Union budget's impact on the insurance sector

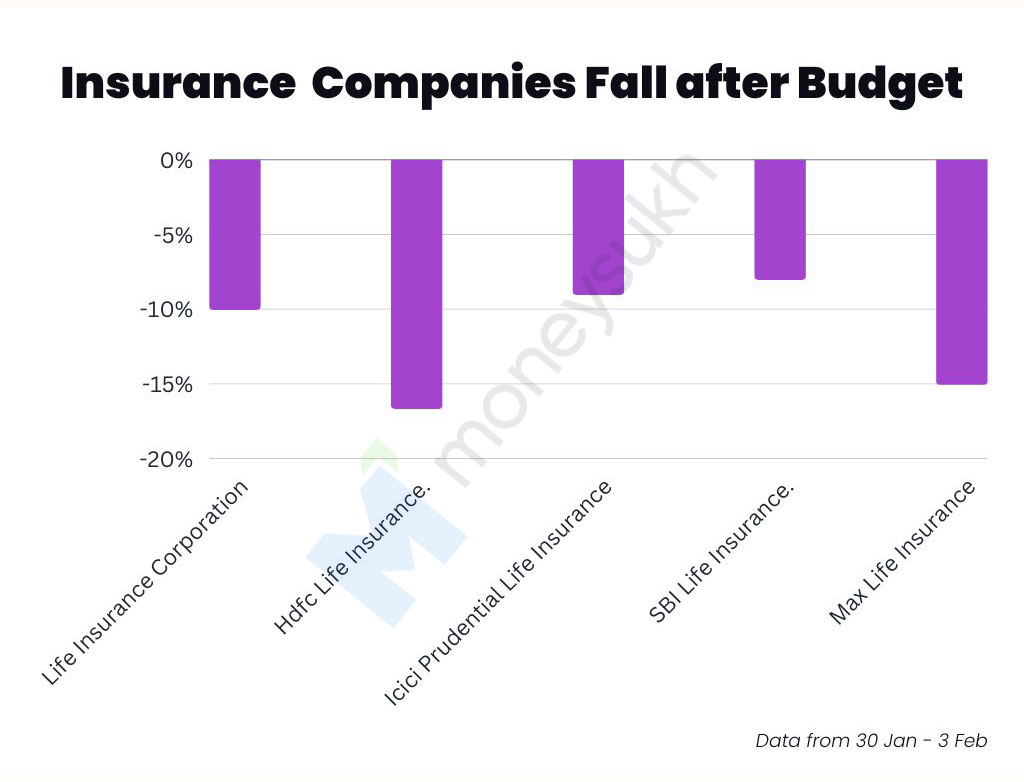

The finance minister stated during the Budget announcement that insurance buyers must pay tax on insurance proceeds if the premium paid surpasses 5 lakhs, causing insurance stocks to fall. Indian insurance providers suffered the most as a result of the budget, with large insurance providers losing between 4.5% and 11% of their value, to mention a few equities.

In response to the announcement, on the day of budget shares of insurance behemoth LIC fell 8.38%, HDFC Life Insurance Company fell 10.96%, ICICI Prudential Life Insurance Company fell 10.97%, and SBI Life Insurance Company fell 9.31%.

While the Finance Minister, Nirlama Sitharaman was announcing the proposals, the personal income tax rebate would be raised from Rs. 5 lakhs to Rs. 7 lakhs, consumers with 5% cash receipts would receive tax relief, and the number of income tax slabs would be reduced from 6 to 5. The market marched upward in one tone. However, when investors began to read between the lines and examine the budget, the indexes began to cool. One of the primary drawbacks of the finance bill is the taxability of the maturity proceeds of a life insurance policy.

The maturity proceeds of all life insurance plans issued after 1st April 2023 with an annual premium of more than Rs. 5l will henceforth be taxable, acc to the union budget 2023. It should be noted that if an individual has more than one life insurance policy issued on or after April 1, 2023, and the aggregate amount of premium paid for such policies exceeds 5 lacs, the maturity amount will be taxable. The death benefit from such life insurance plans remains tax-free, and it does not apply to ULIPs.

This is bad news for insurance companies that have established various products aimed at HNI and UHNI clients, with premiums payable exceeding INR 5 lacs and returns tax-free. This will in turn have a negative influence on the insurance industry. Most of the individuals who opt for life insurance policy solely on base of tax benefit with insurance and very less consider it as insurance. The insurance business will suffer as a result of this. The individual who fall under the new tax regime and have an annual income of up to Rs 7 lakh would be exempt from paying tax. As the news tax regime is now the default tax policy, in the next years we might be in a position where we will no longer be eligible for any tax benefits, such as deductions under 80C and health insurance. One potential benefit of this approach is that consumers may focus on acquiring term plans and regard insurance as a risk-management tool rather than a vehicle for earning profits.

No comment yet, add your voice below!