Brief Introduction

The centre on Monday (December 9, 2024), announced the Appointment of Revenue Secretary Sanjay Malhotra As the 26th Governor of the reserve bank of India after Shaktikant das .A day before Office holder Governor Shaktikant das’s Six year term comes to end on Tuesday (December 10, 2024). The New RBI governor Sanjay Malhotra currently as Revenue Secretary in the Ministry of Finance will take Charge at a Challenging time with Inflation having bugbear.

Sanjay Malhotra Steps into a High Challenging Role Where as he has to Control the Increasing Inflation Rate and the RBI Follows a Framework That Target inflation rate keeping at around (4% with a margin of 2% above or below). However, rising global uncertainty and Supply side challenges (like climate and geopolitical issues) make this frame work less affective. Malhotra needs to recheck this framework, potentially allowing for more flexibility and considering both inflation and Economic Growth.

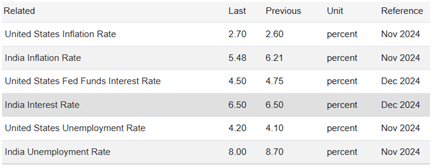

Monitory policy surely in his prime agenda as reduction in repo rate will provide relief to the business and consumer. On the other hand increasing of inflation rate will slow down the GDP Growth. The monitory Policy has taken measure actions as reducing (CRR) by 4% to Inject Rs 1.16 Lakh Cr into bank system. The rupee is in recent pressure due to stronger Dollar Index. Any monetary easing to support growth might weaken the Rupee consequently affect the imports and rise in Inflation.

Safeguarding the financial sector will also be a major Focus for new RBI governor. He should focus on Measures that balance Price stability with growth , Such as Maintaining adequate Liquidity ,ensuring smooth credit Flow to critical sectors . The Inflation rates adversely affect the Economic Growth India has made Finacial inculsion, With over 500 Million Account opened under Pradhan Mantri Jan Dhan Yojna (pmjdy) .However there stills challenges in Ensuring these Accounts are used affectively Providing better Access to credit and bridging the digital divide. Moreover he will emphasizes to support Digital banking and ensure that people are well equipped to use financial services. The financial system must be stable to support the Economic Growth- this includes ensuring the non –Banking financial Companies (NBFCs) are well regulated, addressing the risk related to all the fintech sector and preventing them into from many gaps. Malhotra Will Need to strengthen the oversight of these Institution and that they don’t pose risk to broader Financial System

Existing Challenges:-

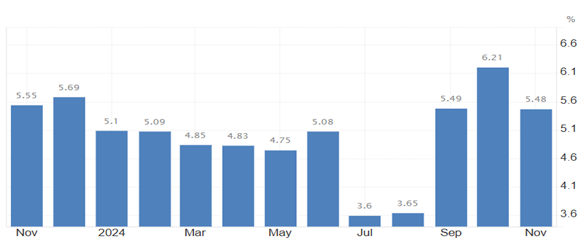

(1) Controlling Inflation: – The Inflation rate of 6.21% in October 2024, Above the RBI Comfort zone. Rising food prices will be the major cause for the same so Monitory Policy Committee aims to bring down by 4% by (FY26). This will need careful planning. As repo rates cycles begin to nose down in major democracies, a reduction in repo rate will provide major relief to economy. On the other hand reduction in reo rates will further shoot inflation rate and slow down the GDP Growth. So new governor should be looking for a fine balance and emphasizes on long term Strategies to ensure sustainable Economic growth.

(2) Stabilizing the rupee: – Indian Rupee record row due to the high market demand for Dollar and Foreign Investment. Indian Rupee is in tremendous pressure, trading at around 84.84 against the US Dollar. Any Monetary easing to support growth might weaken the Rupee, its affect the imports and increasing Inflation.

(3) Dealing With Global Issue: – Rising oil Price and external factors could impact Indian economy. So RBI Governor will need to shield Financials system from these challenges.

(4) Strengthening financial stability: – Safeguarding the financial sector will also be a Major Focus .there are some point related to this-

- Addressing cyber security risk in an increasingly digital world.

- Supporting digital growth without Compromising.

(5) Public and Market Expectation: – Governor will need to manage the public perceptions, align with political expectation and gain the financial market confidence.