Synthetic Long Call option strategy-Bullish Options Trading Strategies

A Synthetic long Call approach is used by investors/traders who are long-term bullish on the underlying asset and currently hold the underlying asset. At the same time, the trader is concerned about the underling’s near-term adverse drawdown. The trader wishes to hold the underlying, but in order to reduce downside risks, he will employ the Synthetic Call option strategies, in which he will purchase one at-the-money (ATM) or out-of-the-money (OTM) Put Option on the underlying.

Scenario 1

If the investor's optimistic forecast is correct, the profit potential on the asset ownership is unlimited.

Scenario 2

If the investor's short-term drawdown worries are correct, the Put Option can completely or partly cover the losses, based on the stock price.

Risk in implementing Synthetic Long Call

Synthetic Long Call option strategy has a high profit potential but a low risk. When the underlying price rises above the strike price of the put option, the put option premium paid becomes worthless.

Reward

The security price can theoretically rise up to infinity with downside hedged.

Breakeven

When the underlying security increases by the amount of the options premium paid, the strategies at that point has reached its breakeven point.

Construction

Buy 1 Bank Nifty Futures

Buy 1 Put Option of Bank Nifty

| Option Type | Expiry Date | Strike Price | LTP | Action | No. Of Lots |

| FUTURES | 29/03/2023 | -NA- | 39000 | Buy | 1 |

| PUT | 29/03/2023 | 39000.0 | 500 | Buy | 1 |

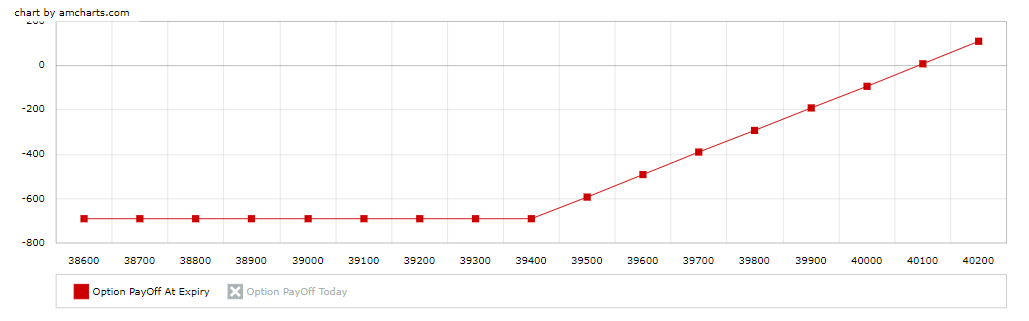

Payoff Chart

| Market Expiry | Payoff 1 | Payoff 2 | Net Premium | Option PayOffAt Expiry |

| 38200.0 | -998.2 | 800.0 | -501.8 | -700.0 |

| 38300.0 | -898.2 | 700.0 | -501.8 | -700.0 |

| 38400.0 | -798.2 | 600.0 | -501.8 | -700.0 |

| 38500.0 | -698.2 | 500.0 | -501.8 | -700.0 |

| 38600.0 | -598.2 | 400.0 | -501.8 | -700.0 |

| 38700.0 | -498.2 | 300.0 | -501.8 | -700.0 |

| 38800.0 | -398.2 | 200.0 | -501.8 | -700.0 |

| 38900.0 | -298.2 | 100.0 | -501.8 | -700.0 |

| 39000.0 | -198.2 | 0.0 | -501.8 | -700.0 |

| 39100.0 | -98.2 | 0.0 | -501.8 | -600.0 |

| 39200.0 | 1.8 | 0.0 | -501.8 | -500.0 |

| 39300.0 | 101.8 | 0.0 | -501.8 | -400.0 |

| 39400.0 | 201.8 | 0.0 | -501.8 | -300.0 |

| 39500.0 | 301.8 | 0.0 | -501.8 | -200.0 |

| 39600.0 | 401.8 | 0.0 | -501.8 | -100.0 |

| 39700.0 | 501.8 | 0.0 | -501.8 | 0.0 |

| 39800.0 | 601.8 | 0.0 | -501.8 | 100.0 |

Option Trading Example

The Bank Nifty is trading at 39000 levels; the trader is bullish in the long run, but wants to protect himself from a decline due to the impending Fed / RBI meeting. He trades a single lot of Bank Nifty futures at around 39000 and purchases one Put Option by paying premium of Rs. 500.

Scenario 1

If the Bank Nifty falls to Rs. 38000, his loss on the option contract will be compensated by the long-put option. Even if the trader continues to hold the long position on the index, he will see a loss of Rs 1000 on books (38000 – 39000).

Scenario 2

If Bank Nifty index settles above the long put strike price at expiration, the investor will make a net profit on the long index position, while the premium paid for the long put option will go worthless, resulting in a net loss from the option contract.

Scenario 3

If Bank Nifty ends at the long put option, the long index position will be unaffected, but the premium paid will be worthless.

For getting payoff chart, breakeven points, potential max loss/ gain while making a option trading strategies, traders can just sign up with Moneysukh and Log in to traderdar.moneysukh.com.

The primary distinction between purchasing an individual call option and employing a Synthetic Call strategy, is the ownership of the underlying asset. In a vanilla Call Option strategy, the investor does not hold the underlying security, whereas in a Synthetic Call strategy, the investor holds the underlying asset and profits from other corporate actions related to the underlying like dividends, bonus, etc.

Also read: Short Put Option Trading Strategy

No comment yet, add your voice below!