In today’s market conditions, retail investors are playing a vital role in indirectly supporting the stock market. The short answer is through mutual funds. The mutual fund industry has witnessed a multifold jump in monthly contributions. If we make a comparison of monthly inflows from 2016 with today’s inflows, the increase has been six times, from 3300 crores in 2016 to Rs. 19000 crores in March 2024. As the Indian economy stands strong with a good economic number, retail participants are doubling down on their bets and taking stock markets to higher levels. Today, mutual funds have about 8.20 crore SIP accounts through which investors regularly invest.

| Month | SIP Contribution Rs. crore | ||

| FY 2023-24 | FY 2022-23 | FY 2016-17 | |

| Total during FY | 199219 | 155972 | 43,921 |

| March | 19,271 | 14,276 | 4,335 |

| February | 19,187 | 13,686 | 4,050 |

| January | 18,838 | 13,856 | 4,095 |

| December | 17,610 | 13,573 | 3,973 |

| November | 17,073 | 13,306 | 3,884 |

| October | 16,928 | 13,041 | 3,434 |

| September | 16,042 | 12,976 | 3,698 |

| August | 15,814 | 12693 | 3,497 |

| July | 15,245 | 12,140 | 3,334 |

| Jun | 14,734 | 12,276 | 3,310 |

| May | 14,749 | 12,286 | 3,189 |

| April | 13,728 | 11863 | 3,122 |

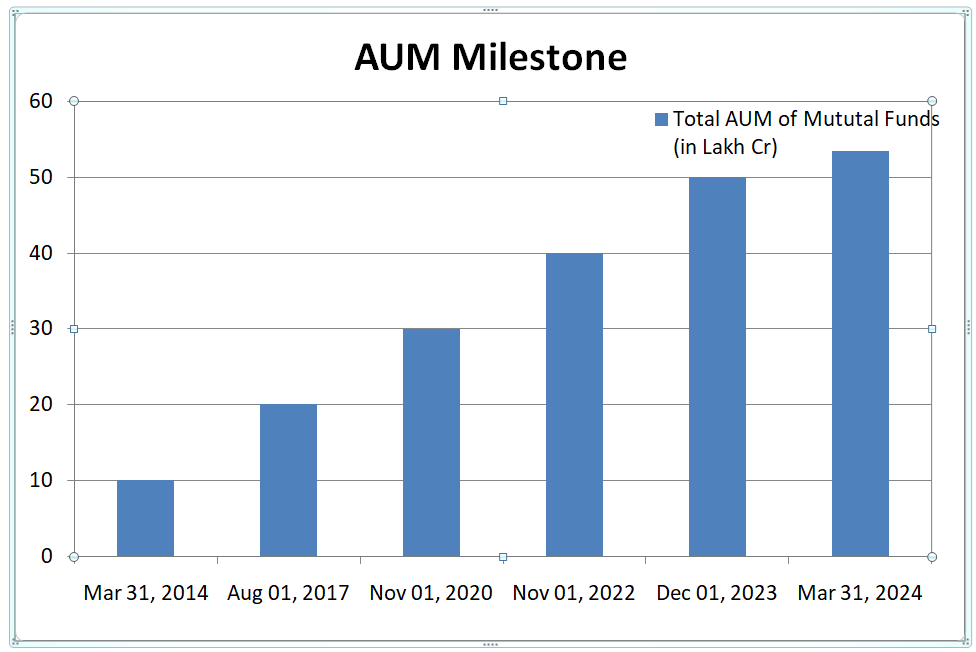

The assets under management (AUM) of the Indian MF industry have grown marvelously over years, from Rs. 8.25 trillion as of March 31, 2014, to Rs. 53.40 trillion as of March 31, 2024. As of March 31, 2024, the AUM of the Indian Mutual Fund Industry stood at Rs. 53,40,195 crore.

As people have seen a return from the stock market, sentiment has started to change to invest and grow with Dalal Street. During 2013, 57% of household savings were parked with banks, and only 0.8% of household savings were in the form of mutual funds. Fast forward to 2023, and the share of household savings in the form of bank deposits can come down significantly to about 37%, while the share of household savings in mutual funds has increased to 6.1%. As more citizens enter formal sector employment, provident and pension funds’ share of household savings has increased from 14.7% in 2013 to 22.4% in 2023. As citizens come closer to the formal sector of employment and become more knowledgeable, SIP numbers, new accounts, and their share in such investment domains are set to rise further. With the advent of discount books and the spreading of awareness about “Mutual Funds Shi Hai,” describing the benefits has resulted in the addition of news registers year over year. From FY 203 to FY24, the industry has seen addition of about 70 lakh people or a 18% growth in new investors.

| Year | Investor count | Number of investors added YOY | Increase YOY |

| Mar-24 | 4,45,88,450 | 69,04,951 | 18% |

| Mar-23 | 3,76,83,499 | 40,18,409 | 12% |

| Mar-22 | 3,36,65,090 | 1,09,03,909 | 48% |

| Mar-21 | 2,27,61,181 | 19,61,995 | 9% |

| Mar-20 | 2,07,99,186 | – | – |

Midcap and small cap segment have out-performed the benchmarks in past 2 years with sectors including public sector enterprises, defence, and pharmaceuticals performing well because of manufacturing and made I Indian initiative by government. Nifty small cap index and Midcap index has given 75% and 57% return over 1 year timeframe.

Following is the return of various categories

| CATEGORY | 1 WEEK% | 1 MONTH% | 3 MONTHS% | 6 MONTHS% | 1 YEAR% | 3 YEARS% | 5 YEARS% |

| Equity Theme – Infrastructure | -0.67 | 9.1 | 10.97 | 30.56 | 66.92 | 35.36 | 24.5 |

| Equity – Auto | -1.02 | 6.62 | 11.76 | 25.26 | 57.96 | 29.25 | 19.21 |

| Equity – Media | -0.75 | 4.72 | 4.44 | 17.49 | 40 | 26.21 | 21.98 |

| Equity – Tax Planning | -1.34 | 5.01 | 4.49 | 17.33 | 39.85 | 22.78 | 18.75 |

| Equity – Diversified | -1.41 | 5.26 | 5.11 | 18.91 | 43.22 | 22.66 | 19.07 |

| Equity Theme – Natural Resources | -1.03 | 8.48 | 11.18 | 27.14 | 45.02 | 22.23 | 22.55 |

| Exchange Traded Funds (ETFs) | -2.24 | 3.05 | 4.86 | 17.65 | 36.58 | 18.91 | 15.45 |

| Equity – Index | -1.97 | 3.9 | 4.4 | 20.03 | 43.5 | 18.82 | 14.63 |

| Equity – Banking | -1.91 | 3.79 | 2.48 | 11.28 | 27.27 | 18.59 | 12.96 |

| Equity Theme – Shariah | -2.31 | 2.14 | 2.17 | 15.45 | 40.66 | 18.4 | 18.29 |

| Equity – FMCG | -2.42 | -1.06 | -4.43 | -1.11 | 12.26 | 17.54 | 13.1 |

| ETF – RGESS | -1.73 | 1.92 | 3.27 | 15.09 | 29.63 | 17.24 | 15.01 |

| Equity – Infotech | -3.27 | -2.26 | -3.01 | 13.56 | 39.49 | 16.44 | 23.19 |

| Equity – Pharma | -1.81 | 2.31 | 4.93 | 21.9 | 49.15 | 15.98 | 23.01 |

| Fund of Funds – Equity | -2.24 | 1.57 | 5.16 | 16.15 | 28.78 | 14.01 | 14.97 |

| Global Funds – Foreign Equity | -3.87 | -2.97 | 4.05 | 15.74 | 19.84 | 6.35 | 11.08 |

| Global Funds – Foreign FOF | -2.77 | -1.3 | 4.33 | 10.81 | 8.44 | 1.05 | 7.62 |

If you are a regular investor and want to find a fund that could give you maximum return on your savings, then the Moneysukh Market section is made for you. You can check fund performance of various schemes, based on sector, stocks that are added in that fund, recent exit and entry and many more criteria to make you choose between so many.