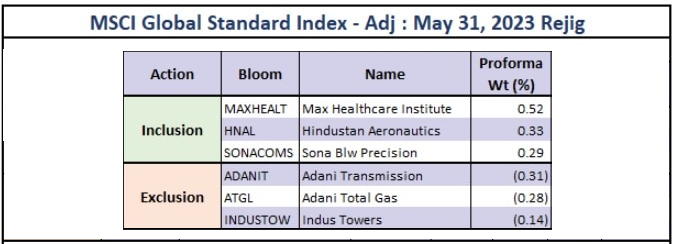

The latest MSCI Global Standard Index rejig will take effect on May 31st, with three stocks added and three removed. Two of the three stocks that will be excluded belonged to the Adani Group. Adani Total Gas (ATGL) and Adani Transmission (ADANITRANS) will be removed from the Global Standard Index by the end of trading session of May 31, Wednesday. The exclusion is being implemented as part of MSCI's quarterly comprehensive index review and is in response to changes in MSCI's calculation of the number of shares considered freely traded in the public market for the two companies. Indus Towers is the thirst security that is being removed. According to the report, 18 million shares of Adani Transmission and Adani Total Gas would be sold, representing weights of 0.34 and 0.31, respectively. Adani total gas and Adani Transmission at time of publishing was trading around Rs. 670 and Rs. 780.

On the other hand, three stocks Max Healthcare Institute with a weightage of 0.52% equaling 42 mn shares, Hindustan Aeronautics with 0.33% weightage equaling to 5 mn shares, and Sona BLW Precision with 0.29% equaling 26 mn shares will be included in the index.

According to Nuvama analysis, India is expected to receive up to $500 million in net passive foreign flow.

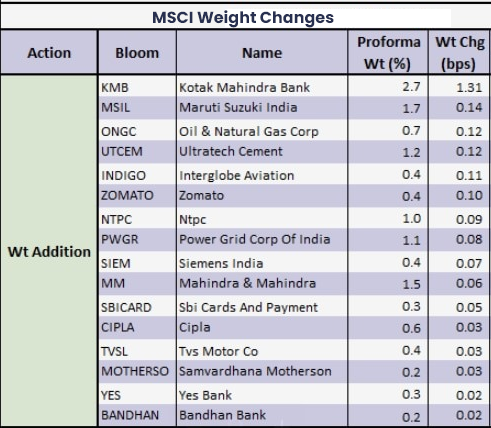

Within the MSCI Global Standard Index, weight increase is expected in 16 stocks while decreasing in 21 stocks.

Those 16 stocks that will see weightage additions, among those Kotak Bank seeing the largest percentage gain of 1.31%, from 1.38% to 2.68%, Maruti Suzuki increasing by 0.14% to 1.7%,

ONGC increasing by 0.12% to 0.7%, Ultratech Cement increasing by 0.12% 1.2%, Interglobe Aviation increasing by 0.11% to 0.4%, Zomato being the only new-age company to register a weightage increase of 0.10%, NTPC increasing by 0.09%, Power Grid Corp of India increasing by 0.08%, Siemens by 0.07%, M&M by 0.06%, SBI Card by 0.05%. Cipla, TVS Motor, and Samvardhana Motherson will see increase of 0.03%. Yes Bank and Bandhan Bank by 0.02%.

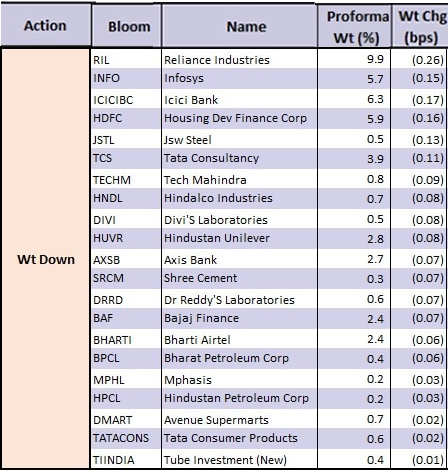

On the contrary, 21 stocks' weightage will be reduced from May 31st, with Reliance Industries (RIL) seeing the biggest reduction of 0.26% to 9.9%. Followed by Infosys seeing a fall of 0.15% to 5.7%, ICICI Bank seeing a fall of 0.17% to 6.3%, HDFC, JSW Steel, Tata consultancy, Tech Mahindra, Hindalco Industries, Divis Labs, Hindustan Unilever, Axis Bank, Shree Cement, Dr. Reddy's Laboratories, Bajaj Finance, Bharti Airtel, BPCL are expected to decrease within the MSCI Global Standard Index.

No comment yet, add your voice below!