Warren Buffett started his investment journey at its early age of 11 and later after often known as “Oracle of Omaha”. Buffett’s investing journey is influenced by Benjamin Graham, under whom Buffett studied and worked. Buffett was influenced by the “value investing” philosophy of Benjamin Graham, in which he purchased undervalued stocks with a margin of safety-later made base of Buffett’s early approach. “Berkshire Hathaway” control taken over by Buffett in 1965, and afterward he transformed this company into a holding company for a diverse set of businesses and investments. Over the period, his investment strategy transformed from buying low-cost companies to acquire businesses with better competitive advantage and high-quality businesses. With disciplined capital allocation, consistent reinvestment, and long-term value change, Berkshire Hathaway into elite investment company over the time-offering compounded returns which far better than the market in the past 5-6 decades.

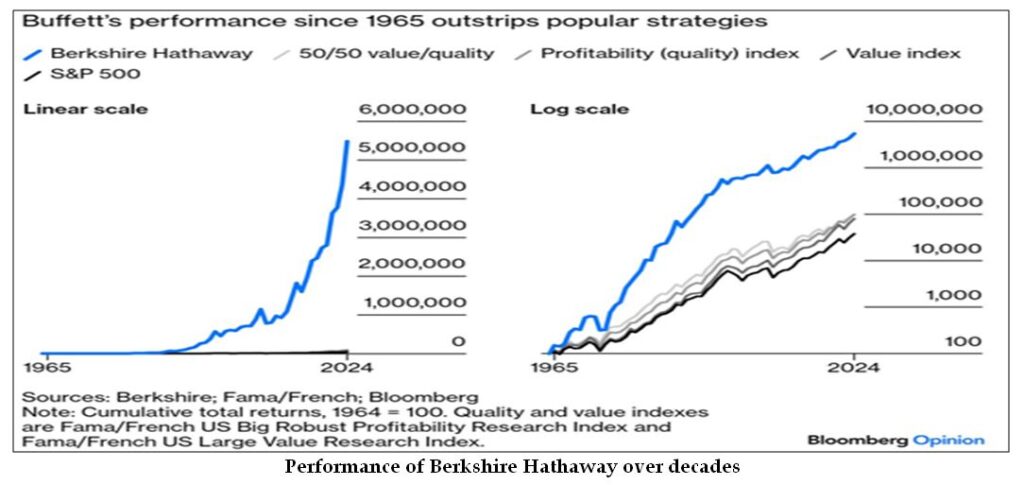

Berkshire Hathaway Returns Comparison

This chart shows the Berkshire Hathaway cumulative total returns in comparison to the S&P 500 and multiple academically grounded investment strategies over period of 1965 to 2024, starting in 1964 with an index value of 100. In left side graph (linear scale) shows that the performance of Berkshire Hathaway has skyrocketed to reach 5 million, beating all other benchmarks. This outstanding return represents the vastness of Buffett’s returns in absolute measure. On the contrary, the S&P 500 and other strategies, such as profitability index, 50/50 value/quality blend, and value index, show absolute performance and cumulative returns that remain flat in a linear chart because of exponential growth domination in the chart. To get a clearer picture, the right side graph (logarithmic scale) shows the same data but on a different scale, which gives significance on “percentage growth” rather than absolute dollar gains. In this chart, each line shows the compounded annual growth rate. Now, if we compare on an adjusted scale, Berkshire Hathaway continuously outperforms the S&P 500 and other academic indices, leading to a huge difference over the six decades. This outstanding dominance over the period represents the ability of Buffett to earn consistently higher compounded returns, only a few investors or strategies are able to match those returns, including financial theory like Fama/French models.

Investing Strategies of Warren Buffett

Value Investing

In the early years of his investment journey, Warren Buffett was a strict value investor, strongly influenced by Benjamin Graham’s thinking. In this strategy, Buffett pick only those stocks that are trading below their intrinsic value which measured by their book value, earning and assets. These were struggling companies with temporary problems, such often known as “cigar butt” because these companies provide one last profitable puff before discarded. Buffett consider a margin of safety which mean market price of stocks are below than its fair value, help in minimizing downside risk. Through this ordinary approach, he booked profit from market inefficiencies with limited capital for investing.

Fair Price Buying

Warren Buffett evolved from picking cheap companies to targeting high-quality businesses with good fundamentals. Warren Buffett was encouraged by Charlie Munger, and he always focused on buy great company at a fair price than fair company at great price. Buffett focused on companies that had stable cash flows, predictable earnings, competitive advantage, and the ability to reinvest profits at higher returns. These businesses had loyal customers, strong brands, and efficient operations. Buffett’s investment in Coca-Cola is a perfect example of pricing power with a global brand.

Long-Term Investing

Buffett always focuses on “buy and hold philosophy,” in which he invests capital with the intention of owning it long-term. He believes in identifying strong businesses and allowing time for compounding returns rather than speculating on short-term market movements. This strategy maximizes returns and reduces the need for frequent trading, lowers transaction costs, and defers capital gains taxes. The holding in American Express, Coca-Cola, and Apple is prime example of long-term investing.

Investment in Businesses with Economic Moats

Warren Buffett focuses on companies with economic moats. Economic moats are a term used to describe a sustainable competitive advantage that protects the profit of a company over a period. In moats includes cost advantages, network effects, regulatory barriers, brand strength, or consumer loyalty. For example, Apple gets an advantage from high switching costs and ecosystem lock-in, meanwhile GEICO enjoys a cost benefit that allows lower insurance premiums. These moats help in tackle competition and consistent return on capital over time.

Utilization of Insurance Float

Buffett perfectly utilizes the insurance float to fund Berkshire Hathaway’s business requirements. Insurance float is the amount that is collected from insurance premiums and has not been paid out in claims. Just like the borrowed fund, the float can be used indefinitely and come with cheap costs or no costs. Buffett used this float to invest in stocks and businesses, in short, Buffett used this as leverage for his business to generate higher returns. Acquisitions of companies like GEICO and General Re secured a steady source of capital to invest in business.

Investment in Crisis

Warren Buffett works on his ideology of “Be fearful when others are greedy and greedy when others are fearful”. Buffett always invests in situations when the market is in panic and strong businesses are trading at discount prices. In the 2008 financial crisis, he made investments in Goldman Sachs and Bank of America and also negotiated special deals such as high dividend yields on preference shares and warrants for additional equity. The ability of Buffett to remain focused and calm under panic market conditions allows him to earn extraordinary returns.

Conclusion

The investment track record of Warren Buffett is a perfect example of long-term investing and the power of discipline in financial markets. Buffett has consistently outperformed and evolved from his early days of deep value investing to acquiring high-quality businesses with better competitive advantages. Buffett’s investment return in comparison to the S&P 500 over the six decades is phenomenal. His investment journey through Berkshire Hathaway demonstrated results of reinvestment, patient capital allocation, and strategic use of leverage (float) for creating immense value on investment. The journey of Warren Buffett is not only a blueprint but also an example of the compounding power of investments.