Business Profile of the HDB Financial Services Limited

HDB Financial Services is a leading diversified retail-focused NBFC in India, offering a wide portfolio of lending products. The company caters to underserved and under banked customers in low to middle-income households with minimal or no credit history. The company with its PAN India network of branches offers business process outsourcing services and fee-based products.

Its loan book has weathered multiple credit cycles in India, and its tech-enabled operating processes have contributed to strong asset quality and low credit costs. The company has also integrated digital capabilities, such as sourcing, credit assessment, risk management, and collections, to streamline operations. With a strong promoter, the company has a strong credit rating of AAA stable, allowing it to fund operations at competitive rates and tenors.

HDB Financial Services Limited IPO Objective

As per the draft red hearing prospects, the IPO issue consists only of offer for sale.

- The OFS consists of up to XXXX Equity Shares aggregating up to Rs. 10, 000 crore. Nothing from those proceeds of OFS will be allotted to company.

- HDB Financial Services IPO offer only has fresh issue of Rs. 2, 500 crore. As per DRHP document, the company aims to utilize IPO proceedings towards augmenting its capital base for future capital requirement.

| Particular | Percentage of Net Proceeds |

| Augmentation of Tier – I Capital base to meet company’s future capital requirements | 100% |

| Total | 100% |

IPO Details of HDB Financial Services Limited:

| IPO Open Date | Wed, Jun 25, 2025 |

| IPO Close Date | Fri, Jun 27, 2025 |

| Basis of Allotment | NA |

| Listing Date | May 6, 2025 |

| Face Value | ₹10 per share |

| Price | ₹700 to ₹740 per share |

| Lot Size | 20 Shares |

| Total Issue Size | 16,89,18,918 shares |

| (aggregating up to ₹12,500.00 Cr) | |

| Fresh Issue | 3,37,83,784 shares |

| (aggregating up to ₹2,500.00 Cr) | |

| Offer For Sale | 13,51,35,135 shares of ₹10 |

| (aggregating up to ₹10,000.00 Cr) | |

| Issue Type | Book Built Issue IPO |

| Listing At | BSE & NSE |

| QIB Shares Offered | Not less than 44.92% of the Net Offer |

| Retail Shares Offered | Not more than 13.48%of the Net Offer |

| NII (HNI) Shares Offered | Not more than 31.44% of the Net Offer |

Issue Price & Size: HDB Financial Services Limited IPO

The issue size of the IPO has been declared and the overall issue size of the IPO is Rs 12,500.00 Cr, out of which 3,37,83,784 Equity Shares, aggregating up to Rs 2,500.00 cr, comprise of fresh issuance, and the remaining Rs 10,000.00 Cr will be offered for sale by shareholders.

Launch Date of HDB Financial Services Limited IPO

HDB Financial IPO will be open on Jun 25, 2025 and close on the Jun 27, 2025. All types of investors can bid between these dates through their eligible categories.

HDB Financial Services Limited Financial Statements

| Particulars | As at and for the six-month period ended September 30, 2024 | As at and for the six-month period ended September 30, 2023 | FY24 | FY23 | FY22 |

| Revenue from operations | |||||

| Interest income | 66956.2 | 52438.5 | 111567.2 | 89277.8 | 83629.7 |

| Sale of services | 6080.3 | 11752.2 | 19495.5 | 26339.3 | 23634.1 |

| Other financial charges | 5454.7 | 4215.9 | 9531.1 | 7564.1 | 5690.1 |

| Net gain on fair value changes | 391.2 | 629.5 | 1136.9 | 850.7 | 164.8 |

| Net gain / (loss) on derecognition of financial instruments under amortised | 23.9 | -11.4 | -19.5 | -3.1 | -55.8 |

| Total Revenue from operations | 78906.3 | 69024.7 | 141711.2 | 124028.8 | 113062.9 |

| Expenses | |||||

| Finance Costs | 30949 | 22315.9 | 48643.2 | 35119.2 | 33255 |

| Impairment on financial instruments | 8434.6 | 5430.5 | 10673.9 | 13304 | 24657.3 |

| Employee Benefits Expenses | 17852.9 | 20453.7 | 38507.5 | 40575.7 | 35004.1 |

| Depreciation, amortization and impairment | 920.4 | 668.3 | 1451.4 | 1118.4 | 989.4 |

| Others expenses | 4921.4 | 4483.7 | 9388.5 | 7637.5 | 5681.5 |

| Total Expenses | 63078.3 | 53352.1 | 108664.5 | 97754.8 | 99587.3 |

| Profit/(loss) before tax | 15828 | 15672.6 | 33046.7 | 26274 | 13475.6 |

| Restated Profit after tax | 11727 | 11677.3 | 24608.4 | 19593.5 | 10114 |

| Particulars | As at and for the six-month period ended September 30, 2024 | As at and for the six-month period ended September 30, 2023 | FY24 | FY23 | FY22 |

| Number of Customers | 17.5 | 13.9 | 15.8 | 12.2 | 9.4 |

| Number of Branches | 1772 | 1602 | 1682 | 1492 | 1374 |

| Number of Locations | 1162 | 1119 | 1148 | 1054 | 989 |

| Number of Total Employees | 59662 | 52782 | 56560 | 45883 | 39034 |

| Breakdown of Total Gross Loans by verticals | |||||

| Enterprise Lending | 393006.5 | 332629.9 | 368225.6 | 316187.1 | 299428.1 |

| Asset Finance | 348496.9 | 293875.6 | 341946.6 | 263262.7 | 231605.8 |

| Consumer Finance | 224738.7 | 152060.9 | 192007.1 | 120857.2 | 82229.3 |

| Total Gross Loans | 986242.1 | 778566.4 | 902179.3 | 700307 | 613263.2 |

| Total Gross Loans Growth y- o-y % | 26.67% | N.A. | 28.83% | 14.19% | 0.00% |

| Secured Loans as % of Total Gross Loans | 71.08% | 71.89% | 71.34% | 72.87% | 73.58% |

| Net Interest Income | 36007.2 | 30122.6 | 62924 | 54158.6 | 50374.7 |

| Other Financial Charges | 5454.7 | 4215.9 | 9531.1 | 7564.1 | 5690.1 |

| Net Total Income | 41877 | 34956.6 | 73572.5 | 62570.3 | 56173.8 |

| Credit Cost | 8434.6 | 5430.5 | 10673.9 | 13304 | 24657.3 |

| Profit after Tax (PAT)* | 11727 | 11677.3 | 24608.4 | 19593.5 | 10114 |

| PAT growth y-o-y % | 0.43% | 27.98% | 25.59% | 93.73% | 158.36% |

| EPS* | 14.78 | 14.75 | 31.08 | 24.78 | 12.81 |

| Average Yield % | 14.18% | 14.18% | 13.92% | 13.59% | 13.64% |

| Average Cost of Borrowings % | 7.88% | 7.65% | 7.53% | 6.76% | 6.70% |

| Net Interest Margin % | 7.63% | 8.15% | 7.85% | 8.25% | 8.21% |

| Cost to Income Ratio | 42.96% | 42.16% | 42.72% | 39% | 34.51% |

| Operating Expense Ratio | 3.81% | 3.99% | 3.92% | 3.71% | 3.16% |

| Credit Cost Ratio | 1.79% | 1.47% | 1.33% | 2.03% | 4.02% |

| Gross Stage 1 and Gross Stage 2 Loans | 965515 | 760042 | 885061.1 | 681158.5 | 582675.6 |

| Gross Stage 3 Loans | 20727.1 | 18524.4 | 17118.2 | 19148.5 | 30587.6 |

| Gross Non-Performing Assets (GNPA)% | 2.10% | 2.38% | 1.90% | 2.73% | 4.99% |

| Net Non-Performing Assets (NNPA)% | 0.83% | 0.77% | 0.63% | 0.95% | 2.29% |

| Provision Coverage Ratio (PCR) | 60.69% | 67.83% | 66.82% | 65.10% | 54.13% |

| Total Equity * | 148793.3 | 125270.4 | 137427.1 | 114369.7 | 95397.3 |

| Return on Equity (ROE)*27 % | 16.39% | 19.49% | 19.55% | 18.68% | 11.25% |

| Return on Assets (ROA)*28 % | 2.41% | 3.15% | 3.03% | 2.97% | 1.62% |

| Total Borrowings by Instrument | |||||

| Term loans and Working Capital Demand Loans | 289027.2 | 233315.5 | 316610.3 | 219680 | 142914.5 |

| Non-Convertible Debentures | 384769.7 | 325566.6 | 336999.6 | 270964.1 | 253323.1 |

| External Commercial Borrowings | 83390.1 | – | 20851.3 | 18889.4 | 40046.3 |

| Subordinated debts | 44584.5 | 28950.6 | 46576.5 | 28944.6 | 34929.4 |

| Perpetual debts | 14877.9 | 6469 | 9905.2 | 6466.4 | 6461.1 |

| Commercial paper | 10161.6 | 22750.7 | 11511.6 | 0 | 0 |

| Borrowing under Securitization | – | 1863.6 | 852.2 | 3708.6 | 12056.4 |

| Total Borrowings | 826811 | 618916 | 743306.7 | 548653.1 | 489730.8 |

| Debt to Equity Ratio* | |||||

| CRAR – Tier I | 5.93 | 5.41 | 5.81 | 5.26 | 5.77 |

| CRAR – Tier II | 14.64% | % | 14.12% | 15.91% | 15.22% |

HDB Financial Services Limited Promoters & Shareholding

As of date, there is only one promoters of the company i.e. HDFC Bank. The promoter i.e. HDFC Bank in aggregate holds 94.36% of the paid-up share capital of company.

Should You Subscribe to HDB Financial Services Limited IPO or Not

While investing or subscribing to any IPO, consider the investment rationales related to the company. Hence, here you can find out the strength of the company that will be its growth factors. And also check the risk factors that can affect the growth and operational efficiency of the company.

Competitive Strengths of HDB Financial Services Limited:

Fastest-growing customer franchise

HDB Financial is India’s largest and fastest-growing customer franchise. The company’s has served over 1 crores happy customers and their customer base primarily consists of middle-class salaried and self-employed individuals, small business owners, and entrepreneurs. The company has sustained strong loan book growth over 17 years, supported by long-term strategic initiatives and strong collections. As of September 30, 2024, the average ticket sizes in Enterprise Lending, Asset Finance, and Consumer Finance were approximately ₹0.57 million, ₹0.84 million, and ₹0.04 million.

Large, diversified and seasoned product portfolio

The company caters to a diverse client’s base with its diverse lending portfolio with clients ranging from enterprise, asset finance, and consumer finance. The company offers business process outsourcing and fee-based products, such as insurance distribution. Their loan book is well diversified, with no single product accounting for more than 25% of its total gross loan book. The company’s diversified product portfolio allows them to cross seel their products using various AI technology and through customer engagement.

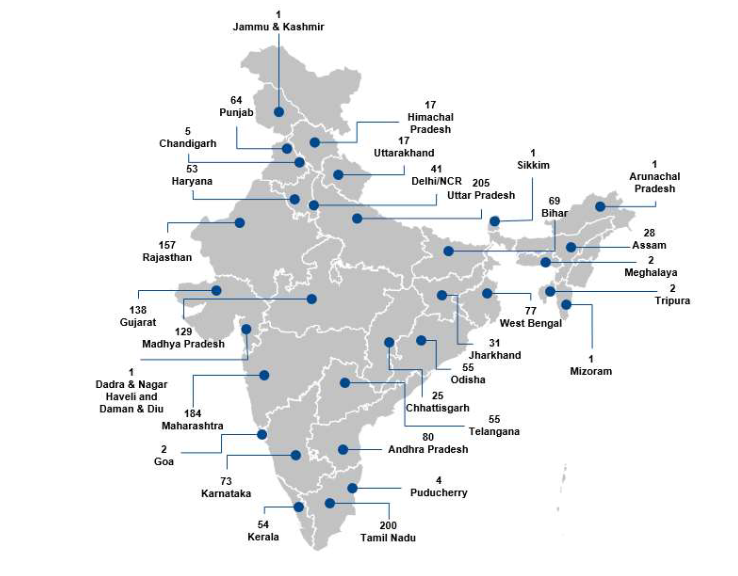

Pan India distribution network

The company has a strong phygital sourcing network speed across nation, consisting of internal, external, and digital distribution networks. Because of its pan India presence, no region accounts for more than 35% of total gross loans. The company has customized sourcing strategies for each business vertical, including a branch-led distribution strategy, a growing omni-channel presence through partnerships with OEMs, dealers, distribution points, retail stores, and direct selling agents. The company also has a digital presence through partnerships with fintechs, a website, and a user-friendly application. The company has 1,772 physical branches across 31 states and union territories, with over 80% located outside India’s 20 largest cities and 70% in Tier 4+ towns.

Robust credit underwriting and strong collections

The company has established in house strong credit underwriting team and collections capabilities to ensure sustainable growth. The company is highly data-driven, using multiple external and internal sources of customer data to perform underwriting. They have developed sophisticated and customized credit scorecards that enable rule-based decisioning systems and automate loan underwriting through rule engines, CRM bureau integration, and 360 credit assessment.

The company has implemented a hybrid credit approach with a centralised credit assessment and underwriting unit for consumer finance products and decentralised regional and branch-level credit assessment and local underwriting teams for Enterprise Lending and Asset Finance products.

Their gross stage 3 loans and credit cost are one of the lowest among its NBFC competitors, with a GNPA and NNPA standing at 1.90% and 0.63%, as of FY24.

Use of advanced technology

Being the subsidiary of India’s biggest private banks comes with many out of the box technology and market acceptance. The company has developed an advanced technology and data analytics platform that covers all key areas of its business, including customer sourcing, onboarding, underwriting, operations, and collections. This technology increases efficiency in sourcing, retaining revenue, increasing employee productivity, and optimizes operations while improving customer experience. The in-house made application HDB On-the-Go allows customers to access company’s products and services online and receives personalized assistance.

The company uses data-analytics for cross-selling its other products and services. The data analytics helps in generating revenue and maximize customer value with minimal customer retention cost. The company has successfully digitalized the onboarding process in products like Auto Loans and Commercial Vehicle Loans, underwriting over 95% loans digitally or through an assisted digital journey.

Credit rating

Backed by a strong promoter comes with strong management and a strong rating. The company has a strong AAA stable credit rating, allowing it to fund operations at competitive rates. Its average cost of borrowings as of Sep, 2024 was standing at 7.88%, which is one of the lowest among competitors. The company funds its borrowings from diversified sources, including public & private sector, foreign banks, mutual funds, insurance companies, pension funds, and financial institutions. As of September 30, 2024, the total borrowings stood at ₹826.8 billion, with no single source of financing representing more than 50% of the company’s borrowings.

Strong promoter

Established in 2007, HDB Financial is a subsidiary of HDFC Bank, India’s largest private sector bank. As of recent filing, the parent company held 94.36% of the issued paid up capital. HDFC Bank has a track record of providing high-quality services across various financial sectors, including retail and wholesale banking, insurance sector, asset management, investment banking, and securities trading. The company operates independently but has the long-term support and brand value of its promoter.

Future plans

- Diversify and expand its customer segments by widening and enhancing its product offering by innovation.

- Expand its network foothold by opening additional branches and deepening relationships with OEMs, dealers, brands, and DSAs.

- Increase the scope of usage of new and emerging technologies such as data analytics, machine learning, and generative AI models.

Risk Factors of HDB Financial Services Limited:

Economic slowdown

The financial performance of any NBFC and specifically a retail-focused NBFC i.e. HDB in India, is heavily reliant on the growth and performance of Indian economy. Factors that could negatively impact operations include sudden increase in inflation which leads to increase in interest rates, exchange rate fluctuations which outs pressure on external borrowings sources, tight credit, domestic income conditions, fiscal and monetary policies, geopolitical tensions, volatility in stock market, liquidity crises, and many more. A slowdown in peoples’ income across segment or slowing economy could reduce loan demand or increase loan default rates, and negatively impact business fundamental.

Bad debts

Every NBFC, Banking institution or a company encounters defaults from customer or client’s side due to various factors, including delayed payments, which leads to an increase in Gross Stage 3 Loans. These factors may affect the quality of the loan portfolio and collection efficiency. As the company expands its geographical footprint and new potential market, it may fail to properly assess credit risks associated with new customers, leading to non-performing loans.

The company offers unsecured enterprise loans to small businesses and unsecured personal loans to retail customers. Unsecured loans pose a higher credit risk than secured loans due to the lack of real collateral. The company may be unable to collect in part or at all in case of non-payment. Expanding the unsecured loan portfolio could yield higher yield to company but can also increase risk of credit losses, potentially decreasing earnings.

| Particulars | As of | ||||

| Sep 30, 2024 | Sep 30, 2023 | FY24 | FY23 | FY22 | |

| Total Gross Loans | 986242.1 | 778566.4 | 902179.3 | 700307 | 613263.2 |

| Gross Stage 3 Loans | 20727.1 | 18524.4 | 17118.2 | 19148.5 | 30587.6 |

| Net Stage 3 Loans | 8148.4 | 5960.1 | 5679.9 | 6682.5 | 14029.5 |

| Gross Stage 3 Loans as a % of Total Gross Loans | 2.1 | 2.38 | 1.9 | 0.134028 | 4.99 |

| Net Stage 3 Loans as a % of Total Gross Loans | 0.83 | 0.73 | 0.63 | 0.95 | 2.29 |

| Secured Loans as a % of Total Gross Loans (%) | 71.08 | 71.89 | 71.34 | 72.87 | 73.58 |

| Personal loans | 241846.3 | 189122.8 | 221654.3 | 1687490 | 146131.1 |

Risk from new customers

Another channel of bad debt can incur form loans given to new-to-credit (NTC) customers without a credit history. New customer makes it difficult to assess their creditworthiness. Due diligence or incomplete back group may not accurately predict the credit risk posed by these customers, and they may be more vulnerable to adverse conditions and have higher risk of default. As can be seen table below, their share of new customer has decreased but the share weight a handsome of total portfolio.

| Particulars | As of | ||||

| Sep 30, 2024 | Sep 30, 2023 | FY24 | FY23 | FY22 | |

| Loans to NTC customers | 12.2 | 13.88 | 13.16 | 15.59 | 19.08 |

| Loans to ETC customers | 87.98 | 86.12 | 86.84 | 84.41 | 80.92 |

Risk from Interest rates

The results of operations and cash flows of a lending business is highly effected by interest rate risk. Net interest margin, a component to check earning position of a business, calculated through the difference between interest income on loan portfolio and finance costs. An unexpected scope of increase in inflation could lead to lender increasing their lending rates, which in-turn cost their funding and financing cost putting pressure on NIM. Other factor that could change interest rates are RBI monetary policies, liquidity factors, and macro-economic conditions. The company manages interest rate risk and mismatches between assets and liabilities adequately to ensure business results, cash flows, and financial condition.

| Particulars | As of | |||

| Sep 30, 2024 | FY24 | FY23 | FY22 | |

| Loans Advanced | ||||

| Fixed interest rate | 77.6 | 77.61 | 76.14 | 76.76 |

| Floating interest rate | 22.4 | 22.39 | 23.86 | 23.24 |

| Borrowings | ||||

| Fixed interest rate | 71.44 | 60.3 | 64.46 | 74.12 |

| Floating interest rate | 28.56 | 39.7 | 35.54 | 25.88 |

| Average Yield (%) | 14.18 | 13.92 | 13.59 | 13.64 |

| Finance cost to Average Total Gross Loans | 6.56 | 6.07 | 5.35 | 5.42 |

| Net Interest Margin (%) | 7.63 | 7.85 | 8.25 | 8.21 |

Competition and regulation

The success of business depends on ability to compete with various financial institutions, including NBFCs, banks, micro-finance companies, and private financiers. Competitors like new age fin-tech companies may have greater resources, better technology, customer loyalty, and investments in digital strategies. Failure to compete effectively could affect performance, results of operations, cash flows, and financial condition. The company is subject to periodic inspections by the central bank. Any non-compliance with regulations and observations made during these inspections could expose the company to penalties and restrictions.

Third party partners

The company relies on various sources of information when evaluating credit and transactions with customers and counterparties. Accurate or incomplete information received could negatively impact the company’s business, reputation, and results of operations, financial condition. Difficulties in assessing credit risks may lead to an increase in non-performing and restructured assets, negatively impacting the company’s business. Asset-liability mismatches may cause liquidity concerns and affect profitability.

| Particulars | As of | ||||

| Sep 30, 2024 | Sep 30, 2023 | FY24 | FY23 | FY22 | |

| Total Disbursements | 321915.4 | 270119.5 | 608992.5 | 448017.6 | 290332.1 |

| Disbursements from third- party partners | 58386.7 | 40681.6 | 98377.2 | 61635 | 24953.4 |

| Disbursements from third- party partners as a % of total disbursements | 18.14 | 15.06 | 16.15 | 13.76 | 8.59 |

Refinancing loans

Coming from a high interest rate environment or customers with higher EMIs, may use balance transfers to refinance their loans. This can lead to potential loss of revenue and customers if it switches to competitors. It also close company chances to cross sell another products and services. Additionally, higher loan origination costs, including commissions paid to third-party distribution channel partners, can result in higher expenses and adversely affect the profitability.

| Particulars | As of | ||||

| Sep 30, 2024 | Sep 30, 2023 | FY24 | FY23 | FY22 | |

| Total amount of balance transfers of loans | 4934.5 | 3638.5 | 7558.9 | 6725.3 | 7213.1 |

| Total amount of balance transfers of loans as a % of total AUM | 0.5 | 0.47 | 0.84 | 0.96 | 1.17 |

HDB Financial Services Limited Grey Market premium

Grey market premium is the premium quoted over the IPO issue price. GMP shows that investors are ready to pay above the upper band of the IPO issue price. GMP is determined in the grey market as per the demand and supply of the shares in the primary market. A grey market is that unofficial ecosystem of unlisted companies’ stocks that start trading even before the launch of the IPO to the date of its listing.

Also Read: What is Grey Market Premium in IPO: How is GMP Calculated & Reliable

However, GMP is not a reliable factor, as it keeps fluctuating as per the demand and supply of shares in the primary market. There are numerous factors that affect the stock market in India and individual stock prices of different companies that are already listed and trading in the secondary market. However, for an IPO-bounded company, you can consider the GMP as the speculative listing price of the share

As per the sources, the GMP of HDB Financial IPO is trading at around Rs 75 in the grey market shows the share of HDB Financial is expected to list at around Rs 815 if you consider the upper price band of Rs 740 announced in the IPO for the bidding.