Business Profile of Orkla India Limited

Orkla India Limited is an Indian food company, offering large range of food products, company deliver its food products from breakfast to lunch and dinner, snacks, desserts and beverages. The heritage brands which owned by company includes MTR Foods, Eastern Condiments and Rasoi Magic. Both MTR Foods and Eastern Condiments are most renowned brands in market. MTR Foods offers instant mixes, ready to eat meals, masalas, breakfast mixes, snacks & beverages such as Spices, RTC foods, RTE foods, vermicelli etc. Whereas Eastern Condiments brand offer spices and convenience foods. As of March 31, 2024, company sold 2.3 million units on average day and has more than 400 products. The company serves its customer across country and good presence in Andhra Pradesh, Karnataka, Kerala and Telangana. It also exports its products to 42 countries including GCC countries, U.S. and Canada. The company operates its manufacturing facilities in India and other countries such as UAE, Thailand and Malaysia.

Objective of Orkla India Limited (MTR) IPO

As per the draft red hearing prospects, the IPO issue consists fresh issue and offer for sale. There is no fresh issue and OFS consists 22,843,004 shares at face value of ₨ 1.00 each aggregating up to ₨ 1,667.54 Cr. There are OFS by company and main objective of company is to achieve the benefits of listing the Equity Shares on the Stock Exchanges

Details of Orkla India Limited IPO

| IPO Open Date | Wed, Oct 29, 2025 |

| IPO Close Date | Fri, Oct 31, 2025 |

| Basis of Allotment | NA |

| Listing Date | Thu, Nov 6, 2025 |

| Face Value | ₹1 per share |

| Price | ₹695 to ₹730 per share |

| Lot Size | 20 Shares |

| Total Issue Size | 2,28,43,004 shares |

| (aggregating up to ₹1,667.54 Cr) | |

| Fresh Issue | N.A |

| N.A | |

| Offer For Sale | 2,28,43,004 shares |

| (aggregating up to ₹1,667.54 Cr) | |

| Issue Type | Book Built Issue IPO |

| Listing At | BSE & NSE |

| QIB Shares Offered | Not less than 50% of the Net Offer |

| Retail Shares Offered | Not more than 35% of the Net Offer |

| NII (HNI) Shares Offered | Not more than 15% of the Net Offer |

Orkla India Limited IPO: Issue Price & Size

The issue size of the IPO has been declared and the overall issue size of the IPO is Rs 1,667.54 Cr, out of which 2,28,43,004 Equity Shares, aggregating up to Rs 1,667.54 cr, comprise only for sale by shareholders.

Launch Date of Orkla India Limited IPO

Orkla India Limited IPO will be open on Oct 29, 2025 and close on the Oct 31, 2025. All types of investors can bid between these dates through their eligible categories.

Financial Statements of Orkla India Limited

| Particular | March 31 , 2025 | March 31 , 2024 | March 31 , 2023 |

| Income | |||

| Revenue from operations | 23,947.1 | 23,560.1 | 21,724.80 |

| Other income | 605.3 | 319.8 | 289.6 |

| Total income | 24,552.4 | 23,879.9 | 22,014.4 |

| Expenses | |||

| Cost of raw materials and packing materials consumed | 11,741.3 | 13,100.5 | 11,940.1 |

| Purchase of stock – in – trade | 1,439.7 | 680.5 | 592.8 |

| Change in inventories of finished goods, WIP | 27.4 | ( 143.6 ) | 145.2 |

| Employee benefits expense | 2,461.9 | 2,323.5 | 2,239.6 |

| Finance costs | 65.5 | 66.4 | 270.8 |

| Depreciation and amortisation expense | 617.3 | 621.2 | 554.1 |

| Other expenses | 4,308.4 | 4,185.2 | 3,694.60 |

| Total expenses | 20,661.5 | 20,833.7 | 19,437.2 |

| Restated profit before tax of associate and JVs | 3,890.9 | 3,046.2 | 2,577.2 |

| Exceptional items ( net ) | ( 336.4 ) | – | ( 20.0 ) |

| Restated PBT and share of profit/(loss) of JVs | 3,554.5 | 3,046.2 | 2,557.20 |

| Share of profit ( loss ) from associate and joint venture | ( 4.0 ) | 22.1 | 11.9 |

| Restated profit before tax | 3,550.50 | 3,068.3 | 2,569.1 |

| Tax expense : | |||

| – Current tax | 870.6 | 635.1 | 60.9 |

| – Adjustment of tax relating to earlier periods | ( 13.4 ) | 8.2 | ( 1.0 ) |

| -Deferred tax charge / ( credit ) | 136.4 | 161.7 | ( 882.1 ) |

| Total tax expense | 993.6 | 805.0 | ( 822.2 ) |

| Restated profit for the year | 2,556.9 | 2,263.30 | 3,391.30 |

Key financial ratios of Orkla India Limited

| Particular | 2025 | 2024 | 2023 |

| Adjusted EBIT (Rs in Mn) | 3,347.1 | 2,814.9 | 2.570.3 |

| Adjusted EBIT margin | 14.0% | 11.9% | 11.8% |

| PAT (Rs in Mn) | 2,556.9 | 2,263.3 | 3.391.3 |

| PAT margin | 10.7 | 9.6 | 15.6 |

| Trade working capital days | 21.4 | 30.7 | 36.3 |

| ROCE | 32.7 | 20.7 | 32.1 |

| Cash conversion | 124.8 | 109.9 | 85.0 |

| Return on Assets | 7.81% | 6.99% | 10.93% |

| Return on Equity | 9.71% | 8.97% | 15.14% |

| Current Ratio | 1.82 | 2.84 | 1.23 |

| D/E Ratio | 0.004 | 0.004 | 0.017 |

| Revenue from operations (Rs in Mn) | 23,947.10 | 23,560.10 | 21,724.80 |

| Revenue growth | 1.6% | 8.4% | 18.2% |

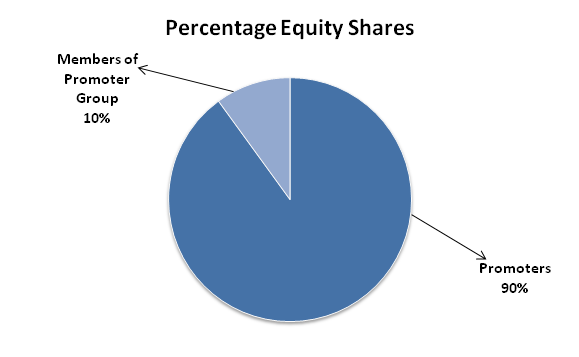

Promoters & Shareholding Orkla India Limited (MTR) IPO

As of date, according to the DRHP filed with SEBI promoters and promoter group have 90.00% shareholding in company.

| Name | Number of Equity Shares | % Equity Shares |

| Promoters | ||

| Orkla Asia Pacific Pte. Ltd | 12,33,02,090 | 90 |

| Orkla ASA | 600 | N.A. |

| Total (A) | 12,33,02,690 | 90 |

| Members of Promoter Group | ||

| Navas Meeran | 68,43,270 | 5 |

| Feroz Meera | 68,43,270 | 5 |

| Total (B) | 1,36,86,540 | 10 |

| Total (A+B) | 13,69,89,230 | 100 |

Should You Subscribe To Orkla India Limited (MTR) IPO

While investing or subscribing to any IPO, consider the investment rationales related to the company. Hence, here you can find out the strength of the company that will be its growth factors. And also check the risk factors that can affect the growth and operational efficiency of the company.

Competitive Strengths of Orkla India Limited IPO

Category market leader

The company is a leading brand in the market and has built significant market shares in the packaged spices market of South India, which highlights its strong brand equity, according to Technopark Report. Under the MTR brand, the company offers spice blends for vegetarian cuisine, while Eastern’s blends are made especially for non-vegetarian cuisines. The product portfolio serves local tastes by offering a range of local dishes in their core market. It helps the company to build and scale household food brands through an in-depth understanding of local taste.

Extensive distribution infrastructure

The company has an extensive pan-India presence with 843 distributions, 1800 sub-distributors, in 28 states and 5 union territories, 31 modern trade partners, and six e-commerce and quick commerce partners. MTR and Eastern are the most widely distributed brands in Karnataka and Kerala for spices, according to Technopark Report. The company sells blended spices at approximately 300,000 retail outlets and 74,500 in Kerala. This large distribution infrastructure enhances the company’s product range presence in retail outlets.

Efficient large-scale manufacturing

The company manufactures its multi-category products in modern and flexible manufacturing facilities with a robust supply chain across sourcing and distribution. As of March 31, 2025, the company operated nine manufacturing units in India with a total capacity of 182,270 TPA. The key manufacturing units of the company situated in Bommasandra, Bengaluru are largely automated. The manufacturing strategy combines in-house and contract manufacturing to optimize the assets base while ensuring flexibility and protecting its proprietary receipts. It capable companies to enhance their responsiveness to market trends while enabling more efficient production schedules.

Capital efficient business model

The company registered revenue from operations of Rs 23,560 million, which was one of the top four among select leading spices and convince food peers, according to Technopark report in fiscal 2024. Orkala India Ltd. was the second fastest 168 growing company in terms of EBITDA out of select leading peer companies for fiscal 2022 and fiscal 2024 with a CAGR of 20.3%. In terms of PAT, the company is the second fastest growing company in fiscal 2022 and 2024 with a CAGR of 39%. The working capital of the company enables it to sustain growth while minimizing the use of capital.

Risk Factors of Orkla India Limited IPO

Large working capital need

The operations of the company require a significant amount of working capital, including financing the purchase of raw materials, maintenance of adequate levels of inventory, and working on the manufacturing process. Any delay in the processing of payments by customers may increase the company’s working capital requirements which may lead to underproduction, low revenues, and a dissatisfied customer base.

Counterfeit, cloned and pass-off products

The company is subject to counterfeit, cloned, and pass-off products in its businesses. Counterfeit and cloned products are those products who sold illegally as legitimate products, whereas pass-off products are manufactured and packaged to resemble legitimate products. The product imitating company brands and selling spurious products may adversely affect the sale of products, resulting decrease in demand for company products in the market.

Geographic concentration

The geographic concentration exposes the company to risk related to changes in consumer preferences, competitive dynamics, and regulatory requirements specific to South India. The sale of products in south India contributed to 70.2% of company revenue in fiscal 2025. Further, eight of nine owned manufacturing facilities are located in south India. Any changes related to social, political, economic, and civil disruption in this region may adversely affect company business, cash flows, and operations.

Competitive industry

The industry in which the company operates is highly competitive. Orkala India Ltd. competes with existing domestic companies and multinational companies as well as new market companies. Some companies have greater resources, including the ability to spend more on advertising and marketing. It could require the company to accept a considerable reduction in profit margins and loss of market share due to price pressure which may negatively impact business and financial conditions.

Orkla India Limited IPO Grey Market Premium

Grey market premium is the premium quoted over the IPO issue price. GMP shows that investors are ready to pay above the upper band of the IPO issue price. GMP is determined in the grey market as per the demand and supply of the shares in the primary market. A grey market is that unofficial ecosystem of unlisted companies’ stocks that start trading even before the launch of the IPO to the date of its listing.

Also Read: What is Grey Market Premium in IPO: How is GMP Calculated & Reliable

However, GMP is not a reliable factor, as it keeps fluctuating as per the demand and supply of shares in the primary market. There are numerous factors that affect the stock market in India and individual stock prices of different companies that are already listed and trading in the secondary market. However, for an IPO-bounded company, you can consider the GMP as the speculative listing price of the share

As per the sources, the GMP of Orkla India Limited IPO is not started in grey market, wait for the IPO announcement. Stay tuned for the latest IPO GMP numbers of Orkla India IPO.