | 0.45 | |

| Anisha | 12,50,000 | 0.45 | |

| Total holding of Promoter Group | 4,91,62,125 | 17.57 | |

| Grand total | 27,96,15,270 | 99.84 | |

Should You Subscribe to Fujiyama Power Systems Limited IPO or Not

While investing or subscribing to any IPO, consider the investment rationales related to the company. Hence, here you can find out the strength of the company that will be its growth factors. And also check the risk factors that can affect the growth and operational efficiency of the company.

Competitive Strengths of Fujiyama Power Systems Limited:

Diversified portfolio

Fujiyama Power Systems is a prominent Indian company specializes in providing solar energy solutions, offering a wide range of products including solar power generation Systems, power backup solutions, power supply solution and chargers. They also provide chargers for E-Rickshaws and lithium-ion batteries. With over 500 SKUs, the company reduces dependence on any single product category, ensuring resilience against market fluctuations and steady revenue growth. As of November 2024, India’s cumulative rooftop solar capacity is 15.1 GW, and they have supplied 1.4 GW of solar inverters over the past five years. The company’s integrated service network ensures customer needs are met, and its products are certified to meet quality and performance standards.

| Product Category | Product Offered |

| Solar power generation Systems | Solar panel |

| Hybrid solar inverter | |

| Off-grid inverter | |

| On-grid inverter | |

| Online solar PCU | |

| Solar management unit | |

| Lithium-ion battery | |

| Tubular lead acid battery | |

| Power backup Solution | Online UPS |

| Inverter | |

| Power Supply Solution | Hybrid charge controller unit |

| Chargers | EV charger |

| Marine charger/ engine start charger |

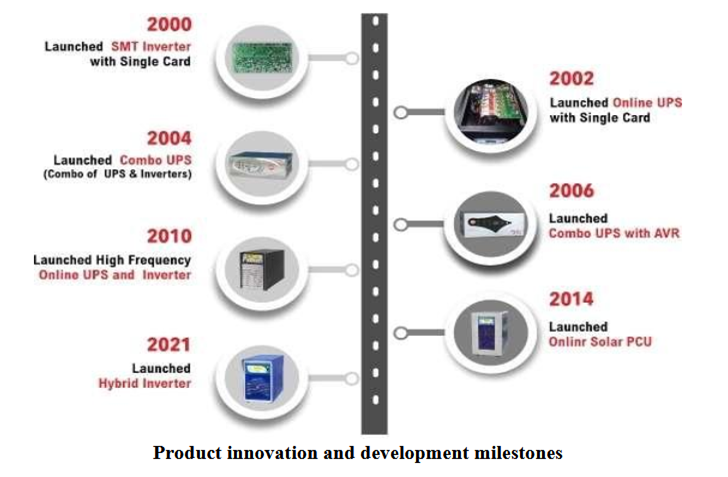

Track record of development and product innovation

The company is committed to technological developments and the introduction of new products to meet the evolving landscape of the solar energy segment. With over 28 years of experience, over 60 R&D professionals, and 400 qualified engineers, the company has a proven track record of early adopting innovative technology in solar energy solutions. They are one of the few Indian companies to develop Online UPS with single card, Combo UPS, AVR, High Frequency Online UPS, and single card SMT Inverter.

They also engage accredited third-party laboratories for further evaluation. They have upgraded their production setup to manufacture the latest technology in solar panels, developed their own Battery Management System, and developed a hybrid inverter based on rMPPT technology.

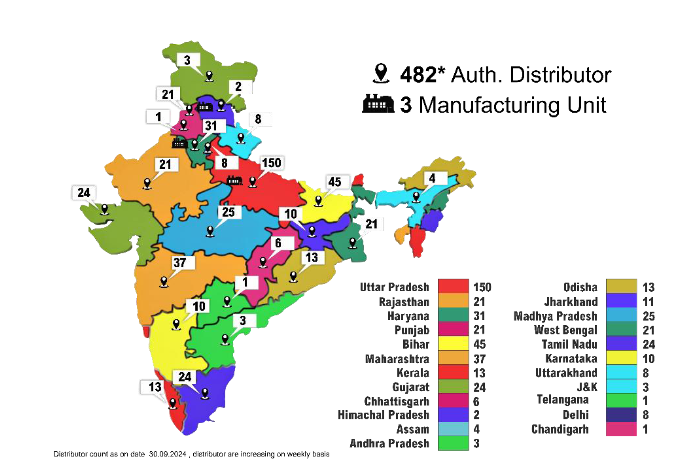

Distribution network

The company has been recognized as India’s most preferred smart city brand and solar inverter brand by UBM India and Informa. They have a wide distribution network, with each distributor adding their existing dealers and a field service engineer. UTL Solar has a robust sales and distribution network, including over 480 distributors, 3,600 dealers, and 400 service engineers. They offer products in over 1,000 exclusive “Shoppes” and provide training to customers on selecting the right rooftop system and components. The company also has a dedicated team of 400 service engineers who provide maintenance and technical support to customers.

The company’s marketing strategy focuses on understanding customer needs, behaviors, and desires, using various channels such as digital media, digital ads, in-store branding, social media, email campaigns, radio, in-app advertisements, and seminars.

Advanced in-house facilities

The company operates three in-house manufacturing facilities in India, with a total installed capacity of 540,800 solar panels, 287,925 solar inverters, 219,648 E-Rickshaw chargers, and 7488 lithium-ion batteries. These facilities are certified under appropriate ISO standards.

The company’s facilities are geographically located in favourable regions, allowing it to tap into new distributors and customers. The company’s manufacturing facilities focus on maximizing production and operational efficiency while maintaining strict quality control. They use automation to reduce manufacturing time, employ inline testing, and implement production and process methodologies such as Total Quality Management, KAIZEN, and 5S.

Future strategies

- Developing new facility for manufacturing solar panels in Dadri, UP and installing another solar inverter and lithium-ion battery line in Greater Noida Facility.

- Expansion of inverter line at Greater Noida Facility

- Use IPO proceeds for establishing an integrated project in Ratlam, MP, which will more than double its current manufacturing capacity

- Increase sales and reach a diverse customer base through increased installed capacity and product portfolio

- Capitalize on government initiatives to meet demand.

- Strengthen its domestic distribution and retail network and increase export sales

- Increasing distribution base and retail network through a curated distribution model and plans to expand its Shoppe network

- Focus on the southern and eastern regions to strengthen its brand presence

Risk Factors of Fujiyama Power Systems Limited:

Segment concentration

As of September 2024, the company generated most of its revenue from sale of solar panels, batteries, and chargers. The demand for these products is influenced by factors such as solar panel prices, installation costs, and availability of space, infrastructure, technological changes, consumer preferences, weather conditions, government policies, and market competition. The demand for power backup solutions has grown in the last three fiscals and ended September 30, 2024. However, the company cannot guarantee continued growth in these categories, and any factors beyond its control may reduce demand, potentially impacting the business, results, and financial condition.

| Particulars | FY22 | FY23 | FY24 | Six months ended Sep 30, 2024 |

| Percentage of Revenue from Operations (%) | ||||

| Solar panels | 27.88 | 29.03 | 35.9 | 36.51 |

| Batteries | 32.82 | 25.26 | 23.43 | 24.61 |

| Inverter, charger and UPS | 32.7 | 30.5 | 28.26 | 31.07 |

| Other | 6.6 | 15.21 | 12.41 | 7.81 |

Reliance on third-party suppliers

The company’s competitiveness and profitability are largely dependent on its ability to source and maintain a stable supply of materials and components at acceptable prices. Major requirements include solar cells, back-sheets, encapsulate, glass, metals, frames, junction box, transistors, capacitors, lithium-ion cells and many more.

The absence of long-term supply contracts exposes the company to risks such as price volatility, market fluctuations, currency fluctuations, climatic and environmental conditions, production and transportation costs, changes in government policies, and regulatory and trade sanctions. Over the years, as can be seen from data in table below, the company has been increasing its depended on over sees suppliers and reduced its dependence on suppliers outside India.

| Particulars | FY22 | FY23 | FY24 | 6-Mon ended Sep 30, 2024 |

| Percentage of Total Purchases (%) | ||||

| Cost of Materials Consumed | 88.84 | 98.26 | 97.91 | 87.19 |

| Purchases from suppliers in India | 87.36 | 83.29 | 74.92 | 70.88 |

| Purchases from suppliers outside India | 12.64 | 16.71 | 25.08 | 29.12 |

Import of raw material

The company sources raw materials for its solar panels and inverters from international and Indian suppliers. A significant portion of these materials, particularly solar cells and lithium-ion cells, are imported from China. Geopolitics has been very volatile in past few years with world leaders focusing on protecting technology and boosting in-house capabilities. Any restrictions imposed by the government on these imports could negatively impact the company’s business prospects. Price fluctuations and import duties also pose risks, potentially causing a decline in operating margins. As can be seen from table, over all share of import has been increasing and from that, share of China represent more than 75% of total import.

Apart from raw material, the company also imports machinery to support its operations. Importing machinery involves several risks and challenges, including changes in government policies, trade agreements, and political, economic disruption.

| Particulars | FY22 | FY23 | FY24 | 6-Mon ended Sep 30, 2024 |

| % of Total Purchases | ||||

| Cost of Imported Materials | 12.64 | 16.71 | 25.08 | 29.12 |

| % of Total Cost of Materials Imported | ||||

| Cost of Imported Materials from China | 64.16 | 55.51 | 82.11 | 90.88 |

Government subsidies

The Indian government’s has played a pivotal role in pushing the wave of solar energy adoption through various initiatives and allocations for solar projects. Initiatives like PM Suryaghar launched in 2024, aims to install rooftop solar panels in 10 million households. These initiatives are making companies products more affordable and the company aim to capitalize on various programs and meet demand through sales channels across India. Any unavailability of these subsidies could increase estimated costs of investments and potentially impact financial condition. Apart from government subsidies, the price of products depends on various factors beyond company’s control, including raw material costs, production and manufacturing costs, technological factors, demand and supply.

Geography concentration

To cater to growing market demand and expand presence across India, the company is expanding presence in new states and cities, particularly in South and West India. However, having limited or no presence in these new markets may lead to lower product pricing and higher expenditure on brand building. Their plans to expand in new markets may be subject to high entry barriers, and may not be successful due to competitors’ established brands. As per prospectus, the company generates a significant portion, (about one-third portion) of its sales from Uttar Pradesh. Top five states contributed to nearly 70% of their revenue and the share has been rising from past years.

The success of business relies on the development, maintenance, and strengthening of its brands. Factors beyond control include managing product quality, increasing brand awareness, adopting new technologies, and protecting intellectual property.

| Particulars | FY22 | FY23 | FY24 | 6-Mon ended Sep 30, 2024 |

| % of Total Retail Sales | ||||

| Retail Sales from Uttar Pradesh | 32.84 | 32.74 | 32.74 | 34.7 |

| Retail Sales from Top Five States | 70.92 | 63.77 | 68.16 | 72.91 |

Capacity utilization and exports

The company exports its products to various international markets, with the largest jurisdiction being the USA for past three fiscals, and Bangladesh for the six months ending Sep 30, 2024. Share of total exports to jurisdiction has been mentioned in below table. The international markets are diverse, with varying levels of economic and infrastructure development. The company may face risks in doing business in markets outside India. Changing rapidly changing geopolitical environment may also affect business interest.

| Particulars | FY22 | FY23 | FY24 | 6-Mon ended Sep 30, 2024 |

| % of total sales | ||||

| Export sales | 2.78 | 4.96 | 4.19 | 2.28 |

| Export sales to largest jurisdiction | 1.72 | 3.05 | 2.32 | 1.14 |

| Export sales to top five jurisdictions | 2.72 | 4.95 | 4.11 | 2.28 |

The company’s capacity utilization for past three fiscals and the six months ending Sep 30, 2024, is based on various assumptions and estimates. The capacity utilization has been stable around 70% and 66.71% as of September 2024.

Fujiyama Power Systems Limited Grey Market premium

Grey market premium is the premium quoted over the IPO issue price. GMP shows that investors are ready to pay above the upper band of the IPO issue price. GMP is determined in the grey market as per the demand and supply of the shares in the primary market. A grey market is that unofficial ecosystem of unlisted companies’ stocks that start trading even before the launch of the IPO to the date of its listing.

Also Read: What is Grey Market Premium in IPO: How is GMP Calculated & Reliable

However, GMP is not a reliable factor, as it keeps fluctuating as per the demand and supply of shares in the primary market. There are numerous factors that affect the stock market in India and individual stock prices of different companies that are already listed and trading in the secondary market. However, for an IPO-bounded company, you can consider the GMP as the speculative listing price of the share

As per the sources, the GMP of Fujiyama Power Systems Limited IPO is trading at around Rs 0 in the grey market shows the share of Fujiyama Power Systems Limited is expected to list at around Rs ₹228 if you consider the upper price band of Rs ₹228 announced in the IPO for the bidding.