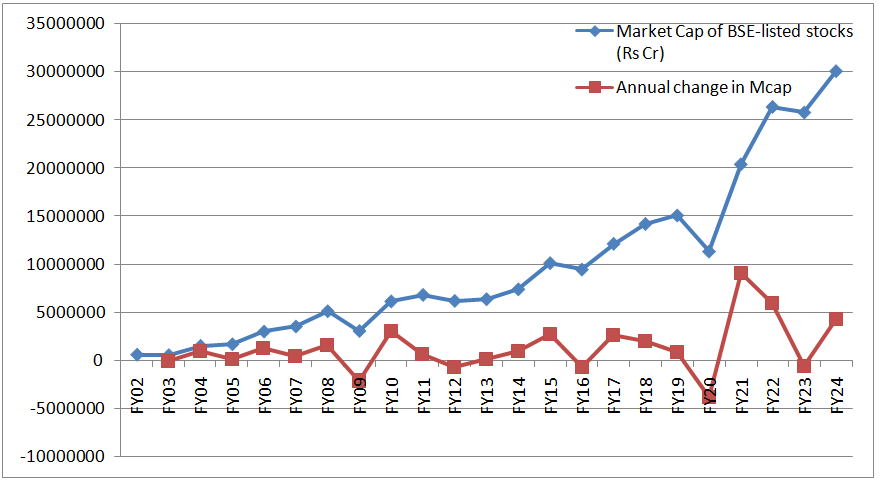

The Sensex and NSE Nifty indexes reached new highs, while the BSE market capitalisation crossed the Rs 300 lakh crore mark. BSE took more than 15 years to reach a market cap of 150 lakh crores, but after the downfall of COVID, when the market fell to a market cap of approximately 110 lakh crores, the market took approximately 4 years to take a run up and make history of reaching 300 lakh crores. As of July 20th, 2023, the Market Capitalization of BSE-listed companies is Rs 3,03,02,122 crore. BSE has a total of 4773 listed companies, out of which 3849 are available for trade.

On March 20, the market cap of companies listed on the BSE was close to Rs 250 lakh crore. But after a bullish wave from domestic and foreign investors, the market saw a boom in the Indian stock market. Since then, there has been a jump of more than 9000 points, or Rs. 45 lakh crore, in investor wealth in the Sensex. The market cap of companies listed on the BSE has increased from Rs 255 lakh crore to Rs 300 lakh crore.

Despite high valuations, Indian equities remain a preferred destination for equity investors. The surge in market capitalisation is a result of increased stock prices and new listings on the stock exchange. The Indian economy has experienced significant growth given the huge platter to serve, with investors seeing SME listings on exchanges every other day, but the new listing can’t be credited solely for such a fabulous run-up. The ongoing Bull Run from March 2023 lows is driven by various factors, and the achievement can be attributed to the country’s stable economic and political framework, favorable investment climate for FII, and favorable macro conditions.

Indian equities have been a favorite destination for domestic and foreign investors due to their strong macroeconomic fundamentals and impressive corporate earnings. Foreign Portfolio Investors (FPIs) injected significant capital, with a $13.65 billion inflow during the June quarter, in number terms, highest investment since December 2020. The country’s strong macroeconomic fundamentals and impressive corporate earnings have consistently attracted investors. India has attracted more flows than South Korea, Taiwan, and Indonesia.

The market boom has been attributed to various sectors, including capital goods, Auto, FMCG, and healthcare. Auto stocks have appreciated by 21% in the last six months, Capital goods have jumped by 18% as of date, whereas FMCG has contributed 20% to the rally.

However, analysts caution investors in the short term against purchasing at high valuations, as the macroeconomic scenario is not so bullish as to warrant the continuation of the rally.

No comment yet, add your voice below!