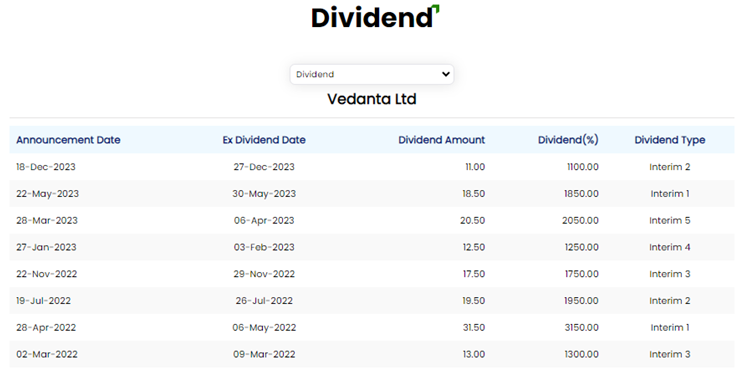

Mining major Vedanta has approved a second interim dividend payout of Rs 11 per share i.e. 1100% on face value of Rs. 1/- per equity share for the current financial year, resulting in a cumulative payout of Rs 4,089 crore. The company has set December 27 as the record date to determine eligible shareholders for dividend payouts. Vedanta’s first interim dividend payout was Rs 18.50 per share. The company’s board will meet again on Tuesday, December 19, to consider and approve fundraising through the issue of non-convertible debentures.

The company’s board of directors approved the first interim dividend of 2023 by the end of January at 12.50, which got ex-date on February 3rd. A second dividend of Rs 20.50 was declared in March, followed by a Rs. 18.50 dividend in May. The quantum of dividend outgo by Vedanta has climbed in the last few years. Vedanta’s total dividend for FY23 amounted to Rs 37,572 crore. The company declared a dividend of Rs 16,689 crore in FY22, far higher than the dividend payout of Rs 3,519 crore in FY21. Vedanta group companies have been juiced for cash amid concerns over persisting delays in the refinancing of Vedanta parent Vedanta Resources’ (VRL) debt, which is due to mature in the coming months.

Vedanta has been a laggard in the year-to-date, giving negative returns of more than 17%. The group companies have faced various downgrades in previous months, starting with the downgrade by the India rating of Vedanta in October, followed by Moody’s downgrading of Vedanta Resources’, the parent company of Vedanta Ltd, ratings from Caa1 to Caa2. Finally, in early December, Standard & Poor’s Global Ratings downgraded its rating on Vedanta Resources Plc, following the company’s move to restructure $3.8 billion in corporate bonds to deleverage the balance sheet. The global rating agency said the Vedanta parent’s ratings stayed on ‘CreditWatch’ with negative implications.

The company has started consent solicitations with existing bondholders to extend its debt maturity profile, allowing for extensions of maturities, amendments to bond terms, and seeking waivers. The company has about $4.5 billion in debt maturities through March 2025. The agency’s action on Vedanta Resources’ bonds is driven by the high likelihood of a conventional default due to the company’s large upcoming debt maturities and weakened access to internal cash flow and external financing. S&P Global Ratings said Vedanta Resources’ proposed liability management exercise is a distressed transaction, adding that it could downgrade the Vedanta parent’s to ‘SD’ (selective default) if the company completes the transaction. S&P had downgraded Vedanta Resources to “CC” from “CCC” in late September, shortly after Moody’s Investors Service lowered its rating on the miner’s unsecured bonds and corporate family rating.

The restructuring aims to reduce Vedanta’s immediate debt burden and provide relief at a time when liquidity conditions remain tight.

Vedanta Resources holds a 68.11 percent stake in Vedanta and plans to divide its businesses, potentially creating five new listed companies, subject to shareholder and creditor approvals. VDl share made gap up opening and is trading in positive at Rs. 262 in intraday.

No comment yet, add your voice below!