Explanation

A Long Call Calendar Spread is a strategy to gain from Theta with limited risk. The neutral calendar spread strategy is implemented if the trader is neutral in the near future and bullish for the long term (2 months or so). It involves writing of near month 1 ATM Call Option and buying 1 Mid-Month ATM Call Option with the same strike price and of the same underlying asset. This strategy is executed for a net cost, and both the profit potential and risk are limited.

Long calendar spreads are similar to short straddles and short strangles, but difference stands in initial investment, risk and profit potential.

Risk:

Maximum risk potential for this option strategy is limited to the initial investment made for implementing strategy.

Reward:

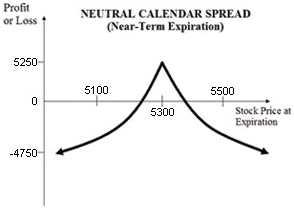

The maximum profit is realized if the stock price is equal to the strike price of the calls on the expiration date of the short call.

Construction:

Sell 1 Near-Month ATM Call Option

Buy 1 Mid-Month ATM Call Option

Payoff Chart

Example

A trader sees a range bound market in near month time frame but sees volatility in market in mid-month time. He implemented a calendar spread option strategy where he shorted near month ATM 17100 call option and received premium of Rs. 264, bought another mid-month 17100 call option at a premium of Rs. 389. Net initial fund outflow is equal to Rs 6700 (389 – 264) *50.

Scenario1:

If the near-monthexpiryofindexclosesat17000 or at the short strike price call option, the the trader will get to keep the premium received amounti.e.Rs.13200.(264*50).And if Mid-Month Nifty expire at16950,thenthe trader will make aloss on long term contract.

Scenario2:

If the near month contract strike price rises above the call option. The short position will start to make contract.

The mid-month call strike price can variate according to the market conditions. If the mid term call rises tit will result in gains other wise losses

No comment yet, add your voice below!