Business Profile of the Greaves Electric Mobility Limited

Greaves Electric Mobility Private Limited (GEMPL) is an Indian company that designs and manufactures electric vehicles (EVs). They provide a variety of vehicles spanning the electric two-wheeler and three-wheeler segments, catering to both personal and commercial use. The company provides a diverse selection of vehicles in all three segments, including high-speed scooters, city-speed scooters, and low-speed scooters, leveraging the engineering expertise of the Greaves group.

The company also provides a comprehensive range of products across the entire continuum of 3W mobility, such as electric three-wheelers, internal combustion engine three-wheelers, and e-rickshaws, which are designed to meet the needs of both cargo and passenger transportation. Their objective is to offer last-mile mobility solutions that are cleaner, more intelligent, and affordable for all individuals.

Greaves Electric Mobility Limited IPO Objective

As per the draft red hearing prospects, the IPO issue consists of both fresh issue and offer for sale.

- The OFS consists of up to 189,398,200 equity shares aggregating up to Rs. XXXX million. Nothing from those proceeds of OFS will be allotted to company.

- Greaves Electric Mobility IPO offer only has fresh issue of Rs. 1000 crores. As per DRHP document, the company mainly aims to utilize IPO proceeds towards product development, subsidiary capex requirement and acquiring stake in subsidiary.

| Particulars | Estimated amount |

| Investment for product and technology development; enhancing capabilities at company’s Tech Centre in Bengaluru | 3752.72 |

| Development of company’s in-house battery assembly capabilities | 829 |

| Funding expansion of the manufacturing capacity of BAPL | 198.94 |

| Funding expansion of the manufacturing capacity of MLR | 382.56 |

| Increasing company’s stake in material subsidiary, MLR, through acquisitions | 736.67 |

| Increase digitization and deployment of IT infrastructure by company | 278.02 |

| Funding inorganic growth through acquisitions and general corporate purposes | XXXX |

(₹ Million)

IPO Details of Greaves Electric Mobility Limited:

| IPO Open Date | N.A. |

| IPO Close Date | N.A. |

| Basis of Allotment | N.A. |

| Listing Date | N.A. |

| Face Value | ₹1 per share |

| Price | N.A. |

| Lot Size | N.A. |

| Total Issue Size | Up to XXXX Equity Shares |

| Aggregating up to ₹XXXX million | |

| Fresh Issue | Up to XXXX Equity Shares |

| Aggregating up to ₹10,000 million | |

| Offer For Sale | Up to 189,398,200 Equity Shares |

| Aggregating up to ₹XXXX million | |

| Issue Type | Book Built Issue IPO |

| Listing At | BSE & NSE |

| QIB Shares Offered | Not less than 75% of the Net Issue |

| Retail Shares Offered | Not more than 10% of the Net Issue |

| NII (HNI) Shares Offered | Not more than 15% of the Net Issue |

Issue Price & Size: Greaves Electric Mobility Limited IPO

The issue price of Greaves Electric Mobility Limited hasn’t been released yet. Upon releasing the dates, the investors can bid between those price ranges. As of DRHP, the company is offering both fresh issue of 1000 crores and offer for sale of up to 189, 398, 200 equity shares.

Launch Date of Greaves Electric Mobility Limited IPO

The IPO opening date of Greaves Electric Mobility hasn’t been officially announced yet, upon the declaration of dates investor can bid for IPO.

Greaves Electric Mobility Limited Financial Statements

| Particulars | 6-Mon ended Sep 30, 2024 | FY24 | FY23 | FY22 |

| Revenue from operations | 3022.31 | 6118.17 | 11215.68 | 5206.07 |

| Other income | 105.16 | 294.94 | 348.79 | 7.6 |

| Total Income | 3127.47 | 6413.12 | 11564.47 | 5213.67 |

| Expenses | ||||

| Cost of materials consumed | 2767.38 | 5191.68 | 8911.99 | 4182.57 |

| Changes in inventories of finished goods and work-in- progress | -58.39 | 74.48 | -207 | -19.92 |

| Employee benefits expense | 358.34 | 1013.6 | 679.29 | 272.62 |

| Finance costs | 56.5 | 82.13 | 96.27 | 120.21 |

| Depreciation and amortisation expense | 208.25 | 316.11 | 150.76 | 100.01 |

| Other expenses | 869.67 | 1894.59 | 2062.15 | 948.6 |

| Total expense | 4201.75 | 8572.59 | 11693.46 | 5604.09 |

| Restated loss before tax | -1074.28 | -6941.67 | -197.38 | -415.42 |

| Restated total comprehensive loss for period | -1057.56 | -6915.66 | -190.52 | -453.22 |

| Particulars | Unit | 6-Mon ended Sep 30, 2024 | FY24 | FY23 | FY22 |

| Revenue from Operations | ₹ Millions | 3022.31 | 6118.17 | 11215.68 | 5206.07 |

| Revenue YoY growth | % | N.A. | -45.45% | 115.43% | N.A. |

| Sales Volume | No. of vehicles ( in thousands) | 29.51 | 61.28 | 115.58 | 63.69 |

| E-2W Revenue from Operations | ₹ Millions | 1919 | 4321.85 | 10527.88 | 4223.4 |

| E-2W Revenue YoY growth | % | N.A. | -58.95% | 149.27% | N.A. |

| E-2W Sales Volume | No. of vehicles ( in thousands) | 22.43 | 47.82 | 108.71 | 53.29 |

| 3W Revenue from Operations | ₹ Millions | 1098.34 | 1776.62 | 668.97 | 974.42 |

| 3W Revenue YoY growth | % | N.A. | 165.58$ | -31.35% | N.A. |

| 3W Sales Volume | No. of vehicles ( in thousands) | 7.08 | 13.47 | 6.87 | 10.39 |

| Operating Gross Profit | ₹ Millions | 313.31 | 852.02 | 2510.7 | 1043.42 |

| Operating Gross Profit Margin | % | 10.37% | 13.93% | 22.39% | 20.04% |

| Operating EBITDA | ₹ Millions | -914.69 | -2056.18 | -230.75 | -177.8 |

| Operating EBITDA Margin | % | -30.26% | -33.61% | -2.06% | -3.42% |

| Profit/ (Loss) after tax | ₹ Millions | -1061.54 | -6915.7 | -199.14 | -453.79 |

| Profit/ (Loss) after tax Margin | % | -33.94% | -107.84% | -1.72% | -8.70% |

| E-2W installed capacity | No. of vehicles ( in thousands) | 480 | 480 | 480 | 480 |

| E-2W capacity utilization | % | 9.80% | 9.73% | 23.21% | 9.74% |

| 3W installed capacity | No. of vehicles ( in thousands) | 35.05 | 32.01 | 21.51 | 21.51 |

| 3W capacity utilization^ | % | 41.00% | 44.54% | 31.68% | 40.63% |

Greaves Electric Mobility Limited Promoters & Shareholding

As of date o filing, there is only one promoter of the company, i.e. Greaves Cotton Limited. The promoter holds 62.26% of the paid-up share capital of company.

| Name of the Shareholder | Number of Equity Shares held on a fully diluted basis | % of the pre-Offer paid-up Eq. Share on fully diluted basis | Name of the selling shareholder |

| Promoter | |||

| Greaves Cotton Limited | 60,09,25,000 | 62.26% | Up to 51,000,000 Equity Shares |

| Selling Shareholder | |||

| Abdul Latif Jameel Green Mobility Solutions DMCC | 35,05,02,300 | 36.31% | Up to 138,398,200 Equity Shares |

Should You Subscribe to Greaves Electric Mobility Limited IPO or Not

While investing or subscribing to any IPO, consider the investment rationales related to the company. Hence, here you can find out the strength of the company that will be its growth factors. And also check the risk factors that can affect the growth and operational efficiency of the company.

Competitive Strengths of Greaves Electric Mobility Limited:

Diversified product portfolio

The company is the only in India to offer a complete suite of E-2W and 3W products, with models across various price ranges. The Ampere brand offers products in all three segments of the E-2W mobility spectrum, including High Speed, City Speed, and Low Speed e-Scooters for B2C and B2B customers. The company’s portfolio of 3Ws includes L3 E-3Ws, L5 E-3Ws, and ICE 3Ws for both passenger and cargo models. The company aims to democratize smart, sustainable mobility across India by catering to multiple customer segments, each with distinct needs and preferences.

| Particulars | 6-Mon ended Sep 30, 2024 | FY24 | FY23 | FY22 |

| E-2Ws | 61.46% | 67.65% | 91.17% | 81.10% |

| 3Ws | 35.18% | 27.75% | 5.81% | 18.75% |

Distribution Channel & Service Network

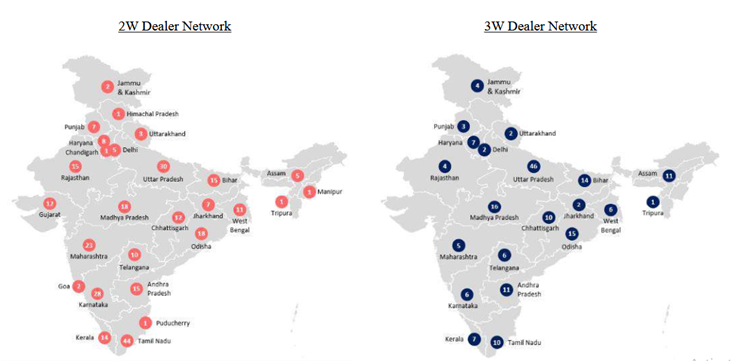

The company has a network chain of pan-India dealers, covering 27 states and union territories. As of Sep 30, 2024, the company had 309 E-2W dealers and 188 3W dealers. The dealer’s ratio represents 90.94% of the total dealers in non-metro cities. The company is one of the leading E-2W companies, with a market share of more than 5% in certain states and union territories. The company also used its website as a means for selling its product. The customers are contacted thought its dealership representative to complete the transaction. The company has established partnerships with e-commerce platforms to facilitate the sale of its products online.

| Particulars | 6-Mon ended Sep 30, 2024 | FY24 | FY23 | FY22 |

| E-2W Dealers | 309 | 329 | 372 | 249 |

| 3W Dealers | 188 | 176 | 139 | 54 |

The company is focused on centralizing customer service, managing complaints for E-2Ws directly from a central office. In order to reduce cost and improve customer satisfaction the company has stopped replacing critical component and started repairing them. As of Sep 30, 2024, the company has an “Ampere Care” center at each of its dealerships. The ampere care provides routine maintenance, roadside assistance, and general information on their E-2Ws. The company also has a large service network for spares and service for E-3Ws and small commercial vehicles through its sister entity, Greaves Retail.

Development and design capabilities

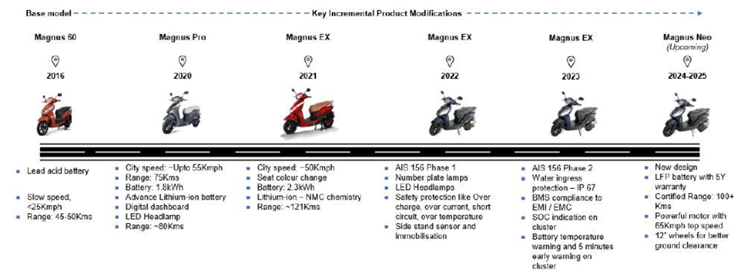

As per DRHP, the company has a strong R&D and product development team of over 100 employees. Over the years, they have frequently improved their engineering and design capabilities. The company has establishing a technology center in Bengaluru in 2024 with advanced equipment for battery and motor dynamo testing, fatigue testing, and hardware-in-the-loop labs. The company has also invested in in-house design capabilities, launching the Nexus E-2W, a ground-up designed-and-made in India product.

Over the years they have improved its designed product capabilities and add new features like bluetooth connectivity, reverse mode, touchscreen displays, and smart/fast charging, etc. The company is also transitioning to lithium iron phosphate batteries for their E-2W models, including the Magnus, due to their high decomposition temperature and lower material cost.

Future strategies

- Maintain leadership in E-2W and E-3W segments.

- Strategically expand product portfolio to capture a broader customer base.

- Expand manufacturing capacity of Greater Noida Factory and Toopran Factory.

- Focus on in-house R&D, technology development, and manufacturing capabilities

- Plan to establish an in-house battery pack assembly at Ranipet Factory by Fiscal 2027

- Increase localization levels across manufacturing processes

- Investment in developing battery packs with alternate battery technologies

- Expansion of software capabilities

- Deepening Market Penetration in Untapped Markets in India and Expansion into International Markets

- Developing new product variants and customized solution packages to better serve B2B customers

Risk Factors of Greaves Electric Mobility Limited:

Retain market share in competition

The company faces competition from traditional automotive and new-age pure electric 2Ws and 3Ws manufacturers. As the electric vehicles are becoming main stream thing, the company has been losing market share to competitors. Company’s market share has reduced in FY24 to 5.7% from 12% in previous financial year. The company’s ability to design, develop, manufacture, and deliver product with improved features is crucial for its competitiveness. If the competitors with improved technology, technical capabilities, and performance compared to the company’s offerings at competitive prices, the company’s overall performance can be adversely affected. Developments in alternative technologies in ICE vehicles, such as CNG, advanced diesel, hydrogen, or fuel cells, may materially and adversely affect the company’s EV business.

Retaining customers

Attracting customers to buy its vehicles and encouraging other to do the same is essential for any company’s prosperity. More the customer buy, more the company flourishes. The company has sold more than 270,000 E-2Ws and 40,000 3Ws since April 2019. The company’s ability to attract consumers is influenced by its product design, pricing, reputation and after-sales services. The company has allotted substantial resources to its advertising and marketing initiatives, despite the fact that its product has experienced fluctuating sales growth.

| Particulars | 6-Mon ended Sep 30, 2024 | FY24 | FY23 | FY22 | ||||

| No. | Growth % | No. | Growth % | No. | Growth % | No. | Growth % | |

| Sales Volumes for E-2Ws | 22428 | N.A. | 47818 | -56.01% | 108710 | 103.98% | 53294 | 135.18% |

| Sales Volumes for 3Ws | 7083 | N.A. | 13465 | 96.14% | 6865 | -33.94% | 10392 | 123.53% |

| ₹ million | % of revenue from operations | ₹ million | % of revenue from operations | ₹ million | % of revenue from operations | ₹ million | % of revenue from operations | |

| Advertising, marketing and sales promotion | 146.32 | 4.84% | 326.28 | 5.33% | 340.45 | 3.04% | 128.02 | 2.46% |

Performance and quality

Demand is directly affective by innovation in products that aligns with industry trends and customer requirement. However, delays in product launches, shifts in customer preferences, and unforeseen technological advancements can affect competitiveness. If vehicles fail to meet promised performance and quality, the company may be required to undertake product recalls or corrective actions. This could harm the company’s reputation and negative publicity.

Components and raw material

The manufacturing of products relies on the availability of components and materials required for our operations and suppliers’ manufacturing processes. Global commodity prices, inflation, and effective negotiation with suppliers can affect company’s ability to provide these components at competitive prices. Countries lacking in certain metals, such as lithium, magnesium, cobalt, and nickel, rely on imports from limited countries for production, increasing the cost of raw materials and overall EV costs. Unexpected global events can further escalate raw material prices, disrupting the supply chain, which can significantly impact business fundamentals and financials.

Product concentration

The company’s E-2W sales revenue is primarily derived from the Magnus and Nexus models. As can be seen from table below, the share of product concentration has been decreasing but remains significant. Future revenue distribution and business levels may vary due to customer demand, supplier terminations, or market perception impacts. Any decrease in demand, termination of arrangements, or impact on the Magnus or Nexus models could materially and adversely affect sales volume, business fundamentals and financials.

| E-2W Model | 6-Mon ended Sep 30, 2024 | FY24 | FY23 | FY22 |

| % of E-2W sales volumes | ||||

| Magnus | 57.60% | 77.40% | 84.79% | 63.20% |

| Nexus | 22.18% | – | – | – |

| Reo | 18.36% | 5.60% | 5.58% | 22.92% |

| Others | 1.86% | 17.00% | 9.76% | 13.88% |

Geographical concentration

The company’s revenue is primarily generated from sales of E-2Ws in the southern region of India, L5 3Ws in the southern region, and L3 E-3Ws in the eastern and northern regions. This geographical concentration can lead to disruptions in sales activities and reduced sales volume. For example, in the fourth quarter of Fiscal 2024, the Regional Transport Office temporarily halted registration of L3 E-3Ws in Agra and Mathura due to traffic congestion, resulting in a 52.72% decrease in sales.

| 6-Mon ended Sep 30, 2024 | East | West | North | South |

| % of total sales quantity | ||||

| E-2Ws | 21.65% | 16.46% | 15.31% | 46.58% |

| L5 3Ws (including ICE 3Ws) | 11.50% | 5.04% | 13.37% | 70.08% |

| L3 E-3Ws | 49.94% | 15.26% | 34.80% | – |

Batteries for EVs

The company has faced a complaint in 2023 due to a fire in a new E-2W purchased from them. Despite compliance, the company may still face failures, lawsuits, product recalls, and liability claims. Negative public perceptions and potential fire-related incidents could harm the business. The company is transitioning to lithium iron phosphate batteries in E-2W models, but any mishandling could lead to safety issues or fires. The company relies on a limited set of suppliers for raw materials and components, which could lead to production disruptions.

The company plans to establish a battery pack assembly line through IPO proceeds at its existing facility in Ranipet, Tamil Nadu. If suppliers fail to comply due to increased prices, the company may have to seek alternative suppliers, leading to increased costs, delays in production and negative implication for business.

| Particulars | 6-Mon ended Sep 30, 2024 | FY24 | FY23 | FY22 |

| Percentage of Total Expenses | ||||

| Top supplier | 13.14% | 19.82% | 23.71% | 17.48% |

| Top five suppliers | 29.07% | 30.56% | 44.95% | 37.85% |

| Top ten suppliers | 40.06% | 39.10% | 55.12% | 49.67% |

The company has sourced lithium ion batteries from five suppliers, including those in India. The cost of the batteries represent as significant part of expenses. The company faces risks related to the availability, pricing, and quality of lithium-ion batteries. If the prices of raw material start to rise, the direct affect will be seen on company’s margin if the company isn’t able to pass on cost to consumer.

| Particulars | 6-Mon ended Sep 30, 2024 | FY24 | FY23 | FY22 |

| Cost of purchase of lithium ion batteries | 763.25 | 2223.69 | 4043.48 | 1297.6 |

| As a % of total expenses | 18.17% | 25.94% | 34.58% | 23.15% |

Subsidies and incentives

Adoption and boost to electric vehicles has been bought into existence because of various schemes and subsidies provided by government. The PM Electric Drive Revolution in Innovative Vehicle Enhancement (PM E-DRIVE Scheme) is a government incentive program that benefits customers. If the subsidies or incentives are reduced, eliminated, or ineligible for these incentives, the demand for electric vehicles (EVs) could decrease, potentially making the company less competitive compared to conventional ICE 2-Ws or ICE-3Ws. Also failure to meet the PM E-DRIVE Scheme requirements could result in the E-2Ws and E-3Ws being no longer eligible for subsidies, potentially impacting the company’s business and financial performance.

Greaves Electric Mobility Limited Grey Market premium

Grey market premium is the premium quoted over the IPO issue price. GMP shows that investors are ready to pay above the upper band of the IPO issue price. GMP is determined in the grey market as per the demand and supply of the shares in the primary market. A grey market is that unofficial ecosystem of unlisted companies’ stocks that start trading even before the launch of the IPO to the date of its listing.

Also Read: What is Grey Market Premium in IPO: How is GMP Calculated & Reliable

However, GMP is not a reliable factor, as it keeps fluctuating as per the demand and supply of shares in the primary market. There are numerous factors that affect the stock market in India and individual stock prices of different companies that are already listed and trading in the secondary market. However, for an IPO-bounded company, you can consider the GMP as the speculative listing price of the share

According to various online sources, the Grey Market Premium or GMP of the Greaves Electric Mobility Limited is trading around Rs XX in the grey market. It means shares are trading at the upper band issue price of Rs XX with a premium in the grey market and may list around the same price.