Protective Put Option Strategy

The Protective Put option strategy is a derivative strategy used to protect against unfavorable downside risk. When an investor is long on the underlying security but wary of the downside, this approach is used. He will protect his position by purchasing an at-the-money (ATM) Put Option. Now, whether the underlying asset goes up or down, the trader is in a secure situation.

Risk:

Limited

Reward:

Unlimited

Construction

Buy 1 Nifty 50 Futures

Buy 1 ATM Put Option

| Option Type | Expiry Date | Strike Price | LTP | Action | No. Of Lots |

| PUT | 29/03/2023 | 17000.0 | 180.15 | Buy | 1 |

| FUTURES | 29/03/2023 | -NA- | 17039.9 | Buy | 1 |

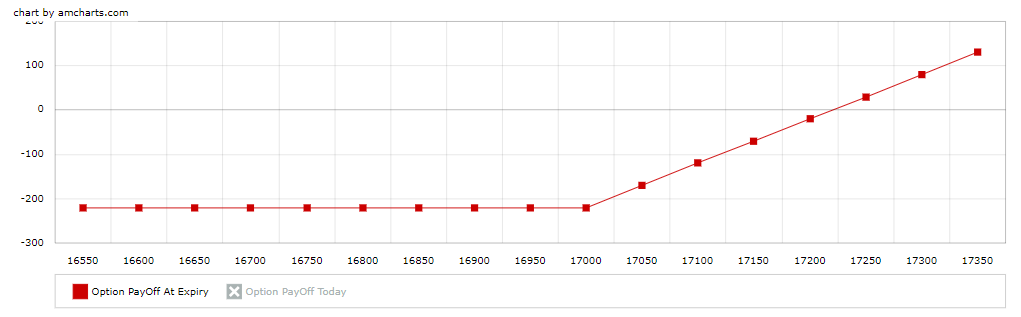

Payoff Chart

| Market Expiry | Payoff 1 | Payoff 2 | Net Premium | Option PayOffAt Expiry |

| 16550.0 | 450.0 | -489.9 | -180.15 | -220.05 |

| 16600.0 | 400.0 | -439.9 | -180.15 | -220.05 |

| 16650.0 | 350.0 | -389.9 | -180.15 | -220.05 |

| 16700.0 | 300.0 | -339.9 | -180.15 | -220.05 |

| 16750.0 | 250.0 | -289.9 | -180.15 | -220.05 |

| 16800.0 | 200.0 | -239.9 | -180.15 | -220.05 |

| 16850.0 | 150.0 | -189.9 | -180.15 | -220.05 |

| 16900.0 | 100.0 | -139.9 | -180.15 | -220.05 |

| 16950.0 | 50.0 | -89.9 | -180.15 | -220.05 |

| 17000.0 | 0.0 | -39.9 | -180.15 | -220.05 |

| 17050.0 | 0.0 | 10.1 | -180.15 | -170.05 |

| 17100.0 | 0.0 | 60.1 | -180.15 | -120.05 |

| 17150.0 | 0.0 | 110.1 | -180.15 | -70.05 |

| 17200.0 | 0.0 | 160.1 | -180.15 | -20.05 |

| 17250.0 | 0.0 | 210.1 | -180.15 | 29.95 |

| 17300.0 | 0.0 | 260.1 | -180.15 | 79.95 |

| 17350.0 | 0.0 | 310.1 | -180.15 | 129.95 |

Protective Put Option Trading Example

Assume the Nifty 50 is currently trading at Rs. 17000 and the investor/trader is bullish towards the market. He is already long on the Nifty 50 futures. To minimize the drawdown risk and protect himself from volatile moves, he will purchase one 17100 at the money (ATM) Put Option by paying premium of Rs. 180.

Scenario 1

At expiry if Nifty 50 closes at Rs. 16900, then the trader will make a loss of Rs. 6000. [{(16900-17000) + (200-180)} *75]

Scenario 2

At expiry if Nifty closes at Rs. 17300, then the trader will make a profit of Rs. 1500. {(17300-17100) – (180)} *75.

Also read Covered Combination Option Strategy

No comment yet, add your voice below!