Business Profile of the Ventive Hospitality Limited

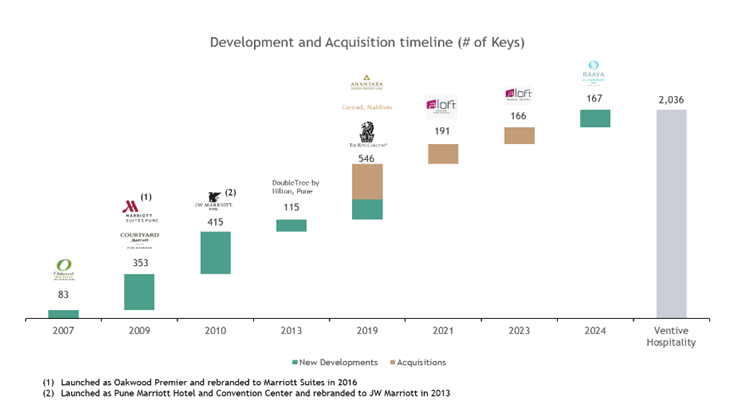

Ventive Hospitality is a hospitality asset owner focusing on luxury offerings across business and leisure segments. All its assets are operated by or franchised from global operators, including Marriott, Hilton, Minor, and Atmosphere. The company owns 11 operational hospitality assets in India and the Maldives, totaling 2,036 keys across the luxury, upper upscale, and upscale segments. The company, founded by Panchshil Realty, has grown significantly in its hospitality portfolio, from 83 keys in 2007 to 2,036 keys as of Sep 30, 2024. BRE Asia, an affiliate of Blackstone, acquired a 50% stake in the company in 2017.

The company has a strong track record in developing and acquiring hotel assets across various geographies and hospitality segments. The company’s in-house asset management team focuses on improving operational performance through increased occupancy rates, revenue generation, and cost efficiencies.

Ventive Hospitality Limited IPO Objective

As per the draft red hearing prospects, the IPO issue consists only of fresh issue.

- Ventive Hospitality IPO offer only has fresh issue of Rs. 1600 crores. As per RHP document, the company aims to utilize IPO proceedings towards repayment of certain borrowing and corporate general expenses.

| Particulars | Estimated amount |

| Payment of certain of borrowings availed by company and subsidiary | 14000 |

| General corporate purposes | 200 |

(₹ Million)

IPO Details of Ventive Hospitality Limited:

| IPO Open Date | December 20, 2024 |

| IPO Close Date | December 24, 2024 |

| Basis of Allotment | December 26, 2024 |

| Listing Date | December 30, 2024 |

| Face Value | ₹1 per share |

| Price | ₹610 to ₹643 per share |

| Lot Size | 23 Shares |

| Total Issue Size | 2,48,83,358 shares |

| (aggregating up to ₹1,600.00 Cr) | |

| Fresh Issue | 2,48,83,358 shares |

| (aggregating up to ₹1,600.00 Cr) | |

| Offer For Sale | NIL |

| NIL | |

| Issue Type | Book Built Issue IPO |

| Listing At | BSE & NSE |

| QIB Shares Offered | Not less than 75% of the Net Issue |

| Retail Shares Offered | Not more than 10% of the Net Issue |

| NII (HNI) Shares Offered | Not more than 15% of the Net Issue |

Issue Price & Size: Ventive Hospitality Limited IPO

The issue price of Ventive Hospitality Limited has been set for Rs. 610 to Rs. 643. The company only has fresh issue of Rs. 1600 crores.

Launch Date of Ventive Hospitality Limited IPO

The IPO opening date of Ventive Hospitality has been announced for December 20. The IPO will close on December 24, 2024.

Ventive Hospitality Limited Financial Statements

| Particular | 6-Mon ended Year Sept 30, 2024 (Cons.) | FY24 | FY23 | FY22 |

| Income | ||||

| Revenue from operations | 3722.78 | 4779.8 | 4308.13 | 2291.7 |

| Other income | 161.5 | 167.28 | 109.41 | 83.35 |

| Total income | 3889.28 | 4947.08 | 4417.54 | 2375.05 |

| Expenses | ||||

| Cost of materials consumed | 265.07 | 322.5 | 330.18 | 156.48 |

| Cost of construction material sold | 0.13 | 1.77 | 1.42 | 2.19 |

| Employee benefits expense | 541.87 | 374.46 | 297.93 | 245.07 |

| Other expenses | 1278.24 | 1242.76 | 1287.09 | 725.34 |

| Finance costs | 831.12 | 472.22 | 415.87 | 406.08 |

| Depreciation and amortisation expense | 608.06 | 481.49 | 493.16 | 479.63 |

| Total expenses | 3524.49 | 2895.2 | 2825.65 | 2014.79 |

| Restated profit before tax and share of profit/(loss) of joint venture | -364.79 | 2051.88 | 1591.89 | 360.26 |

| Share of loss of joint venture | -93.11 | – | – | – |

| Restated profit before tax | 271.69 | 2051.88 | 1591.89 | 360.26 |

| Restated profit/(loss) for the period/year | -207.62 | 1663.17 | 1312.73 | 294.31 |

| Company | Company (Proforma) | |||||||

| 6-Mon period ended | Fiscal | 6-Mon period ended | Fiscal | – | ||||

| September 30, 2024 | 2024 | 2023 | 2022 | September 30, 2024 | 2024 | 2023 | 2022 | |

| Total income | 3889.28 | 4947.08 | 4417.54 | 2375.05 | 8759.04 | 19073.78 | 17621.87 | 11976.09 |

| Total income growth (%) | N.A. | 11.99 | 86 | N.A. | N.A. | 8.24 | 47.14 | N.A. |

| Revenue from operations | 3727.78 | 4779.8 | 4308.13 | 2291.7 | 8464.41 | 18420.66 | 16993.74 | 11625.7 |

| Revenue Growth (%) | N.A. | 10.95 | 87.99 | N.A. | N.A. | 8.4 | 46.17 | N.A. |

| F&B Revenue | 866.65 | 111.061 | 1096.78 | 533.92 | 2094.59 | 4815.08 | 4454.28 | 2945.62 |

| F&B revenue contribution (As a % of revenue from operations) | 23.25 | 23.24 | 25.46 | 23.3 | 24.75 | 26.14 | 26.21 | 25.34 |

| EBITDA | 1803.97 | 3005.59 | 2500.92 | 1245.97 | 3638.88 | 8697.75 | 7711.21 | 4924.34 |

| EBITDA growth (%) | N.A. | 20.18 | 100.72 | N.A. | N.A. | 12.79 | 56.59 | N.A. |

| EBITDA margin (%) | 46.38 | 60.75 | 56.61 | 52.46 | 41.54 | 45.6 | 43.76 | 41.12 |

| 164 Profit / (loss) for the period/ year | -207.62 | 1663.17 | 1312.73 | 294.31 | -1378.28 | -667.46 | -156.75 | -1461.97 |

| Profit /(loss) margin | -5.4 | 33.62 | 29.72 | 12.39 | -15.74 | -3.5 | 0.89 | -12.21 |

| Net borrowings | 34229.74 | 3416.86 | 3658.48 | 2999 | N.A. | 34071.58 | 333623.6 | 29845.7 |

| Net borrowings/ total equity | 0.9 | 1.02 | 2.18 | 1.39 | N.A. | 0.93 | 0.92 | 0.87 |

| Inventory/ Keys | 2036 | 415 | 415 | 415 | 2036 | 2036 | 1869 | 1869 |

| Number of hotels | 11 | 1 | 1 | 1 | 11 | 11 | 10 | 10 |

| Average room rate | 13315.79 | 12690.4 | 10526.54 | 8549.24 | 16645.18 | 19975.99 | 17992.55 | 20834.14 |

| Average occupancy | 58.02 | 56.09 | 60.03 | 23.09 | 60.68 | 59.47 | 63.67 | 34.82 |

| RevPAR | 7726.3 | 7117.45 | 6318.84 | 1973.65 | 10099.55 | 11880.69 | 11456.44 | 7255.19 |

| Total Revenue per Occupied room | 26078.23 | 28701.87 | 24939.3 | 26095.95 | 30279.64 | 35615.85 | 31811.83 | 37926.88 |

| Annuity Related KPIs | ||||||||

| Income from Annuity assets | 1528.1 | 2323.67 | 2030.51 | 1354.53 | 2454.51 | 4661.03 | 4161.24 | 3392 |

| Committed Occupancy | 95.55 | 98.61 | 95.73 | 94.11 | 95.55 | 97.04 | 94.02 | 94.49 |

Ventive Hospitality Limited Promoters & Shareholding

As of date, there are 5 promoters of the company.

The promoter along with promoter group in aggregate collectively holds 100% of the paid-up share capital of company.

| Name of the shareholder | Pre-Issue number of Shares | Percentage of the pre-Issue share |

| Promoters | ||

| Premsagar Infra Realty Private Limited | 87070470 | 41.73 |

| Atul I. Chordia | 3858570 | 1.85 |

| Atul I. Chordia HUF | 2310850 | 1.11 |

| BRE Asia ICC Holdings Ltd | 52104896 | 24.97 |

| BREP Asia III India Holding Co VI Pte. Ltd. | 23465150 | 11.25 |

| Total | 168809936 | 80.9 |

| Promoter Group | ||

| Meena Chordia | 433980 | 0.21 |

| Panchshil Hotels Private Limited | 3588690 | 1.72 |

| Balewadi Techpark Private Limited | 8971730 | 4.3 |

| Panchshil Infrastructure Holdings Private Limited | 9730880 | 4.66 |

| Promoters | ||

| Panchshil IT Park Private Limited | 4853830 | 233 |

| Sagar Chordia | 1301950 | 0.62 |

| Panchshil Realty and Developers Private Limited | 9137230 | 4.38 |

| Yash Chordia | 433980 | 0.21 |

| Yashika Chordia | 433980 | 0.21 |

| BREP Asia SBS ICC Holding (NQ) Ltd | 114884 | 0.06 |

| Total | 39001134 | 18.69 |

| Grand total | 207811070 | 99.59 |

Should You Subscribe to Ventive Hospitality Limited IPO or Not

While investing or subscribing to any IPO, consider the investment rationales related to the company. Hence, here you can find out the strength of the company that will be its growth factors. And also check the risk factors that can affect the growth and operational efficiency of the company.

Competitive Strengths of Ventive Hospitality Limited:

Premium hospitality assets

Ventive hospitality portfolio includes luxury assets operated by global brands, including JW Marriott, Pune, and The Ritz-Carlton, Pune. These assets contributed to over 80% of company’s pro forma revenue from hotel operations and 58% of pro forma total income for the six months ended Sep 30, 2024. In India, these assets offer large-scale events spaces and award-winning F&B offerings, and are located near key transport and social infrastructure areas. The luxury and upper upscale hotels in Pune command an ARR premium to other properties within their respective markets on average in India and the Maldives, which is a testament to their superior asset quality, contemporary offerings, and customer experience.

The Indian hotel industry is dominated by chain-affiliated hotels, with the Maldives hospitality industry being dominated by chain-affiliated hotels.

Development & acquisition-led growth

Ventive hospitality operating portfolio comprises seven hospitality assets with 1,331 keys, Promoter, Promoter Group, and affiliates, and four hospitality assets with 705 keys acquired by them. The company has a 15-year track record in developing marquee hospitality assets, executing landmark acquisitions, and establishing a presence in desirable destinations across the Indian Ocean Region. Their hospitality assets are located in established business destinations, premium tourist destinations, and spiritual and cultural hubs. The company leverages deep knowledge of the hospitality sector to identify the appropriate operator and sub-brand for each asset, focusing on factors such as size, location, and anticipated demand across guest segments.

Promoters with global and local expertise

The Panchshil Group and BRE Group (Blackstone) are two prominent real estate companies in Pune, India. Panchshil Realty, a leading luxury real estate developer, contributes 28% of the completed Grade A commercial office stock and 16% of the upcoming commercial office supply. The company has developed over 31 msf of real estate across multiple asset classes, including hospitality, commercial, retail, luxury residential, and data centers. Blackstone, a global investment firm, has US$1.1 trillion of AUM and is the largest investor in hotels globally. The two companies have extensive experience in building or rebuilding leading companies and taking them public. Panchshil Realty and Blackstone have a ten-year partnership, with extensive experience in real estate, hospitality, and commercial projects.

Future strategies

- Expand hospitality assets by increasing the number of keys across its portfolio to approx 2,403 keys in FY28.

- Develop an 80-key villa-style luxury resort in Southeast Sri Lanka.

- Organic growth through premiumization and guest satisfaction.

- Increase occupancy through upsell programs, direct bookings, and strategic pricing.

- Leverage prime locations and premium market standing through strategic pricing, customer segmentation, and targeted marketing efforts.

- Optimize event spaces at its hospitality assets to diversify revenue sources and increase its share of revenue from food and beverage sales.

- Promote spaces extensively to increase weekend occupancy rates and revenue through complementary offerings.

- Deploy proactive asset management practices to increase the value and profitability of its assets

Risk Factors of Ventive Hospitality Limited:

Recently acquired portfolio

The company has recently assumed certain assets and liabilities, including included JW Marriott, Pune, ICC Offices, Pune, and ICC Pavilion, Pune, which could materially impact its business fundamental and financial condition of company. The company does not have an operating history to evaluate its overall performance and is subject to business risks and uncertainties associated with a new business enterprise formed through a combination of existing 49 businesses.

Reliance on third party brands

The company’s hospitality assets are operated by or franchised from third-party brands like Marriott, Hilton, Minor, and Atmosphere. As of Sep 30, 2024, the portfolio consisted of 11 operational assets, with six operated by Marriott, two by Hilton, one by Minor, one by Atmosphere Core, and one by Oakwood. As of Sep 30, 2024, these assets comprised 78.05% of the company’s total keys. The company’s hotel operator services agreements have terms ranging from 10 to 30 years, and non-compliance could result in termination of these agreements. If these agreements are terminated, the company may be required to pay damages to the hotel operators or have to operate the property itself. Any negative branding or decrease in service quality could negatively affect the company’s reputation, business fundamentals and financial condition.

Seasonality and real estate market

The hospitality industry in India and the Maldives experiences seasonal variations, with higher revenues varying from property to property based on location and segment. The industry is cyclical, with demand following key macroeconomic indicators. Changes in economic conditions and room supply can result in significant volatility in results. The costs of running hospitality assets can be significant, leading to significant fluctuations in room rates, sales, and results of operations.

The business relies heavily on the real estate market, especially in Pune, India. Any deterioration in prices or market conditions could negatively impact the business, financial condition, and cash flows. Factors such as recession, property taxes, development regulations, and COVID-19 outbreaks could lead to a decline in demand for leasing our annuity assets. Rental rates depend on supply and demand conditions, and the business cannot guarantee future demand growth or stability. Leases with tenants may expire or not be renewed, and delays in finding suitable tenants could impact revenue. Changes in pre-committed lease arrangements may also affect the business and financial performance.

| Particulars | 6-Mon ended Sep 30, 2024 | FY24 | FY23 | FY22 |

| Pro forma revenue from rental income | 26.37% | 22.89% | 22.15% | 26.82% |

| Pro forma revenue from commercial leasing and mall operations | 28.02% | 24.44% | 23.61% | 28.32% |

Conflicts of interest

The Panchshil Group and its affiliates, including Blackstone, engage in various activities, including investments in the real estate and hospitality industries. Directors of Panchshil and Blackstone may engage in activities where their interests conflict with those of shareholders. The company may compete with existing and future private and public investment vehicles established by Panchshil or Blackstone, which may present conflicts of interest. Blackstone’s real estate funds are one of India’s largest office landlords and have interests across multiple real estate asset classes. Conflicts of interest may arise in allocating or addressing business opportunities and strategies among the company, its subsidiaries, Promoters.

Ventive Hospitality Limited Grey Market premium

Grey market premium is the premium quoted over the IPO issue price. GMP shows that investors are ready to pay above the upper band of the IPO issue price. GMP is determined in the grey market as per the demand and supply of the shares in the primary market. A grey market is that unofficial ecosystem of unlisted companies’ stocks that start trading even before the launch of the IPO to the date of its listing.

Also Read: What is Grey Market Premium in IPO: How is GMP Calculated & Reliable

However, GMP is not a reliable factor, as it keeps fluctuating as per the demand and supply of shares in the primary market. There are numerous factors that affect the stock market in India and individual stock prices of different companies that are already listed and trading in the secondary market. However, for an IPO-bounded company, you can consider the GMP as the speculative listing price of the share

According to various online sources, the Grey Market Premium or GMP of the Ventive Hospitality Limited is trading around Rs XX in the grey market. It means shares are trading at the upper band issue price of Rs XX with a premium in the grey market and may list around the same price.