Business Profile of the Smartworks Coworking Spaces Limited

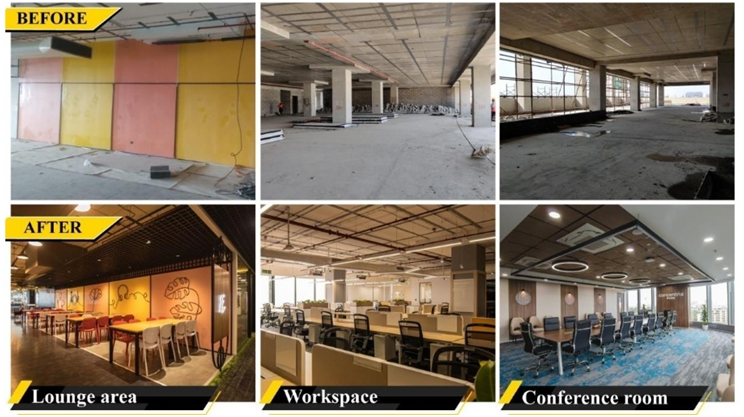

Smartworks offers customized workspace solutions for mid-to-large enterprises, including Indian corporates, MNCs, and startups. The company focuses on providing fully serviced, aesthetically pleasing, and tech-enabled office environments with daily life and aspirational amenities for employees. With a footprint of 8 million sq. ft. in India, 13 cities, 41 centers, and two centers in Singapore, Smartworks Campus Ecosystem offers integrated proprietary technology infrastructure, including a Client SPOC portal, facial recognition access, digitized meeting room booking system, food ordering via member app, digital checklists, and app-based smart access systems for common amenities like gym, creche, and game room.

The company has a base of 603 clients, including Indian corporates, MNCs, and startups across sectors. The company’s Occupancy Rate has grown at a CAGR of 49.56% between March 31, 2022, and March 31, 2024, with 149,660 committed seats and an Occupancy Rate of 90.13%. The company’s largest contract with a client increased from over 2,000 Seats in Fiscal 2022 to over 4,800 Seats in Fiscal 2024.

The Main Objectives to Launch the Smartworks Coworking Spaces Limited IPO

As per the draft red hearing prospects, the IPO issue consists of both offer for sale and fresh issue by the company.

- The OFS consists of up to 6,759,480 Equity Shares aggregating up to Rs. [●] million. Nothing from those proceeds of OFS will be allotted to company.

- Smartworks Coworking Spaces IPO also has a fresh issue of Rs. 550 crores. Out of total 550 crores; Rs. 140 crores will be used for payment of certain borrowing; around Rs. 280 crores will be used for capex and rest for general corporate purposes.

| Particulars | Total estimated amount/expenditure |

| Repayment of certain borrowings availed by Company | 1400 |

| Capex for fit-outs in the New Centres and

for security deposits of the New Centres |

2823 |

| General corporate purposes | [•] |

| Total | [•] |

IPO Details of Smartworks Coworking Spaces Limited:

| IPO Open Date | Thu, Jul 10, 2025 |

| IPO Close Date | Mon, Jul 14, 2025 |

| Basis of Allotment | NA |

| Listing Date | Thu, Jul 17, 2025 |

| Face Value | ₹10 per share |

| Price | ₹387 to ₹407 per share |

| Lot Size | 36 Shares |

| Total Issue Size | 1,43,13,400 shares |

| (aggregating up to ₹582.56 Cr) | |

| Fresh Issue | 1,09,33,660 shares |

| (aggregating up to ₹445.00 Cr) | |

| Offer For Sale | 33,79,740 shares of ₹10 |

| (aggregating up to ₹137.56 Cr) | |

| Issue Type | Book Built Issue IPO |

| Listing At | BSE & NSE |

| QIB Shares Offered | Not less than 50% of the Net Offer |

| Retail Shares Offered | Not more than 35% of the Net Offer |

| NII (HNI) Shares Offered | Not more than 15% of the Net Offer |

Issue Price & Size: Smartworks Coworking Spaces Limited IPO

The issue size of the IPO has been declared and the overall issue size of the IPO is Rs 582.56 Cr, out of which 1,09,33,660 Equity Shares, aggregating up to Rs 445.00 cr, comprise of fresh issuance, and the remaining Rs 137.56 Cr will be offered for sale by shareholders.

Launch Date of Smartworks Coworking Spaces Limited IPO

Smartworks Coworking Spaces Limited IPO will be open on Jul 10, 2025 and close on the, Jul 14, 2025. All types of investors can bid between these dates through their eligible categories.

Smartworks Coworking Spaces Limited Financial Statements

| Particulars | FY24 | FY23 | FY22 |

| Income | |||

| Revenue from operations | 10393.64 | 7113.92 | 3602.37 |

| Other income | 737.46 | 326.78 | 339.67 |

| Total income | 11131.1 | 7440.7 | 3942.04 |

| EXPENSES | |||

| Operating expenses | 3029.41 | 2200.24 | 1081.79 |

| Employee benefits expense | 496.08 | 408.37 | 256.38 |

| Finance costs | 3283.18 | 2366.56 | 1223.55 |

| Depreciation and amortization expns | 4727.2 | 3562.46 | 2119.07 |

| Other expenses | 271.45 | 265.33 | 202.7 |

| Total expenses | 11807.32 | 8802.96 | 4883.49 |

| Restated loss for the year | -499.57 | -1010.46 | -699.05 |

| Particulars | SMARTWORKS COWORKING SPACES LIMITED | Awfis space solution Limted | ||

| FY24 | FY23 | FY22 | FY24 | |

| Financial Parameters | ||||

| Revenue from Operation | 10393.64 | 7113.92 | 3602.37 | 8488.19 |

| Revenue from Operation growth | 46.10% | 97.48% | N.A. | 55..57% |

| Total Income | 11131.1 | 7440.7 | 3942.04 | 8748.03 |

| Total Income growth | 49.60% | 88.75% | N.A. | 54.62% |

| EBITDA | 6596.7 | 4239.98 | 2061.5 | 2454.1 |

| EBITDA Margin | 63.47% | 59.60% | 57.23% | 28.91% |

| Adjusted EBITDA( | 1060.37 | 363.6 | -30.18 | 709.03 |

| Restated Loss for the year | -499.57% | -1070.46% | -699.05 | -175.67 |

| Restated loss for the year as

% of Total Income |

-4.49% | -13.58% | -17.73% | 2.01% |

| Total Equity | 500.07 | 314.66 | 1140.9 | 2514.31 |

| Capital Employed | 3770.66% | 3055.13% | 2319.12 | 2263.71 |

| Total Assets | 41470.84% | 44735.03% | 28595.73 | 13980.79 |

| Return on Capital Employed( | 28.12% | 11.90% | -1.30% | 31.32% |

| Operational Parameters | ||||

| Cities | 13 | 12 | 10 | 17 |

| Centres | 41 | 39 | 30 | 181 |

| Super Built Up Area | 8 | 6.16 | 3.99 | 5.6 |

| Number of Capacity Seats in all Centres | 182228 | 137564 | 86416 | N.A. |

| Number of Capacity Seats in Operational Centres | 163022 | 137564 | 86416 | 85030 |

| Number of Occupied Seats in Operational centres | 130047 | 105568 | 58137 | 67414 |

| Occupancy rate in Operational Centres | 79.77% | 76.74% | 67.28% | 71% |

| Number Of Clients | 603 | 521 | 410 | 2459 |

| Seats Retention Rate | 88.27% | 96.24% | 76.11% | N.A. |

Smartworks Coworking Spaces Limited Promoters & Shareholding

There are 6 promoters of Smartworks Coworking Spaces

- Neetish Sarda;

- Harsh Binani;

- Saumya Binani;

- NS Niketan LLP;

- SNS Infrarealty LLP; and

- Aryadeep Realestates Private Limited.

| Name of the Shareholder | No. of Eq Shares held on a fully diluted basis | % of paid-up Eq share capital on a fully diluted basis |

| Promoters | ||

| NS Niketan LLP | 43769998 | 42.42 |

| SNS Infrarealty LLP | 27585016 | 26.73 |

| Neetish Sarda | 3277 | Negligible |

| Saumya Binani | 71361462 | 69.15 |

| Members of the Promoter Group (other than Promoters) | ||

| Individuals | ||

| Neeta Sarda | 7400 | 0.01 |

| Entities | ||

| Harsh Binani HUF | 30000 | 0.03 |

| Vision Comptech Integrators Ltd. | 1000 | Negligible |

| Total promoter and promoter group holding | 71399862 | 69.19 |

Should You Subscribe to Smartworks Coworking Spaces Limited IPO or Not

While investing or subscribing to any IPO, consider the investment rationales related to the company. Hence, here you can find out the strength of the company that will be its growth factors. And also check the risk factors that can affect the growth and operational efficiency of the company.

Competitive Strengths of Smartworks Coworking Spaces Limited:

Market leadership

As of March 31, 2024, Smartworks is present in 17 out of these 23 key clusters, accounting for about 90.01% of the SBA under companies management. They focus on leasing entire/large properties in prime locations from landlords and transform them into fully serviced, aesthetically pleasing, and tech-enabled Campuses with daily-life and aspirational amenities. As of FY24, Smartworks has four out of five largest lease signed centres in India all of which are above 0.5 million square feet in size.

Focus on acquiring Enterprise Clients

The company caters to teams of all sizes, from under 50 to over 4,800 seats, with a particular focus on mid and large enterprises with over 300 seats. Their ability to serve customized infrastructure and operational requirements makes them a suitable partner for these clients. The largest client deal size has increased from over 2,000 seats in Fiscal 2022 to over 4,800 seats in Fiscal 2024, demonstrating their value proposition and focus on serving large enterprises.

| Particulars | FY24 | FY23 | FY22 |

| Weighted average total tenure

(in months) |

46 | 46 | 45 |

| 0-100 Seats | 35 | 34 | 34 |

| 101-300 Seats | 40 | 43 | 43 |

| 300+ | 49 | 49 | 48 |

| Weighted average lock-in tenure

(in months) |

30 | 30 | 28 |

| 0-100 Seats | 24 | 22 | 19 |

| 101-300 Seats | 27 | 27 | 27 |

| 300+ | 33 | 32 | 31 |

These mid-to-large enterprises typically form long-term contractual arrangements and over 30.65% of the company’s Rental Revenue in FY24 came from clients with a presence in multiple cities.

| Particulars | FY24 | FY23 | FY22 |

| Rental Rev. from multi-city Clients* (₹ million) | 3025.4 | 2203.05 | 818.99 |

| Rental Revenue (in ₹ million) | 9870.26 | 6645.82 | 3384.51 |

| % of Rental Rev. from multi-city Clients | 30.56% | 33.15% | 24.20% |

The company serves clients across various growth sectors, such as information technology, engineering, insurance, energy, Ed-tech, e-commerce, fintech, and consulting, reducing concentration risk.

Cost efficient execution capabilities

The company offers a commercial model that aligns with the price-conscious Indian market, offering superior office experiences and customised solutions. They use modular and reusable fit-outs, achieve economies of scale, and leverage proprietary technology in their facility build-out and operations. This allows end-user occupiers to allocate capital towards their core business, reducing upfront capital investment. In Fiscal 2024, the company’s budgeted capital expenditure per square feet was approximately ₹1,350.00, which translated into a per seat capital expenditure budget of approximately ₹ 60,000. They focus on taking entire/large properties on lease for extended periods, allowing them to invest in reusable, durable, and easy-to-maintain fit-outs and optimize installation costs.

Strong management

The company’s growth is attributed to its strong leadership team, including Neetish Sarda, a graduate from the University of London, and Harsh Binani, a co-founder and promoter with a master’s in business administration from Northwestern University. The management team, consisting of Key Managerial Personnels and Senior Management, has extensive experience in real estate, product design, and finance.

Risk Factors of Smartworks Coworking Spaces Limited:

Geographic concentration

As of FY24, the company leased 41 centers across 13 cities, including Bengaluru, Pune, Hyderabad, Gurugram, Mumbai, Noida, and Chennai. The top four cities, Pune, Bangalore, Hyderabad, and Mumbai, constituted 80.07% of the company’s rental revenue in FY24. The success and appeal of the centers depends on their location, demographic patterns, economic conditions, and the availability of better-suited alternate locations.

If the company cannot retain clients or any significant disruption like social, political, economic disaster could negatively impact revenue and growth.

| City | No. of Centers as of Mar 31, 2024 | FY24 | FY23 | FY22 |

| As a % of total Rental Revenue | ||||

| Pune | 8 | 31.07 | 30.45 | 19.74 |

| Bangalore | 9 | 25.55 | 22.72 | 28.65 |

| Hyderabad | 3 | 14.2 | 12.82 | 0.94 |

| Mumbai | 3 | 9.25 | 11.86 | 13.44 |

| Other Cities | 18 | 19.93 | 22.15 | 30.23 |

Targeted clients

The company primarily targets mid-to large Enterprise Clients with workspace needs exceeding 300 Seats across multiple centers and cities in India. These clients often have better negotiating abilities and may dictate key commercial terms, including pricing. However, the company may struggle to identify or source clients with such workspace requirements at favorable commercial terms or at all. They may also source their real estate requirements through brokers, who may offer multiple options and prioritize competitors over the company. The company also undertakes significant capital expenditure for the fit-out process of its centers and may require additional financing to meet these requirements. If a client terminates an agreement, the company may not be able to find a replacement client or retain existing clients, which could adversely affect the business, cash flows, results of operations, and financial condition.

| Seats cohorts | As % of total Rental Revenue for Fiscal 2024 | As % of total Rental Revenue for Fiscal 2023 | As % of total Rental Revenue for Fiscal 2024 |

| 0-100 | 12.77 | 14.94 | 23.36 |

| 101-300 | 27.25 | 29.21 | 36.66 |

| More than 300 | 59.98 | 55.85 | 39.98 |

Identifying clients

The company focuses on leasing large properties from landlords of commercial real-estate properties. They have a presence in 17 Tier-1 cities with 32 centers. The success of the business is largely dependent on identifying the right buildings and properties to offer as managed workspaces to clients, in the right locations, and sourcing them at the right rate of rental and other commercial terms. If the company cannot identify the right buildings or reach out to landlords, it could adversely affect business growth, cash flows, results of operation, profitability, and financial condition.

Inability to retain existing Client

The company generates revenue by charging lease rentals for workspaces provided to clients within its centres. Agreements typically last between two and five years, with pre-mature terminations and notice periods. Clients terminate agreements without notice, such as termination of lease arrangements with landlords or inability to provide suitable alternate accommodation. The company’s seats retention rate has increased in the past three fiscals, but it may not be able to retain existing clients or attract new ones due to factors such as pricing, competition, location selection, amenities, preference for managed workspaces, economic slowdowns, decreased demand, and technological advancements. The company’s inability to retain or attract clients may lead to a decline in revenue and growth, negatively impacting its business, results of operations, cash flows, and financial condition.

| Particulars | FY24 | FY23 | FY22 |

| Number of Seats Retained | 28336 | 27999 | 9797 |

| Total number of Seats due for Retention | 32102 | 29094 | 12872 |

| Seats Retention Rate | 88.27% | 96.24% | 76.11% |

History of losses

As can be seen from table below, the company has along with its 3 subsidiary has reported a loss in past. Smartworks Space Pte. Ltd., a subsidiary, was incorporated in March 2024 in Singapore and did not have any financial transactions as of FY24. The company’s new and existing centers may not generate revenue or cash flow comparable to those generated by existing centers. Hence, the company cannot assure that it will achieve or sustain profitability and not continue to incur net losses.

| Particulars | FY24 | FY23 | FY22 |

| Smartworks Coworking Spaces Limited | |||

| Restated loss for the year | -499.57 | -1010.46 | -699.05 |

| Smartworks Tech Solutions Private Limited | |||

| Restated loss for the year | -26.58 | -7.77 | -1.63 |

| Smartworks Office Services Private Limited | |||

| Restated loss for the year | -0.1 | -0.09 | -0.07 |

| Smartworks Stellar Services Limited | |||

| Restated loss for the year | -0.53 | -4.17 | N.A. |

(in ₹ million)

Scope for acquired asset

The company plans to continue evaluating acquisition opportunities and expanding its portfolio based on economies of acquisition costs. It has leased two centers in Singapore through an agreement with Keppel Real Estate Services Pte. Ltd., which may require substantial time and effort from management. If the acquisition fails to achieve appropriate growth and success, and the acquired assets may add-on or the company may have to direct more resources into existing operations which could adversely affect the company’s business, cash flows, results of operations, and prospects.

Anonymous complaints against company

The company has received anonymous letters and emails from various stakeholders alleging irregularities in operation, illegal funds, non-payment of borrowings. An independent law firm conducted a fact-finding legal due diligence on the allegations, concluding that they were baseless and devoid of any substance other than one criminal matter relating to Anvay Naik. The company filed FIR and a civil suit in the High Court of Karnataka at Bangalore against Pratik Shah and Sanjay Aggarwal.

Smartworks Coworking Spaces Limited Grey Market premium

Grey market premium is the premium quoted over the IPO issue price. GMP shows that investors are ready to pay above the upper band of the IPO issue price. GMP is determined in the grey market as per the demand and supply of the shares in the primary market. A grey market is that unofficial ecosystem of unlisted companies’ stocks that start trading even before the launch of the IPO to the date of its listing.

Also Read: What is Grey Market Premium in IPO: How is GMP Calculated & Reliable

However, GMP is not a reliable factor, as it keeps fluctuating as per the demand and supply of shares in the primary market. There are numerous factors that affect the stock market in India and individual stock prices of different companies that are already listed and trading in the secondary market. However, for an IPO-bounded company, you can consider the GMP as the speculative listing price of the share

As per the sources, the GMP of Smartworks Coworking Spaces Limited IPO is not started in grey market, wait for the IPO announcement. Stay tuned for the latest IPO GMP numbers of Smartworks Coworking IPO.