Recently listed IPO Company Honasa Consumer, the parent company of skin care brand Mamaearth, which listed on the NSE and BSE at a small premium from the issue price, reported a doubling of its net profit for the second quarter. Mamaearth's IPO didn’t get a good response from retail investors but managed to sail through because of good responses from qualified institutional buyers (QIBs) and non-institutional investors. The bet that the institutional client had placed turned out to be profitable, as the stock generated a 25.70% return after dipping following the listing of the stock on the bourse.

Companies consolidated revenue from operations for the September quarter grew 21% YoY and 6.81% Q-o-Q to Rs 496.1 crore, driven by volume growth of 27 percent YoY. According to the filing, the company’s like-for-like growth for continuing business was 24 percent. The company’s earnings before interest, tax, depreciation, and amortisation (EBITDA) grew 53 percent YoY to Rs 40 crore. EBITDA margin improved 170 basis points to 8.1 percent from 6.4 percent in the same quarter a year ago. The operating margin for the quarter under review has increased by 192 bp to 6.81%. Dr Sheth’s has become the fourth brand from the Honasa portfolio to enter the Rs 150 crore club in terms of annual recurring revenue after Aqualogica and Derma Co.

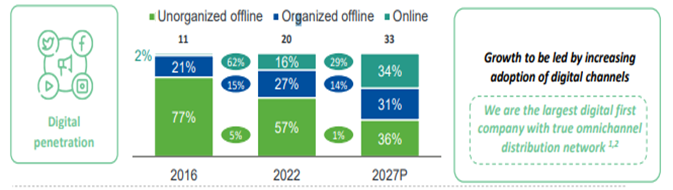

Mamaearth's revenue from offline channels increased from 18.63% in FY21 to 36.14 percent in FY23. As the offline share of revenues continues to rise, the company is increasingly competing with HUL, P&G, Dabur, and Reckitt on their territory, which is expected to demand more operations and advertising resources to be spent on the ground.

Advertising is one of the biggest expenses for the company, with ad costs growing 22% in Q2 to Rs 174 crore. Mamaearth intends to spend Rs 182 crore of IPO proceeds on ads over the next four years, with the majority of this amount expected to be for television campaigns. The company has built a strong offline distribution, with brands retailing at 1,65,937 retail outlets in September, an increase of 47% YoY.

The stock made a gap-up opening after the stellar performance, breaking previous highs following the quarterly result, and hit the 20% circuit in 3 candles in a 15-minute time frame. The stock currently traded at Rs. 423.75.

| Particulars | Sep-23 | Jun-23 | Sep-22 | Jun-22 |

| Total Income from operations (net) | 496.11 | 464.49 | 410.49 | 312.25 |

| Total Expenses | 462.2 | 441.67 | 390.38 | 329.5 |

| Profit from operations before other income, finance costs and exceptional items | 33.91 | 22.82 | 20.11 | -17.25 |

| Operating margin | 6.83518 | 4.91292 | 4.89902 | -5.52442 |

| Other Income | 7.08 | 12.61 | 5.02 | 4.31 |

| Profit from ordinary activities before finance costs and exceptional items | 40.99 | 35.43 | 25.13 | -12.94 |

| Finance Costs | 1.79 | 1.48 | 1.97 | 1.09 |

| Profit from ordinary activities before tax | 39.21 | 33.95 | 23.16 | -14.03 |

| Net Profit after tax for the Period | 29.44 | 24.72 | 15.19 | -11.53 |

No comment yet, add your voice below!