Indian stock market made a flat opening, but overall outlook remains tilted towards a bearish trend. Traders were cautious ahead of TCS Q3 results later today as expectations suggest that revenue for the IT giant is widely expected to remain muted due to higher furloughs in Q3. Agricultural and Processed Food Products Export Development Authority (APEDA) Chairman Abhishek Dev stated that Indian exporters have huge opportunities to increase their share in the global agriculture trade from the current 2.4%. India’s share in the organic product segment is about 2.5 percent, but the chairman said India has an ambitious target of increasing the share four times in the next five years. The global market for organic goods is $147 billion, and the country’s organic food exports have grown at a steady pace. Disappointing inflation data from China added pressure, indicating that recent stimulus measures have failed to rejuvenate one of the world’s largest consumer markets. Expectations for results will influence stock-specific movements during the earnings season.

| Sensex | 77620.21 | -528.28 | -0.68% |

| Nifty 50 | 23526.50 | -162.45 | -0.69% |

| Nifty Bank | 49503.50 | -331.55 | -0.67% |

| Dow Jones | 42635.20 | +106.84 | +0.25% |

| SGX | 23660.00 | -95.00 | -0.40% |

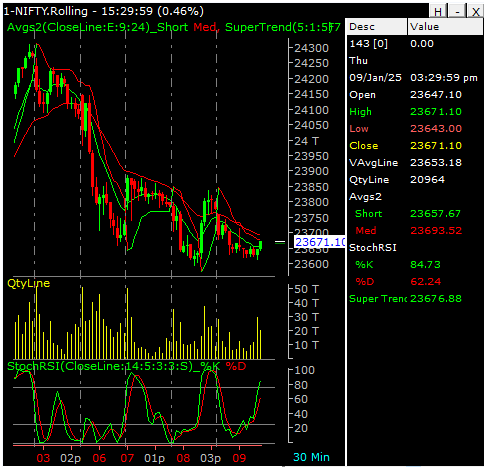

NIFTY 50 FUT

CORPORATE NEWS

- Trishakti Industries receives order from KEC International

- BORORENEW aims 50% capacity expansion in manufacturing of solar glass

- JK Cement inks pact with DPIIT

- GMR Airports to acquire 50% stake in BDGASPL

- NTPC Green Energy’s arm inks MoU with Deendayal Port Authority

- TV Today Network to close FM Radio broadcasting operations

- NTPC Green Energy incorporates joint venture in Rajasthan

- Persistent Systems launches Pi-OmniKG with Google Cloud technology

- NMDC to incorporate subsidiary in Gujarat

- Rama Phosphates launches new product ‘UROSUPER’

CORPORATE ACTIONS

| Symbol | Face Value | Purpose | Ex-Date | Record Date |

| SHRIRAMFIN | 10 | Stock split from Rs 10/-Share To Rs 2/-Share | 10-Jan-25 | 10-Jan-25 |

| JAIBALAJI | 10 | Stock split from Rs 10/-Share To Rs 2/-Share | 17-Jan-25 | 17-Jan-25 |

| NAVA | 2 | Stock split from Rs 2/-Share To Rs 1/-Share | 20-Jan-25 | 20-Jan-25 |

KEY SUPPORT & RESISTANCE LEVELS

| Company | LTP | Resistance | Support | ||

| R1 | R2 | S1 | S2 | ||

| NIFTY 50 | 23,526.50 | 23821 | 24115 | 23197 | 22868 |

| NIFTY BANK | 49,503.50 | 50122 | 50741 | 48810 | 48117 |

| FINNIFTY | 23,026.15 | 23314 | 23602 | 22704 | 22381 |

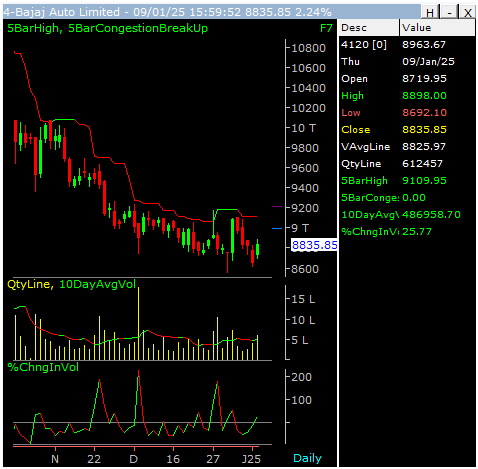

| BAJAJ-AUTO | 8,825.00 | 8935 | 9046 | 8701 | 8578 |

| NESTLEIND | 2259 | 2287 | 2315 | 2227 | 2196 |

| HINDUNILVR | 2440 | 2471 | 2501 | 2406 | 2372 |

| M&M | 3,131.80 | 3171 | 3210 | 3088 | 3044 |

| BRITANNIA | 4,922.00 | 4984 | 5045 | 4853 | 4784 |

| KOTAKBANK | 1,791.00 | 1813 | 1836 | 1766 | 1741 |

| ASIANPAINT | 2352 | 2381 | 2411 | 2319 | 2286 |

| HINDALCO | 591.00 | 598 | 606 | 583 | 574 |

| SBILIFE | 1471.45 | 1490 | 1508 | 1451 | 1430 |

| BHARTIARTL | 1,607.80 | 1628 | 1648 | 1585 | 1563 |

| TATACONSUM | 966.55 | 979 | 991 | 953 | 939 |

| HEROMOTOCO | 4147.5 | 4199 | 4251 | 4089 | 4031 |

| ITC | 450.45 | 456 | 462 | 444 | 438 |

| TITAN | 3,489.00 | 3533 | 3576 | 3440 | 3391 |

| DRREDDY | 1372 | 1389 | 1406 | 1353 | 1334 |

| HCLTECH | 1,934.00 | 1958 | 1982 | 1907 | 1880 |

| INDUSINDBK | 981 | 993 | 1006 | 967 | 954 |

| ICICIBANK | 1,263.50 | 1279 | 1295 | 1246 | 1228 |

| EICHERMOT | 5153.55 | 5218 | 5282 | 5081 | 5009 |

| BEL | 281.45 | 285 | 288 | 278 | 274 |

| POWERGRID | 305.50 | 309 | 313 | 301 | 297 |

| SUNPHARMA | 1830.05 | 1853 | 1876 | 1804 | 1779 |

| CIPLA | 1488.45 | 1507 | 1526 | 1468 | 1447 |

| BAJAJFINSV | 1,689.00 | 1710 | 1731 | 1665 | 1642 |

| APOLLOHOSP | 7,102.00 | 7191 | 7280 | 7003 | 6903 |

| MARUTI | 11,751.15 | 11898 | 12045 | 11587 | 11422 |

| HDFCLIFE | 614 | 622 | 629 | 605 | 597 |

| INFY | 1920.1 | 1944 | 1968 | 1893 | 1866 |

| RELIANCE | 1,256.80 | 1273 | 1288 | 1239 | 1222 |

| BAJFINANCE | 7,291.70 | 7383 | 7474 | 7190 | 7088 |

| GRASIM | 2,414.00 | 2444 | 2474 | 2380 | 2346 |

| TECHM | 1,648.00 | 1669 | 1689 | 1625 | 1602 |

| ULTRACEMCO | 11,292.55 | 11434 | 11575 | 11134 | 10976 |

| AXISBANK | 1064 | 1077 | 1091 | 1049 | 1034 |

| JSWSTEEL | 892.45 | 904 | 915 | 880 | 867 |

| TRENT | 6620 | 6703 | 6786 | 6527 | 6435 |

| SBIN | 762 | 772 | 781 | 751 | 741 |

| ADANIENT | 2484.85 | 2516 | 2547 | 2450 | 2415 |

| ADANIPORTS | 1,135.90 | 1150 | 1164 | 1120 | 1104 |

| HDFCBANK | 1,668.80 | 1690 | 1711 | 1645 | 1622 |

| NTPC | 320.35 | 324 | 328 | 316 | 311 |

| TCS | 4044 | 4095 | 4145 | 3987 | 3931 |

| WIPRO | 292.55 | 296 | 300 | 288 | 284 |

| TATAMOTORS | 781.40 | 791 | 801 | 770 | 760 |

| LT | 3,535.00 | 3579 | 3623 | 3486 | 3436 |

| TATASTEEL | 130.12 | 132 | 133 | 128 | 126 |

| COALINDIA | 372.95 | 378 | 382 | 368 | 363 |

| BPCL | 281.05 | 285 | 288 | 277 | 273 |

| SHRIRAMFIN | 2,828.95 | 2864 | 2900 | 2789 | 2750 |

| ONGC | 264.30 | 268 | 271 | 261 | 257 |

CHART OF THE DAY