RBI Trims Interest Rate 25bps as Global Headwinds Mount

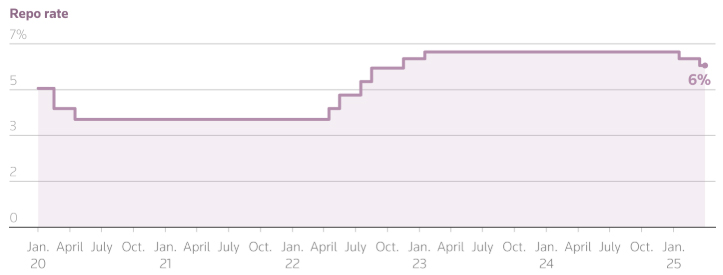

The important move of RBI aimed at supporting the Indian economy ahead of rising global concerns, the Reserve Bank of India has announced a cut in repo rate of 25 basis points, bringing it down to 6.00%. It is the second consecutive rate reduction in 2025, showing a clear change in RBI’s monetary policy stance from “neutral” to “accommodative”. Global markets troubles by intensifying trade tensions specifically the imposition of steep U.S. tariffs on China imports. The central bank is taking proactive steps to protect India from external shocks and stimulate domestic demand.

RBI rate over the period

The RBI rate cut and stance change mirror concerns about the impact of weak global growth on the Indian economy and MPC’s decision to reduce the repo rate to 6% and adopt an accommodative stance will provide cushion to the domestic economy from adverse effects of global economic instability. The rate cut comes at a time when India’s GDP growth has shown signs of slowing and the economy needed intervention to revive consumption and investment. By minimizing the cost of borrowing, the central banks plan to provide a much-needed boost to key sectors like real estate, infrastructure, and manufacturing. The MPC has also decided to cut the GDP growth rate to 6.5% in 2025-26 from 6.7% projected earlier and retail inflation is expected to be 4% in 2025-26. This decision was made amid uncertainty in the global market following the reciprocal tariffs announcement by the US president.

What are key reasons of rate cut?

The slowing domestic economic growth rate is the core reason behind the RBI rate cut decision. The GDP growth rate could fall short of earlier an expectation which is also shown by recent indicators. The GDP growth rate projections have been revised downward to 6.5% from 6.7% for FY 2025-26 because of less demand in major sectors such as consumer goods, manufacturing, and exports. If RBI doesn’t cut the interest rate, it can further dampen investment and consumption of the economy. By cutting rates central bank aims to encourage borrowing both by consumers and businesses to stimulate economic activity.

The rising global uncertainty and trade concerns turned the global economy volatile, mainly following U.S. President Donald Trump’s move to impose over 100% tariffs on Chinese goods. It is a major fear of a prolonged global trade war, which could adversely affect international supply chains. It results in reduced global trade volume and hurts export-driven economies including India. However, India is not directly involved in the U.S.-China trade war but its indirect consequences such as weak global demand and risk aversion among investors can affect Indian markets. The cut in rate by RBI is a positive step to shield India from these global headwinds by supporting domestic growth.

The slow and stable inflation is also the reason for the rate cut despite there is lot of global uncertainties but inflation in India is under control and not increasing too fast. The prices of everyday items like fuel, food, and essentials have been growing slowly and are under control. The main reason is oil prices have come down and the value of the Indian rupee is not losing quickly which helps to keep import costs low. The inflation rate is in the RBI safe zone (currently 4%) which gives freedom to RBI to lower interest rates to boost economic growth. Because prices are not rising too quickly, the RBI can safely reduce the rate without worrying about increasing the inflation rate.

The recent Union Budget introduced by the Indian government aims to boost consumption and infrastructure investment including tax cuts and public spending initiatives. The RBI rate cut and fiscal policy of the government provide synergy to economic growth. The rate cut by RBI complements government efforts by ensuring that credit becomes cheaper, allowing both businesses and households to benefit from government-driven growth opportunities. Along with this improving liquidity and credit transmission is also the reason for the rate cut. The rate cut is to improve liquidity and credit flow to the private sectors of the economy. RBI reduces the repo rate, it becomes cheaper for banks to take money from RBI. This gives banks more funds at low borrowing costs and further banks lend this money to the customers at lower interest rates it is called credit transmission. It helps directly to MSMEs to take loans for manufacturing which allows more liquidity in the economy and credit facility for infrastructure & small businesses.

Impact of RBI repo rate cut

The real estate sector is one that feels the positive impact of the rate cut by RBI. Because when RBI reduces the repo rate it’s become cheaper for banks to borrow money. As a result, banks lower the interest rates on loans making borrowing more affordable for consumers. The monthly installments are becoming more in range of customers easing the financial burden on home buyers. This encourages more people to purchase property which leads to increased demand in the real estate sector.

The FD rate (Fixed Deposit) which is offered by commercial banks has fallen after RBI reduced the repo rate. When the cost of borrowing becomes cheaper banks are now in a position where they are not required to offer high returns on fixed deposits or on saving accounts because they have easy access to borrow money at a lower rate from RBI. As a result, the interest rate on FD generally falls. The State Bank of India has reduced its rates by 10 bps for depositing below ₨ 3cr. The revised rate is 6.7% as compared to 6.8% earlier for depositing less than two years and 6.9% from 7% for depositing less than three years. Similarly, the Bank of India has reduced its FD rate to 4.25% from 4.5% earlier for depositing less than ₨ 3cr for 91 days and 5.75% from 6% for 179 days. The fall in the FD rate is expected as RBI eases in borrowing costs.

The RBI rate cut positively impact stock market because a rate cut is primarily intended to stimulate economic growth by lowering cost of borrowing which encourages spending and investment in market. The current consecutive rate by RBI will provide more inflows of capital in market which provide cushion for Indian market from global uncertainty and tariffs impacts.