Business Profile of the Sambhv Steel Tubes Limited 217

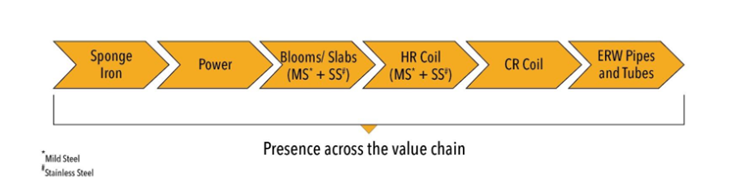

Sambhv Steel Tubes is a leading manufacturer of electric resistance welded steel pipes and structural tubes in India, with a single location backward integrated manufacturing facility. They manufacture a range of finished products, including ERW black pipes and galvanized iron pipes, using intermediate products like sponge iron, blooms/slabs, and hot-rolled coil. They are one of the two players in India manufacturing ERW steel pipes and tubes using narrow-width HR coil. The company’s integrated manufacturing facility in Chhattisgarh is equipped with advanced technology and production processes, allowing them to respond swiftly to market demand.

They have continuously expanded their manufacturing capacity and at present has a total installed capacity of 1,122,400 MTPA and 1,540,000 MTPA of high-quality steel products. The company has a wide distribution network of 33 distinct distributors, distributing their products through over 600 dealers in India. They have a market share in the domestic ERW pipes segment in India of approximately 2.00% in terms of sales volume. The company’s focus on sustainable captive power generation maximizes energy efficiency and reduces environmental impact.

The company plans to expand its product portfolio to include additional value-added products, such as galvanized coils, pre-galvanized pipes, cold-rolled full hard pipes, and stainless steel HR annealed and pickled coils.

Sambhv Steel Tubes Limited IPO Objective

As per the draft red hearing prospects, the IPO issue consists only of offer for sale.

- The OFS consists of up to XXXX Equity Shares aggregating up to Rs. 1, 000 million. Nothing from those proceeds of OFS will be allotted to company.

- Sambhv Steel Tubes IPO offer only has fresh issue of Rs. 4, 400 million. As per DRHP document, the company aims to utilize IPO proceedings towards payment of certain outstanding borrowings availed by company and corporate general purposes.

| Particulars | Estimated Amount |

| Payment of certain outstanding borrowings availed by company | 3900 |

| General corporate purposes | 500 |

(₹ Million)

IPO Details of Sambhv Steel Tubes Limited:

| IPO Open Date | Wed, Jun 25, 2025 |

| IPO Close Date | Fri, Jun 27, 2025 |

| Basis of Allotment | NA |

| Listing Date | Wed, Jul 2, 2025 |

| Face Value | ₹10 per share |

| Price | ₹77 to ₹82 per share |

| Lot Size | 182 Shares |

| Total Issue Size | 6,58,53,657 shares |

| (aggregating up to ₹540.00 Cr) | |

| Fresh Issue | 5,36,58,536 shares |

| (aggregating up to ₹440.00 Cr) | |

| Offer For Sale | 1,21,95,121 shares of ₹10 |

| (aggregating up to ₹100.00 Cr) | |

| Issue Type | Book Built Issue IPO |

| Listing At | BSE & NSE |

| QIB Shares Offered | Not less than 50% of the Net Offer |

| Retail Shares Offered | Not more than 35%of the Net Offer |

| NII (HNI) Shares Offered | Not more than 15% of the Net Offer |

Issue Price & Size: Sambhv Steel Tubes Limited IPO

The issue size of the IPO has been declared and the overall issue size of the IPO is Rs 540.00 Cr, out of which 5,36,58,536 Equity Shares, aggregating up to Rs 540.00 cr, comprise of fresh issuance, and the remaining Rs 100.00 Cr will be offered for sale by shareholders.

Launch Date of Sambhv Steel Tubes Limited IPO

Sambhv Steel Tubes IPO will be open on Jun 25, 2025and close on the Jun 27, 2025. All types of investors can bid between these dates through their eligible categories.

Sambhv Steel Tubes Limited Financial Statements

| Particulars | FY24 | FY23 | FY22 |

| Income | |||

| Revenue from operations | 12875.57 | 9372.2 | 8193.49 |

| Other income | 36.18 | 17.84 | 14.04 |

| Total income | 12891.75 | 9390.04 | 8207.53 |

| Expenses | |||

| Cost of materials consumed | 8287.16 | 6700.23 | 6344.5 |

| Purchases of stock-in-trade | 1056.93 | 569.19 | 135.44 |

| Changes in inventories of stock-in-trade and finished goods | -142.25 | -302.41 | -281.87 |

| Employee benefits expense | 571.33 | 414.61 | 234.65 |

| Finance costs | 318.15 | 218.16 | 191.24 |

| Depreciation and amortization expense | 209.1 | 161.51 | 101.2 |

| Other expenses | 1485.68 | 817.58 | 515.62 |

| Total expenses | 11786.1 | 8578.87 | 7240.78 |

| Profit before tax | 1107.65 | 811.17 | 966.75 |

| Profit for the year | 824.39 | 603.83 | 721.08 |

| Key performance indicators | FY24 | FY23 | FY22 |

| Revenue from operations | 12857.57 | 9372.2 | 8193.49 |

| Revenue growth (in %) | 37.19 | 14.39 | – |

| Total Income | 12893.75 | 99390.04 | 8207.53 |

| Gross Profit | 3655.73 | 2405.19 | 1995.42 |

| Gross Profit Margin (%) | 28.43 | 25.66 | 24.35 |

| EBITDA | 1598.72 | 1173 | 1245.15 |

| EBITDA Margin (in %) | 12.43 | 12.52 | 15.2 |

| EBIT | 1425.8 | 1029.33 | 1157.99 |

| EBIT Margin (in %) | 11.09 | 10.98 | 14.13 |

| Profit After Tax | 824.39 | 603.83 | 721.08 |

| Profit After Tax Margin (in %) | 6.41 | 6.44 | 8.8 |

| Return on Equity (RoE) (in %) | 25.42 | 33.57 | 63.65 |

| Return on Capital Employed (in %) | 17.66 | 20.2 | 28.9 |

| Cash Profit | 1033.49 | 765.34 | 822.28 |

| Debt | 3505.4 | 2850.53 | 2416.4 |

| Debt/ Equity | 0.8 | 1.35 | 1.62 |

| Debt/ EBITDA | 2.19 | 2.43 | 1.94 |

| Interest coverage ratio | 4.48 | 4.72 | 6.06 |

| Fixed Asset Turnover Ratio | 3.82 | 3.19 | 3.48 |

| Working Capital Days | 41 | 57 | 47 |

| Cash Flow from Operations | 1424.28 | 655.52 | 344.95 |

| Operating Cash flow to EBITDA | 0.89 | 0.56 | 0.28 |

| Sales volumes by product segment (MTPA) | |||

| Sponge Iron (MTPA) | 2125.26 | 7941.08 | 14157.06 |

| Blooms/Slabs (MTPA) | 31096.37 | 42122.22 | 53892.98 |

| HR Coils (MTPA) | 4977.29 | 42303.08 | 89334.11 |

| ERW Pipes and Tubes (MTPA) | 179374.15 | 64780.21 | – |

| GI Pipes (MTPA) | 5688.54 | 906.93 | – |

| Total sales volumes (MTPA) | 223261.61 | 158053 | 157384.2 |

| Volume growth (in %) | 41.26 | 0.43 | Nil |

| EBITDA per ton (in Rs) | 7160.7 | 7421.54 | 7911.47 |

| Sales value by product segment | |||

| Sponge Iron | 64.46 | 273.78 | 451.67 |

| Blooms/Slabs | 1363.51 | 2026.47 | 2252.16 |

| HR Coils | 245.96 | 2569.11 | 5023.95 |

| ERW Pipes and Tubes | 9448.15 | 3569.37 | Nil |

| GI Pipes | 392.44 | 65.42 | Nil |

| Total sales value | 11514.52 | 8504.15 | 7727.78 |

Sambhv Steel Tubes Limited Promoters & Shareholding

As of date, there are two promoters of the company.

The promoter along with promoter group in aggregate collectively holds 79.15% of the paid-up share capital of company.

| Name of Promoters | Pre-Offer Equity shares held | % of the Equity Share capital |

| Promoter | ||

| Brijlal Goyal | 1,85,36,250 | 7.69 |

| Suresh Kumar Goyal | 1,85,36,250 | 7.69 |

| Vikas Kumar Goyal | 1,85,36,250 | 7.69 |

| Sheetal Goyal | 1,90,88,660 | 7.92 |

| Shashank Goyal | 69,62,340 | 2.89 |

| Rohit Goyal* | 74,40,000 | 3.09 |

| Total | 8,90,99,750 | 36.97 |

| Name of Promoter Group | ||

| Suman Goyal | 1,91,13,660 | 7.93 |

| Kaushlya Goyal | 1,90,88,660 | 7.92 |

| Ashish Goyal | 1,85,35,850 | 7.69 |

| Manoj Kumar Goyal | 1,20,50,100 | 5 |

| Goyal Realty & Agriculture Private Limited | 76,00,000 | 3.15 |

| Harsheet Goyal | 73,78,000 | 3.06 |

| Ayush Agrawal | 1,00,000 | 0.04 |

| Raj Agrawal | 1,00,000 | 0.04 |

| Manoj Goyal & Sons (HUF) | 10,100 | Negligible |

| Goyal & Sons (HUF) | 10,000 | Negligible |

| Suresh Kumar Goyal & Sons (HUF) | 10,000 | Negligible |

| Vikas Kumar Goyal & Sons (HUF) | 10,000 | Negligible |

| Ashish Kumar Goyal (HUF) | 10,000 | Negligible |

| Total | 8,40,16,370 | 34.83 |

Should You Subscribe to Sambhv Steel Tubes Limited IPO or Not

While investing or subscribing to any IPO, consider the investment rationales related to the company. Hence, here you can find out the strength of the company that will be its growth factors. And also check the risk factors that can affect the growth and operational efficiency of the company.

Competitive Strengths of Sambhv Steel Tubes Limited:

Backward integrated manufacturing facility

Sambhv Steel Tubes is the only Indian manufacturer of ERW steel pipes and tubes with a single location backward integrated manufacturing facility. The facility produces intermediate products such as sponge iron, mild steel blooms/slabs, and HR coils, which are used for captive consumption in manufacturing final products like ERW black pipes and tubes, galvanized pipes, and steel door frames.

The company has undertaken forward integration initiatives to produce value-added finished products using in-house raw materials, resulting in cost advantages. The company has also added GI pipes to its product portfolio. The Sarora (Tilda) Facility is supported by a captive power plant with an installed capacity of 25 MW, resulting in increased cost savings.

Strategically located manufacturing plants

The company manufactures ERW black steel pipes and structural tubes at its Sarora (Tilda) Facility in Chhattisgarh. The facility is strategically located near key raw material suppliers, which produces India’s highest grade of iron ore, and the largest coal producer in India. This strategic proximity optimizes logistics and ensures a steady supply chain. The company also produces sponge iron, a key input in its production value chain. The facility is well connected by roads and railways, making it a logistics and distribution hub in Chhattisgarh. This strategic location minimizes logistics complexities and ensures timely delivery and superior service to customers.

Innovation and execution capabilities

The company began operations in 2018 with sponge iron manufacturing and has since expanded to include value-added pipe and tube products. They are the only company in India producing narrow-width HR coils through a secondary manufacturing route using induction furnaces and direct reduced iron (DRI). Other key process innovation techniques include the manufacture of stainless steel through argon oxygen decarburization (AOD) and alloy steel through ladle refining. The company also uses a WHRB-based power plant for power generation and an AFBC-based power plant for combustion of low-quality fuel generated during sponge iron manufacturing.

Through process innovation, the company has produced customized value-added products, such as GI pipes with advanced threading and single and double door frames. They recently supplied corten steel, a steel alloy that resists corrosion and is used primarily for container manufacturing in marine transport.

Distribution network across India

As of recent financial year, the company has 33 distributors, including two distributing through six branches in 15 states and one union territory. These distributors distribute finished products to over 600 dealers in India, providing a competitive advantage. The company has expanded its distribution network to include construction and infrastructure companies, government organizations, and original equipment manufacturers (OEMs). The company has been strengthening its position in West India and North India. Distributors in North India have been increased from 3 in FY23 to 17 in FY24. While, west India distributor has increased from 10 to 12, but share of revenue has jumped from 11% in FY23 to over 30% in FY24.

| Geography | Number of Distributors | Fiscal 2024 |

| (As of March 31, 2024) | % of Revenue from Operations | |

| West India | 12 | 30.05 |

| North India | 17 | 21.96 |

| East India | 8 | 7.53 |

| South India | 8 | 1.82 |

Future plans

- Increase in installed capacity over the years

- Committed to commissioning a greenfield manufacturing facility in Village – Kesda, District Baloda Bazar Bhatapara, Chhattisgarh.

- Increase distributor network in coastal States and certain other States

- Plans to expand international footprint.

- Diversifies the revenue base and expands the geographical footprint

- Develop new value-added products and focus on customization.

- Achieve higher operational efficiencies and cost optimization.

Risk Factors of Sambhv Steel Tubes Limited:

Under-utilization of capacities

Capacity utilization plays an important role in yielding profits and maintaining operational efficiency. Capacity utilization can by affected by factors such as product mix, volatile customer demand, uninterrupted operations, overhead costs, and manufacturing costs. The company has one operational manufacturing facility in Sarora (Tilda), Raipur, Chhattisgarh, with an installed capacity of 1,540,000 MTPA as of Sep, 2024. It plans to operationalize a second facility in Kuthrel, Raipur, Chhattisgarh, and commission a greenfield facility in Chhattisgarh. The company’s installed capacity of blooms/slabs has increased to 360,000 MTPA due to a change in product mix.

| Particular | Installed capacity | Capacity utilization | |||||

| Sep 20, 2024 | FY24 | FY23 | FY22 | FY24 | FY23 | FY22 | |

| Sponge iron | 280000 | 105000 | 105000 | 90000 | 114.67 | 111.32 | 120.16 |

| Bloom/ slabs (mild steel) | 300000 | 317400 | 231000 | 150000 | 82.57 | 94.52 | 110.4 |

| Bloom/ Slabs with argon oxygen decarburization process (Stainless Steel) | 60000 | – | – | – | – | – | – |

| HR coil (mild steel) | 390000 | 350000 | 350000 | 150000 | 58.71 | 54.63 | 102.66 |

| HR coil (Stainless Steel) | 60000 | – | – | – | – | – | – |

| ERW and GI pipes | 350000 | 250000 | 250000 | – | 74.04 | 41.78 | – |

| Cold rolled coils (Mild Steel) | 10000 | 100000 | 100000 | – | – | – | – |

| Total Installed Capacity (MTPA) | 1540000 | 1122400 | 1036000 | 390000 | – | – | – |

| Power | 25 MW | 15 MW | 15 MW | 15 MW | 90.11% | 92.71% | 91.44% |

Raw material

The company relies on third-party suppliers for raw materials such as iron ore, coal, iron ore pellets, sponge iron, and mild steel scrap. The expansion of the Sarora facility has increased the demand for these materials, potentially affecting the company’s ability to pass through raw material costs. Any increase in raw material prices could strain the company’s working capital, requiring additional funds to procure raw materials at higher prices.

| Particulars | FY24 | FY23 | FY22 |

| Cost of raw materials consumed | 8287.16 | 6700.23 | 6344.5 |

| Cost of raw materials consumed (as a % of revenue from operations) | 64.45 | 71.49 | 77.43 |

The company primarily sources its raw materials from key suppliers, such as Navratna PSU, Godawari Power and Ispat Limited, Sarda Energy and Minerals Limited, and Shyam Metalics and Energy Limited. The company may also need to replace suppliers if their products do not meet safety, quality, or performance standards. The absence of long-term supply contracts may lead to risks such as termination of supply, price volatility, and disruptions in procurement. As can be seen from table below, the company has diversified its suppliers and reduced share of its top suppliers as compared to total from 25 in FY22 to around 14%. Its shares of top 10 suppliers has also reduced from 63% in fy22 to 48% in FY24.

| Particulars | FY24 | FY23 | FY22 |

| Percentage of raw materials consumed | |||

| Top supplier | 13.91 | 14.7 | 25.4 |

| Top five suppliers | 36.74 | 42.59 | 56.01 |

| Top 10 suppliers | 48.61 | 55.82 | 62.91 |

Revenue concentration

The company relies heavily on revenue from selling products like electric resistance welded black pipes and galvanized iron pipes. Any shift in demand, customer reliance on other suppliers, or technological changes could negatively impact the company’s business fundamentals and overall financial condition. Future success depends on diversifying revenue stream and reducing access concentration on any product line through feedbacks and R&D. The company plans to introduce other value-added products, but cannot guarantee market acceptance or anticipate future technological and regulatory changes.

| Particular | FY24 | FY23 | FY22 |

| % of revenue from operations | |||

| Intermediate products | |||

| Blooms / Slabs | 11.62 | 23.08 | 27.49 |

| HR coils | 2.1 | 29.27 | 61.32 |

| Sponge iron | 0.55 | 3.12 | 5.51 |

| Finished products | |||

| ERW black pipes and tubes (hollow section) | 79.12 | 40.66 | – |

| GI pipes | 3.34 | 0.75 | – |

| Steel door frames | 1.41 | – | – |

Manufacturing units

The prospectus outlines the company’s operational manufacturing facilities in Sarora (Tilda), Raipur, Chhattisgarh, and plans to operationalize a second facility in Raipur, Chhattisgarh. The company’s manufacturing operations are reliant on government policies, which could adversely affect their business operations and overall financials. The concentration of operations in Chhattisgarh increases exposure to adverse developments related to regulation, economic changes, and natural disasters. Other than government policies, the company utilizes various inputs like power, water resources and any disruption in frequent supply of these inputs can lead to disruption in operations. Any interruption in production may require significant capital expenditure, negatively affecting profitability and cash flows.

Geographic concentration

Company’s products were distributed by 33 distributors in 39 Indian states and one union territory. A significant portion of sales value in FY24 came from north and west India. Their operations are susceptible to local and regional factors, such as economic and weather conditions and other unforeseen events. As part of company’s strategy, they plan to increase distributor network in coastal States and certain other States, such as Kerala, Tamil Nadu, Andhra Pradesh, Telangana, Karnataka, Goa, and Delhi.

Reliance on distributors and direct customers

The company relies heavily on distributors and direct customers to sell its finished products, including ERW black pipes and tubes (hollow section) and GI pipes. The company also supplies its products to steel manufacturers, construction and infrastructure companies, and government organizations. The company’s distribution network is limited, and any events that could adversely impact sales could include failure to maintain relationships with existing distributors, failure to establish relationships with new distributors, reduced orders, or disruption in delivery. Any slowdown in housing or construction activity could lead to slowdown in sector. As can be seen from able, revenue from top customer has been consolidating but revenue from top 5, 10 customers has been raising y-o-y.

| Particulars | FY24 | FY23 | FY22 |

| Percentage of revenue from operations | |||

| Top customer | 8.66 | 9.33 | 6.08 |

| Top five customer | 30.74 | 27.63 | 26.44 |

| Top 10 customer | 49.46 | 39.81 | 41.06 |

Seasonality

Steel prices fluctuate due to factors like raw material availability, demand, production, capacity, volume of imports/exports, transportation costs, and social and political factors. Low steel prices can negatively impact the industry’s results, resulting in lower revenue and margins. The volatility of the steel and steel products industry can become unpredictable, and major downturns can have a material effect on profitability. Apart from seasonality, product quality is crucial, and failure to maintain or enhance it could have a material adverse effect on business fundaments and financial condition. Also, issues with the products quality could result in potential product liability claims and reduced demand.

Sambhv Steel Tubes Limited Grey Market premium

Grey market premium is the premium quoted over the IPO issue price. GMP shows that investors are ready to pay above the upper band of the IPO issue price. GMP is determined in the grey market as per the demand and supply of the shares in the primary market. A grey market is that unofficial ecosystem of unlisted companies’ stocks that start trading even before the launch of the IPO to the date of its listing.

Also Read: What is Grey Market Premium in IPO: How is GMP Calculated & Reliable

However, GMP is not a reliable factor, as it keeps fluctuating as per the demand and supply of shares in the primary market. There are numerous factors that affect the stock market in India and individual stock prices of different companies that are already listed and trading in the secondary market. However, for an IPO-bounded company, you can consider the GMP as the speculative listing price of the share

As per the sources, the GMP of Sambhv Steel Tubes is not started in grey market, wait for the IPO announcement. Stay tuned for the latest IPO GMP numbers of Sambhv Steel Tubes IPO.