Business Profile of the Swiggy Limited

Swiggy has pioneered the hyperlocal commerce industry in India, launching Food Delivery in 2014 and Quick Commerce in 2020. Swiggy also provides comprehensive business enablement solutions to restaurant, merchant, and brand partners, including analytics-backed tools, fulfilment services, and last-mile delivery. The company caters to users’ needs of ease, immediacy, quality, variety, reliability, and consistency in their consumption. Swiggy is the only unified app in India that fulfills all food and related missions of urban users of ordering-in, eating-out, and cooking-at-home. The company’s innovation-led approach focuses on identifying and addressing user convenience needs, increasing the frequency with which they interact on the platform.

Swiggy Limited IPO Objective

As per the draft red hearing prospects, the IPO issue consists only of offer for sale.

- The OFS consists of up to 175,087,863 equity shares aggregating up to Rs. 6, 828.43 cr. Nothing from those proceeds of OFS will be allotted to company.

- Swiggy IPO offer only has fresh issue of Rs. 4, 4990 crores. The company aims to utilize around Rs. 164.8 crores for paying up of certain debt of its subsidiary, Rs. 755.4 crores for expansion of company, Rs, 423.3 crores for leases, 703.4 crores for improving cloud infrastructure and tech, Rs. 1115.3 crores for marketing and adv and rest of the amount for acquisition and general proposes.

Particulars Estimated amount Estimated utilization of Proceeds FY25 FY26 FY27 FY28 Investment in material subsidiary, Scooty, for repayment of certain borrowings 1648 1648 Investment in our Material Subsidiary, Scootsy, for: 11787 750 3677 4058 3302 (a) Expansion through setting up of Dark Stores 7554 453 2428 2747 1926 (b) Making lease / license payments for Dark Stores 4233 297 1249 1311 1376 Investment in technology and cloud infrastructure 7034 355 2177 2418 2084 Brand marketing and business promotion expenses 11153 615 3319 3590 3629 Funding inorganic growth, acquisitions and general corporate purposes XXXX XXXX XXXX XXXX XXXX Total XXXX XXXX XXXX XXXX XXXX

IPO Details of Swiggy Limited:

| IPO Open Date | November 6, 2024 |

| IPO Close Date | November 8, 2024 |

| Basis of Allotment | November 11, 2024 |

| Listing Date | November 13, 2024 |

| Face Value | ₹1 per share |

| Price | ₹371 to ₹390 per share |

| Lot Size | 38 shares |

| Total Issue Size | 290,446,837 shares |

| Aggregating up to ₹11,327.43 Cr | |

| Fresh Issue | 115,358,974 shares |

| aggregating up to ₹4,499.00 Cr | |

| Offer For Sale | 175,087,863 shares |

| Aggregating up to ₹6,828.43 crores | |

| Issue Type | Book Built Issue IPO |

| Listing At | BSE & NSE |

| QIB Shares Offered | Not less than 75% of the Net Issue |

| Retail Shares Offered | Not more than 10% of the Net Issue |

| NII (HNI) Shares Offered | Not more than 15% of the Net Issue |

Issue Price & Size: Swiggy Limited IPO

The issue price of Swiggy Limited has been set for Rs. 371 to Rs. 390. The company has both fresh issue of Rs. 4499 crores as well as offer for sale of up to 175,087,863 equity shares.

Launch Date of Swiggy Limited IPO

The IPO opening date of Swiggy has been officially announced for November 6, 2024 till November 8, 2024.

Swiggy Limited Financial Statements

| As of and for the three months ended | FY24 | FY23 | FY22 | ||

| June 30, 2024 | June 30, 2023 | ||||

| Income | |||||

| Revenue from operations | 32222.17 | 23898.18 | 112473.9 | 82645.96 | 57048.97 |

| Other income | 878.94 | 1198.32 | 3869.59 | 4498.57 | 4148.8 |

| Total income | 33101.11 | 25096.5 | 116343.5 | 87144.53 | 61197.77 |

| Expenses | |||||

| Cost of materials consumed | 77.69 | 143.63 | 410.83 | 719.99 | 510.53 |

| Purchases of stock-in-trade | 11951.48 | 8970 | 45547.5 | 33019.51 | 22245.4 |

| Changes in inventories of stock-in-trade | -75.5 | -13.3 | -116.34 | 69.23 | -75.46 |

| Employee benefits expense | 5891.85 | 4857.8 | 20121.64 | 21298.2 | 17084.9 |

| Finance costs | 198.26 | 174 | 714.03 | 581.92 | 483.76 |

| Depreciation and amortisation expense | 1216.72 | 912.98 | 4205.85 | 2857.86 | 1700.9 |

| Other expenses | |||||

| Advertising and sales promotion | 4453.73 | 4871.35 | 18507.99 | 25011.6 | 20050.73 |

| Delivery and related charges | 10460.45 | 7490.01 | 33510.59 | 28349.44 | 20688.13 |

| Others | 4904.9 | 3319.01 | 16371.75 | 16936.24 | 13055.63 |

| Total expenses | 39079.58 | 30725.64 | 139473.8 | 128844 | 95744.53 |

| Loss before share of loss of an associate, exceptional items and tax | -5978.47 | -5629.14 | -23130.4 | -41699.5 | -34546.8 |

| Loss before tax | -6110.07 | -5640.84 | -23503.4 | -41793.1 | -36289 |

| Loss for the period/year | -6110.07 | -5640.84 | -23503.4 | -41793.1 | -36289 |

| Particulars | Unit | As of and for the three months ended | FY24 | FY23 | FY22 | |

| June 30, 2024 | June 30, 2023 | – | – | – | ||

| Swiggy Platform | ||||||

| B2C Total Orders | (# in million) | 213.92 | 182.39 | 760.18 | 648.65 | 495.8 |

| B2C GOV | (in ₹ million) | 101895.9 | 82771.86 | 349690.8 | 277405.2 | 301222.6 |

| Consolidated Gross Revenue | (in ₹ million) | 3472.87 | 26938.48 | 123203.1 | 94796.89 | 68604.44 |

| Consolidated Adjusted EBITDA | (in ₹ million) | -3489 | -4868.96 | -18355.7 | 39103.37 | 32337.62 |

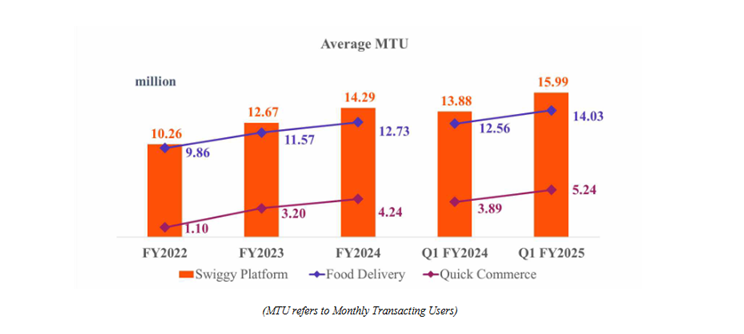

| Average Monthly Transacting Users | (# in million) | 15.99 | 13.88 | 14.29 | 12.67 | 10.26 |

| Average Monthly Transacting Delivery Partners | # | 457249 | 350280 | 392589 | 322819 | 243496 |

| Platform Frequency | # | 4.5 | 4.42 | 4.48 | 4.34 | 4.14 |

| Food Delivery | ||||||

| Total Orders | (# in million) | 155.98 | 141 | 577.74 | 516.87 | 454.14 |

| GOV | (in ₹ million) | 68083.44 | 59587.43 | 247174.4 | 215170.8 | 184788.3 |

| AOV | (₹ per order) | 436 | 423 | 428 | 416 | 407 |

| Gross Revenue | (in ₹ million) | 17296.3 | 14545.32 | 60815.51 | 51792.05 | 44298.07 |

| Contribution Margin (as a percentage of GOV) | (in %) | 6.40% | 5.24% | 5.72% | 2.94% | 1.59% |

| Adjusted EBITDA | (in ₹ million) | 578.43 | -431.95 | -471.8 | -10349.9 | -14095.2 |

| Average Monthly Transacting Users | (# in million) | 14.03 | 12.56 | 12.73 | 11.57 | 9.86 |

| Average Monthly Transacting Restaurant Partners | # | 223671 | 183138 | 196499 | 174598 | 129036 |

| Out-of-home Consumption | ||||||

| Total Transactions | (# in million) | 2.03 | 1.86 | 6.98 | 3.3 | – |

| GOV | (in ₹ million) | 6571.95 | 5769.28 | 21830.67 | 11050.75 | – |

| AOV | (₹ per order) | 3236 | 3099 | 3129 | 3344 | – |

| Gross Revenue | (in ₹ million) | 467.03 | 311.25 | 1571.86 | 776.86 | – |

| Contribution Margin (as a percentage of GOV) | (in %) | 3.49% | 2.78% | 2.45% | 1.20% | – |

| Adjusted EBITDA | (in ₹ million) | -131.57 | -490.13 | -1735.96 | -1372.06 | -65.22 |

| Average monthly Active Restaurants | # | 33352 | 22889 | 26575 | 10426 | – |

| Quick Commerce | ||||||

| Total Orders | (# in million) | 55.9 | 39.53 | 175.46 | 128.48 | 41.66 |

| GOV | (in ₹ million) | 27240.47 | 17415.15 | 80685.67 | 51183.67 | 16434.33 |

| AOV | (₹ per order) | 498 | 441 | 460 | 398 | 394 |

| Gross Revenue | (in ₹ million) | 4033.85 | 2123.05 | 10877 | 5472.75 | 1242.23 |

| Contribution Margin (as a percentage of GOV) | (in %) | -3.18% | -7.50% | -6.01% | -23.55% | -32.26% |

| Adjusted EBITDA | (in ₹ million) | -3179.15 | -3121.09 | -13090.9 | -20267.6 | -8832.56 |

| Average Monthly Transacting Users | (# in million) | 5.24 | 3.89 | 4.24 | 3.2 | 1.1 |

| Active Dark Stores | # | 557 | 421 | 523 | 421 | 301 |

| Supply Chain and Distribution | ||||||

| Revenue | (in ₹ million) | 12682.57 | 9475.81 | 47796.05 | 32863.47 | 14653 |

| Adjusted EBITDA | (in ₹ million) | -578.91 | -426.62 | -1847.2 | -2954.98 | -3015.49 |

| Platform Innovations | ||||||

| Gross Revenue | (in ₹ million) | 293.12 | 483.05 | 2142.72 | 3891.76 | 8411.14 |

| Adjusted EBITDA | (in ₹ million) | -166.8 | -399.17 | -1189.77 | -4158.81 | -6329.18 |

Swiggy Limited Promoters & Shareholding

Swiggy Limited does not have an identifiable promoter in terms of SEBI ICDR Regulations and hence, there are no members forming part of the promoter group. Below is the list of shareholder, holding 1% or more of the paid-up equity share capital of company.

| Name of the Selling Shareholders | No. of Equity Shares held (on a fully diluted basis) | % of the pre-offer Eq. Share capital on a fully diluted basis |

| Sriharsha Majety | 139044940 | 6.23 |

| Lakshmi Nandan Reddy Obu | 39147523 | 1.76 |

| Rahul Jaimini | 25472982 | 1.14 |

| Elevation Capital V Limited | 69150558 | 3.1 |

| Accel India IV (Mauritius) Limited | 105090411 | 4.71 |

| Norwest Venture Partners VII-A- Mauritiu | 76126137 | 3.41 |

| MIH India Food Holdings B.V. | 490456425 | 30.95 |

| Inspired Elite Investments Limited | 86560785 | 3.88 |

| DST EuroAsia V B.V | 72150678 | 3.23 |

| Coatue PE Asia XI LLC | 49846179 | 2.23 |

| Tencent Cloud Europe B.V. | 81172539 | 3.64 |

| HH BTPL Holdings II Pte. Ltd | 25929708 | 1.16 |

| SVF II SONGBIRD (DE) LLC | 172912821 | 7.75 |

| OFI Global China Fund, LLC | 39689344 | 1.78 |

| Alpha Wave Ventures II , LP | 26928165 | 1.21 |

| Accel Leaders 3 Holdings (Mauritius) Ltd | 30547404 | 1.37 |

| INQ Holding LLC | 65701676 | 2.95 |

Should You Subscribe to Swiggy Limited IPO or Not

While investing or subscribing to any IPO, consider the investment rationales related to the company. Hence, here you can find out the strength of the company that will be its growth factors. And also check the risk factors that can affect the growth and operational efficiency of the company.

Competitive Strengths of Swiggy Limited:

Pioneers in hyperlocal commerce

Swiggy, a pioneer in hyperlocal commerce has been a leader in innovation in India since its launch of Food Delivery in 2014 and Quick Commerce in 2020. The company’s innovation approach focuses on addressing user convenience needs, increasing the frequency of interactions on its platform. Swiggy has expanded beyond its core offerings by adding new offerings and expanding its geographic reach. The company uses its network of users and partners to assess market attractiveness and demand for new offerings, scaling offerings across cities as needed. Swiggy also engages in strategic acquisitions to augment growth by expanding platform capabilities and adding adjacent offerings.

The company’s innovation-led approach operates as a self-reinforcing ecosystem, driving interactions with users and enhancing value for all ecosystem participants and the overall platform.

Growing network

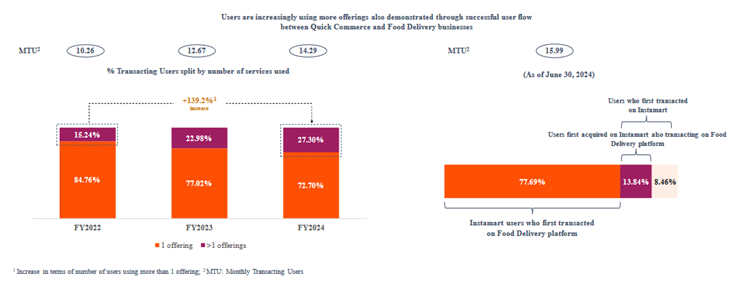

In its tenth year, their platform has reached 112.73 million users, driven by a unified app, growing offerings, and a wide network of partners. This growth in monthly transacting users, particularly in Food Delivery and Quick Commerce, is a testament to user experience.

Rising user engagement

Swiggy’s platform has seen a higher monthly transaction frequency compared to hyperlocal commerce players in FY24, driven by its customer-focused approach, seamless user experience, and increasing propensity to pay for convenience. This has resulted in higher engagement and user stickiness.

Swiggy is the leader in Monthly GOV per average MTU in Food Delivery, driven by higher customer engagement and higher order frequency among leading Food Delivery marketplaces. The platform’s Gross Order Value (GAV) retention has increased across cohorts as users age, indicating a propensity to spend more on the platform with increasing habit formation tendencies.

| Three months ended June 30 | |||||

| Particulars | 2024 | 2023 | FY24 | FY23 | FY22 |

| Swiggy Platform Frequency | 4.5 | 4.42 | 4.48 | 4.34 | 4.14 |

Among most valuable Indian brands

Swiggy is the most valuable brand in India’s Consumer Technology & Services Platforms category, ranking among the Top 25 most valuable brands. The brand is recognized for its convenience and quality. Swiggy is the only unified app in India that fulfills all food-related missions for urban users, including ordering-in, eating-out, and cooking-at-home. As of June 30, 2024, it captured the largest share of consumer wallet in hyperlocal commerce use-cases. Swiggy’s brand recognition, unified app approach, and high frequency offerings increase user engagement, ensure user stickiness, and enable cost-effective introduction of new offerings.

Preferred choice of partners

Swiggy, a food delivery platform, offers a unified app approach, an engaged user base, and an on-demand delivery network to help restaurant, merchant, and brand partners engage with their user base at low incremental costs. The platform provides business enablement solutions, such as targeted advertisements, integrated payment systems, and end-to-end supply chain solutions, to help partners achieve optimal return on their investments.

Swiggy’s data-driven technology helps understand demand patterns, optimize delivery partner allocation, and track orders in real time. The platform also focuses on the health and safety of delivery partners, offering robust insurance policies and training programs. The average monthly transacting restaurant partner base, active dark stores, and average monthly transacting delivery partners base have increased from Fiscal 2022 to the three months ended June 30, 2024.

Risk Factors of Swiggy Limited:

Long history of losses

The company, which started in 2014 as a food delivery service company, has expanded its services to include Quick Commerce, Dineout, and other hyperlocal commerce through Swiggy Minis. Despite expanding its service offering and leading to increase in gross revenues, the company has incurred significant expenses to support growth. This has resulted in net losses in each year since its incorporation and negative cash flows from operating activities. The company expects to continue expanding its operations, including increasing user and partner base, introducing new offerings, and expanding in existing and new cities. However, revenue growth going forward may not see exponential pace as the company face hard competition and the government authority have been alerted in past incidents.

Customer retention

The business growth relies on cost-effectively retaining and acquiring users. The Swiggy platform’s annual transacting users and B2C platform frequency retention data for Fiscals 2024, 2023, and 2022 show a decline in user base due to changes in user behavior, unavailability of food and product options, and competition.

To attract and retain users, the platform incurs expenses such as discounts, promotions, and advertising. The success of promotions and marketing initiatives depends on continued investments and the ability to adapt to industry trends and user preferences. Failure to refine existing marketing approaches or introduce new effective ones could negatively impact the business, financial condition, and results of operations.

| Platform Annual Transacting Users(1) Cohort | ||||

| ATU (millions) | Year I | Year II | Year III | |

| Fiscal 2022 | 35.09 | 1.00x | 0.59X | 0.52x |

| Fiscal 2023 | 43.34 | 1.00x | 0.57X | |

| Fiscal 2024 | 46.84 | 1.00x | ||

| B2C Platform Frequency Retention by Cohort | ||||

| Year I | Year II | Year III | ||

| Fiscal 2022 | 1.00x | 1.09x | 1.16x | |

| Fiscal 2023 | 1.00x | 1.12x | ||

| Fiscal 2024 | 1.00x | |||

Attracting delivery partners

The company emphasizes the importance of having a large and flexible network of delivery partners and a seamless technology experience for its success. Delivery partners engage with the platform on a gig basis, allowing them to work for various hours and days at their discretion. The average monthly transaction cost for delivery partners is 58.27.

The company’s ability to attract and retain partners depends on the delivery fee, incentives, and benefits offered. Failure to retain and expand the delivery partner base could result in them earning less than competitive delivery fees, the introduction of other platforms offering better terms, strikes, unionizations, or legislation disrupting the service.

| Particulars | Three months ended June 30 | ||||

| 2024 | 2023 | FY24 | FY23 | FY22 | |

| Swiggy Platform Avg Monthly Transacting Delivery Partners | 457249 | 350280 | 392589 | 322819 | 243496 |

| Average delivery charges paid per order to Delivery Partners | 58.27 | 55.98 | 56.01 | 58.99 | 59.23 |

| Average number of orders processed by Delivery Partner | 463 | 515 | 1919 | 1999 | 2036 |

Inability to retain existing or acquire additional restaurant partners

The growth of platform relies on attracting and retaining restaurant, merchant, and brand partners, and increasing the selection and assortment of food and products. Company large user base, its active marketing skills and business enablement tools attract partners. However, if they fail to attract and retain partners cost-effectively and at competitive prices, it may negatively impact its operations and fundamentals.

Intense competition across markets could adversely affect business fundamentals and financial condition of the company. Partners’ operating costs are affected by factors beyond their control, such as inflation, raw materials availability, labor, rental costs, energy costs, and changing user preferences.

| Particulars | 3-mon ended June 30 | ||||

| 2024 | 2023 | FY24 | FY23 | FY22 | |

| Food Delivery Average Monthly Transacting Restaurant Partners | 223671 | 183138 | 196499 | 174598 | 129036 |

| Out-of-home Consumption Average Monthly Active Restaurants | 33352 | 22889 | 26575 | 10426 | – |

| Active Dark Stores | 557 | 421 | 523 | 421 | 301 |

Importance of Dark Stores

The success of the Quick Commerce business relies on the location, size, and density of its Dark Stores. These stores are operated on leasehold basis, allowing merchant partners access to a wide user base, a wider product selection, rapid order fulfillment, and reduced last-mile time and cost. Active Dark Stores refer to those with at least one completed order on the last day of the period/year.

Reasons for closure include replacement with more optimal locations, reducing delivery times and costs, and relocation/reorganization into larger spaces. The company intends to use part of the Net Proceeds for expansion of its Dark Store network and making lease/license payments for Dark Stores.

The number of Dark Stores opened and closed during the relevant period is shown in the table.

| Particulars | Three months ended June 30 | ||||

| 2024 | 2023 | FY24 | FY23 | FY22 | |

| Opening count of the Dark Stores | 538 | 460 | 460 | 330 | 12 |

| Number of Dark Stores added during the period | 59 | 45 | 220 | 248 | 324 |

| Number of Dark Stores closed during the period | 16 | 61 | 142 | 118 | 6 |

| Number of Dark Stores open as on the last day of each period | 581 | 444 | 538 | 460 | 330 |

| Active Dark Stores | 557 | 421 | 523 | 421 | 301 |

| % of number of Dark Stores as on the end of the period | 95.87% | 94.82% | 97.21% | 91.52% | 91.21% |

Warehouse management

The success of Supply Chain and Distribution business is largely influenced by the location, size, and density of their warehouses. These warehouses are operated on a leasehold basis, with a total of 50 warehouses as of June 30, 2024. The company cannot guarantee that the current locations will remain suitable for wholesalers and retailers, or that we will successfully open new warehouses. Factors such as increased lease/license payments or shifting demographic patterns may require us to shut down or relocate our warehouses.

| Particulars | Three months ended June 30 | ||||

| 2024 | 2023 | FY24 | FY23 | FY22 | |

| No. of Warehouses as on the beginning of the period | 50 | 32 | 32 | 32 | 4 |

| No. of Warehouses opened | 6 | 0 | 28 | 17 | 29 |

| No. of Warehouses closed | 2 | 1 | 10 | 17 | 1 |

| No. of Warehouses as on the end of the period | 54 | 31 | 50 | 32 | 32 |

| Cities where Warehouses are present at the end of the period | 13 | 14 | 12 | 13 | 7 |

Ensure hygiene, quality & quantity of food

The industry is vulnerable to health concerns due to food-borne illnesses, food quality, allergic reactions, and public perception of healthy eating in India. Future concerns may arise from partners not providing food or products of the desired quality, quantity, description, or weight. Negative publicity could discourage users from purchasing certain products, reducing brand value. Recalls and recalls could result in lost sales, diverted resources, increased customer support costs, and legal expenses.

Utilization of IPO proceeds

The company intends to use a portion of the Net Proceeds of the Offer for investment in its Material Subsidiary, Scootsy, for expanding its Dark Store network and making lease/license payments for Dark Stores. However, the costs of equipment, fit-outs, and installations may escalate due to revisions in commercial terms, inflation, or other factors. The company has not entered into definitive agreements to place orders for equipment, fit-outs, and installations, and risks and uncertainties, such as economic trends, competitive landscape, and regulatory approvals, may limit or delay efforts to achieve profitable growth. The company is yet to identify the exact locations or lease agreements for setting up Dark Stores, and any variation in the utilisation of the Net Proceeds would be subject to certain compliance requirements, including prior shareholders’ approval.

The company plans to use a portion of the net proceeds for inorganic growth through unidentified acquisitions, which could involve significant challenges and risks If the company cannot make fruitful acquisitions and investments, its business, results of operations, and financial condition could be adversely affected. The actual deployment of funds will depend on factors such as timing, nature, size, number of acquisitions, and access to capital.

Swiggy Limited Grey Market premium

Grey market premium is the premium quoted over the IPO issue price. GMP shows that investors are ready to pay above the upper band of the IPO issue price. GMP is determined in the grey market as per the demand and supply of the shares in the primary market. A grey market is that unofficial ecosystem of unlisted companies’ stocks that start trading even before the launch of the IPO to the date of its listing.

Also Read: What is Grey Market Premium in IPO: How is GMP Calculated & Reliable

However, GMP is not a reliable factor, as it keeps fluctuating as per the demand and supply of shares in the primary market. There are numerous factors that affect the stock market in India and individual stock prices of different companies that are already listed and trading in the secondary market. However, for an IPO-bounded company, you can consider the GMP as the speculative listing price of the share

According to various online sources, the Grey Market Premium or GMP of the Swiggy Limited is trading around Rs XX in the grey market. It means shares are trading at the upper band issue price of Rs XX with a premium in the grey market and may list around the same price.