Business Profile of Ravi Infrabuild Limited

Ravi Infrabuild Projects Limited is a civil construction company mainly focused on civil engineering projects like flyovers, highways, bridges and tunnels primarily for public sector clients. The company was established in 1995 and incorporated in 2009 as private limited in Udaipur, Rajasthan. Ravi Infrabuild has experience of more than 20 years, also handle government based project in various states including Gujarat, Karnataka, Rajasthan, Madhya Pradesh, Uttar Pradesh and Maharashtra. The company operates in different modes like hybrid annuity models and EPC (Engineering, Procurement and Construction). Company includes different projects in its portfolio under Bharatmala Pariyojna, IRCTC, MoRTH and NHAI & various state governments.

Objective of Ravi Infrabuild IPO

As per the draft red hearing prospects, the IPO issue consists only fresh issue. The fresh issue consists of XXXX shares at the face value of ₨ 10.00 each aggregating up to ₹ 11,000.00 millions. There are only fresh shares issues and main objective of company is repayment of borrowing related to subsidiaries and company, purchase of equipment and general corporate expenses.

Details of Ravi Infrabuild IPO

| IPO Open Date | N.A. |

| IPO Close Date | N.A. |

| Basis of Allotment | N.A. |

| Listing Date | N.A. |

| Face Value | ₹10.00 per share |

| Price | N.A. |

| Lot Size | N.A. |

| Total Issue Size | Up to XXXX Equity Shares |

| Aggregating up to ₨ 11,000.00 million | |

| Fresh Issue | Up to XXXX Equity Shares |

| Aggregating up to ₨ 11,000.00 million | |

| Offer For Sale | N.A. |

| N.A. | |

| Issue Type | Book Built Issue IPO |

| Listing At | BSE & NSE |

| QIB Shares Offered | Not more than 75% of the Net Issue |

| Retail Shares Offered | Not more than 10% of the Net Issue |

| NII (HNI) Shares Offered | Not less than 15% of the Net Issue |

Ravi Infrabuild IPO: Issue Price & Size

The issue price of RAVI INFRABUILD LIMITED hasn’t been released yet. Upon releasing the dates, the investors can bid between those price ranges. The company has fresh issue aggregating up to ₹ 11,000.00 million at the price of ₨XXXX.

Launch Date of Ravi Infrabuild IPO

The IPO opening date of RAVI INFRABUILD LIMITED hasn’t been officially announced yet, upon the declaration of dates investor can bid for IPO.

Financial Statements of Ravi Infrabuild Limited

| Particulars (₨ in millions) | Ended Dec 31, 2024 | FY2024 | FY2023 | FY2022 |

| Income | ||||

| Revenue from operations | 10,275.89 | 13,909.93 | 10,162.11 | 11,051.11 |

| Other income | 584.84 | 160.06 | 99.51 | 42.52 |

| Total Income | 10,860.73 | 14,069.99 | 10,261.62 | 11,093.63 |

| Expenses | ||||

| Cost of materials consumed | 4077.37 | 4,683.79 | 3,181.85 | 4,225.37 |

| Sub – contract and site expenses | 3,982.11 | 5,488.23 | 4,585.93 | 5,303.30 |

| Employee benefits expenses | 522.95 | 627.92 | 409.06 | 395.90 |

| Finance costs | 782.89 | 553.08 | 286.15 | 176.29 |

| Depreciation and amortization expenses | 253.14 | 312.47 | 183.57 | 193.58 |

| Other expenses | 131.32 | 167.80 | 192.51 | 71.25 |

| Total expenses | 9,749.77 | 11,833.29 | 8,839.07 | 10,365.69 |

| Profit/Loss for before tax and exceptional items | 1,110.96 | 2,236.70 | 1,422.55 | 727.94 |

| Exceptional items | – | ( 539.33 ) | – | – |

| Profit/Loss for after tax and exceptional items | 1,116.96 | 1,697.37 | 1,422.55 | 727.94 |

| Тах expense | ||||

| -Current tax | 255.76 | 342.75 | 347.17 | 158.85 |

| Deferred tax charge/(credit) | 36.36 | 107.44 | 34.65 | 10.26 |

| 292.12 | 450.19 | 381.82 | 169.11 | |

| Restated Profit ( Loss ) for the period after tax | 818.84 | 1,247.18 | 1,040.73 | 558.83 |

Key financial ratios of Ravi Infrabuild Limited

| Ratios | Ended Dec 31 , 2024 | FY 2024 | FY 2023 | FY 2022 |

| EBITDA (Rs in Millions) | 1,562.15 | 2,402.86 | 1,792.76 | 1,055.29 |

| EBITDA Margin | 15.20 | 17.27 | 17.64 | 9.55 |

| PAT Margin | 7.97 | 8.97 | 10.24 | 5.06 |

| Cash Profit Margin | 9.87 | 11.08 | 11.93 | 6.78 |

| Total Debt (Rs in Millions) | 11,583.57 | 8,153.37 | 2,612.46 | 2,030.68 |

| Net Debt (Rs in Millions) | 10,264.47 | 6,423.00 | 1,356.78 | 972.19 |

| Net Debt to EBITDA | 6.57 | 2.67 | 0.76 | 0.92 |

| Debt Equity Ratio | 2.20 | 1.84 | 0.82 | 0.95 |

| RoNW | 15.56 | 28.10 | 32.68 | 26.11 |

| RoCE | 11.24 | 17.87 | 29.47 | 21.68 |

| Current Ratio | 1.65 | 2.25 | 1.69 | 1.51 |

| Interest Coverage Ratio | 1.74 | 3.79 | 5.97 | 5.23 |

| Asset Turnover Ratio | 0.92 | 1.11 | 1.69 | |

| Inventory Turnover Ratio | 9.75 | 17.21 | 23.58 | 33.73 |

| ROA | 4.58 | 10.19 | 13.14 | 8.52 |

Promoters & Shareholding Ravi Infrabuild IPO

As of date, according to the DRHP filed with SEBI promoters and promoter group have 100.00% shareholding in company.

| Name of the Shareholder | Number of Equity Shares | Equity Share capital ( % ) |

| Promoter | ||

| Narayan Singh Rao | 40,995,000 | 54.66 |

| Dilip Singh Rao | 19,005,000 | 25.34 |

| Ravi Singh Rao | 3,000,000 | 4.00 |

| Promoter Group | ||

| Abhishek Rao | 3,000,000 | 4.00 |

| Ankit Singh Rao | 3,000,000 | 4.00 |

| Nirmala Kunwar Rao | 3,000,000 | 4.00 |

| Sita Rao | 3,000,000 | 4.00 |

| Total | 75,000,000 | 100.00 |

Should You Subscribe To Ravi Infrabuild IPO

While investing or subscribing to any IPO, consider the investment rationales related to the company. Hence, here you can find out the strength of the company that will be its growth factors. And also check the risk factors that can affect the growth and operational efficiency of the company.

Competitive Strengths of Ravi Infrabuild IPO:-

Demonstrated project capabilities

The company is supported by in-house engineering and design teams, which enable company to firstly, offer customized solutions in accordance with project requirements and secondly, to continually undertake incremental enhancements and improvements of company processes and design thereby enhance its engineering standards. These teams assist in making detailed design that are made to meet specific need of clients and reducing dependency on third party.

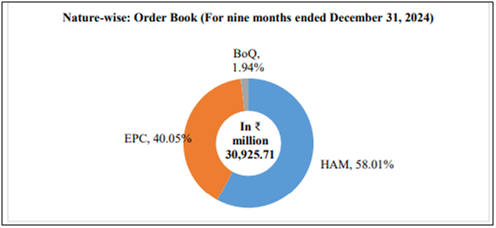

Robust financial performance & order growth

In infrastructure industry, an order book is considered a measure of future performance because it represents a committed portion of expecting future revenue. The company aim to select projects with potentially higher margins and projects which help in market penetration. Company shown growth in their financial performance in recent years, position company for future growth and further diversification of client base & offerings.

| Clients (₨ in millions) | As on | |||

| Dec 31 , 2024 | Mar 31 , 2024 | Mar 31 , 2023 | Mar 31 , 2022 | |

| National Highways Authority of India | 16,704.87 | 15,992.77 | 11,471.86 | 9,095.90 |

| Ministry of Road Transport and Highways | 5,704.20 | 7,065.17 | 5087.80 | 5,041.76 |

| Madhya Pradesh Road Development Corporation Limited | 5,632.40 | 0 | 344.90 | 0 |

| North Western Railway | 600.14 | 910.72 | 0 | 0 |

| Public Works Department , Rajasthan | 0 | 0 | 919.46 | 1,607.14 |

| Urban Improvement Trust , Bhilwara | 0 | 0 | 0 | 291.65 |

Diversified Portfolio Projects

Ravi Infrabuild have experienced of executing projects across diverse geographic locations in India. As on December 31, 2024, company has completed more than 90 projects which include 13 EPC and 6 HAM projects in highways, expressways and railways sectors.

As on December 31, 2024, company has 12 ongoing projects and company ensure that major construction material are delivered on time which enable company to manage process effectively and raw material requirements in optimal way.

Long-standing relationships with a marquee client base

The company has long standing relationships with their clients such as NHAI, MoRTH and MPRDC since fiscal 2022, 2018 and 2009 respectively. Company relationships with clients and ongoing active engagements with clients also allow company to plan its capital expenditure, improve ability to benefit from increasing economies of scale.

| Ended December, 2024 | Fiscal, 2024 | Fiscal, 2023 | Fiscal, 2022 | ||||||

| Clients | Revenue (in million) |

% of revenue from operations |

Revenue (in million) |

% of revenue from operations |

Revenue (in million) |

% of revenue from operations |

Revenue (in million) |

% of revenue from operations |

|

| National Highways Authority of India |

7,526.98 | 73.25 | 8,988.71 | 64.62 | 6,558.33 | 64.54 | 5,449.59 | 49.31 | |

| Ministry of Road Transport and Highways |

1,772.48 | 17.25 | 2,664.23 | 19.15 | 1,548.09 | 15.23 | 1,854.86 | 16.78 | |

| Madhya Pradesh Road Development Corporation Limited |

221.07 | 2.15 | 576.25 | 4.14 | 281.68 | 2.77 | 1,386.73 | 12.55 | |

| Public Works Department , Rajasthan |

211.37 | 2.06 | 1.144.90 | 8.23 | 831.94 | 8.19 | 3.98 | 0.04 | |

| North Western Railways |

335.47 | 3.26 | 205.36 | 1.48 | 128.56 | 1.27 | 279.32 | 2.53 | |

As of current date company is eligible to bid for single NHAI/MoRTH of EPC road projects up to a value of ₨16,665.10 million, thereby ensuring a competitive cost of structure to achieve sustainable growth & profitability.

Risk Factors of Ravi Infrabuild IPO:-

Government dependency

The business of company is mainly dependent on contract signed by government authorities and government owned entities. In terms of total order booking National Highways Logistics Management Limited (NHLML) and Ministry of Road Transport and Highway (MoRTH) contributed 78.95%. Whereas NHAII and MoRTH are top two clients who contributed 90% of company revenue from operations in nine months ended December 31, 2024. Any adverse changes in the central or state government policies may lead to material effect on revenue of business.

Price competitive bidding

All projects which have been primarily awarded to company through competitive bidding process. Further, once prospective bidders satisfy the prequalification requirements of tender then project usually awarded on basis of price competitiveness of the bid. The company incurs huge costs in preparation and submission of bids, if company not able to qualify or win new projects it could negatively affect operations of company.

Huge working capital requirement

The company requires a significant amount of working capital. In many business operations large amounts of working capital are required to finance the purchase of materials and preparation of constriction, engineering and other work on projects before payments are received from clients. If company experience insufficient cash flows to enable its fund requirements for working capital, then it creates an adverse effect on company operations.

Persistent negative cash flows

The company sustained negative cash flows from operating activities in the past. It experience negative cash flow for nine months ended December 31, 2024 and fiscals 2024 and 2022 and may continue to experience such negative cash flow in future.

| Particulars (₨ in millions) | Nine months ended Dec 31, 2024 | Fiscal 2024 | Fiscal 2023 | Fiscal 2022 |

| Net cash generated from operating activities | -2,403.38 | -4,164.13 | 495.46 | -362.72 |

| Net cash generated from investing activities | -555.79 | -303.36 | -814.59 | -547.17 |

| Net cash generated from financing activities | 2,665.81 | 5,006.73 | 295.72 | 965.56 |

Company business and growth plans could materially affect by negative cash flows over extended periods. As a result, company cash flows, business, future financial performance and results of operations could negatively affect.

Ravi Infrabuild IPO Grey Market Premium

Grey market premium is the premium quoted over the IPO issue price. GMP shows that investors are ready to pay above the upper band of the IPO issue price. GMP is determined in the grey market as per the demand and supply of the shares in the primary market. A grey market is that unofficial ecosystem of unlisted companies’ stocks that start trading even before the launch of the IPO to the date of its listing.

Also Read: What is Grey Market Premium in IPO: How is GMP Calculated & Reliable

However, GMP is not a reliable factor, as it keeps fluctuating as per the demand and supply of shares in the primary market. There are numerous factors that affect the stock market in India and individual stock prices of different companies that are already listed and trading in the secondary market. However, for an IPO-bounded company, you can consider the GMP as the speculative listing price of the share

According to various online sources, the Grey Market Premium or GMP of the Ravi Infrabuild Limited is trading around Rs XX in the grey market. It means shares are trading at the upper band issue price of Rs XX with a premium in the grey market and may list around the same price.