Business Profile of the Saatvik Green Energy Limited

Saatvik Green Energy is a leading module manufacturer in India, with an operational capacity of about 1.8 gigawatt modules. The company is recognized for its capabilities in module manufacturing and engineering, procurement, and construction (EPC) services. The company sells solar PV modules through direct sales and distribution networks both domestic and international.

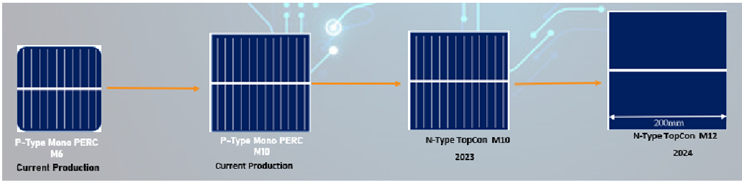

The company produces high-quality solar panels using automation, quality control measures, and environmental sustainability. They offer a comprehensive portfolio of solar module products, including monocrystalline passive emitter and rear cell (Mono PERC) and N-TopCon solar modules. The company has expanded its annual installed capacity from 125 MW in Fiscal 2017 to about 1.8 GW in Fiscal 2024

Saatvik Green Energy has a diverse customer base, including utility scale solar developers, independent power producers, commercial and industrial clients, EPC contractors, and public sector undertakings.

Saatvik Green Energy Limited IPO Objective

As per the draft red hearing prospects, the IPO issue consists only of offer for sale.

- The OFS consists of up to XXXX Equity Shares aggregating up to Rs. 3, 000 million. Nothing from those proceeds of OFS will be allotted to company.

- Saatvik Green Energy IPO offer only has fresh issue of Rs. 8, 500 million. As per DRHP document, the company aims to utilize IPO proceedings towards payment of certain borrowing at company and subsidiary level, for setting up a manufacturing plant and corporate general purposes.

| Particulars | Estimated Amount |

| Payment of certain outstanding borrowings availed by company | 123.12 |

| Investment in wholly owned subsidiary, Saatvik Solar Industries for payment of certain outstanding borrowings | 957.51 |

| Investment in Saatvik Solar Industries for setting up of a 4 GW solar PV module manufacturing facility | 5527.45 |

| General corporate purposes | XXXX |

(₹ Million)

IPO Details of Saatvik Green Energy Limited:

| IPO Open Date | N.A. |

| IPO Close Date | N.A. |

| Basis of Allotment | N.A. |

| Listing Date | N.A. |

| Face Value | ₹2 per share |

| Price | N.A. |

| Lot Size | N.A. |

| Total Issue Size | XXXX Equity shares |

| Aggregating up to ₹ 11,500.00 million | |

| Fresh Issue | XXXX Equity shares |

| Aggregating up to ₹ 8,500.00 million | |

| Offer For Sale | XXXX Equity shares |

| Aggregating up to ₹ 3,000.00 million | |

| Issue Type | Book Built Issue IPO |

| Listing At | BSE & NSE |

| QIB Shares Offered | Not more than 50% of the Net Issue |

| Retail Shares Offered | Not less than 35% of the Net Issue |

| NII (HNI) Shares Offered | Not less than 15% of the Net Issue |

Issue Price & Size: Saatvik Green Energy Limited IPO

The issue price of Saatvik Green Energy Limited hasn’t been released yet. Upon releasing the dates, the investors can bid between those price ranges. The company has both fresh issue of Rs. 850 crores as well as offer for sale of Rs. 300 crores.

Launch Date of Saatvik Green Energy Limited IPO

The IPO opening date of Saatvik Green Energy hasn’t been officially announced yet, upon the declaration of dates investor can bid for IPO.

Saatvik Green Energy Limited Financial Statements

| Particulars | Period ended June 30, 2024 | Period ended June 30, 2023 | FY24 | FY23 | FY22 |

| Revenue from operations | 2459.76 | 2335.03 | 10879.65 | 6085.88 | 4799.5 |

| Other income | 81.18 | 24.36 | 92.16 | 90..39 | 3.49 |

| Total income | 2540.94 | 2359.39 | 10971.81 | 6176.27 | 4802.99 |

| Expenses | |||||

| Cost of materials and services consumed | 1581.54 | 1842.97 | 6553.02 | 5559.25 | 3428.07 |

| Purchase of Stock-in-Trade | 582.4 | 29.05 | 2309.49 | 64.18 | 1044.49 |

| Changes in | -424.42 | 67.05 | -608.4 | -211.17 | -182.12 |

| Employee benefits expense | 79.35 | 35.08 | 170.27 | 101.26 | 76.8 |

| Finance costs | 66.47 | 32.78 | 142.32 | 105.87 | 40.27 |

| Depreciation and amortization expense | 43.46 | 11.38 | 107.39 | 66.15 | 24.66 |

| Other expenses | 316.15 | 151.51 | 978.99 | 424.09 | 288.09 |

| Total expenses | 2244.95 | 2169.82 | 9653.08 | 6109.63 | 4720.26 |

| Restated Profit before tax | 295.99 | 189.57 | 1318.73 | 66.64 | 82.73 |

| Restated Profit for the period/year | 212.45 | 139.78 | 1004.72 | 47.45 | 59.64 |

| Key Performance Indicators: | Period ended June 30, 2024 | Period Ended June 30, 2024 | FY24 | FY23 | FY22 |

| Operational | |||||

| Installed Capacity (MW) | 1742 | 440 | 1154 | 550 | 270 |

| Effective installed capacity (MW) | 320 | 97 | 566 | 510 | 240 |

| Actual production solar module (MW) | 172.08 | 85.03 | 501 | 248.6 | 2225 |

| Capacity Utilization (%) | 53.78 | 87.66 | 88.52 | 48.75 | 93.75 |

| Total Order book (in ₹ million) | 31141.79 | 13040.05 | 5599.73 | 6861.87 | 3736.67 |

| Total Order book (MW) | 2438.36 | 40.1 | 300.13 | 223.36 | 158.28 |

| Financial | |||||

| Revenue from operations | 2459.76 | 2335.03 | 10879.65 | 6085.88 | 4799.5 |

| Domestic (module sales) | 2199.03 | 2230.08 | 9663 | 6034.09 | 4215.81 |

| Export (Module Sales) | 129.78 | 35.83 | 177.91 | 46.86 | 0.04 |

| EPC and O&M services | 96.19 | 630.18 | 1601.55 | 0 | 0 |

| Export % | 5.28 | 1.53 | 1.64 | 0.77 | 0 |

| EBITDA | 405.92 | 233.73 | 1568.44 | 238.66 | 147.66 |

| EBITDA Margin | 16.5 | 10.01 | 14.42 | 392 | 3.08 |

| Restated profit for the period | 212.45 | 139.8 | 1004.72 | 47.45 | 59.64 |

| PAT Margin % | 8.36 | 5.92 | 9.16 | 0.77 | 1.24 |

| ROE % | 14.99 | 40.85 | 83.21 | 23.4 | 38.19 |

| ROCE % | 13.63 | 27.33 | 64.07 | 24.8 | 40.83 |

| Asset Turnover Ratio | 0.36 | 0.87 | 2.29 | 2.53 | 3.04 |

| Debt to equity ratio (times) | 1.8 | 3.79 | 2.18 | 7.13 | 6.53 |

| Current ratio (times) | 1.11 | 1.13 | 1.11 | 1.07 | 1.01 |

| Net working capital | 441.39 | 250.62 | 484.38 | 126.26 | 15.05 |

| Net working capital days (days) | 16.33 | 9.77 | 16.25 | 7.57 | 1.14 |

| Gross debt | 2557.97 | 1295.68 | 2634.2 | 1444.92 | 1019.76 |

Saatvik Green Energy Limited Promoters & Shareholding

As of date, there are four promoters of the company.

The promoter along with promoter group in aggregate collectively holds 73.69% of the paid-up share capital of company.

| Name of Shareholder | Number of Equity Share | % of total pre-Offer paid up Equity capital | Selling shareholders |

| Promoters | |||

| Neelesh Garg | 1,59,33,600 | 14.22 | |

| Manik Garg | 1,69,40,940 | 15.12 | |

| Manavika Garg | 10,14,000 | 0.91 | |

| SPG Trust | 4,86,71,340 | 43.44 | |

| Total | 8,25,59,880 | 73.69 | |

| Promoter Group | |||

| Parmod Kumar | 1,02,21,090 | 9.12 | Aggregating up to ₹ 1,500 million |

| Sunila Garg | 81,12,000 | 7.24 | Aggregating up to ₹ 1,500 million |

| Total | 1,83,33,090 | 16.36 | |

| Grand Total | 10,08,92,970 | 90.05 | |

Should You Subscribe to Saatvik Green Energy Limited IPO or Not

While investing or subscribing to any IPO, consider the investment rationales related to the company. Hence, here you can find out the strength of the company that will be its growth factors. And also check the risk factors that can affect the growth and operational efficiency of the company.

Competitive Strengths of Saatvik Green Energy Limited:

Quality Customer Base and Large Order Book

Saatvik Green Energy offers competitive pricing for its products, allowing them to access a large and diverse customer base and generate revenue. We have a presence in various segments and geographies, including manufacturing, automobile, cement, real estate, steel, energy, telecommunications, and infrastructure. They have a substantial order book of solar modules, with a total order book of Rs. 32,141.79 million as of June 30, 2024. This provides revenue certainty, diversification, and reduces risk associated with key customer loss, ensuring business continuity and sustainable growth.

| Customers | 3-Mon ended June 30, 2024 | 3-Mon ended June 30, 2023 | FY24 | FY23 | FY22 |

| Percentage of Revenue from Operations (%) | |||||

| Top one Customer | 22.69 | 18.3 | 13.6 | 18.95 | 49.8 |

| Top 5 Customer | 47.07 | 59.89 | 46.06 | 61.05 | 75.15 |

| Top 10 Customer | 61.77 | 75.74 | 63.86 | 79.38 | 84.08 |

| Period of Relationship | |||||

| 5 to 10 years | 0.31 | 0.09 | 0.1 | 0.03 | 0.07 |

| 1 to 5 years | 1.28 | 1.03 | 1.69 | 12.35 | 53.68 |

Leading Module Manufacturing Companies in India

The company is a leading integrated player in module manufacturing, EPC, and O&M services in India, with 69.12 MW of an installed EPC base in FY24. Its in-house capabilities include manufacturing, private labelling, scale production, technical support, customer service, and quality control. The company offers a seamless combination of products and services, ensuring consistent performance across every stage of their solar and EPC projects. As of June 30, 2024, the company had 12 commissioned and contracted solar power projects with an aggregate capacity of 69.12 MW.

The company's central location provides excellent connectivity to key markets across North, Central, West, and East India. This has resulted in the company becoming one of the largest module manufacturers in North India, supported by the proliferation of industries in the National Capital Region, Uttarakhand, Western Uttar Pradesh, Haryana, and Madhya Pradesh.

Innovative Technology Solutions

They invest in advanced manufacturing techniques and materials to offer efficient, durable, and cost-effective solutions. The company's strength lies in its flexibility in adopting technology within the solar industry. They use advanced technologies like half-cut, MBB, and circular-ribbon modules within N-TopCon technology, offering dual glass modules with customizable options. Their focus on design and technology enhancement is complemented by rigorous quality testing, ensuring sustainability.

They have consistently advanced their solar module offerings, starting with M2 Mono PV modules in 2018 and transitioning to Mono PERC modules in 2020. This customer-centric approach reinforces their position as a trusted partner in the renewable energy transition.

Well-positioned to capitalize on industry tailwinds through multiple sales and revenue channels

The company is strategically positioned to capitalize on favorable industry tailwinds, with approximately 60 GW capacity added over the last five years. The company's strengths lie in its in-house capabilities, such as a large installed capacity of up to about 1.8 GW, production of modules of up to 625 Wp, and ALMM-approved modules. They prioritize flexibility, quality control, and tailored solutions, strong relationships with clients and partners, and confidentiality in strategic planning.

The company focuses on catering to various market segments, from individual consumers to large-scale industrial and utility clients. They employ multiple sales and revenue channels to drive business growth and establish their prominence in the solar industry. They have established a network of channel partners and authorized distributors across India, expanding their market reach and increasing sales.

The company has an extensive network consisting of resellers, distributors, and channel partners across India, ensuring solar products are widely available and easily accessible. Their distribution and retail footprint in India has been a key strength, and they have grown their network over the years by leveraging their extensive knowledge of the solar industry ecosystem and their relationship with stakeholders.

Future plans

- Backward integration into cell manufacturing for long-term growth, sustainability, margin expansion, cost saving, etc.

- Implementing junction box manufacturing, manufacturing line for ethylene vinyl acetate, polyolefin elastomer, expanded polyethylene films, frame manufacturing, and a PV ribbon.

- Establish a new 4.80 GW integrated cell and 4.0 GW module manufacturing facility in Odisha.

- Offer bundled solutions including EPC services and O&M support.

- Expand customer base in India and internationally, entering new markets and strengthening existing ones.

- Prioritize R&D to stay at the forefront of technological advancement.

- Optimize supply chain and expand distribution network across India.

Risk Factors of Saatvik Green Energy Limited:

Client concentration

As can be seen from table below, the company is dependent on its top customers for generating significant portion of its revenue from operations. Share of top client has been increasing year over year, whereas top five customers share have been decreasing but still occupy a significant portion. As per draft, the contracts with these customers can be terminated with or without cause leaving company vulnerable.

| Particular | For 3-Mon ended June 30, 2024 | For 3-Mon ended June 30, 2023 | FY24 | FY23 | FY22 |

| Percentage of Revenue from Operations (%) | |||||

| Revenue from top one customer | 22.69% | 18.30% | 13.60% | 18.95% | 49.80% |

| Revenue from top five customers | 47.07% | 59.89% | 46.06% | 61.05% | 75.15% |

| Revenue from top 10 customers | 61.77% | 75.74% | 63.86% | 79.38% | 84.08% |

Product concentration

The company manufactures Mono PERC and N-TopCon solar modules, available in mono-facial and bifacial options for various applications, including the commercial sector. The company's segmented income is affected by changes in solar module demand, which is influenced by factors like energy supply, reliability of solar power, resource availability, raw material price volatility, and government incentives. The company's productivity, business prospects, and future financial performance may be adversely affected if demand for solar solutions weakens. As can be from table below, the company generated significant portfolio of its revenue from sale of Mono PERC modules. The revenue streams keep on adjusting at interval of some periods.

| Particular | For 3-Mon ended June 30, 2024 | For 3-Mon ended June 30, 2023 | FY24 | FY23 | FY22 |

| Percent age of Revenue from Operations | |||||

| Income from the sale of Mono PERC modules | 78.31% | 92.67% | 86.72% | 71.72% | 0.68% |

| Income from the sale of poly modules | - | 4.37% | 3.54% | 28.20% | 87.16% |

| Income from the sale of N-TopCon solar modules | 16.30% | - | 0.17% | - | - |

Raw material

The company sources is dependent upon raw material for manufacturing of its products. the prices of raw material varies with the changing macroeconomic condition and in the time of war, and rising conflicts the prices of raw materials can become extremely volatile. The manufacturing process involves purchasing raw materials like solar PV cells, backsheet, encapsulant, and glass. Thas can be seen from table, the raw material contributes to nearly 75% of their expenses and factors outside their control, such as economic conditions, competition, and supply, can adversely affect the business and financial condition.

| Particular | For 3-Mon ended June 30, 2024 | For 3-Mon ended June 30, 2023 | FY24 | FY23 | FY22 |

| Percentage of Total Purchases (%) | |||||

| Cost of raw materials and services consumed | 75.32% | 107.11% | 71.75% | 101.90% | 66.15% |

The company's competitiveness, cost-effectiveness, and profitability are largely dependent on company’s ability to source and maintain a stable supply of materials. The data in table below shows the composition concentration of top suppliers in previous periods.

| Particular | For 3-Mon ended June 30, 2024 | For 3-Mon ended June 30, 2023 | FY24 | FY23 | FY22 |

| Percentage of Total Purchases (%) | |||||

| Largest supplier | 9.54 | 21.67 | 8.26 | 15.24 | 15.14 |

| Top 5 suppliers | 24.29 | 42.52 | 26.48 | 38.82 | 47.22 |

| Top 10 suppliers | 34.84 | 60.08 | 38.85 | 55.49 | 64.84 |

Import of component

The company has imported various crucial component used in the manufacturing in previous periods. Any restrictions from the government, state, governmental authorities on imports from China and other jurisdictions may negatively affect the company's business operations and prospects.

| Particular | For 3-Mon ended June 30, 2024 | For 3-Mon ended June 30, 2023 | FY24 | FY23 | FY22 |

| Percentage of Total Purchases (%) | |||||

| Purchase of imported raw materials and services | 47.12% | 71.90% | 46.27% | 56.67% | 55.06% |

Trade receivables

Companies in order to boost its sales usually give merchandise on credit. The action opens them to counter party credit risk. Data in the table mentioned below shows the trade receivables data. Trade receivables has been on a rise in recent past and sudden spike in trade receivables turnover days to over 50 days sounds like alarming. Delays in receiving payments or non-receipt could negatively impact our business, results, and cash flows.

| Particular | For 3-Mon ended June 30, 2024 | For 3-Mon ended June 30, 2023 | FY24 | FY23 | FY22 |

| Trade Receivables | 952.78 | 799.55 | 1767.45 | 209.21 | 109.15 |

| Trade receivables turnover days | 50.32 | 19.66 | 33.16 | 9.55 | 8.71 |

| Allowance for doubtful or bad debts | 2.46 | 2.06 | 2.46 | 2.06 | 2.06 |

Saatvik Green Energy Limited Grey Market premium

Grey market premium is the premium quoted over the IPO issue price. GMP shows that investors are ready to pay above the upper band of the IPO issue price. GMP is determined in the grey market as per the demand and supply of the shares in the primary market. A grey market is that unofficial ecosystem of unlisted companies' stocks that start trading even before the launch of the IPO to the date of its listing.

Also Read: What is Grey Market Premium in IPO: How is GMP Calculated & Reliable

However, GMP is not a reliable factor, as it keeps fluctuating as per the demand and supply of shares in the primary market. There are numerous factors that affect the stock market in India and individual stock prices of different companies that are already listed and trading in the secondary market. However, for an IPO-bounded company, you can consider the GMP as the speculative listing price of the share

According to various online sources, the Grey Market Premium or GMP of the Saatvik Green Energy Limited is trading around Rs XX in the grey market. It means shares are trading at the upper band issue price of Rs XX with a premium in the grey market and may list around the same price.