Elections are always unpredictable, and when they fall during a time when many economies are surrounded by war and clashes and the economies are also slowing, it gives a whole new flavor to the region. In 2024, half of the world population will be visiting polling booths to select their leaders, so we can expect many new faces or many existing faces running the administration. Some of the important elections that would be on investors radars would be India, US, and Russia. The US elections are the most unpredictable, whereas in the India general elections, the current administration is set to repeat the victory.

Analysts assert that state elections, or semi-finals, do not exert any influence on the outcome of the Lok Sabha election. Prior to the 2019 Lok Sabha elections, the Congress seized three Hindi heartland states, Chhattisgarh, Rajasthan, and MP from the BJP. After five months, the aforementioned states were decisively won in the parliamentary elections by the second Modi surge. Both indices experienced an increase of more than 12 percent over the course of the period.

So the semi-final results are long past, and what we are left with now is a gap that hasn’t been filled yet: a bull run from late October, making flag formation, a max accelerator on the economic growth paddle, fire in PSU stocks, whether you take banking or railways, and consumers piling up money in SIP’s and FII taking out money from equities. The market is trading overvalued since the semi-finals results came out, and there is a potential disconnect between price and value. The premium valuation is sustained due to a positive economic number, the Modi factor, and the China slowdown-diverting fund to India. But as we all know, “The market can stay irrational longer than you can stay solvent.”

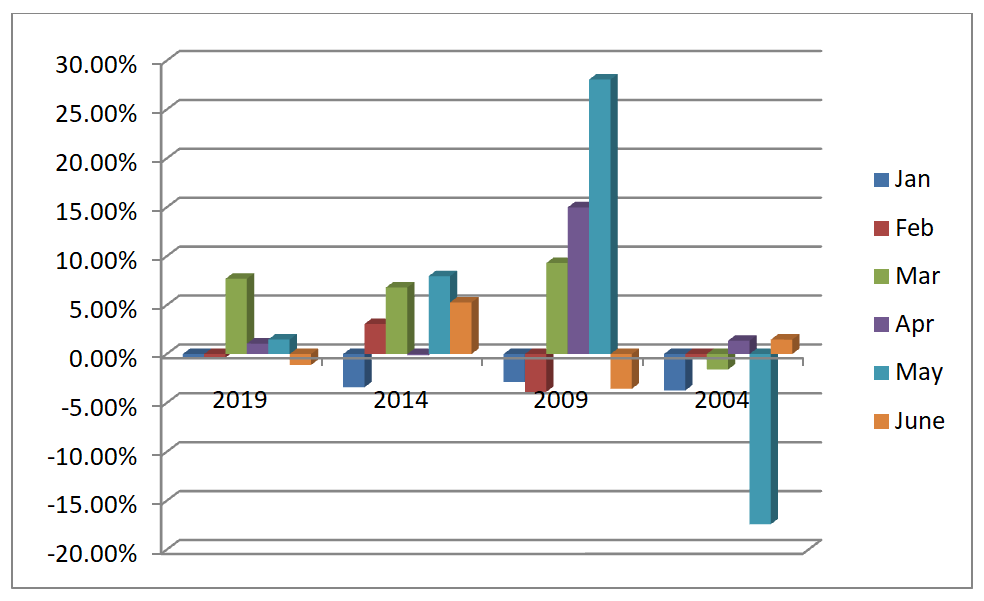

A recent study suggests that the Nifty has a tendency to bottom out in February–March, followed by a minimum 14% rally towards the general election outcome, as seen in previous instances over the past two decades, followed by minimum 5% fall from top.

If the current government comes into power, the country expects sustained, robust government expenditure, particularly benefiting the rural market. Crude prices are trading within a range, which is fiscally positive for the country. Domestic issue: keeping aside the number of seats won by the BJP, major pointers that would be watchful remain many, like the acceleration of attacks in the Red Sea and the rise of conflict between Israel, Hamas, and Russia-Ukraine, western economies falling into recession or any financial vulnerability, China attacking Taiwan or China slowing down itself. In total, macroeconomic factors would have greater significance than domestic factors in steering the direction of the markets.