Business Profile of the NTPC Green Energy Limited

Among India’s top ten renewable energy businesses, NTPC Green Energy is backed by strong promoter i.e. NTPC limited. The NTPC Group, a large-scale integrated energy business, has a pan-India presence and contributes to India’s total installed capacity and power generation. The portfolio of the company consists in 11,571 MW contracted and awarded projects and 14,696 MWs that are operational projects. To carry out Renewable Energy Park initiatives and advance renewable energy projects, they have signed Memoranda of Understanding with state agencies. By 2032, the corporation is dedicated to increasing its non-fossil-based capacity to 45–50% of its portfolio including 60 GW renewable energy capacity.

As of June 30, 2024, the company had 15 offtakers across 37 solar projects and 9 wind projects. Right now, the company is building 31 renewable energy projects spread over seven states. From operations in the three-month period ended June 30, 2024 and Fiscal 2024 respectively, renewable energy sales accounted for 96.48% and 96.17% respectively.

Using a turn-key EPC contract strategy for solar and wind projects, the company boasts considerable in-house expertise in the implementation and procurement of renewable energy projects. Third-party vendors offer operation and maintenance services with an eye toward increasing plant efficiency using technology like robotic dry cleaning and CCTV surveillance.

NTPC Green Energy Limited IPO Objective

As per the draft red hearing prospects, the IPO issue consists only of offer for sale.

- NTPC green IPO offer only has fresh issue of Rs. 10, 000 crores. The company aims to utilize Rs 7, 500 crores toward repayment of certain borrowings and rest of the amount will be used for general corporate purposes.

| Particulars | Amount from Net Proceeds |

| Repayment of certain outstanding borrowings | Rs. 7500 crores |

| General corporate purposes | XXXX |

| Total | XXXX |

IPO Details of NTPC Green Energy Limited:

| IPO Open Date | November 19, 2024 |

| IPO Close Date | November 22, 2024 |

| Basis of Allotment | November 25, 2024 |

| Listing Date | November 27, 2024 |

| Face Value | ₹10 per share |

| Price | ₹102 to ₹108 per share |

| Lot Size | 138 Shares |

| Total Issue Size | 925,925,926 shares |

| Aggregating up to ₹10,000.00 Cr | |

| Fresh Issue | 925,925,926 shares |

| Aggregating up to ₹10,000.00 Cr | |

| Offer For Sale | NIL |

| NIL | |

| Issue Type | Book Built Issue IPO |

| Listing At | BSE & NSE |

| QIB Shares Offered | Not less than 75% of the Net Issue |

| Retail Shares Offered | Not more than 10% of the Net Issue |

| NII (HNI) Shares Offered | Not more than 15% of the Net Issue |

Issue Price & Size: NTPC Green Energy Limited IPO

The issue price of NTPC Green Energy Limited has been announced for Rs. 102 to Rs. 108. The company only has fresh issue of Rs. 10, 000 crores.

Launch Date of NTPC Green Energy Limited IPO

The IPO opening date of NTPC Green Energy has been officially announced for November 19 to November 22, 2024. The IPO will list on November 27 on NSE and BSE.

NTPC Green Energy Limited Financial Statements

| Particulars | For 3-months ended 30 June 2024 | FY24 | From 07 April 2022 to

31 March 2023 |

| Income | |||

| Revenue from operations | 5784.42 | 19625.98 | 1696.9 |

| Other income | 289.77 | 750.59 | 9.41 |

| Total income | 6074.19 | 20376.57 | 1706.31 |

| Expenses | |||

| Employee benefits expense | 147.65 | 370.14 | 28.07 |

| Finance costs | 1831.46 | 6905.73 | 498.72 |

| Depreciation and amortization expenses | 1753.77 | 6427.58 | 499.06 |

| Other expenses | 506.86 | 1791.12 | 155.02 |

| Total expenses | 4239.78 | 15494.57 | 1180.87 |

| Profit before tax | 1834.41 | 4881.98 | 252.44 |

| Profit for the year | 1386.11 | 3447.21 | 1712.28 |

| Particulars | Restated Consolidated Financial Info | Special Purpose Carved- Out Combined Financial Statements | |||

| 3 month ended June 30, 2024 | FY24 | FY23 | FY23 | FY22 | |

| Operational | |||||

| Installed Capacity / Megawatts Operating (MW) | |||||

| Solar | 2825 | 2825 | 2561 | 2561 | 1395 |

| Wind | 100 | 100 | 50 | 50 | 50 |

| Megawatts Contracted & Awarded as on | |||||

| Solar | 9771 | 9571 | 5750 | 5750 | 4616 |

| Wind | 2000 | 2000 | 500 | 500 | 150 |

| Average CUF for the assets held as on last date of the financial year/period (%) | |||||

| Solar | 26.80% | 23.97% | 27.17% | 22.74% | 19.21% |

| Wind | 28.67% | 19.78% | 16.48% | 23.58% | 23.66% |

| Financial | |||||

| Revenue from Operations | 5784.42 | 19625.98 | 1696.9 | 14497.09 | 9104.21 |

| Total Income | 6074.19 | 20376.57 | 1706.31 | 14575.27 | 9182.43 |

| Operating EBITDA | 5129.87 | 17464.7 | 1513.81 | 13096.16 | 7948.88 |

| Operating EBITDA Margin (7) (% of Revenue from Operations) | 88.68% | 88.99% | 89.21% | 90.34% | 87.31% |

| Profit/(Loss) After Tax (PAT) | 1386.11 | 3447.21 | 1712.28 | 4564.88 | 947.42 |

| PAT margin % (as % of Revenue from operations) | 23.96% | 17.56% | 100.91% | 31.49% | 10.41% |

| Net Debt/Equity (x) | 2.32 | 1.98 | 1.09 | 1.09 | 4.41 |

| Cash PAT | 3139.88 | 9874.79 | 2211.34 | 9129.71 | 3775.04 |

| Cash PAT margin | 54.28% | 50.31% | 130.32% | 62.98% | 41.46% |

| Cash RoE (% of average equity) | 4.98% | 17.76% | – | 26.70% | 23.08% |

| Interest Coverage | 2.96 | 2.64 | 3.05 | 2.8 | 3.17 |

NTPC Green Energy Limited Promoters & Shareholding

President of India, acting through the Ministry of Power, Government of India and NTPC Limited is the only promoter of the company. The promoter in aggregate hold 100.00% of the paid-up share capital of company, on a fully diluted basis.

Should You Subscribe to NTPC Green Energy Limited IPO or Not

While investing or subscribing to any IPO, consider the investment rationales related to the company. Hence, here you can find out the strength of the company that will be its growth factors. And also check the risk factors that can affect the growth and operational efficiency of the company.

Competitive Strengths of NTPC Green Energy Limited:

Backed by strong promoter

NTPC green is backed by NTPC limited which is among India’s top 10 renewable energy players in India. NTPC Group has a large-scale integrated energy business and pan-India presence in terms of total installed capacity and power generation. With promoters support and reputation, the company wants to take on government initiative and plans to expand its non-fossil-based capacity to 45-50% of its portfolio, including 60 GW renewable energy capacities by 2032.

Large portfolio of solar energy projects

The company has a large portfolio of utility-scale solar and wind energy projects, including those for PSUs and Indian corporates. The portfolio consisted of 14,696 MWs, including 2,925 MWs operating projects and 11,771 MWs projects contracted and awarded. The capacity under pipeline consisted of 10,975 MWs, totaling 25,671 MWs. Renewable energy sales from these projects accounted for 96.48% and 96.17% of the company’s revenue from operations in the three months ended June 30, 2024 and FY24.

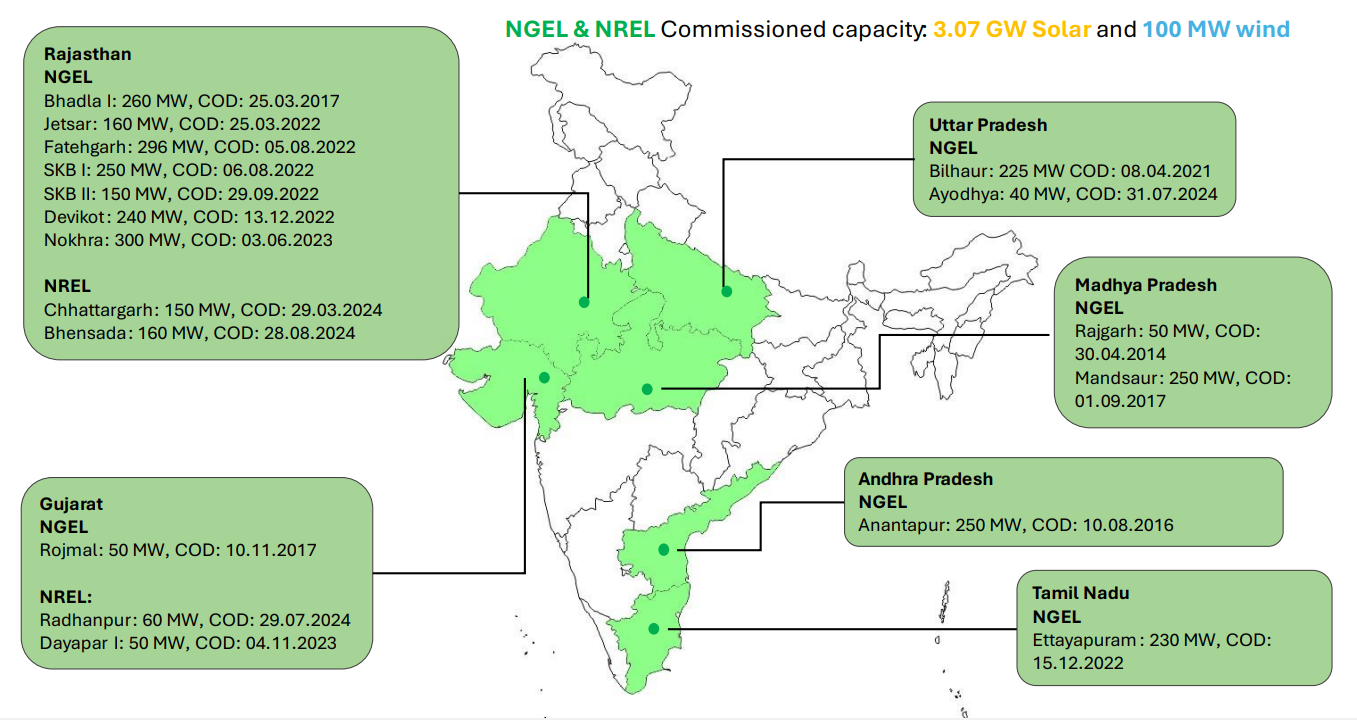

As of June 30, 2024, the company had 15 offtakers across 37 solar and 9 wind projects, all government agencies and public utilities with long-term PPAs with an average term of 25 years. The portfolio is concentrated in Rajasthan and Gujaratwhere solar panels works efficiently. The company is also located across seven other states in India, helping to counter the concentration risk of offtakers.

Strong in-house experience team

As of June 30, 2024, the company is in the process of constructing projects in seven states, consisting of 11,771 MWs, contracted and awarded. All capacity additions have been through organic growth rather than acquisition. The company has strong in-house experience in renewable energy project execution and procurement, working with third-party aggregators, developers, and EPC contractors. The company’s construction includes design, engineering, procurement, structure, module and inverter installations, substation construction, interconnection work, and the balance of plant construction.

They have diversified their strategy for setting up power plants from using turnkey engineering, procurement, and construction (EPC) contract models to a model where they take responsibility for procurement of major equipment and supplies. They aim to continue to leverage the NTPC Group’s economies of scale to negotiate and reduce the cost of components, equipment, and materials for their solar and wind projects.

| Additions to megawatts operating | Company Operating Data | Carved-out Operating Data | ||

| 3-mon ended June 30, 2024 | FY24 | FY23 | FY22 | |

| MW Operating | ||||

| Solar (MWs) | – | 264 | 1166 | 375 |

| Wind (MWs) | – | 50 | 0 | 0 |

| Total MW operating additions in year | – | 314 | 1166 | 375 |

| MW Contracted and Awarded | ||||

| Solar (MWs) | 200 | 3821 | 1134 | 2155 |

| Wind (MWs) | – | 1500 | 350 | 150 |

| Total MW contracted and awarded additions in year | 200 | 5321 | 1484 | 2305 |

| Total MW operating, contracted and awarded additions plus Capacity under Pipeline addition in year | 200 | 56635 | 2650 | 2680 |

Future strategies

The company plans to strengthen its position as a leading renewable energy company in India by focusing on new geographies and offtaker customers. By the backing of strong promoter, they aim to leverage their experience in executing large solar and wind energy projects to win bids and tenders from Central and State government agencies.

The company is investing in hydrogen, green chemical, and battery storage capabilities and solutions, as well as associated technologies. Current initiatives include developing a green hydrogen hub at Pudimadaka, finalizing a tie-up for electrolysers, and other projects including a renewable energy park in Maharashtra and green hydrogen production in Rajasthan.

To drive efficiency and cost reductions in project execution and operating & maintenance, the company plans to implement new technologies, reduce operating and maintenance costs, maintain a supply of critical spares, award bulk O&M contracts, implement manpower planning, secure long-term warranty coverage, and deploy cloud computing-based remote asset monitoring integrated using AI and machine learning technologies.

CRISIL Research predicts 137-142 GW of solar capacity additions over Fiscal 2025 to Fiscal 2029, and wind power capacity additions will be approximately 34-36 GW.

Risk Factors of NTPC Green Energy Limited:

Dependence on off-takers

The company has 15 off-takers across 37 solar projects and 9 wind projects in India, with the majority being government agencies and public utilities. The company’s business is concentrated with its top 9 off-takers. The company expects to continue relying on existing top 9 off-takers for a large portion of its revenue for rest of FY25.

If due to any unknown circumstance, any of the off-takers are unable to fulfill their obligations under the PPAs agreement, the company operations and its cash flows could be adversely affected.

Availability and cost of materials and equipment

The company’s operating equipment for solar and wind energy projects consists of solar panels, inverters, cables, solar mounting structures, trackers, transmission lines, and power evacuation systems. They purchase major components from domestic and international manufacturers.

The company’s business and profitability are heavily dependent on the availability and cost of these materials, components, and equipment. Any delays in the delivery of ordered materials, components, and equipment could materially and adversely affect their business, results of operations, financial condition, and cash flows. They also import equipment from China, with the cost of materials, components, and equipment purchased from suppliers in India and outside India. Trade restrictions, sanctions, or higher tariffs may significantly impact their sourcing decisions and may lead to increased costs of purchase and shortages of raw materials.

| Suppliers | Type of Equipment, components and materials supplied | Restated Consolidated Financial Info | |

| 3 months ended June 30, 2024 | FY24 | ||

| % of supplies | |||

| Largest Supplier | Solar modules including installation | 37.08% | 19.59% |

| Top 10 Suppliers | Solar Modules, WTG, land procurement, balance of supply, including installation | 92.58% | 77.71% |

| Top 20 Suppliers | Solar Modules, WTG, land procurement, balance of supply, including installation | 95.33% | 80.89% |

Cost overruns or delays

The company’s renewable energy project portfolio includes contracts and awarded projects, which are currently being commissioned and operationalized. Miscalculations in tariff rates, construction costs, land acquisition, and component prices can affect the economics of successful bids and make the projects economically unviable. Suppliers may renegotiate supply contracts, increasing capital expenditure and potentially causing suppliers to renegotiate supply contracts. Unanticipated capital expenditure for interconnection rights, regulatory approvals, preliminary engineering permits, and legal expenses can also adversely affect project profitability. The company’s project portfolio also includes contracted and awarded projects, which could be affected by labor shortages, work stoppages, and labor disputes.

Risks from PPA agreement

The company sells power generated from a power plant to central government-owned intermediaries or state distribution companies at pre-determined fixed tariffs. The terms of these PPAs are 25 years from the date of commercial operation or scheduled commissioning dates. Some PPAs require the company to maintain a performance bank guarantee, which may result in liquidation of guarantees and termination of non-commissioned capacity. Delays in the execution of PPAs can impact operational capacity and revenue, limiting business flexibility and exposing the company to increased risks of unforeseen changes.

| Particulars | Restated Consolidated Financial Info | Special Purpose Carved-Out Combined Financial Statements | ||

| 3-Mon period ended June 30, 2024 | FY24 | FY23 | FY22 | |

| % Revenue from operations | ||||

| Renewable Energy Sales | ||||

| Solar | 91.65% | 63.77% | 94.17% | 92.79% |

| Wind | 4.83% | 2.40% | 2.77% | 4.40% |

| Total Renewable Energy Sales | 96.48% | 96.17% | 96.94% | 97.19% |

Significant competition

After government push toward green energy, capex and development of green energy plants has pick pace. The company faces significant competition in the renewable energy markets, primarily from Indian and international developers and operators of solar and wind projects. The deregulation of the Indian power sector and increased private sector investment have even further intensified competition. They may also have a more effective localized business presence, enter into strategic alliances, form affiliates, and merge with suppliers or contractors.

As the renewable energy industry evolves, new competitors may emerge, and competition may increase with more sophisticated technology or government support for renewable energy sources. Additionally, competition with traditional energy companies using fossil fuels could negatively impact the company’s business and financial condition.

Inability to collect receivables

The company generates electricity income through Power Purchase Agreements (PPAs) with central and state government-run utilities. The company has faced delays in payments by some offtakers, but these have now been collected. The MoP Late Payment Surcharge (LPSC) Rules have significantly reduced this payment risk. The company faces risks if counterparties to its PPAs do not fulfill their obligations, leading to financial stress, insolvency, or liquidation proceedings. The company’s business, results of operations, and financial condition could be adversely affected by these risks.

Data mentioned in table below shows trade receivables, our provisions created for expected credit allowances and our past due but not impaired receivables.

| Particulars | Restated Consolidated Financial Information | Special Purpose Carved-Out Combined Financial Statements | ||

| June 30, 2024 | FY24 | FY23 | FY22 | |

| Trade receivables (₹ million) | 5553.61 | 7048.14 | 3254.98 | 1776.47 |

| Trade receivable days | 99.12 | 96.07 | 63.34 | 68.01 |

| Provision for Expected Credit Allowances | – | – | – | – |

| Past due but not impaired | 182.23 | 179.08 | 134.52 | 93.58 |

Climate conditions

The company earns significant revenue from selling power through solar energy projects. The renewable energy projects’ electricity and revenues are heavily influenced by weather conditions and air pollution, which are beyond companies control. Damaged systems, such as solar panels and inverters, can lead to costly repairs and delayed installations. Unfavorable weather can also affect our ability to meet performance guarantees and cash flows. Wind farm operational performance is also influenced by external factors like wake effects and construction work.

Restriction on imports

Although the company sources significant part of its supplies form India, but the imports occupy important shares. The company imports solar module cells and wind turbine generator components from China. If due to disruption in trade, the company faces potential risks due to restrictions imposed by governments, such as customs duties, and regulations addressing forced labor in the global solar supply chain. The company has developed multiple supply sources but could still face increased costs and negative publicity.

| Particulars | Restated Consolidated Financial Information | |

| Three months period ended June 30, 2024 | FY24 | |

| % Costs of supplies | ||

| India | 88.81% | 81.87% |

| Outside India | ||

| …China | 11.19% | 18.13% |

| Total Outside India | 11.19% | 18.13% |

Technical problems hindering supply

The company’s ability to sell electricity is influenced by the availability of evacuation and transmission infrastructure, grid constraints, and the development of transmission lines. Operational failures or lack of capacity can lead to lower revenues. Grid constraints may also curtail the transmission of full output, affecting the company’s ability to supply contracted amounts. The company is responsible for establishing connections with the grid, which may increase costs.

Technical problems, equipment failures, and equipment shutdowns can also negatively impact the company’s generating capacity. Compliance with electricity transmission reliability requirements and standards may lead to penalties, negatively impacting the business.

Renewable offerings in early stages

The renewable energy market in India is still in its early stages, and trends are based on limited data. Factors affecting demand for renewable projects include economic and market conditions, cost and reliability, availability of grid capacity, public perceptions, and regulations. Failure to adapt to industry trends and evolving technologies could materially adversely affect the business and results of operations. Changes in policies and government incentives could also reduce the economic benefits of existing renewable energy projects. The success of new renewable offerings, such as green hydrogen, green chemicals, and energy storage systems, depends on factors such as anticipating customer needs, obtaining regulatory approvals, establishing collaborations, and achieving market acceptability. The development and commercialization of these offerings can be costly, and competitors may have greater resources and adaptability.

NTPC Green Energy Limited Grey Market premium

Grey market premium is the premium quoted over the IPO issue price. GMP shows that investors are ready to pay above the upper band of the IPO issue price. GMP is determined in the grey market as per the demand and supply of the shares in the primary market. A grey market is that unofficial ecosystem of unlisted companies’ stocks that start trading even before the launch of the IPO to the date of its listing.

Also Read: What is Grey Market Premium in IPO: How is GMP Calculated & Reliable

However, GMP is not a reliable factor, as it keeps fluctuating as per the demand and supply of shares in the primary market. There are numerous factors that affect the stock market in India and individual stock prices of different companies that are already listed and trading in the secondary market. However, for an IPO-bounded company, you can consider the GMP as the speculative listing price of the share

According to various online sources, the Grey Market Premium or GMP of the NTPC Green Energy Limited is trading around Rs XX in the grey market. It means shares are trading at the upper band issue price of Rs XX with a premium in the grey market and may list around the same price.